Adventure Sports Travel Insurance Market Overview

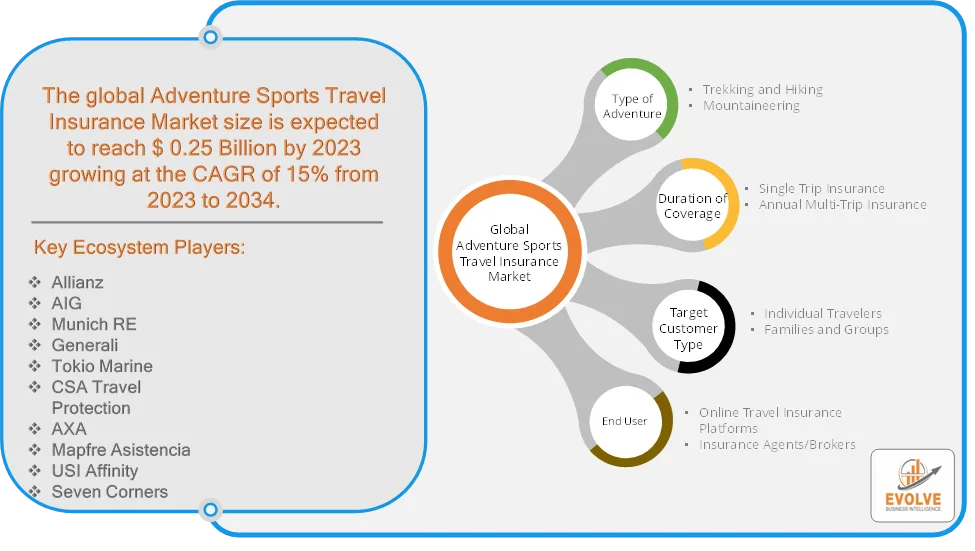

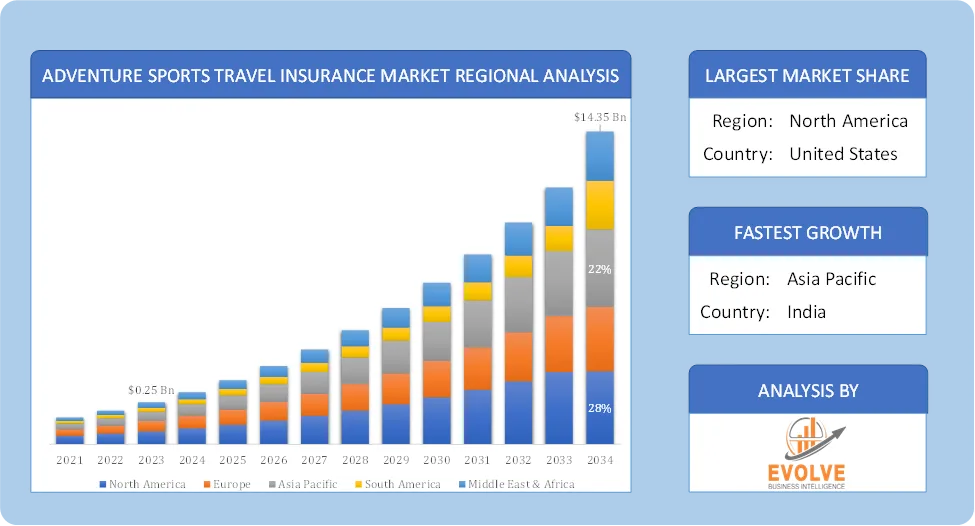

The Adventure Sports Travel Insurance Market size accounted for USD 0.25 Billion in 2023 and is estimated to account for 3.85 Billion in 2024. The Market is expected to reach USD 14.35 Billion by 2034 growing at a compound annual growth rate (CAGR) of 15% from 2024 to 2034. The Adventure Sports Travel Insurance market is a growing segment within the global travel insurance industry. It caters to travelers who participate in high-risk activities such as skiing, rock climbing, scuba diving, mountaineering, paragliding, bungee jumping, and more. These specialized insurance policies are designed to cover the unique risks associated with such activities, which are typically excluded from standard travel insurance plans.

The Adventure Sports Travel Insurance market presents significant opportunities for growth as more people seek adventurous travel experiences and become increasingly aware of the need for specialized protection. Insurance providers are adapting to these trends by offering more comprehensive, flexible, and technologically advanced solutions.

Global Adventure Sports Travel Insurance Market Synopsis

Adventure Sports Travel Insurance Market Dynamics

Adventure Sports Travel Insurance Market Dynamics

The major factors that have impacted the growth of Adventure Sports Travel Insurance Market are as follows:

Drivers:

Ø Growing Popularity of Adventure Tourism

Increasing global interest in adventure sports such as trekking, scuba diving, skiing, and paragliding. Rising participation of millennials and Gen Z travelers seeking unique and adrenaline-filled experiences. Growth of adventure tourism destinations, especially in regions like Europe, North America, and Asia-Pacific. Travelers are increasingly recognizing the risks associated with adventure sports. Many governments and tourism boards now recommend or mandate travel insurance for high-risk activities and digital campaigns and educational initiatives by insurance providers are helping spread awareness.

Restraint:

- High Premium Costs and Lack of Awareness

Insurance for adventure sports is significantly more expensive due to the high-risk nature of activities like skydiving, scuba diving, and mountaineering. Many travelers, especially budget-conscious individuals, may opt out of purchasing coverage due to the cost. Many adventure travelers, especially in developing regions, are unaware of the importance of insurance and low penetration of travel insurance in certain emerging markets limits market growth.

Opportunity:

⮚ Expansion of Adventure Tourism Industry

The global adventure tourism market is growing, with more travelers engaging in high-risk activities like scuba diving, trekking, and skydiving. Offering modular policies where travelers can select coverage for specific adventure activities instead of purchasing broad, expensive plans. AI-driven underwriting and claims processing can enhance efficiency and reduce fraud. Blockchain technology for secure transactions and transparent policy management and mobile-based insurance platforms allowing travelers to purchase, modify, and claim policies in real-time.

Adventure Sports Travel Insurance Market Segment Overview

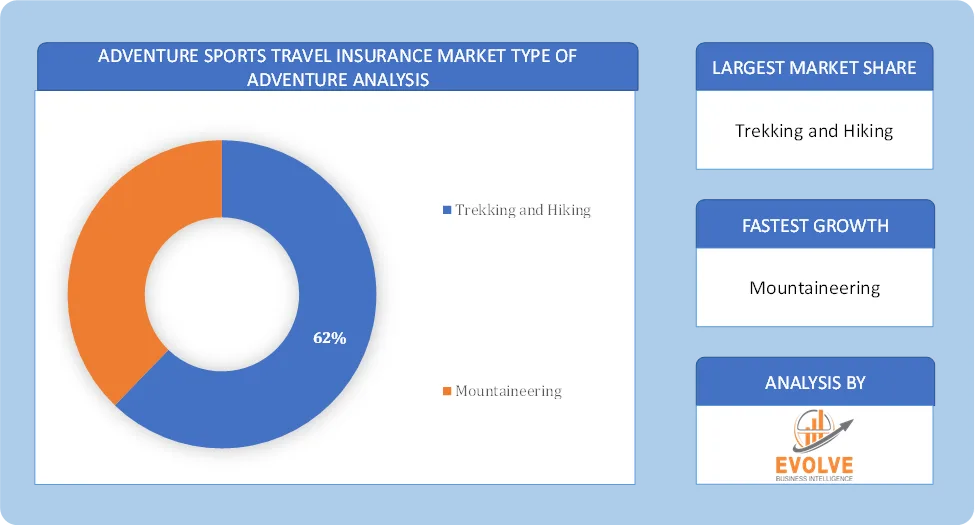

Based on Type of Adventure, the market is segmented based on Trekking and Hiking, Mountaineering. The Trekking and Hiking segment dominant the market. Insurers are increasingly offering customizable policies to cater to the specific needs of trekkers and hikers. Online platforms are making it easier for travelers to compare and purchase adventure sports travel insurance.

By Duration of Coverage

Based on Duration of Coverage, the market segment has been divided into Single Trip Insurance, Annual Multi-Trip Insurance. The Annual Multi-Trip Insurance segment dominant the market. It Provides coverage for an unlimited number of trips within a 12-month period, subject to certain limitations on trip duration. This segment caters to the growing number of individuals who engage in frequent leisure and adventure travel.

By Target Customer Type

Based on Target Customer Type, the market segment has been divided into Individual Travelers, Families and Groups. The Families and Groups segment dominant the market. The growing trend of families seeking adventure travel experiences drives demand for specialized insurance. Insurance providers are offering more flexible and customizable group policies to meet the specific needs of families and groups.

By End User

Based on End User, the market segment has been divided into Online Travel Insurance Platforms, Insurance Agents/Brokers. The Online Travel Insurance Platforms segment dominant the market. Online platforms enable travelers to compare multiple insurance policies from different providers. They often offer customizable options, allowing travelers to tailor coverage to their specific needs and activities and Online purchase processes are typically quick and efficient, allowing travelers to obtain coverage in minutes.

Global Adventure Sports Travel Insurance Market Regional Analysis

Based on region, the global Adventure Sports Travel Insurance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Adventure Sports Travel Insurance Market followed by the Asia-Pacific and Europe regions.

North America Adventure Sports Travel Insurance Market

North America Adventure Sports Travel Insurance Market

North America holds a dominant position in the Adventure Sports Travel Insurance Market. Due to high participation in adventure sports, especially in the U.S. and Canada. It has strong presence of established travel insurance providers like Allianz, AIG, and World Nomads and high demand for skiing, snowboarding, mountain biking, and water sports insurance. It has High disposable income and spending on adventure tourism, strong awareness of travel insurance benefits and establishing digital insurance platforms and direct-to-consumer sales.

Asia-Pacific Adventure Sports Travel Insurance Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Adventure Sports Travel Insurance Market industry. Increasing outbound travel, a rising middle class, and growing awareness of travel risks are fueling this growth. South Asia is showing a robust recovery in tourism and increasing disposable incomes, infrastructure development supporting tourism, and the appeal of diverse adventure destinations are driving market expansion. There is a rising demand for travel insurance, including coverage for adventure sports, driven by the increasing influx of tourists. Single-trip travel insurance currently dominates the market in this region.

Competitive Landscape

The global Adventure Sports Travel Insurance Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Allianz

- AIG

- Munich RE

- Generali

- Tokio Marine

- CSA Travel Protection

- AXA

- Mapfre Asistencia

- USI Affinity

- Seven Corners.

Scope of the Report

Global Adventure Sports Travel Insurance Market, by Type of Adventure

- Trekking and Hiking

- Mountaineering

Global Adventure Sports Travel Insurance Market, by Duration of Coverage

- Single Trip Insurance

- Annual Multi-Trip Insurance

Global Adventure Sports Travel Insurance Market, by Target Customer Type

- Individual Travelers

- Families and Groups

Global Adventure Sports Travel Insurance Market, by End User

- Online Travel Insurance Platforms

- Insurance Agents/Brokers

Global Adventure Sports Travel Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 14.35 Billion |

| CAGR (2024-2034) | 15% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type of Adventure, Duration of Coverage, Target Customer Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Allianz, AIG, Munich RE, Generali, Tokio Marine, CSA Travel Protection, AXA, Mapfre Asistencia, USI Affinity and Seven Corners. |

| Key Market Opportunities | · Digital Transformation & Insurtech Innovations |

| Key Market Drivers | · Growing Popularity of Adventure Tourism

· Rising Awareness About Travel Insurance |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Adventure Sports Travel Insurance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Adventure Sports Travel Insurance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Adventure Sports Travel Insurance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Adventure Sports Travel Insurance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.