Telecom Electronic Manufacturing Service Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

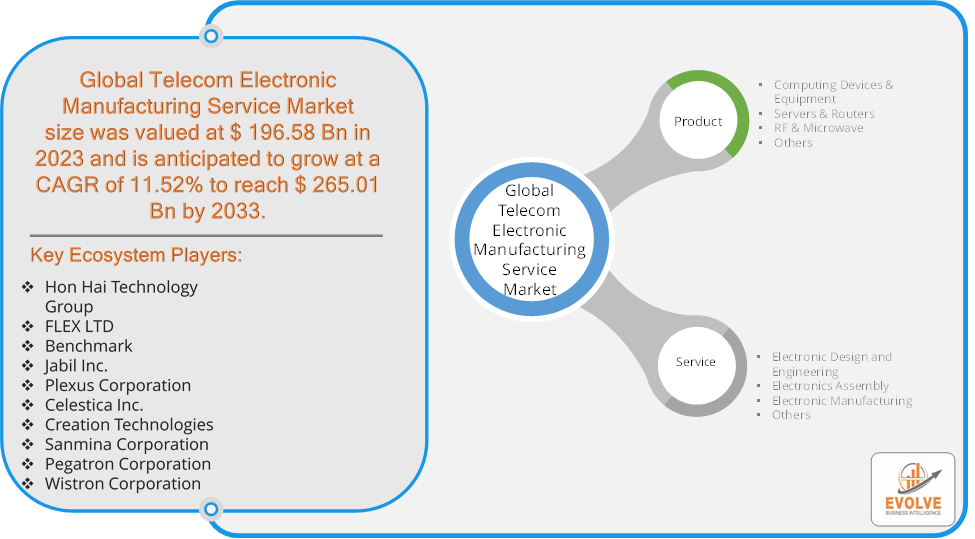

Telecom Electronic Manufacturing Service Market Research Report: Information By Product Type (Computing Devices & Equipment, Servers & Routers, RF & Microwave, Others), By Service (Electronic Design and Engineering, Electronics Assembly, Electronic Manufacturing, Others), and by Region — Forecast till 2033

Page: 158

Telecom Electronic Manufacturing Service Market Overview

The Telecom Electronic Manufacturing Service Market Size is expected to reach USD 265.01 Billion by 2033. The Telecom Electronic Manufacturing Service Market industry size accounted for USD 196.58 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.52% from 2023 to 2033. The Telecom Electronic Manufacturing Service (EMS) Market involves companies that provide manufacturing services for electronic components and devices used in telecommunications. These services typically include design, assembly, testing, distribution, and repair of electronic parts and systems. The market caters to various telecom sectors, including wireless communication, broadband networks, satellite communication, and other related areas.

The telecom EMS companies act as partners to telecom equipment manufacturers. They handle the production side of things, allowing telecom companies to focus on research, development, and design. Overall, the Telecom EMS Market plays a crucial role in the telecom industry’s supply chain, enabling telecom companies to deliver high-quality and innovative products to their customers.

Global Telecom Electronic Manufacturing Service Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Telecom Electronic Manufacturing Service (EMS) Market. The pandemic caused disruptions in the supply chain, leading to shortages of essential electronic components and raw materials. Many manufacturing facilities had to temporarily shut down or operate at reduced capacity to comply with lockdown measures and health protocols. Implementing additional health and safety measures in factories added to operational costs. The shift to remote work and online education increased the demand for reliable internet and telecom services, driving investments in telecom infrastructure. With more people staying at home, there was a surge in data usage, leading to the need for upgraded and expanded telecom networks. Telecom companies accelerated their investment in 5G infrastructure to meet the growing demand for high-speed internet and enhanced connectivity. The need for advanced 5G-compatible devices and components spurred innovation and development in the telecom EMS sector. The pandemic highlighted the need for more resilient and diversified supply chains, leading EMS providers to explore multiple sourcing options and invest in supply chain management technologies.

Telecom Electronic Manufacturing Service Market Dynamics

The major factors that have impacted the growth of Telecom Electronic Manufacturing Service Market are as follows:

Drivers:

Ø Increasing Demand for Telecom Infrastructure

The global rollout of 5G networks is a significant driver, requiring advanced electronic components and systems for base stations, antennas, and other infrastructure. The demand for high-speed internet services is driving investments in fiber optic networks and broadband infrastructure. Advances in miniaturization and the integration of electronic components are enabling more compact and efficient telecom devices. The development of new materials and components, such as advanced semiconductors and high-frequency circuits, supports the next generation of telecom technology. The growth of video streaming, online gaming, and other data-intensive services drives the need for enhanced telecom networks.

Restraint:

- Perception of High Capital Investment

Setting up advanced manufacturing facilities requires significant capital investment, which can be a barrier for new entrants and smaller players. Continuous investment in maintaining and upgrading manufacturing equipment to keep pace with technological advancements is necessary but costly. The risk of patent infringements and intellectual property disputes can pose legal challenges and financial risks for EMS providers. Economic downturns and fluctuations in global markets can affect investment in telecom infrastructure and, consequently, the demand for EMS services.

Opportunity:

⮚ Growth of IoT Applications

The increasing adoption of IoT technologies in smart cities and homes drives the demand for a wide range of connected devices, sensors, and communication modules. The growth of Industry 4.0 and the industrial IoT sector presents opportunities for EMS providers to supply components for automation, monitoring, and control systems. Continuous advancements in telecom technology, including the development of next-generation networks (6G), present opportunities for EMS providers to innovate and offer cutting-edge solutions. Initiatives to expand high-speed internet access to rural and remote areas generate demand for telecom infrastructure and related electronic components. The deployment of fiber optic networks for high-speed internet services drives the need for advanced manufacturing services.

Telecom Electronic Manufacturing Service Market Segment Overview

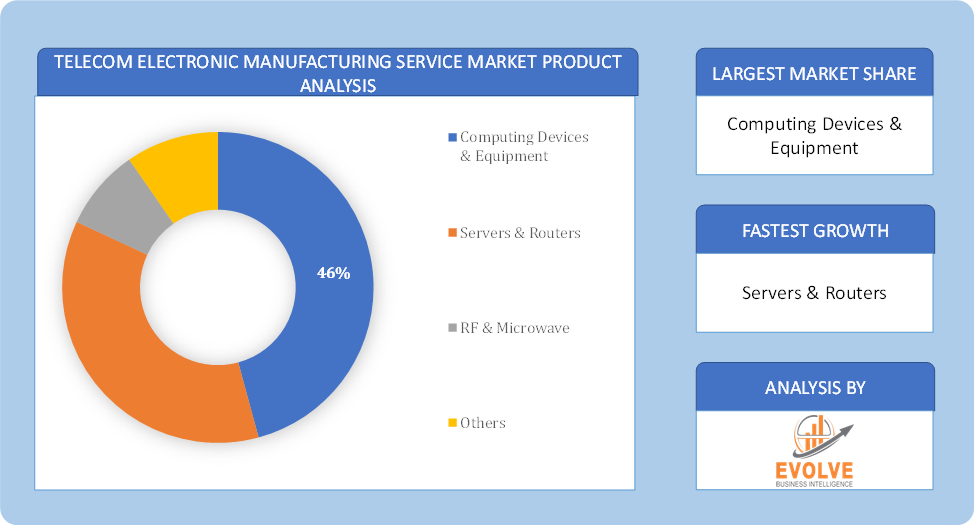

By Product Type

Based on Product Type, the market is segmented based on Computing Devices & Equipment, Servers & Routers, RF & Microwave and Others. Servers and routers segment dominant the market. Servers and routers are utilized rather frequently in the telecommunications business. Renowned electronic manufacturing service providers may put together the servers and routers. Telecommunications servers are open, standards-based computing platforms that serve as a carrier-grade common platform for various communications applications. They also allow equipment manufacturers to add value at many different levels of the system architecture. Routers are communication tools that link two distinct networks.

By Service

Based on Service, the market segment has been divided into the Electronic Design and Engineering, Electronics Assembly, Electronic Manufacturing and Others. Electronic manufacturing is the largest segment within the telecom EMS market. This segment encompasses the complete process of producing electronic components and devices, from procurement of raw materials to final assembly and testing. It includes not only the assembly of components but also the fabrication of printed circuit boards (PCBs), molding and extrusion of plastics, and final product assembly. The demand for electronic manufacturing is driven by the high volume of electronic components required by the telecom industry and the complex nature of the manufacturing processes involved.

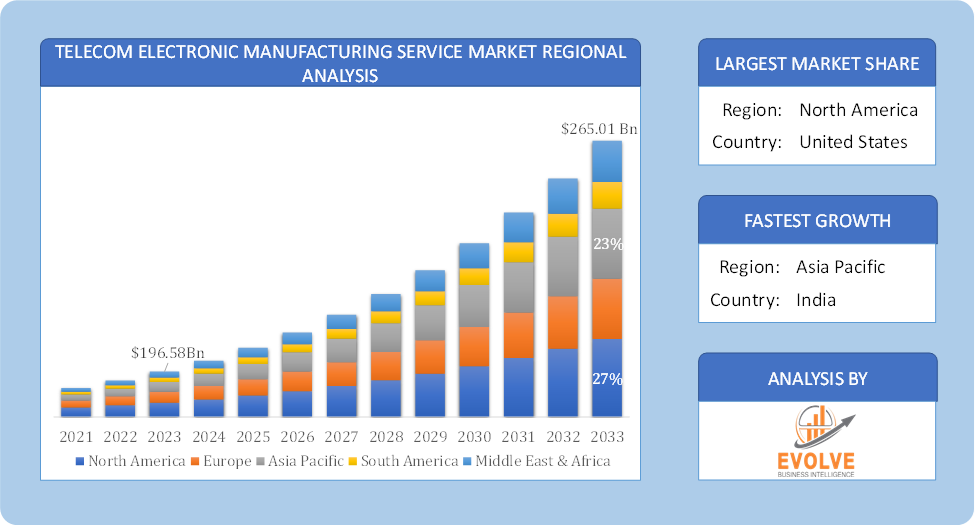

Global Telecom Electronic Manufacturing Service Market Regional Analysis

Based on region, the global Telecom Electronic Manufacturing Service Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Telecom Electronic Manufacturing Service Market followed by the Asia-Pacific and Europe regions.

Telecom Electronic Manufacturing Service North America Market

North America holds a dominant position in the Telecom Electronic Manufacturing Service Market. Advanced telecom infrastructure with significant investments in 5G networks and IoT applications. Strong presence of major telecom companies and technology firms. Growing demand for smart devices and IoT applications in industries and smart cities.

Telecom Electronic Manufacturing Service Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Telecom Electronic Manufacturing Service Market industry. Rapidly growing telecom infrastructure, particularly in China, India, and Southeast Asia. Major manufacturing hub for electronic components and devices. Significant investments in 5G networks and digital transformation initiatives. Large consumer base driving demand for telecom devices and services.

Competitive Landscape

The global Telecom Electronic Manufacturing Service Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Hon Hai Technology Group

- FLEX LTD

- Benchmark

- Jabil Inc.

- Plexus Corporation

- Celestica Inc.

- Creation Technologies

- Sanmina Corporation

- Pegatron Corporation

- Wistron Corporation

Key Development

In June 2023, Creation Technologies LP announced its shift to a newly expanded facility in Changzhou, China, which spans 150,000 square feet, underscoring its commitment to expanding its global presence and enhancing its presence in China.

In June 2022, Flex announced its strategic initiative to bolster its presence in the automotive industry by expanding its operations in Jalisco, Mexico. The forthcoming project involves the construction of a cutting-edge facility spanning 145,000 square feet. This state-of-the-art facility is poised to become a pivotal manufacturing hub in the region, with a focus on producing advanced electronic components to propel the advancement of electric and autonomous vehicles.

Scope of the Report

Global Telecom Electronic Manufacturing Service Market, by Product Type

- Computing Devices & Equipment

- Servers & Routers

- RF & Microwave

- Others

Global Telecom Electronic Manufacturing Service Market, by Service

- Electronic Design and Engineering

- Electronics Assembly

- Electronic Manufacturing

- Others

Global Telecom Electronic Manufacturing Service Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 265.01 Billion |

| CAGR (2023-2033) | 11.52% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Service |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Hon Hai Technology Group, FLEX LTD, Benchmark, Jabil Inc., Plexus Corporation, Celestica Inc., Creation Technologies, Sanmina Corporation, Pegatron Corporation and Wistron Corporation. |

| Key Market Opportunities | · Growth of IoT Applications · Increased Demand for High-Speed Internet |

| Key Market Drivers | · Increasing Demand for Telecom Infrastructure · Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Telecom Electronic Manufacturing Service Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Telecom Electronic Manufacturing Service Market historical market size for the year 2021, and forecast from 2023 to 2033

- Telecom Electronic Manufacturing Service Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Telecom Electronic Manufacturing Service Market affected by the pandemic

To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Telecom Electronic Manufacturing Service Market is 2021- 2033

What is the growth rate of the global Telecom Electronic Manufacturing Service Market?

The global Telecom Electronic Manufacturing Service Market is growing at a CAGR of 11.52% over the next 10 years

Which region has the highest growth rate in the market of Telecom Electronic Manufacturing Service Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Telecom Electronic Manufacturing Service Market?

North America holds the largest share in 2022

Who are the key players in the global Telecom Electronic Manufacturing Service Market?

Hon Hai Technology Group, FLEX LTD, Benchmark, Jabil Inc., Plexus Corporation, Celestica Inc., Creation Technologies, Sanmina Corporation, Pegatron Corporation and Wistron Corporation. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Telecom Electronic Manufacturing Service Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Telecom Electronic Manufacturing Service Market 4.8. Import Analysis of the Telecom Electronic Manufacturing Service Market 4.9. Export Analysis of the Telecom Electronic Manufacturing Service Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Telecom Electronic Manufacturing Service Market, By Product Type 6.1. Introduction 6.2. Computing Devices & Equipment 6.3. Servers & Routers 6.4. RF & Microwave 6.5. Others Chapter 7. Global Telecom Electronic Manufacturing Service Market, By Service 7.1. Introduction 7.2. Electronic Design and Engineering 7.3. Electronics Assembly 7.4. Electronic Manufacturing 7.5. Others Chapter 8. Global Telecom Electronic Manufacturing Service Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Hon Hai Technology Group 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. FLEX LTD 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Benchmark 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Jabil Inc. 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Plexus Corporation 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Celestica Inc. 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Creation Technologies 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Sanmina Corporation 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Pegatron Corporation 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Wistron Corporation 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology