Swine Feed Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

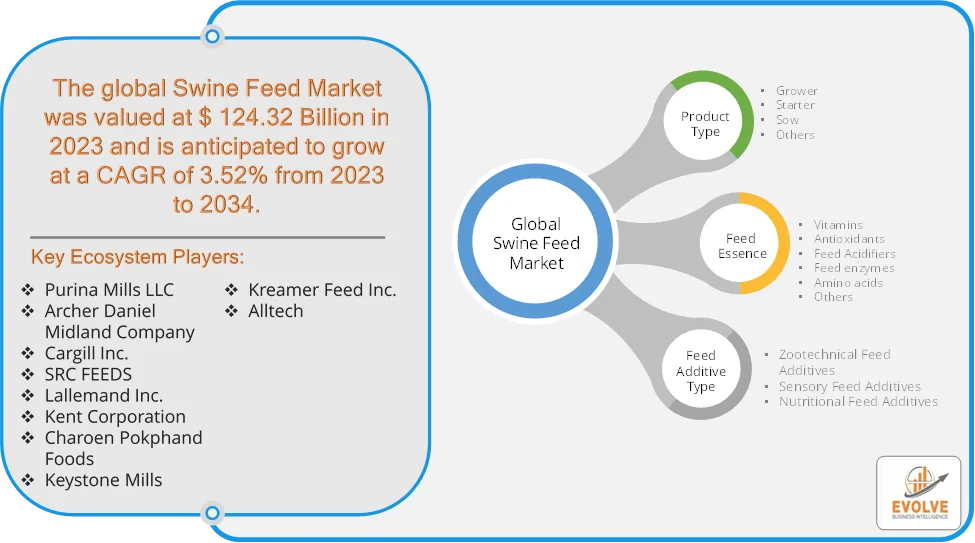

Swine Feed Market Research Report: Information By Product Type (Grower, Starter, Sow, and Others), Feed Essence (Vitamins, Antioxidants, Feed Acidifiers, Feed enzymes, Amino acids, and Others), Feed Additive Type (Zootechnical Feed Additives, Sensory Feed Additives, Nutritional Feed Additives), and by Region — Forecast till 2034

Page: 165

Swine Feed Market Overview

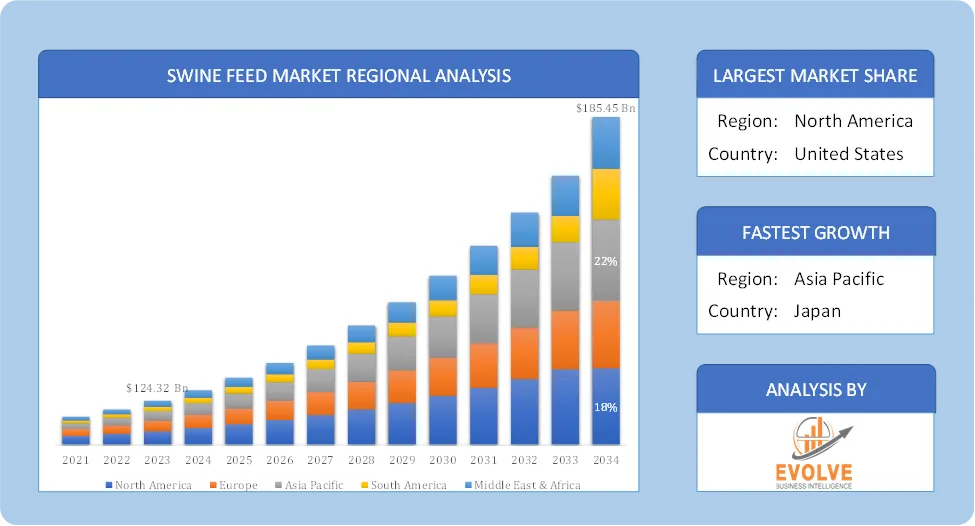

The Swine Feed Market size accounted for USD 124.32 Billion in 2023 and is estimated to account for 136.88 Billion in 2024. The Market is expected to reach USD 185.45 Billion by 2034 growing at a compound annual growth rate (CAGR) of 3.52% from 2024 to 2034. The Swine Feed Market focuses on providing specialized nutrition for pigs at different stages of growth, including starters, growers, and finishers. This market is crucial for the livestock industry, ensuring optimal health, weight gain, and meat quality in swine.

The swine feed market is a vital part of the global food supply chain, experiencing steady growth driven by increasing pork consumption and a focus on quality and efficient production. The market is evolving with trends towards specialized nutrition, sustainability, and technological advancements.

Global Swine Feed Market Synopsis

Swine Feed Market Dynamics

Swine Feed Market Dynamics

The major factors that have impacted the growth of Swine Feed Market are as follows:

Drivers:

Ø Growth of Commercial Pig Farming

The shift from traditional pig farming to intensive commercial operations is boosting the demand for nutritionally balanced feed. Large-scale farms require specialized feeds to maximize production efficiency, improve weight gain, and ensure consistent meat quality. Improved feed formulations with essential nutrients, vitamins, and minerals enhance pig health and productivity and the use of probiotics, prebiotics, enzymes, and amino acids helps improve digestion and overall feed efficiency and frequent disease outbreaks, such as African Swine Fever (ASF) and Porcine Reproductive and Respiratory Syndrome (PRRS), have increased the demand for fortified and medicated feeds.

Restraint:

- Fluctuating Raw Material Prices and High Cost of Specialized

Corn, soybean meal, wheat, and other essential feed ingredients often experience price volatility due to factors like climate change, supply chain disruptions, and geopolitical tensions. Rising raw material costs directly impact the profitability of feed manufacturers and pig farmers. Organic, non-GMO, and medicated feeds come at a higher cost, making them less accessible to small-scale pig farmers and the affordability challenge can limit the adoption of premium feed products, especially in developing regions.

Opportunity:

⮚ Rising Demand for High-Quality & Nutrient-Enriched Feed

Growing awareness among pig farmers about the importance of balanced nutrition is increasing demand for fortified feeds with essential vitamins, minerals, and amino acids. Feed manufacturers can develop customized feed solutions based on swine growth stages and specific health requirements. Consumer preference for antibiotic-free, organic, and sustainably raised pork is driving demand for organic and non-GMO feed alternatives and feed manufacturers can capitalize on this trend by developing premium organic feed formulations using plant-based and alternative protein sources. The shift away from antibiotic growth promoters (AGPs) has increased demand for natural alternatives like probiotics, prebiotics, enzymes, and essential oils and the market has opportunities in functional additives that improve digestion, enhance immunity, and boost growth performance.

Swine Feed Market Segment Overview

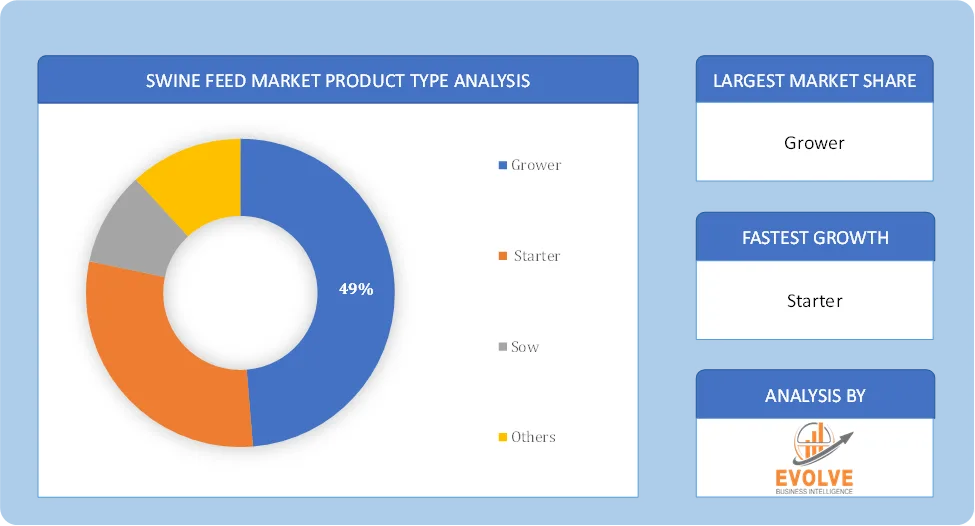

Based on Product Type, the market is segmented based on Grower, Starter, Sow, and Others. The grower segment dominant the market. The demand for swine feed, specifically the grower feed, is primarily driven by the increasing focus on maximizing the growth potential and efficiency of pigs during the crucial growth phase. Grower feed is formulated to provide the necessary nutrients and support rapid development in young swine, optimizing their transition from the starter stage to adulthood.

By Feed Essence

Based on Feed Essence, the market segment has been divided into Vitamins, Antioxidants, Feed Acidifiers, Feed enzymes, Amino acids, and Others. The amino acids segment dominant the market. The expanding product adoption owing to the imperative role that amino acids play in swine nutrition and overall growth represents one of the key factors boosting the market growth. Amino acids are the building blocks of proteins, which are essential for muscle development and overall swine health. With an increasing emphasis on optimizing feed efficiency and meat quality in swine production, there is a growing recognition that providing precise and balanced amino acids in swine feed is crucial, which is contributing to the surging inclusion of amino acids in swine feed.

By Feed Additive Type

Based on Application, the market segment has been divided into Zootechnical Feed Additives, Sensory Feed Additives, Nutritional Feed Additives. Nutritional feed additives segment dominant the market. The demand for nutritional feed additives in the swine industry is being driven by the need for enhanced animal health, performance, and sustainable production. Swine farmers are increasingly recognizing the pivotal role of nutritional feed additives in improving feed efficiency, disease resistance, and overall well-being of their pigs. These additives include vitamins, minerals, probiotics, and enzymes, among others, which contribute to optimized nutrition and digestion in swine.

Global Swine Feed Market Regional Analysis

Based on region, the global Swine Feed Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Swine Feed Market followed by the Asia-Pacific and Europe regions.

North America Swine Feed Market

North America Swine Feed Market

North America holds a dominant position in the Swine Feed Market. The U.S., Canada, and Mexico are key players, with the U.S. being the leading producer of pork and swine feed and it has strong emphasis on quality control, disease prevention, and sustainable feed practices. Advanced agricultural practices and feeding systems contribute to market growth and Increasing demand for organic and premium pig feed, especially in the U.S. Fluctuations in the prices of corn and soybean meal affect feed production costs.

Asia-Pacific Swine Feed Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Swine Feed Market industry. Countries like China are the world’s largest pork producers, leading to substantial demand for swine feed. Modernization of swine farming practices towards intensive commercial operations also contributes. A shift towards modern, intensive commercial swine farming is increasing the demand for high-performance feeds and Growing emphasis on feed quality and safety to meet consumer demand for high-quality pork.

Competitive Landscape

The global Swine Feed Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Purina Mills LLC

- Archer Daniel Midland Company

- Cargill Inc.

- SRC FEEDS

- Lallemand Inc.

- Kent Corporation

- Charoen Pokphand Foods

- Keystone Mills

- Kreamer Feed Inc.

Key Development

In January 2023, Cargill expanded its animal nutrition partnership with BASF, incorporating research and development, opening new markets, and enhancing feed enzymes distribution. Together, they will create and offer tailored enzyme products and solutions for animals, particularly swine.

In November 2022, Royal DSM-Firmenich, a global purpose-led science-based company, announced its resumption of Rovimix® Vitamin A production in Sisseln, Switzerland.

Scope of the Report

Global Swine Feed Market, by Product Type

- Grower

- Starter

- Sow

- Others

Global Swine Feed Market, by Feed Essence

- Vitamins

- Antioxidants

- Feed Acidifiers

- Feed enzymes

- Amino acids

- Others

Global Swine Feed Market, by Feed Additive Type

- Zootechnical Feed Additives

- Sensory Feed Additives

- Nutritional Feed Additives

Global Swine Feed Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 185.45 Billion |

| CAGR (2024-2034) | 3.52% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Feed Essence, Feed Additive Type |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Purina Mills LLC, Archer Daniel Midland Company, Cargill Inc., SRC FEEDS, Lallemand Inc., Kent Corporation, Charoen Pokphand Foods, Keystone Mills, Kreamer Feed Inc. and Alltech. |

| Key Market Opportunities | · Rising Demand for High-Quality & Nutrient-Enriched Feed |

| Key Market Drivers | · Growth of Commercial Pig Farming · Advances in Animal Nutrition & Feed Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Swine Feed Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Swine Feed Market historical market size for the year 2021, and forecast from 2023 to 2033

- Swine Feed Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Swine Feed Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Swine Feed Market is 2021- 2033

What is the growth rate of the global Swine Feed Market?

The global Swine Feed Market is growing at a CAGR of 3.52% over the next 10 years

Which region has the highest growth rate in the market of Swine Feed Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Swine Feed Market?

North America holds the largest share in 2022

Who are the key players in the global Swine Feed Market?

Purina Mills LLC, Archer Daniel Midland Company, Cargill Inc., SRC FEEDS, Lallemand Inc., Kent Corporation, Charoen Pokphand Foods, Keystone Mills, Kreamer Feed Inc. and Alltech. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Product Type Segement – Market Opportunity Score

4.1.2. Feed Essence Segment – Market Opportunity Score

4.1.3. Feed Additive Type Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Swine Feed Market Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Swine Feed Market Market, By Product Type

7.1. Introduction

7.1.1. Grower

7.1.2 Starter

7.1.3. Sow

7.1.4. Others

CHAPTER 8 Swine Feed Market Market, By Feed Essence

8.1. Introduction

8.1.1. Vitamins

8.1.2. Antioxidants

8.1.3. Feed Acidifiers

8.1.4. Feed enzymes,

8.1.5 Amino acids

8.1.6. Others

CHAPTER 9. Swine Feed Market Market, By Feed Additive Type

9.1. Introduction

9.1.1. Zootechnical Feed Additives

9.1.2. Sensory Feed Additives

9.1.3. Nutritional Feed Additives

CHAPTER 10. Swine Feed Market Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product Type, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Feed Essence, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Feed Additive Type, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Purina Mills LLC

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Archer Daniel Midland Company

13.3. Cargill Inc.

13.4. SRC FEEDS

13.5. Lallemand Inc.

13.6. Kent Corporation

13.7. Charoen Pokphand Foods

13.8. Keystone Mills

13.9 Kreamer Feed Inc.

13.10 Alltech.

Connect to Analyst

Research Methodology