Testing, Inspection, and Certification (TIC) Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Testing, Inspection, and Certification (TIC) Market Research Report: Information By Service Type (Testing, Inspection, Certification, and Others), By Sourcing Type (In-House Services, Outsourced Services), By Application (Consumer Goods & Retail, Agriculture & Food, Chemical, Construction & Infrastructure, Energy & Power, Industrial & Manufacturing, Medical & Life Sciences, Mining, Oil & Gas And Petroleum, Public Sector, Automotive, Aerospace, Marine, Railway, Supply Chain & Logistics, IT & Telecom, Sports & Entertainment, Others), and by Region — Forecast till 2034

Page: 156

Testing, Inspection, and Certification (TIC) Market Overview

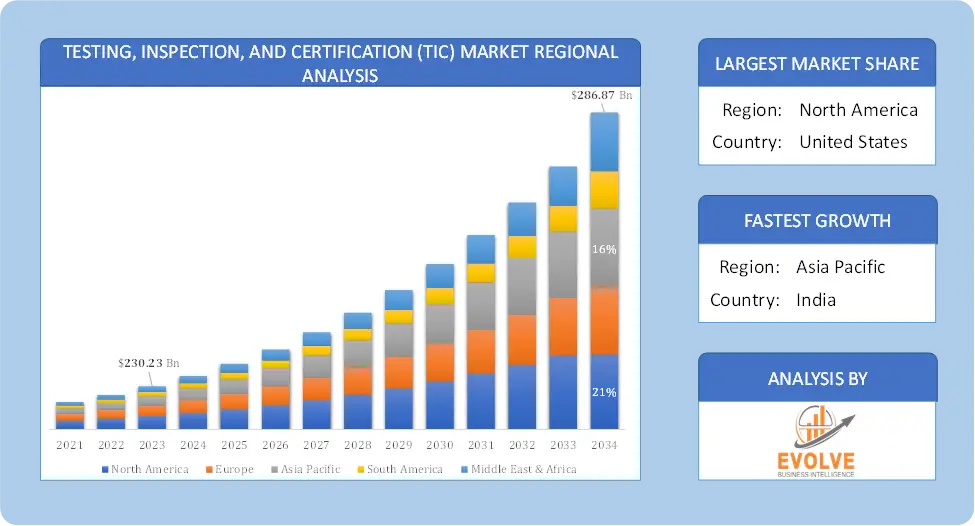

The Testing, Inspection, and Certification (TIC) Market size accounted for USD 230.23 Billion in 2023 and is estimated to account for 233.65 Billion in 2024. The Market is expected to reach USD 286.87 Billion by 2034 growing at a compound annual growth rate (CAGR) of 4.87% from 2024 to 2034. The Testing, Inspection, and Certification (TIC) Market involves services that ensure products, systems, or processes meet specific standards and regulatory requirements. These services are crucial in various industries such as manufacturing, energy, transportation, and healthcare, to ensure quality, safety, and compliance.

The TIC market is driven by growing regulatory standards, increasing demand for consumer safety, and the rise of global trade, which requires compliance with international quality standards. Various industries, including automotive, aerospace, food and beverages, and construction, depend on these services to maintain product reliability, safety, and quality.

Global Testing, Inspection, and Certification (TIC) Market Synopsis

Testing, Inspection, and Certification (TIC) Market Dynamics

Testing, Inspection, and Certification (TIC) Market Dynamics

The major factors that have impacted the growth of Testing, Inspection, and Certification (TIC) Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in sectors like electronics, manufacturing, and energy have led to the development of more complex products, requiring advanced TIC services to test and certify new technologies, such as electric vehicles, renewable energy systems, and smart devices. Consumers are becoming more conscious about product quality, safety, and environmental impact, leading businesses to invest in TIC services to meet consumer expectations and regulatory demands for quality assurance, safety certifications, and eco-friendly labels. The adoption of Industry 4.0 technologies, such as IoT, AI, and automation in manufacturing, has created the need for TIC services to verify the proper functioning and security of these technologies.

Restraint:

- Perception of High Cost of TIC Services and In-house Testing Capabilities

For many businesses, especially small and medium-sized enterprises (SMEs), the cost of testing, inspection, and certification services can be prohibitive. The need to comply with multiple regulatory standards across different regions increases the financial burden, limiting the adoption of TIC services. Many large companies are establishing in-house testing and inspection capabilities to reduce dependence on third-party TIC providers. This limits the growth potential of TIC companies, particularly in industries where businesses can afford to build their own facilities.

Opportunity:

⮚ Adoption of New Technologies

The rise of new technologies, such as electric vehicles, renewable energy, Internet of Things (IoT), and artificial intelligence (AI), presents significant opportunities for TIC providers. These technologies require advanced testing and certification to ensure safety, performance, and compliance with emerging standards. The integration of digital tools such as AI, blockchain, big data analytics, and automation in testing, inspection, and certification processes can enhance efficiency, reduce costs, and improve accuracy. TIC companies that adopt these technologies can gain a competitive edge and offer more sophisticated, tech-driven solutions.

Testing, Inspection, and Certification (TIC) Market Segment Overview

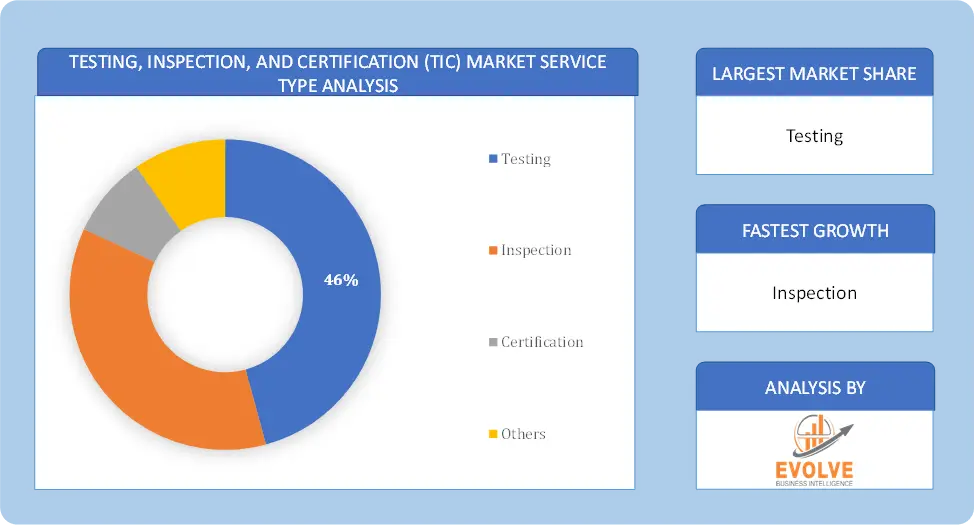

By Service Type

Based on Service Type, the market is segmented based on Testing, Inspection, Certification, and Others. The testing services segment dominated the market because testing is critical to ensuring product quality, safety, and compliance with regulatory standards. Companies across various industries rely on testing services to validate their products’ performance, reliability, and safety. Testing services involve conducting rigorous tests and assessments to identify defects, weaknesses, or non-compliance issues.

Based on Service Type, the market is segmented based on Testing, Inspection, Certification, and Others. The testing services segment dominated the market because testing is critical to ensuring product quality, safety, and compliance with regulatory standards. Companies across various industries rely on testing services to validate their products’ performance, reliability, and safety. Testing services involve conducting rigorous tests and assessments to identify defects, weaknesses, or non-compliance issues.

By Sourcing Type

Based on Sourcing Type, the market segment has been divided into In-House Services and Outsourced Services. The outsourcing segment dominated the market because outsourcing allows companies to access specialized expertise and resources that may not be available in-house. Organizations can benefit from their extensive knowledge and experience in conducting testing, inspection, and certification activities by partnering with external TIC providers. Secondly, outsourcing TIC services can help companies reduce costs and improve operational efficiency. Instead of investing in building and maintaining their own TIC infrastructure, outsourcing allows businesses to leverage the existing infrastructure of service providers, resulting in cost savings.

By Application

Based on Application, the market segment has been divided into Consumer Goods & Retail, Agriculture & Food, Chemical, Construction & Infrastructure, Energy & Power, Industrial & Manufacturing, Medical & Life Sciences, Mining, Oil & Gas And Petroleum, Public Sector, Automotive, Aerospace, Marine, Railway, Supply Chain & Logistics, IT & Telecom, Sports & Entertainment and Others. The consumer goods & retail segment dominant the market. consumer goods, such as electronics, toys, textiles, and household products always required testing services owing to the high volume of products that comply with stringent regulatory standards. As a result, the high demand for product safety, quality assurance, and regulatory compliance in this industry will likely continue to boost the market demand.

Global Testing, Inspection, and Certification (TIC) Market Regional Analysis

Based on region, the global Testing, Inspection, and Certification (TIC) Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Testing, Inspection, and Certification (TIC) Market followed by the Asia-Pacific and Europe regions.

Global Testing, Inspection, and Certification (TIC) North America Market

Global Testing, Inspection, and Certification (TIC) North America Market

North America holds a dominant position in the Testing, Inspection, and Certification (TIC) Market. The North American TIC market is also mature, with a focus on regulatory compliance and risk management. The United States and Canada are major players in this market. The North American TIC market is driven by stringent regulatory standards, especially in industries such as healthcare, pharmaceuticals, aerospace, and automotive. The U.S. and Canada have well-established regulatory bodies like the U.S. Food and Drug Administration (FDA) and the Federal Aviation Administration (FAA), which mandate rigorous testing and certification and growth in sectors such as electric vehicles, renewable energy, and digital technologies offers TIC service providers new opportunities to support the safe adoption of these innovations.

Global Testing, Inspection, and Certification (TIC) Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Testing, Inspection, and Certification (TIC) Market industry. This region is experiencing the fastest growth in the TIC market, driven by rapid industrialization, increasing consumer demand for quality products, and government initiatives to promote quality standards. Countries such as China, India, and Japan are major contributors to this growth. The rapid industrialization, urbanization, and economic growth in countries like China, India, Japan, and South Korea have fueled demand for TIC services. Governments in these regions are increasingly implementing stricter quality and safety standards, particularly in sectors like manufacturing, consumer goods, and food safety.

Competitive Landscape

The global Testing, Inspection, and Certification (TIC) Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- SGS Group

- Bureau Veritas

- Intertek

- Dekra

- Eurofins Scientific

- TUV SUD

- DNV

- APPLUS+

- ALS Limited

- TÜV Nord Group

Key Development

In May 2023, SGS partnered with Worldly, the global comprehensive impact intelligence platform for consumer goods and fashion businesses. With this partnership, SGS would bring scalable, third-party data validation to the consumer goods industry, to help enterprises frequently and accurately report to stakeholders, decreasing greenwashing risk, improving supply chain transparency, and complying with key legislation.

In April 2022, TUV SUD collaborated with ioMosaic, a leading US provider of process safety solutions. The collaboration aims to ally process safety and risk management services. Moreover, this collaboration would benefit the customers of both TÜV SÜD and ioMosaic, offering a broader range of services and additional digital applications, and wider training offers, notably increasing laboratory capacity and more training specialization.

Scope of the Report

Global Testing, Inspection, and Certification (TIC) Market, by Service Type

- Testing

- Inspection

- Certification

- Others

Global Testing, Inspection, and Certification (TIC) Market, by Sourcing Type

- In-House Services

- Outsourced Services

Global Testing, Inspection, and Certification (TIC) Market, by Application

- Consumer Goods & Retail

- Agriculture & Food

- Chemical

- Construction & Infrastructure

- Energy & Power

- Industrial & Manufacturing

- Medical & Life Sciences

- Mining

- Oil & Gas and Petroleum

- Public Sector

- Automotive

- Aerospace

- Marine

- Railway

- Supply Chain & Logistics

- IT & Telecom

- Sports & Entertainment

- Others

Global Testing, Inspection, and Certification (TIC) Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $286.87 Billion |

| CAGR | 4.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Service Type, Sourcing Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | SGS Group, Bureau Veritas, Intertek, Dekra, Eurofins Scientific, TUV SUD, DNV, APPLUS+, ALS Limited and TÜV Nord Group. |

| Key Market Opportunities | • Adoption of New Technologies • Digital Transformation and Automation |

| Key Market Drivers | • Technological Advancements • Increased Adoption of Digital and Automation Technologies |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Testing, Inspection, and Certification (TIC) Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Testing, Inspection, and Certification (TIC) Market historical market size for the year 2021, and forecast from 2023 to 2033

- Testing, Inspection, and Certification (TIC) Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Testing, Inspection, and Certification (TIC) Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Testing, Inspection, and Certification (TIC) Market is 2021- 2033

What is the growth rate of the global Testing, Inspection, and Certification (TIC) Market?

The global Testing, Inspection, and Certification (TIC) Market is growing at a CAGR of 4.87% over the next 10 years

Which region has the highest growth rate in the market of Testing, Inspection, and Certification (TIC) Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Testing, Inspection, and Certification (TIC) Market?

North America holds the largest share in 2022

Who are the key players in the global Testing, Inspection, and Certification (TIC) Market?

SGS Group, Bureau Veritas, Intertek, Dekra, Eurofins Scientific, TUV SUD, DNV, APPLUS+, ALS Limited and TÜV Nord Group. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Testing, Inspection, and Certification (TIC) Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Testing, Inspection, and Certification (TIC) Market, By Service Type 6.1. Introduction 6.2. Testing 6.3. Inspection 6.4. Certification 6.5. Others Chapter 7. Global Testing, Inspection, and Certification (TIC) Market, By Sourcing Type 7.1. Introduction 7.2. In House Services 7.3. Outsources Services Chapter 8. Global Testing, Inspection, and Certification (TIC) Market, By Application 8.1. Introduction 8.2. Consumer goods & retail 8.3. Agriculture & food 8.4. Chemical 8.5. Construction & infrastructure 8.6. Energy & power 8.7. Industrial & manufacturing 8.8. Medical & life sciences 8.9. Mining 8.10. Oil & gas and petroleum 8.11. Public sector 8.12. Automotive 8.13. Aerospace 8.14. Marine 8.15. Railway 8.16. Supply chain & logistics 8.17. It and telecom 8.18. Sports & entertainment Chapter 9. Global Testing, Inspection, and Certification (TIC) Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Service Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.2.6. Market Size and Forecast, By Application, 2020 - 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.2.7.5. Market Size and Forecast, By Application, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Service Type, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.2.8.6. Market Size and Forecast, By Application, 2020 – 2028 9.2.9. Mexico 9.2.9.1. Introduction 9.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.9.4. Market Size and Forecast, By Service Type, 2020 - 2028 9.2.9.5. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.2.9.6. Market Size and Forecast, By Application, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.6. Market Size and Forecast, By Application, 2020 - 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.7.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.8.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.9.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.10.5. Market Size and Forecast, By Application, 2020 - 2028 9.3.11. Spain 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.11.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.12. Russia 9.3.12.1. Introduction 9.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.12.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.12.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.12.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.13. Nehterland 9.3.13.1. Introduction 9.3.13.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.13.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.13.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.13.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.14. Switzerland 9.3.14.1. Introduction 9.3.14.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.14.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.14.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.14.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.15. Poland 9.3.15.1. Introduction 9.3.15.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.15.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.15.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.15.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.16. Norway 9.3.16.1. Introduction 9.3.16.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.16.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.16.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.16.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.17. Rest Of Europe 9.3.17.1. Introduction 9.3.17.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.17.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.3.17.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.3.17.5. Market Size and Forecast, By Application, 2020 – 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.7. Market Size and Forecast, By Application, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.8.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.9.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.10.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.11.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.12. Australia 9.4.12.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.12.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.13. Singapore 9.4.13.1. Introduction 9.4.13.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.13.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.13.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.13.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.14. Thailand 9.4.14.1. Introduction 9.4.14.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.14.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.14.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.14.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.15. Indonesia 9.4.15.1. Introduction 9.4.15.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.15.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.15.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.15.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.16. Malayisa 9.4.16.1. Introduction 9.4.16.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.16.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.16.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.16.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.17. Hongkong 9.4.17.1. Introduction 9.4.17.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.17.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.17.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.17.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.18. Rest Of Asia-Pacific 9.4.18.1. Introduction 9.4.18.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.18.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.4.18.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.4.18.5. Market Size and Forecast, By Application, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.7.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.8.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.9. Brazil 9.5.9.1. Introduction 9.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.9.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.9.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.9.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.10. Argentina 9.5.10.1. Introduction 9.5.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.10.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.10.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.10.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.11. Saudi Arabia 9.5.11.1. Introduction 9.5.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.11.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.11.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.11.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.12. United Arab Emirates 9.5.12.1. Introduction 9.5.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.12.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.12.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.12.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.13. Iran 9.5.13.1. Introduction 9.5.13.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.13.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.13.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.13.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.14. Iraq 9.5.14.1. Introduction 9.5.14.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.14.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.14.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.14.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.15. South Africa 9.5.15.1. Introduction 9.5.15.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.15.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.15.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.15.5. Market Size and Forecast, By Application, 2020 - 2028 9.5.16. Oman 9.5.16.1. Introduction 9.5.16.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.16.3. Market Size and Forecast, By Service Type, 2020 - 2028 9.5.16.4. Market Size and Forecast, By Sourcing Type, 2020 - 2028 9.5.16.5. Market Size and Forecast, By Application, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. SGS GROUP 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. BUREAU VERITAS 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. INTERTEK 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. DEKRA SE 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. EUROFINS SCIENTIFIC 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. TÜV SÜD 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. DNV GL 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. APPLUS+ 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. ALS LIMITED 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. TÜV NORD GROUP 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.10.4. Recent Development and Strategies Adopted 11.10.5. SWOT Analysis 11.11. LLOYD’S REGISTER GROUP LIMITED 11.11.1. Business Overview 11.11.2. Financial Analysis 11.11.3. Product Portfolio 11.11.4. Recent Development and Strategies Adopted 11.11.5. SWOT Analysis 11.12. MISTRAS 11.12.1. Business Overview 11.12.2. Financial Analysis 11.12.3. Product Portfolio 11.12.4. Recent Development and Strategies Adopted 11.12.5. SWOT Analysis 11.13. ELEMENT MATERIALS SERVICE TYPE 11.13.1. Business Overview 11.13.2. Financial Analysis 11.13.3. Product Portfolio 11.13.4. Recent Development and Strategies Adopted 11.13.5. SWOT Analysis 11.14. UL LLC 11.14.1. Business Overview 11.14.2. Financial Analysis 11.14.3. Product Portfolio 11.14.4. Recent Development and Strategies Adopted 11.14.5. SWOT Analysis 11.15. APAVE INTERNATIONAL 11.15.1. Business Overview 11.15.2. Financial Analysis 11.15.3. Product Portfolio 11.15.4. Recent Development and Strategies Adopted 11.15.5. SWOT Analysis 11.16. OPUS GROUP AB 11.16.1. Business Overview 11.16.2. Financial Analysis 11.16.3. Product Portfolio 11.16.4. Recent Development and Strategies Adopted 11.16.5. SWOT Analysis 11.17. CSA GROUP 11.17.1. Business Overview 11.17.2. Financial Analysis 11.17.3. Product Portfolio 11.17.4. Recent Development and Strategies Adopted 11.17.5. SWOT Analysis 11.18. CUGNIER 11.18.1. Business Overview 11.18.2. Financial Analysis 11.18.3. Product Portfolio 11.18.4. Recent Development and Strategies Adopted 11.18.5. SWOT Analysis 11.19. LENOR GROUP 11.19.1. Business Overview 11.19.2. Financial Analysis 11.19.3. Product Portfolio 11.19.4. Recent Development and Strategies Adopted 11.19.5. SWOT Analysis 11.20. KIWA NV 11.20.1. Business Overview 11.20.2. Financial Analysis 11.20.3. Product Portfolio 11.20.4. Recent Development and Strategies Adopted 11.20.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology