Abrasives Market Overview

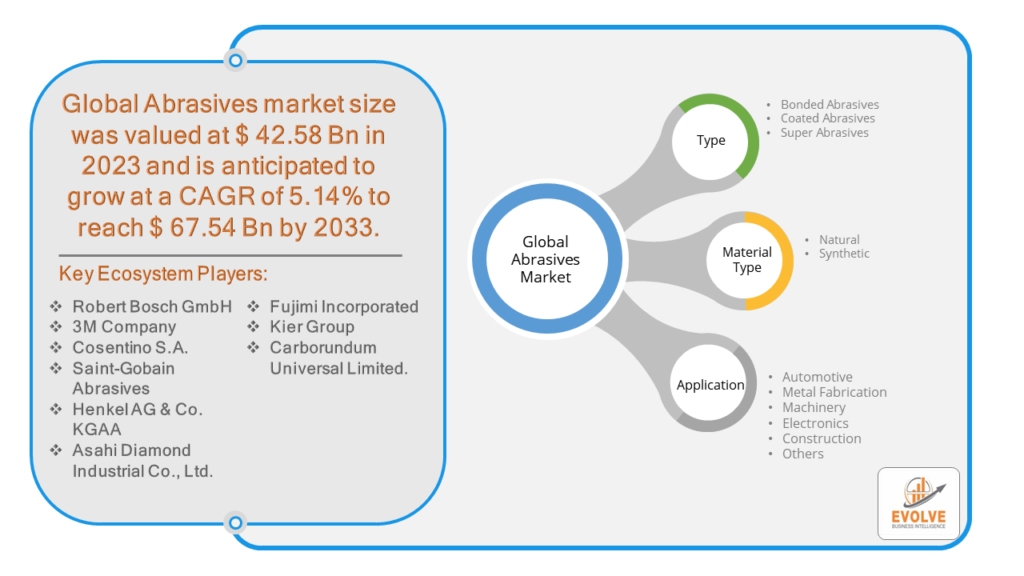

The Abrasives Market Size is expected to reach USD 67.54 Billion by 2033. The Abrasives industry size accounted for USD 42.58 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.14% from 2023 to 2033. The Abrasives Market refers to the industry that produces and sells materials used for grinding, cutting, polishing, and drilling of solid surfaces across various end-user industries such as automotive, machinery, aerospace and defense, metal fabrication, building and construction, medical devices, oil and gas, electrical and electronics, and others. The market is segmented by raw materials (natural and synthetic), type (coated abrasive, bonded abrasive, super abrasive, and others), product (disc, cups, cylinder, and others), form (block form and powdered form), application (grinding, cutting, polishing, drilling, finishing, and others), and end-user. The market is expected to grow at a CAGR of 5.5% from 2021 to 2028, with Asia Pacific holding the largest market share. The market is driven by the increasing demand for abrasives in the electronics industry and the benefits associated with their use in the medical industry.

Global Abrasives Market Synopsis

The Abrasives market experienced a positive impact due to the COVID-19 pandemic. Due to supply chain disruptions brought on by the COVID-19 pandemic, there are now shortages or decreased demand in the abrasives industry. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Global Abrasives Market Dynamics

The major factors that have impacted the growth of Abrasives are as follows:

Drivers:

⮚ Technological Advancements

Advancements in abrasive technologies lead to the development of new materials, coatings, and manufacturing processes. These innovations enhance the efficiency, precision, and performance of abrasives, driving their adoption across different industries.

Restraint:

- Substitute Technologies

Advancements in alternative technologies, such as laser cutting, waterjet cutting, and abrasive waterjet machining, pose a challenge to traditional abrasive processes in certain applications. These technologies offer advantages such as higher precision, reduced material waste, and lower environmental impact, potentially displacing abrasive-based methods in specific industries.

Opportunity:

⮚ Expanding Applications

Abrasives find applications beyond traditional industries such as automotive, construction, and manufacturing. Opportunities exist in emerging sectors such as renewable energy (e.g., solar panel manufacturing), medical devices, aerospace composites, and additive manufacturing (3D printing). Manufacturers can diversify their product portfolios to address these niche markets.

Abrasives Market Segment Overview

By Material

Based on the Material, the market is segmented based on Natural and Synthetic. In 2021, the synthetic category accounted for approximately 50%-52% of the total revenue generated by the abrasives market, holding the dominant position. Conversely, alumina, silicon carbide, and synthetic diamond are examples of raw minerals or chemical precursors that go through a lot of processing to become synthetic abrasives.

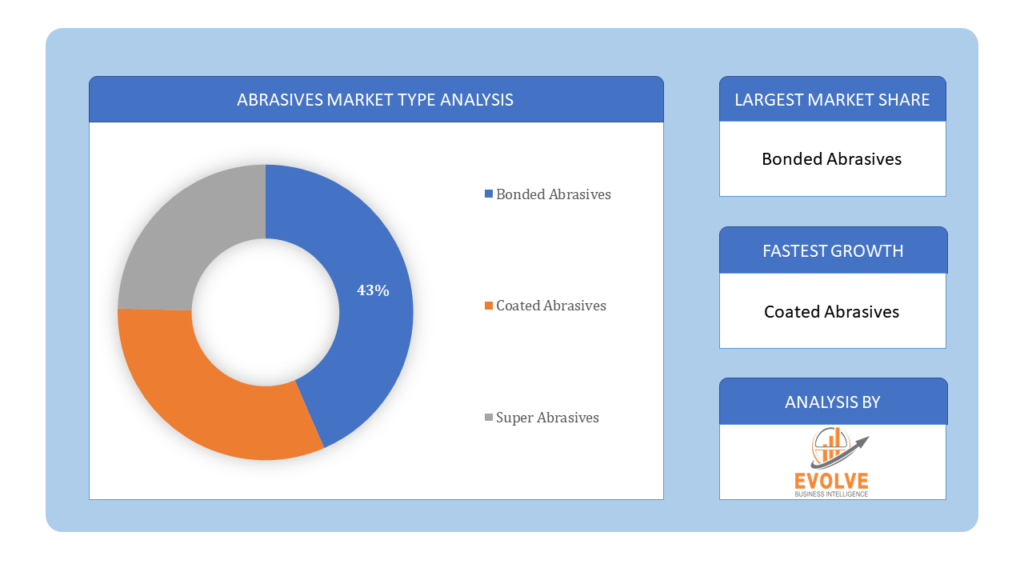

By Type

Based on the Type, the market has been divided into Bonded Abrasives, Coated Abrasives and Super Abrasive. In 2021, the bonded sector accounted for approximately 40%–42% of the total revenue generated by the abrasives market, holding the dominant share. Resin-bonded abrasives are extensively used in the automotive industry to machine a range of driveline, suspension, body, and chassis components.

Based on the Type, the market has been divided into Bonded Abrasives, Coated Abrasives and Super Abrasive. In 2021, the bonded sector accounted for approximately 40%–42% of the total revenue generated by the abrasives market, holding the dominant share. Resin-bonded abrasives are extensively used in the automotive industry to machine a range of driveline, suspension, body, and chassis components.

By End User

Based on End User, the market has been divided into Automotive, Metal Fabrication, Machinery, Electronics, Construction and Others. In 2021, the Automotive segment held a dominant position in the market. It is anticipated that over the projection period of 2022-2030, the Metalworking segment will develop at a quicker rate. This is because market leaders are seeing explosive growth. Industries that rely on metal fabrication, such aerospace, defense, and agriculture, are all growing steadily. All of these indicators suggest that the industry has a promising future.

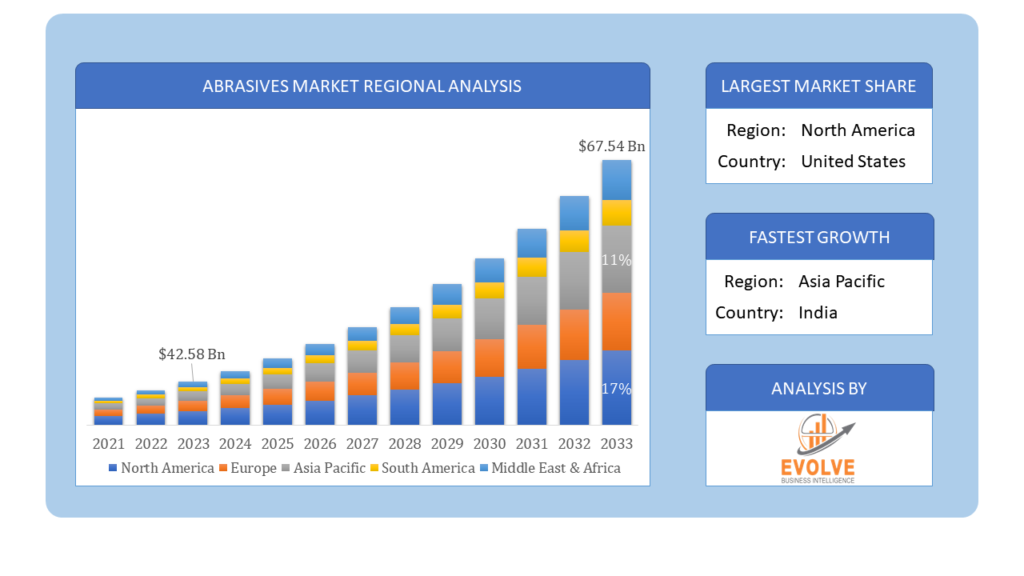

Global Abrasives Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Abrasives, followed by those in North America and Europe.

Abrasives Asia-Pacific Market

Abrasives Asia-Pacific Market

Asia-Pacific dominates the Abrasives market due to several factors. Asia-Pacific Abrasives market accounted for USD 29.2 billion in 2021 and is expected to exhibit an 6.25% CAGR during the study period. This is explained by the region’s majoe economies’ strong growth in the metalworking, automotive, and other industries, which is driving up demand for abrasives.

Abrasives North America Market

The North America region has been witnessing remarkable growth in recent years. The second-largest market share is held by the abrasives market in North America. In terms of both car production and sales, the US is currently the second-largest market in the globe. Because North American supply chains are so well-integrated, almost 40% of the raw materials used to make automobiles in the majority of the countries come from the US and Canada. Between 2005 and 2020, the United States’ exports of automotive parts and components more than tripled.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Robert Bosch GmbH, 3M Company, COSENTINO S.A, Saint-Gobain Abrasives, and Henkel AG & Co. KGAA are some of the leading players in the global Abrasives Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Robert Bosch GmbH

- 3M Company

- COSENTINO S.A

- Saint-Gobain Abrasives

- Henkel AG & Co. KGAA

- Asahi Diamond Industrial Co., Ltd.

- Fujimi Incorporated

- Kier Group

- Carborundum Universal Limited.

Key development:

November 2021: 3M launched 3M Xtract Cubitron II 710W Net Abrasive Disc that provides twice the life and cut-rate and up to 97 percent dust removal.

Scope of the Report

Global Abrasives Market, by Material

- Natural

- Synthetic

Global Abrasives Market, by Type

- Bonded Abrasives

- Coated Abrasives

- Super Abrasives

Global Abrasives Market, by End User

- Automotive

- Metal Fabrication

- Machinery

- Electronics

- Construction

- Others

Global Abrasives Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $67.54 Billion |

| CAGR | 5.14% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material, Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Robert Bosch GmbH, 3M Company, COSENTINO S.A, Saint-Gobain Abrasives, Henkel AG & Co. KGAA, Asahi Diamond Industrial Co., Ltd., Fujimi Incorporated, Kier Group, Carborundum Universal Limited. |

| Key Market Opportunities | • Growth of the construction industry |

| Key Market Drivers | • Increasing demand from the automotive industry Increasing demand from the metal working industry |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Abrasives Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Abrasives market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Abrasives market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Abrasives Market.