US Wood Flooring Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

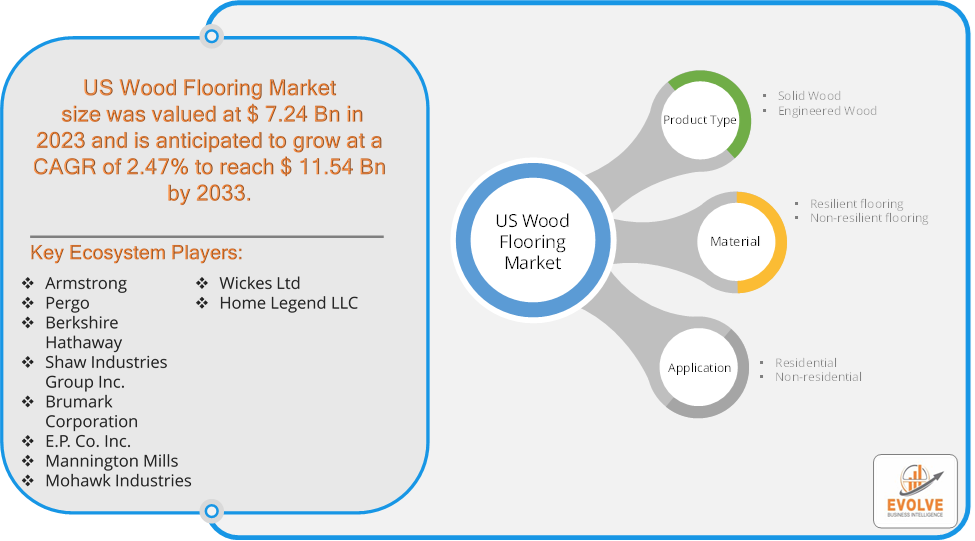

US Wood Flooring Market Research Report: Information By Product Type (Solid Wood and Engineered Wood), By Material (Resilient flooring, Non-resilient flooring), By Application (Residential, Non-residential), and by Region — Forecast till 2033

Page: 75

US Wood Flooring Market Overview

The US Wood Flooring Market Size is expected to reach USD 11.54 Billion by 2033. The US Wood Flooring Market industry size accounted for USD 7.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 2.47% from 2023 to 2033. The US Wood Flooring Market refers to the industry sector that focuses on the production, distribution, and sale of wood flooring products within the United States. This market includes a wide range of wood flooring types such as solid wood, engineered wood, and laminate flooring.

The US Wood Flooring Market is competitive, with numerous players ranging from large multinational companies to small local manufacturers. It is influenced by factors such as economic conditions, housing market trends, and consumer preferences.

US Wood Flooring Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the US Wood Flooring Market. Lockdowns and restrictions in key wood-producing regions led to shortages in raw materials. Transportation delays and increased shipping costs disrupted the supply chain, affecting the timely delivery of products. Temporary shutdowns of manufacturing facilities due to health and safety regulations resulted in decreased production capacity. Early in the pandemic, the uncertainty and economic slowdown led to a decline in new construction and renovation projects, reducing demand for wood flooring. As people spent more time at home and focused on home improvement projects, there was a resurgence in demand for wood flooring, especially in the residential sector. With physical stores closed or operating at reduced capacity, consumers and businesses turned to online platforms for purchasing wood flooring products. Increased awareness of hygiene led to a preference for easy-to-clean and low-maintenance flooring options, benefiting certain wood flooring products. The wood flooring market adapted by enhancing digital presence, improving e-commerce capabilities, and focusing on customer engagement through virtual means.

US Wood Flooring Market Dynamics

The major factors that have impacted the growth of US Wood Flooring Market are as follows:

Drivers:

Ø Home Renovation and Remodeling Trends

Rising interest in home renovation and remodeling projects drives demand for wood flooring as homeowners seek to upgrade and enhance their living spaces. Growth in do-it-yourself (DIY) home improvement projects contributes to the market, with many consumers opting to install wood flooring themselves. Growing awareness of environmental issues and sustainability drives demand for wood flooring made from responsibly sourced and certified sustainable materials. Innovations in wood flooring manufacturing improve product durability, ease of installation, and resistance to moisture and wear. Development of engineered wood flooring and advanced finishes offers greater stability, versatility, and aesthetic appeal.

Restraint:

- Perception of High Cost and Maintenance Requirements

Wood flooring, especially high-quality solid and engineered wood options, tends to be more expensive than alternatives like laminate, vinyl, or carpet, making it less accessible for budget-conscious consumers. Professional installation of wood flooring can be costly, further adding to the overall expense. Wood flooring requires regular maintenance, such as cleaning, polishing, and occasional refinishing, which can be time-consuming and costly. Wood flooring is prone to scratches, dents, and water damage, requiring careful maintenance to preserve its appearance and longevity.

Opportunity:

⮚ Sustainability and Eco-Friendly Products

Increasing demand for sustainable construction materials provides an opportunity for wood flooring manufacturers to promote eco-friendly products. Certifications such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) can attract environmentally conscious consumers. Using reclaimed or recycled wood for flooring appeals to sustainability-focused buyers and reduces environmental impact. Expanding e-commerce platforms and enhancing online presence can reach a broader audience. Virtual showrooms, augmented reality (AR) apps, and online consultation services can enhance the buying experience. Developing direct-to-consumer sales models can reduce costs and improve margins by bypassing traditional retail channels.

US Wood Flooring Market Segment Overview

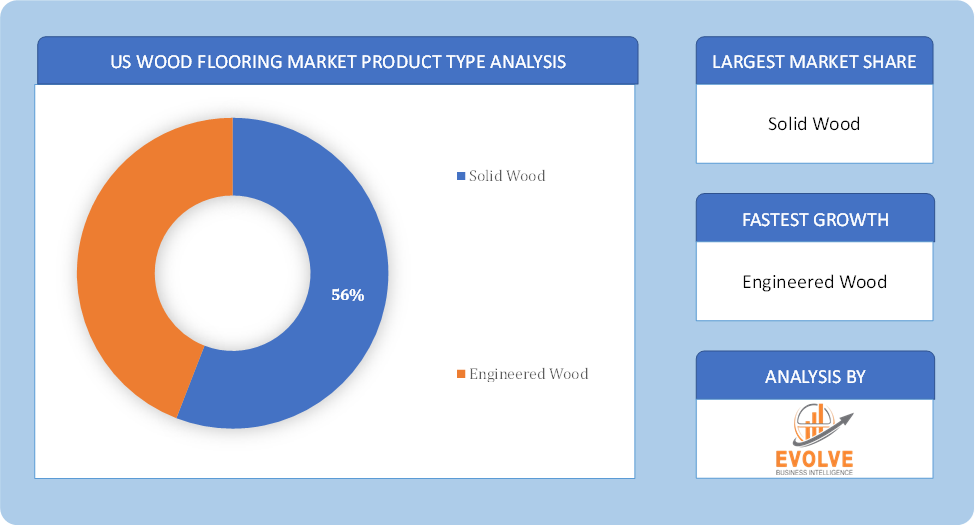

By Product Type

By Product Type

Based on Product Type, the market is segmented based on Solid Wood and Engineered Wood. The engineered wood segment dominant the market. Engineered wood is less susceptible to swelling and contracting as a result of changes in humidity and temperature. Additionally, it is within the price range for a sizable residential customer base and adds visual appeal wherever it is installed. The decking and cladding industries frequently employ engineered wood because it offers advanced and improved abrasion resistance, dimensional precision, and reliability attributes.

By Material

Based on Material, the market segment has been divided into the Resilient flooring and Non-resilient flooring. The Resilient flooring segment dominant the market. Resilient flooring is known for its high durability and resistance to wear and tear, making it suitable for high-traffic areas. Resilient flooring tends to be more cost-effective compared to traditional wood flooring, making it accessible to a wider range of consumers.

By Application

Based on Application, the market segment has been divided into the Residential and Non-residential. The Residential segment dominant the market. The Dominance of the segment is due to the provision of the natural feeling of home. The Development of radiant heat-compatible grades has increased the residential segment’s adoption of lumber-based flooring products.

Competitive Landscape

The US Wood Flooring Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Armstrong

- Pergo

- Berkshire Hathaway

- Shaw Industries Group Inc.

- Brumark Corporation

- E.P. Co. Inc.

- Mannington Mills

- Mohawk Industries

- Wickes Ltd

- Home Legend LLC

Key Development

In May 2022, Somerset Hardwood Flooring, a vertically integrated forest products business with headquarters in Somerset, Kentucky, was purchased by Swiss-based Bauwerk Group AG. According to estimates, the acquisition will help Bauwerk Group AG strengthen its position in the North American flooring market and increase its image. With a solid presence in the necessary sales channels, Somerset Hardwood Flooring has a well-established brand and market position in the United States.

Scope of the Report

US Wood Flooring Market, by Product Type

- Solid Wood

- Engineered Wood

US Wood Flooring Market, by Material

- Resilient flooring

- Non-resilient flooring

US Wood Flooring Market, by Application

- Residential

- Non-residential

Global US Wood Flooring Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 11.54 Billion |

| CAGR (2023-2033) | 2.47% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Material, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Armstrong, Pergo, Berkshire Hathaway, Shaw Industries Group Inc., Brumark Corporation, E.P. Co. Inc., Mannington Mills, Mohawk Industries, Wickes Ltd and Home Legend LLC. |

| Key Market Opportunities | · Sustainability and Eco-Friendly Products · E-Commerce Growth |

| Key Market Drivers | · Home Renovation and Remodeling Trends · Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future US Wood Flooring Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- US Wood Flooring Market historical market size for the year 2021, and forecast from 2023 to 2033

- US Wood Flooring Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global US Wood Flooring Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the US Wood Flooring Market is 2021- 2033

What is the growth rate of the US Wood Flooring Market?

The global US Wood Flooring Market is growing at a CAGR of 2.47% over the next 10 years

Which region has the highest growth rate in the market of US Wood Flooring Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global US Wood Flooring Market?

North America holds the largest share in 2022

Who are the key players in the US Wood Flooring Market?

Armstrong, Pergo, Berkshire Hathaway, Shaw Industries Group Inc., Brumark Corporation, E.P. Co. Inc., Mannington Mills, Mohawk Industries, Wickes Ltd and Home Legend LLC. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Type Segement – Market Opportunity Score 4.1.2. Material Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on US Wood Flooring Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. US Wood Flooring Market, By Product Type 7.1. Introduction 7.1.1. Solid Wood 7.1.2. Engineered Wood CHAPTER 8 US Wood Flooring Market, By Material 8.1. Introduction 8.1.1. Resilient flooring 8.1.2. Non-resilient flooring CHAPTER 9. US Wood Flooring Market, By Application 9.1. Introduction 9.1.1. Residential 9.1.2 Non-residential CHAPTER 11. Competitive Landscape 11.1. Competitior Benchmarking 2023 11.2. Market Share Analysis 11.3. Key Developments Analysis By Top 5 Companies 11.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 12. Company Profiles 12.1. Armstrong 12.1.1. Hanon Systems 12.1.2. Financial Analysis 12.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 12.1.2.2. Geographic Revenue Mix, 2022 (% Share) 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Pergo 12.3. Berkshire Hathaway 12.4. Shaw Industries Group Inc. 12.5. Brumark Corporation 12.6. E.P. Co. Inc. 12.7. Mannington Mills 12.8. Mohawk Industries 12.9 Wickes Ltd 12.10 Home Legend LLC

Connect to Analyst

Research Methodology