Uninterrupted Power Supply (UPS) Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

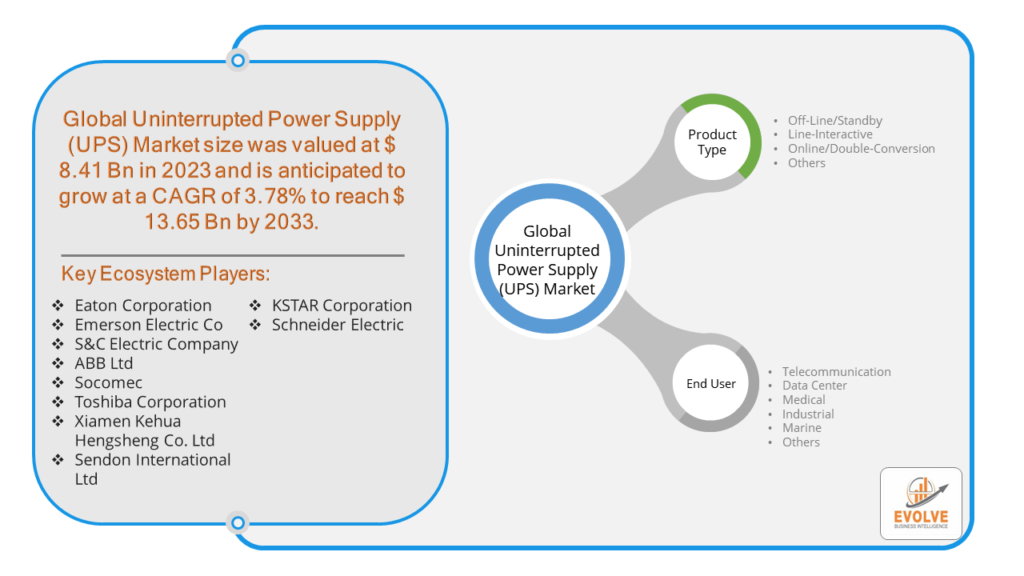

Uninterrupted Power Supply (UPS) Market Research Report: Information By Product Type (Off-Line/Standby, Line-Interactive, Online/Double-Conversion, Others), By Application (Telecommunication, Data Center, Medical, Industrial, Marine, Others), and by Region — Forecast till 2033

Page: 168

Uninterrupted Power Supply (UPS) Market Overview

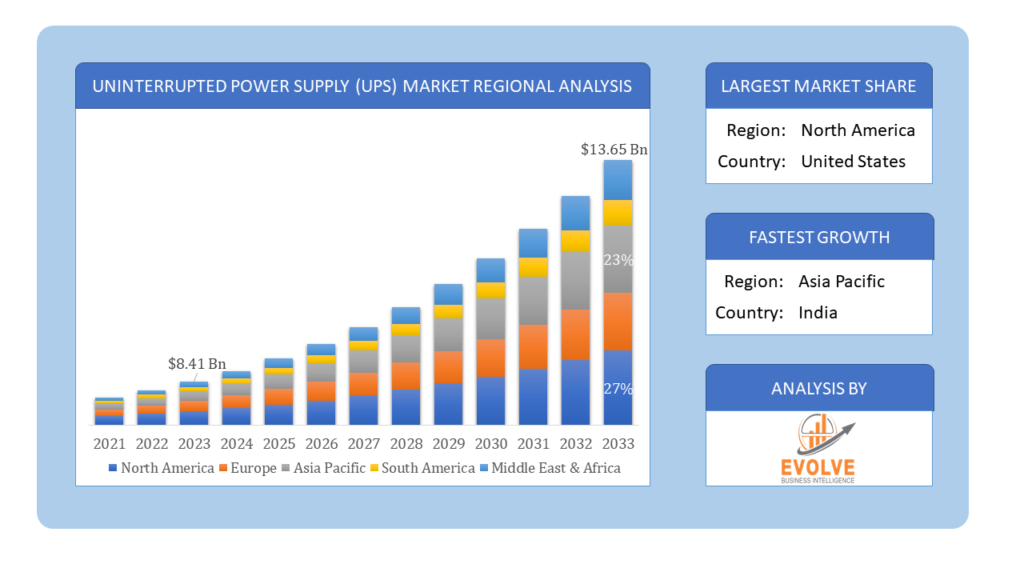

The Uninterrupted Power Supply (UPS) Market Size is expected to reach USD 13.65 Billion by 2033. The Uninterrupted Power Supply (UPS) Market industry size accounted for USD 8.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.78% from 2023 to 2033. The Uninterrupted Power Supply (UPS) Market refers to the global industry focused on the production, distribution, and sale of UPS systems, which provide emergency power to a load when the input power source or mains power fails. These systems ensure the continuous operation of electronic devices during power outages and protect against power surges, voltage drops, and other electrical anomalies.

The UPS market is essential for ensuring business continuity and protecting sensitive equipment from power disruptions, with a growing focus on innovation and sustainability.

Global Uninterrupted Power Supply (UPS) Market Synopsis

The COVID-19 pandemic had a significant impact on the Uninterrupted Power Supply (UPS) market. With the surge in remote work, online education, and digital entertainment, there was an increased demand for data center services, leading to a higher need for reliable UPS systems to ensure uninterrupted operations. Hospitals and healthcare facilities required more UPS systems to support critical medical equipment and ensure continuous operation, especially in the face of increased patient loads and the need for vaccination storage and administration. The pandemic accelerated digital transformation and the expansion of telecommunications infrastructure to support increased data usage, leading to greater investment in UPS systems to guarantee network reliability. The pandemic caused significant disruptions in global supply chains, affecting the manufacturing and distribution of UPS components and systems. This led to delays in production and longer lead times for delivery. Restrictions on movement and transportation during the pandemic affected the logistics of delivering UPS systems to end-users, leading to potential delays and increased costs. The pandemic accelerated the adoption of smart and modular UPS systems that offer remote monitoring and management capabilities, allowing businesses to maintain power systems with reduced on-site personnel.

Uninterrupted Power Supply (UPS) Market Dynamics

The major factors that have impacted the growth of Uninterrupted Power Supply (UPS) Market are as follows:

Drivers:

Ø Increasing Demand for Data Centers

The rapid growth of cloud services and big data analytics requires robust data center infrastructure with reliable power backup solutions. As more businesses undergo digital transformation, the need for data centers to support digital services increases, driving demand for UPS systems. The growth of 5G networks and telecommunications infrastructure increases the demand for UPS systems to support network reliability and uptime. Advancements in UPS technology, such as remote monitoring, predictive maintenance, and energy efficiency improvements, make these systems more attractive to businesses. The development of modular UPS systems allows businesses to scale power solutions according to their needs, providing flexibility and cost savings.

Restraint:

- Perception of High Initial Costs and Innovation Pace

The initial cost of purchasing and installing UPS systems, particularly large and sophisticated units, can be a significant barrier for small and medium-sized enterprises (SMEs) and residential users. Regular maintenance and periodic replacement of batteries add to the overall cost of owning a UPS system, making it a considerable investment. The rapid pace of technological innovation may render some UPS solutions obsolete, leading to reluctance in investing in new technologies without assured longevity and compatibility.

Opportunity:

⮚ Advancements in Battery Technology

The increasing adoption of lithium-ion batteries offers opportunities for UPS systems that are lighter, more efficient, and have longer lifespans compared to traditional lead-acid batteries. Innovations in energy storage technologies, such as solid-state batteries and flow batteries, present opportunities to enhance the performance and sustainability of UPS systems. The development of smart UPS systems with remote monitoring, predictive maintenance, and real-time diagnostics offers significant opportunities to enhance reliability and reduce operational costs. Incorporating Internet of Things (IoT) capabilities into UPS systems can provide enhanced data analytics, automation, and control, creating opportunities for advanced UPS solutions.

Uninterrupted Power Supply (UPS) Market Segment Overview

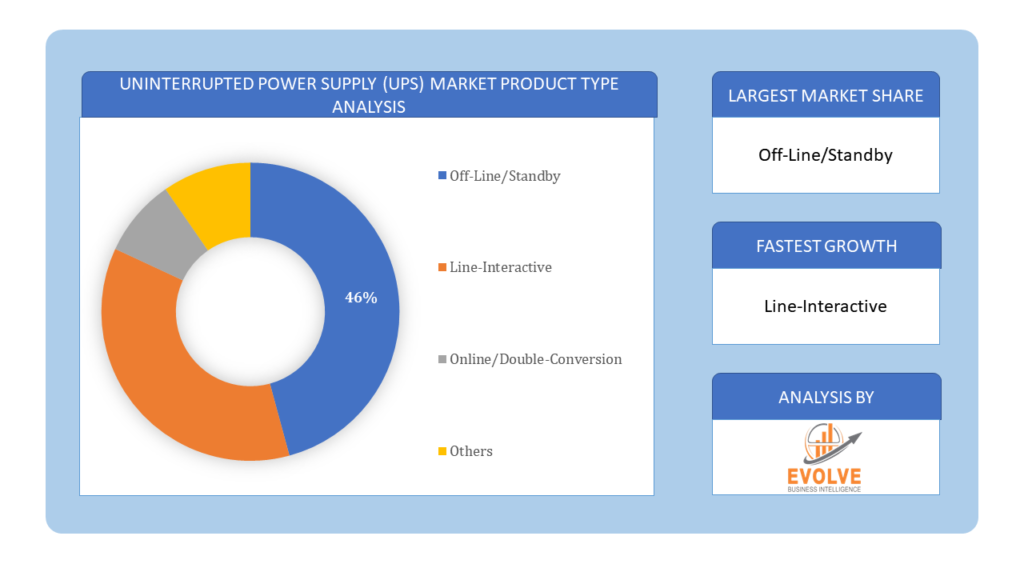

By Product Type

Based on Product Type, the market is segmented based on Off-Line/Standby, Line-Interactive, Online/Double-Conversion and Others. The Off-Line/Standby segment dominant the market. UPS comprises in-built transformers, switches, inverters, and others. Offline/standby UPS systems operated through battery inverters remain off. However, the system automatically switches on in case of a power breakdown. Offline UPS systems offer a switching time of less than 5ms and provide power backup only for a small duration. Offline UPS are commonly used with low power tolerance appliances such as computers, TV sets, and others.

Based on Product Type, the market is segmented based on Off-Line/Standby, Line-Interactive, Online/Double-Conversion and Others. The Off-Line/Standby segment dominant the market. UPS comprises in-built transformers, switches, inverters, and others. Offline/standby UPS systems operated through battery inverters remain off. However, the system automatically switches on in case of a power breakdown. Offline UPS systems offer a switching time of less than 5ms and provide power backup only for a small duration. Offline UPS are commonly used with low power tolerance appliances such as computers, TV sets, and others.

By Application

Based on Application, the market segment has been divided into Telecommunication, Data Center, Medical, Industrial, Marine and Others. The Data Centre segment dominated the market. The industry is witnessing enormous data generation due to the growth of digital infrastructure for enterprises. The uninterrupted power supply is considered the linchpin of any data center, offering businesses vital data protection solutions and a backup power supply. The UPS systems are installed in data centers to prevent damage from occurring due to frequent power cuts.

Global Uninterrupted Power Supply (UPS) Market Regional Analysis

Based on region, the global Uninterrupted Power Supply (UPS) Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Uninterrupted Power Supply (UPS) Market followed by the Asia-Pacific and Europe regions.

Uninterrupted Power Supply (UPS) North America Market

Uninterrupted Power Supply (UPS) North America Market

North America holds a dominant position in the Uninterrupted Power Supply (UPS) Market. North America, particularly the United States and Canada, represents a mature and technologically advanced market for UPS systems. The region has high adoption rates across various sectors including data centers, healthcare, and telecommunications. High demand for data centers, increasing adoption of cloud computing, and stringent regulations for data protection and business continuity drive the UPS market in North America.

Uninterrupted Power Supply (UPS) Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Uninterrupted Power Supply (UPS) Market industry. Asia-Pacific is one of the fastest-growing regions for UPS systems, driven by rapid urbanization, industrialization, and the expansion of IT and telecommunications infrastructure. Increasing infrastructure development, the rise of data centers, and growing awareness of power reliability and backup solutions drive market growth. Emerging markets like India and China are significant contributors. Adoption of advanced UPS technologies and modular solutions is growing. There is also a push for integrating UPS systems with renewable energy sources and enhancing energy efficiency.

Competitive Landscape

The global Uninterrupted Power Supply (UPS) Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Eaton Corporation

- Emerson Electric Co

- S&C Electric Company

- ABB Ltd

- Socomec

- Toshiba Corporation

- Xiamen Kehua Hengsheng Co. Ltd

- Sendon International Ltd

- KSTAR Corporation

- Schneider Electric

Key Development

In February 2022, to grow its UPS business in North America, Mitsubishi Electric Corporation announced that its US subsidiary Mitsubishi Electric Power Products, Inc. (MEPPI) acquired California-based Computer Protection Technology, Inc. (CPT). With this transaction, MEPPI and CPT hope to enhance their respective business models and offer highly dependable and expert one-stop services for UPS systems in the North American market, including installation and maintenance.

In November 2021, Long-Life 240W and 480W DIN Rail Mounted Emerson Electric Co introduced uninterrupted Power Supplies. The Ultra-reliable SolaHD SDU DC-B UPS control module has a service life of 15 years.

Scope of the Report

Global Uninterrupted Power Supply (UPS) Market, by Product Type

- Off-Line/Standby

- Line-Interactive

- Online/Double-Conversion

- Others

Global Uninterrupted Power Supply (UPS) Market, by Application

- Telecommunication

- Data Center

- Medical

- Industrial

- Marine

- Others

Global Uninterrupted Power Supply (UPS) Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $13.65 Billion |

| CAGR | 3.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Eaton Corporation, Emerson Electric Co, S&C Electric Company, ABB Ltd, Socomec, Toshiba Corporation, Xiamen Kehua Hengsheng Co. Ltd, Sendon International Ltd, KSTAR Corporation and Schneider Electric |

| Key Market Opportunities | • Advancements in Battery Technology • Smart UPS Technologies |

| Key Market Drivers | • Increasing Demand for Data Centers • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Uninterrupted Power Supply (UPS) Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Uninterrupted Power Supply (UPS) Market historical market size for the year 2021, and forecast from 2023 to 2033

- Uninterrupted Power Supply (UPS) Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Uninterrupted Power Supply (UPS) Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Uninterrupted Power Supply (UPS) Market is 2021- 2033

2.What is the growth rate of the global Uninterrupted Power Supply (UPS) Market?

- The global Uninterrupted Power Supply (UPS) Market is growing at a CAGR of 3.78% over the next 10 years

3.Which region has the highest growth rate in the market of Uninterrupted Power Supply (UPS) Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Uninterrupted Power Supply (UPS) Market?

- North America holds the largest share in 2022

5.Who are the key players in the global Uninterrupted Power Supply (UPS) Market?

Eaton Corporation, Emerson Electric Co, S&C Electric Company, ABB Ltd, Socomec, Toshiba Corporation, Xiamen Kehua Hengsheng Co. Ltd, Sendon International Ltd, KSTAR Corporation and Schneider Electric are the major companies operating in the market

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Uninterrupted Power Supply (UPS) Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Uninterrupted Power Supply (UPS) Market 4.8. Import Analysis of the Uninterrupted Power Supply (UPS) Market 4.9. Export Analysis of the Uninterrupted Power Supply (UPS) Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Uninterrupted Power Supply (UPS) Market, By Product Type 6.1. Introduction 6.2. Off-Line/Standby 6.3. Line-Interactive 6.4. Online/Double-Conversion 6.5. Others Chapter 7. Global Uninterrupted Power Supply (UPS) Market, By Application 7.1. Introduction 7.2. Telecommunication 7.3. Data Center 7.4. Medical 7.5. Industrial 7.6. Marine 7.7. Others Chapter 8. Global Uninterrupted Power Supply (UPS) Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Eaton Corporation 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Emerson Electric Co 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. S&C Electric Company 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. ABB Ltd 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Socomec 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Toshiba Corporation 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Xiamen Kehua Hengsheng Co. Ltd 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Sendon International Ltd 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 KSTAR Corporation 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Schneider Electric 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology