Steel Structure Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

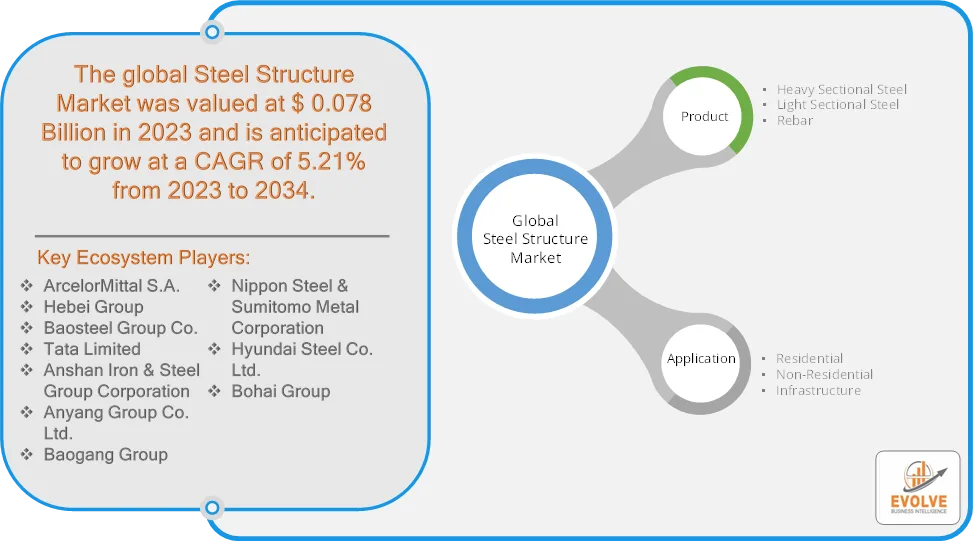

Steel Structure Market Research Report: Information By Product (Heavy Sectional Steel, Light Sectional Steel, Rebar), By Application (Residential, Non-Residential, Infrastructure), and by Region — Forecast till 2033

Page: 129

Steel Structure Market Overview

The Steel Structure Market size accounted for USD 0.078 Billion in 2023 and is estimated to account for 0.096 Billion in 2024. The Market is expected to reach USD 0.152 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.21% from 2024 to 2034. The Steel Structure Market is a crucial segment of the construction and infrastructure industry, encompassing the design, fabrication, and installation of steel-based structures. These structures are widely used in commercial, residential, industrial, and infrastructure projects due to their high strength, durability, and flexibility. Structural steel is a highly recyclable material, aligning with the growing demand for sustainable construction practices and green building initiatives.

The Steel Structure Market is expected to grow steadily due to the rising demand for sustainable and cost-effective construction solutions. The structural steel market is poised for continued growth, driven by increasing construction activities, sustainability trends, and technological advancements.

Global Steel Structure Market Synopsis

Steel Structure Market Dynamics

Steel Structure Market Dynamics

The major factors that have impacted the growth of Steel Structure Market are as follows:

Drivers:

Ø Growing Construction & Infrastructure Development

Rapid urbanization is increasing demand for steel structures in commercial and residential projects. Governments worldwide are investing in bridges, highways, airports, and railways, all of which require durable and high-strength steel structures. Pre-engineered buildings (PEBs) and modular steel structures are gaining popularity due to their fast construction time, cost efficiency, and reduced labor requirements. Prefabrication helps reduce material waste and enhances sustainability and the industrial and commercial sectors are adopting modular steel structures for warehouses, factories, and office buildings.

Restraint:

- Fluctuating Raw Material Prices and High Initial Investment Costs

Steel prices are highly volatile due to fluctuations in the cost of raw materials like iron ore, coal, and scrap metal. Price instability affects profit margins and makes long-term project planning difficult. Steel structures require specialized fabrication, welding, and coating processes, leading to high upfront costs. Advanced steel alloys and coatings for corrosion resistance increase material expenses and Smaller construction firms may find reinforced concrete or alternative materials more cost-effective for certain applications.

Opportunity:

⮚ Growth in Prefabrication & Modular Construction

Prefabricated steel structures reduce construction time and labor costs. Demand for pre-engineered buildings (PEBs) is increasing in industrial, commercial, and military applications and Modular construction is gaining popularity in disaster relief housing, healthcare facilities, and remote site projects. 3D printing of steel structures is improving design flexibility and reducing material waste. Smart fabrication techniques (robotic welding, AI-driven steel processing) enhance production efficiency and High-performance, corrosion-resistant steel alloys are expanding steel’s applications in marine, defense, and extreme weather environments.

Steel Structure Market Segment Overview

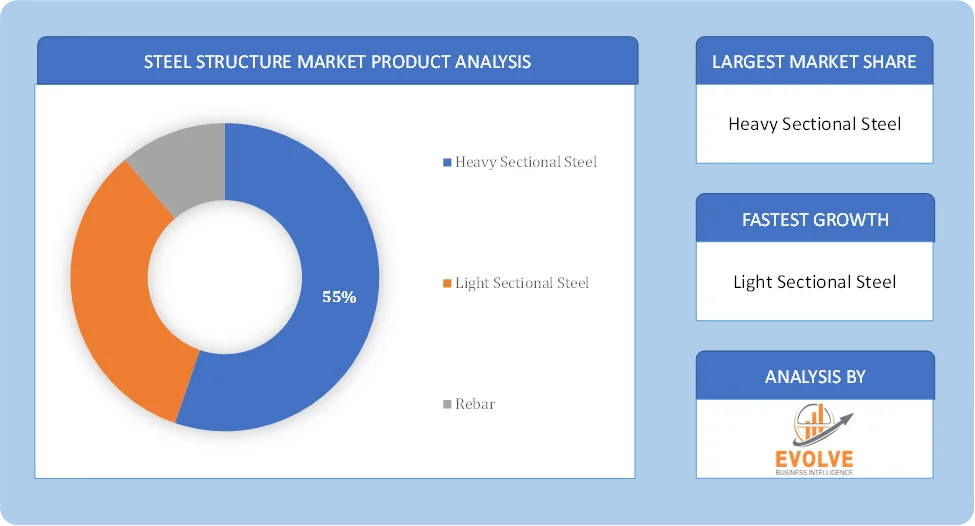

Based on Product, the market is segmented based on Heavy Sectional Steel, Light Sectional Steel, Rebar. The heavy sectional steel segment dominated the market due to its strength, load-bearing capacity, and suitability for supporting substantial loads and providing structural stability. It is commonly employed in applications where structural integrity and durability are paramount.

By Application

Based on Application, the market segment has been divided into the Residential, Non-Residential, Infrastructure. The non-residential segment dominates the market and is often influenced by the construction of commercial buildings, industrial facilities, and institutional structures. Structural steel is favored in these applications due to its strength, versatility, and ability to support large spans and heavy loads.

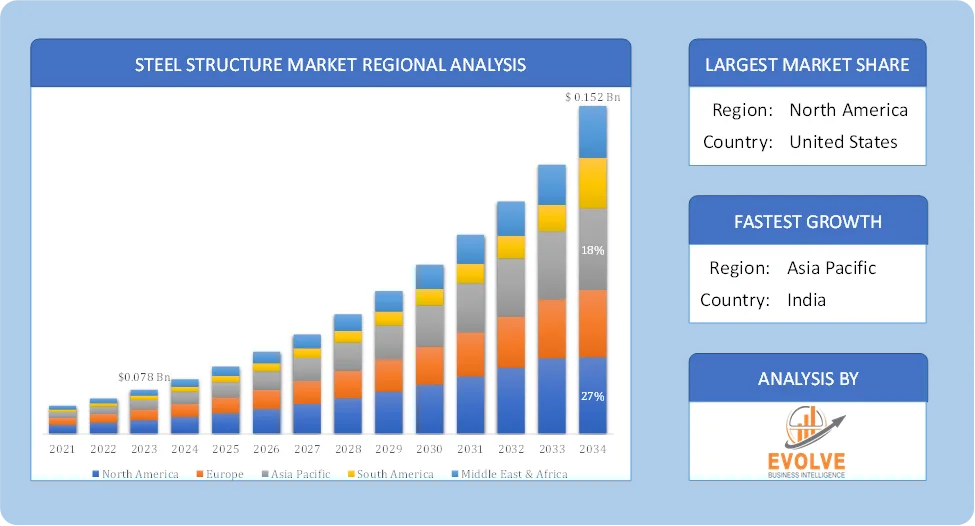

Global Steel Structure Market Regional Analysis

Based on region, the global Steel Structure Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Steel Structure Market followed by the Asia-Pacific and Europe regions.

North America Global Steel Structure Market

North America holds a dominant position in the Steel Structure Market. The U.S. and Canada have a mature market with steady investments in warehouses, data centers, and logistics hubs. The U.S. Infrastructure Bill is boosting demand for steel bridges, highways, and public buildings. Increasing infrastructure development and renovation projects and rising construction spending.

Asia-Pacific Global Steel Structure Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Steel Structure Market industry. Countries like China, India, and Japan are heavily investing in high-rise buildings, bridges, and industrial facilities and APAC is a global hub for manufacturing, requiring steel-based industrial structures. Significant investments in infrastructure development, including transportation and construction projects and growing demand for residential and commercial buildings. China is a major player, being one of the world’s largest steel producers.

Competitive Landscape

The global Steel Structure Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ArcelorMittal S.A.

- Hebei Group

- Baosteel Group Co.

- Tata Limited

- Anshan Iron & Steel Group Corporation

- Anyang Group Co. Ltd.

- Baogang Group

- Nippon Steel & Sumitomo Metal Corporation

- Hyundai Steel Co. Ltd.

- Bohai Group.

Key Development

In September 2024, Mycron Steel Bhd is set to launch its own patented green steel products by 2025. The main motive behind this launch is to address the increasing demand for sustainable materials in the automotive and construction industries.

Scope of the Report

Global Steel Structure Market, by Product

- Heavy Sectional Steel

- Light Sectional Steel

- Rebar

Global Steel Structure Market, by Application

- Residential

- Non-Residential

- Infrastructure

Global Steel Structure Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 0.152 Billion |

| CAGR (2023-2033) | 5.21% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | ArcelorMittal S.A., Hebei Group, Baosteel Group Co., Tata Limited, Anshan Iron & Steel Group Corporation, Anyang Group Co. Ltd., Baogang Group, Nippon Steel & Sumitomo Metal Corporation, Hyundai Steel Co. Ltd. and Bohai Group. |

| Key Market Opportunities | · Growth in Prefabrication & Modular Construction · Technological Advancements in Steel Manufacturing |

| Key Market Drivers | · Growing Construction & Infrastructure Development · Increasing Demand for Prefabricated & Modular Construction |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Steel Structure Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Steel Structure Market historical market size for the year 2021, and forecast from 2023 to 2033

- Steel Structure Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Steel Structure Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Steel Structure Market is 2021- 2033

What is the growth rate of the global Steel Structure Market?

The global Steel Structure Market is growing at a CAGR of 5.21% over the next 10 years

Which region has the highest growth rate in the market of Steel Structure Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Steel Structure Market?

North America holds the largest share in 2022

Who are the key players in the global Steel Structure Market?

ArcelorMittal S.A., Hebei Group, Baosteel Group Co., Tata Limited, Anshan Iron & Steel Group Corporation, Anyang Group Co. Ltd., Baogang Group, Nippon Steel & Sumitomo Metal Corporation, Hyundai Steel Co. Ltd. and Bohai Group. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Contents

Chapter 1. Executive Summary

Chapter 2. Scope Of The Study

2.1. Market Definition

2.2. Scope Of The Study

2.2.1. Objectives of Report

2.2.2. Limitations

2.3. Market Structure

Chapter 3. Evolve BI Methodology

Chapter 4. Market Insights and Trends

4.1. Supply/ Value Chain Analysis

4.1.1. Raw End Users Providers

4.1.2. Manufacturing Process

4.1.3. Distributors/Retailers

4.1.4. End-Use Industry

4.2. Porter’s Five Forces Analysis

4.2.1. Threat Of New Entrants

4.2.2. Bargaining Power Of Buyers

4.2.3. Bargaining Power Of Suppliers

4.2.4. Threat Of Substitutes

4.2.5. Industry Rivalry

4.3. Impact Of COVID-19 on the Steel Structure Market

4.3.1. Impact on Market Size

4.3.2. End-Use Industry Trend, Preferences, and Budget Impact

4.3.3. Regulatory Framework/Government Policies

4.3.4. Key Players' Strategy to Tackle Negative Impact

4.3.5. Opportunity Window

4.4. Technology Overview

12.28. Macro factor

4.6. Micro Factor

4.7. Demand Supply Gap Analysis of the Steel Structure Market

4.8. Import Analysis of the Steel Structure Market

4.9. Export Analysis of the Steel Structure Market

Chapter 5. Market Dynamics

5.1. Introduction

5.2. DROC Analysis

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Patent Analysis

5.4. Industry Roadmap

5.5. Parent/Peer Market Analysis

Chapter 6. Global Steel Structure Market, By Product

6.1. Introduction

6.2. Heavy Sectional Steel

6.3. Light Sectional Steel

6.4. Rebar

Chapter 7. Global Steel Structure Market, By Application

7.1. Introduction

7.2. Residential

7.3. Non-Residential

7.4. Infrastructure

Chapter 8. Global Steel Structure Market, By Region

8.1. Introduction

8.2. North America

8.2.1. Introduction

8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.2.3. Market Size and Forecast, By Country, 2024-2034

8.2.4. Market Size and Forecast, By Product Type, 2024-2034

8.2.5. Market Size and Forecast, By End User, 2024-2034

8.2.6. US

8.2.6.1. Introduction

8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034

8.2.6.4. Market Size and Forecast, By End User, 2024-2034

8.2.7. Canada

8.2.7.1. Introduction

8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034

8.2.7.5. Market Size and Forecast, By End User, 2024-2034

8.3. Europe

8.3.1. Introduction

8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.3. Market Size and Forecast, By Country, 2024-2034

8.3.4. Market Size and Forecast, By Product Type, 2024-2034

8.3.5. Market Size and Forecast, By End User, 2024-2034

8.3.6. Germany

8.3.6.1. Introduction

8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034

8.3.6.4. Market Size and Forecast, By End User, 2024-2034

8.3.7. France

8.3.7.1. Introduction

8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034

8.3.7.4. Market Size and Forecast, By End User, 2024-2034

8.3.8. UK

8.3.8.1. Introduction

8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034

8.3.8.4. Market Size and Forecast, By End User, 2024-2034

8.3.9. Italy

8.3.9.1. Introduction

8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034

8.3.9.4. Market Size and Forecast, By End User, 2024-2034

8.3.11. Rest Of Europe

8.3.11.1. Introduction

8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034

8.3.11.4. Market Size and Forecast, By End User, 2024-2034

8.4. Asia-Pacific

8.4.1. Introduction

8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.3. Market Size and Forecast, By Country, 2024-2034

8.4.4. Market Size and Forecast, By Product Type, 2024-2034

8.12.28. Market Size and Forecast, By End User, 2024-2034

8.4.6. China

8.4.6.1. Introduction

8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034

8.4.6.4. Market Size and Forecast, By End User, 2024-2034

8.4.7. India

8.4.7.1. Introduction

8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034

8.4.7.4. Market Size and Forecast, By End User, 2024-2034

8.4.8. Japan

8.4.8.1. Introduction

8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034

8.4.8.4. Market Size and Forecast, By End User, 2024-2034

8.4.9. South Korea

8.4.9.1. Introduction

8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034

8.4.9.4. Market Size and Forecast, By End User, 2024-2034

8.4.10. Rest Of Asia-Pacific

8.4.10.1. Introduction

8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034

8.4.10.4. Market Size and Forecast, By End User, 2024-2034

8.5. Rest Of The World (RoW)

8.5.1. Introduction

8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends

8.5.3. Market Size and Forecast, By Product Type, 2024-2034

8.5.4. Market Size and Forecast, By End User, 2024-2034

Chapter 9. Company Landscape

9.1. Introduction

9.2. Vendor Share Analysis

9.3. Key Development Analysis

9.4. Competitor Dashboard

Chapter 10. Company Profiles

10.1. ArcelorMittal S.A.

10.1.1. Business Overview

10.1.2. Government & Defense Analysis

10.1.2.1. Government & Defense – Existing/Funding

10.1.3. Product Portfolio

10.1.4. Recent Development and Strategies Adopted

10.1.5. SWOT Analysis

10.2. Hebei Group

10.2.1. Business Overview

10.2.2. Government & Defense Analysis

10.2.2.1. Government & Defense – Existing/Funding

10.2.3. Product Portfolio

10.2.4. Recent Development and Strategies Adopted

10.2.5. SWOT Analysis

10.3. Baosteel Group Co.

10.3.1. Business Overview

10.3.2. Government & Defense Analysis

10.3.2.1. Government & Defense – Existing/Funding

10.3.3. Product Portfolio

10.3.4. Recent Development and Strategies Adopted

10.3.5. SWOT Analysis

10.4. Tata Limited

10.4.1. Business Overview

10.4.2. Government & Defense Analysis

10.4.2.1. Government & Defense – Existing/Funding

10.4.3. Product Portfolio

10.4.4. Recent Development and Strategies Adopted

10.12.28. SWOT Analysis

10.5. Anshan Iron & Steel Group Corporation

10.5.1. Business Overview

10.5.2. Government & Defense Analysis

10.5.2.1. Government & Defense – Existing/Funding

10.5.3. Product Portfolio

10.5.4. Recent Development and Strategies Adopted

10.5.5. SWOT Analysis

10.6. Anyang Group Co. Ltd.

10.6.1. Business Overview

10.6.2. Government & Defense Analysis

10.6.2.1. Government & Defense – Existing/Funding

10.6.3. Product Portfolio

10.6.4. Recent Development and Strategies Adopted

10.6.5. SWOT Analysis

10.7. Baogang Group

10.7.1. Business Overview

10.7.2. Government & Defense Analysis

10.7.2.1. Government & Defense – Existing/Funding

10.7.3. Product Portfolio

10.7.4. Recent Development and Strategies Adopted

10.7.5. SWOT Analysis

10.8 Nippon Steel & Sumitomo Metal Corporation

10.8.1. Business Overview

10.8.2. Government & Defense Analysis

10.8.2.1. Government & Defense – Existing/Funding

10.8.3. Product Portfolio

10.8.4. Recent Development and Strategies Adopted

10.8.5. SWOT Analysis

10.9 Hyundai Steel Co. Ltd.

10.9.1. Business Overview

10.9.2. Government & Defense Analysis

10.9.2.1. Government & Defense – Existing/Funding

10.9.3. Product Portfolio

10.9.4. Recent Development and Strategies Adopted

10.9.5. SWOT Analysis

10.10. Bohai Group.

10.10.1. Business Overview

10.10.2. Government & Defense Analysis

10.9.2.1. Government & Defense – Existing/Funding

10.10.3. Product Portfolio

10.10.4. Recent Development and Strategies Adopted

10.10.5. SWOT Analysis

Connect To Analyst

Research Methodology