Soup Market Overview

The Soup Market Size is expected to reach USD 0.98 Billion by 2033. The Soup industry size accounted for USD 0.41 Billion in 2023 and is expected to expand at a CAGR of 2.94% from 2023 to 2033. A soup is a versatile and comforting liquid dish typically made by combining various ingredients such as vegetables, meats, or legumes in a flavored broth or stock. It serves as a nourishing and easily digestible meal that transcends cultural boundaries, with countless variations worldwide reflecting local tastes and culinary traditions. Whether served hot or cold, soup provides a satisfying balance of textures and flavors, often acting as a canvas for creativity in the kitchen. From hearty stews to delicate consommés, soup has been a culinary cornerstone for centuries, offering both sustenance and a communal experience as people gather to savor its warmth and richness.

Global Soup Market Synopsis

The Soup market experienced a moderate impact during the COVID-19 pandemic as consumer behavior shifted in response to lockdowns, economic uncertainties, and lifestyle changes. While the demand for convenient and shelf-stable food products increased, including canned and packaged soups, some segments of the market faced challenges due to supply chain disruptions and fluctuations in raw material prices. On the other hand, the rise in home cooking and health-conscious choices during the pandemic contributed to a surge in demand for premium and organic soup options. Additionally, the food service sector, a significant contributor to the Soup market, saw a decline as restaurants and cafes faced closures or restrictions.

Global Soup Market Dynamics

The major factors that have impacted the growth of Soup are as follows:

Drivers:

⮚ Growing Health Consciousness

the increasing awareness and emphasis on health-conscious eating habits. Consumers are seeking nutritious and balanced meal options, and soups, particularly those with natural and organic ingredients, are perceived as wholesome choices. As people become more mindful of their dietary preferences and nutritional requirements, the demand for soups with low sodium, reduced additives, and high vegetable content is rising. This health-conscious trend provides an opportunity for soup manufacturers to innovate and introduce products that align with these preferences, catering to a broader consumer base seeking convenient yet nutritious meal solutions.

Restraint:

- Supply Chain Disruptions

The industry relies on a complex network of sourcing ingredients, manufacturing, and distribution. Disruptions, such as those experienced during the COVID-19 pandemic, natural disasters, or geopolitical events, can lead to challenges in procuring raw materials, production delays, and distribution bottlenecks. These disruptions may affect the overall efficiency of the supply chain, potentially leading to increased production costs and shortages. Navigating and mitigating these challenges is crucial for soup manufacturers to maintain a stable and reliable supply chain, ensuring consistent availability of products in the market.

Opportunity:

⮚ Innovation in Flavor Profiles and Packaging

The Soup market lies in continuous innovation in flavor profiles and packaging. Consumer preferences are dynamic, and there is an increasing demand for unique and exotic flavor combinations, as well as options catering to diverse dietary preferences such as vegan, gluten-free, and plant-based diets. Additionally, innovative packaging solutions that enhance convenience, portability, and sustainability can attract a broader consumer base. Manufacturers exploring new and distinctive flavors while embracing eco-friendly packaging practices can stay competitive in the market and capitalize on the evolving preferences of discerning consumers.

Soup Market Segment Overview

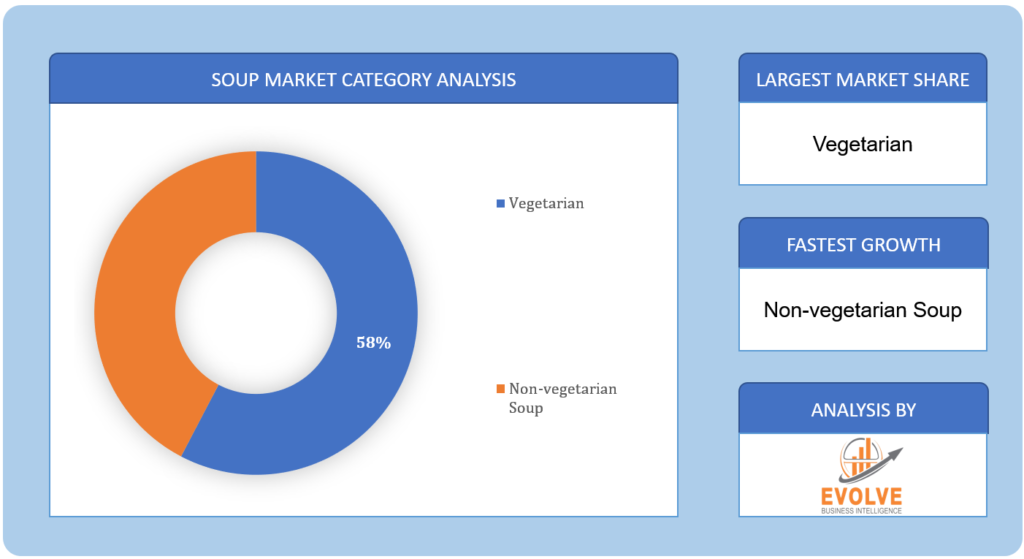

By Category

Based on the Category, the market is segmented based on Vegetarian and Non-vegetarian Soup. The Vegetarian segment was anticipated to lead the Soup market due to the growing global trend towards plant-based diets, heightened health consciousness, and the increasing preference for sustainable and ethical food choices.

Based on the Category, the market is segmented based on Vegetarian and Non-vegetarian Soup. The Vegetarian segment was anticipated to lead the Soup market due to the growing global trend towards plant-based diets, heightened health consciousness, and the increasing preference for sustainable and ethical food choices.

By Product Type

Based on the Product Type, the market has been divided into Canned/Preserved, Chilled, Dehydrated, Frozen, Instant, and UHT. The Canned/Preserved segment is expected to dominate the Soup market, primarily driven by its long shelf life, convenience, and widespread consumer demand for ready-to-eat, time-saving meal solutions.

By Packaging

Based on Packaging, the market has been divided into Canned, Pouched, and Other. The Canned segment is positioned to capture the largest market share in the Soup market, fueled by its extended shelf life, affordability, and the growing demand for convenient and easily accessible meal options, especially in fast-paced lifestyles.

Global Soup Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Soup, followed by those in Asia-Pacific and Europe.

North America asserts dominance in the Soup market owing to a combination of diverse consumer preferences, a robust food industry infrastructure, and a well-established culture of incorporating soups into daily diets. The region’s market dominance is reflected in the wide array of soup offerings catering to varying tastes, including traditional favorites and innovative, health-conscious options. Additionally, the prevalence of busy lifestyles has fueled the demand for convenient and ready-to-eat soup products. The well-established presence of major soup manufacturers, coupled with a focus on product innovation and marketing strategies, further strengthens North America’s position as a key player in the global Soup market.

Asia Pacific Market

The Asia-Pacific region has experienced remarkable growth in the Soup market, fueled by a combination of shifting consumer preferences, urbanization, and a rising awareness of convenience-oriented food choices. As the region undergoes rapid economic development, there is an increasing demand for time-saving and ready-to-eat meal options, with soup emerging as a popular choice. Local culinary traditions, diverse flavor profiles, and a penchant for nutritious eating have driven the creation of a wide range of soup varieties tailored to suit regional tastes. Additionally, the expanding middle-class population, coupled with a growing awareness of health and wellness, has contributed to the surge in demand for both traditional and innovative soup offerings. The Asia-Pacific’s dynamic and evolving food culture, coupled with the convenience factor associated with soups, positions the region as a significant and rapidly expanding market in the global soup industry.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Campbell’s, Progresso (General Mills), Knorr (Unilever), Amy’s Kitchen, and Pacific Foods are some of the leading players in the global Soup Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Campbell’s

- Progresso (General Mills)

- Knorr (Unilever)

- Amy’s Kitchen

- Pacific Foods

- Heinz

- Barilla

- Hain Celestial Group

- Panera Bread

- Imagine Foods

Key development:

In September 2022, Tideford Organics, the UK’s leading plant-based, vegan, and gluten-free soup brand, unveiled a variety of new soup flavors and enhanced recipes while doubling its retail distribution compared to the previous year. The Inspired line saw the introduction of enticing options such as Indian Cauliflower Masala, Lebanese Lentil + Kale, and Malaysian Coconut + Noodle soups. Additionally, the Favourites collection welcomed the addition of Butternut and sage.

In July 2022, Upton’s Naturals expanded its range of vegan soups by introducing three new recipes. These products boast 8-11g of plant-based protein per serving, and they are certified non-GMO (NSF), Plant-Based Certified, and allergen-free, catering to a diverse and health-conscious consumer base.

Scope of the Report

Global Soup Market, by Category

- Vegetarian

- Non-vegetarian Soup

Global Soup Market, by Product Type

- Canned/Preserved

- Chilled

- Dehydrated

- Frozen

- Instant

- UHT

Global Soup Market, by Packaging

- Canned

- Pouched

- Other

Global Soup Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.98 Billion |

| CAGR | 2.94% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Category, Product Type, Packaging |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Campbell’s, Progresso (General Mills), Knorr (Unilever), Amy’s Kitchen, Pacific Foods, Heinz, Barilla, Hain Celestial Group, Panera Bread, Imagine Foods |

| Key Market Opportunities | • Continuous innovation in soup flavor combinations to meet diverse consumer preferences. • Development of unique and exotic flavors to attract a broader customer base. |

| Key Market Drivers | • Increasing consumer awareness and emphasis on healthier eating habits. • Rising demand for soups with natural, organic, and nutritious ingredients. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Soup Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Soup market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Soup market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Soup Market.