Lactic Acid Market Overview

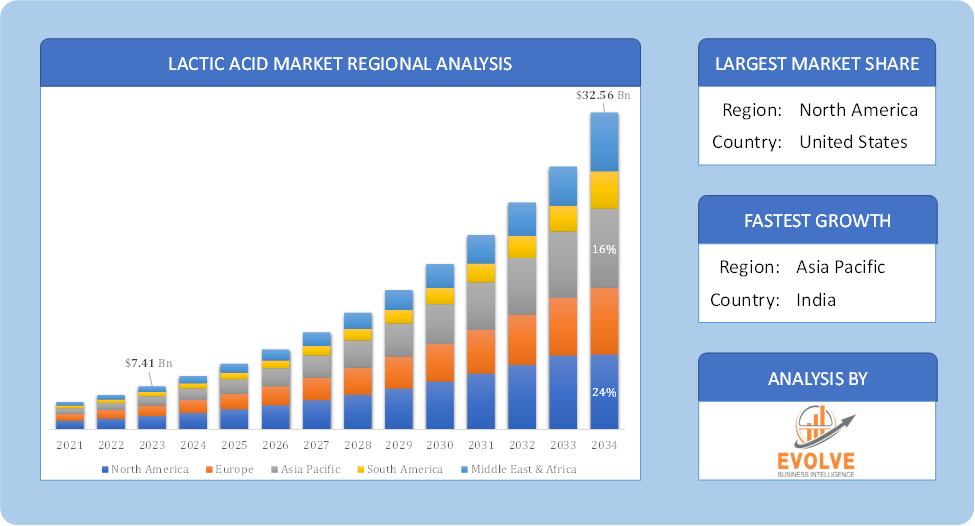

The Lactic Acid Market size accounted for USD 7.41 Billion in 2023 and is estimated to account for 8.37 Billion in 2024. The Market is expected to reach USD 32.56 Billion by 2034 growing at a compound annual growth rate (CAGR) of 18.25% from 2024 to 2034. The Lactic Acid Market is the global Market for lactic acid, a naturally occurring organic acid with a wide range of applications in various industries. It is produced by the fermentation of sugars using bacteria and has several advantages, including being biodegradable, biocompatible, and derived from renewable resources.

The increasing demand for bio-based products, rising health consciousness, and growing applications in the food and beverage industry are expected to drive the lactic acid Market growth. However, factors like fluctuating raw material prices and strict regulations can hamper the Market growth.

Global Lactic Acid Market Synopsis

Lactic Acid Market Dynamics

Lactic Acid Market Dynamics

The major factors that have impacted the growth of Lactic Acid are as follows:

Drivers:

Ø Increasing Demand for Biodegradable Plastics

Growing awareness about plastic pollution and the need for sustainable alternatives drive demand for biodegradable plastics made from lactic acid, such as polylactic acid (PLA). Lactic acid is widely used in the food and beverage industry as a preservative, flavoring agent, and pH regulator. Rising consumer preference for natural and organic food additives supports Market growth. Lactic acid is used in the production of pharmaceuticals, including drug delivery systems and topical formulations. Increasing use of lactic acid in cosmetics and personal care products for its exfoliating and moisturizing properties. Advancements in fermentation technology enhance production efficiency and yield, making lactic acid more cost-effective. Development of innovative, bio-based production methods reduces reliance on fossil fuels and aligns with sustainability goals.

Restraint:

- Perception of High Production Costs

The cost of raw materials, such as corn starch and sugarcane, can be high and subject to fluctuations, impacting the overall production cost of lactic acid. Lactic acid production, especially through traditional methods, can be energy-intensive, adding to the cost. The production of lactic acid is heavily dependent on agricultural feedstocks, which can be affected by seasonal variations, crop yields, and climate change. The fermentation process used in producing lactic acid can be complex and require precise conditions, posing challenges in scaling up production efficiently. Continuous innovation is needed to improve yields and reduce costs, which requires significant investment in research and development.

Opportunity:

⮚ Increasing Demand for Sustainable Materials and Packaging Innovations

Growing environmental awareness and regulatory mandates to reduce plastic waste create significant opportunities for lactic acid, particularly in the production of polylactic acid (PLA) for biodegradable plastics. The shift towards sustainable packaging solutions in the food and beverage industry and consumer goods sector boosts demand for lactic acid-based plastics. Rising consumer preference for natural and clean-label ingredients offers opportunities for lactic acid as a natural preservative and flavor enhancer. The growing Market for functional foods and beverages that promote health and wellness can leverage lactic acid for its beneficial properties. Increased demand for skincare products with anti-aging and exfoliating properties can drive the use of lactic acid in cosmetics. Innovations in pharmaceutical formulations, including lactic acid-based drug delivery systems, provide growth opportunities.

Lactic Acid Segment Overview

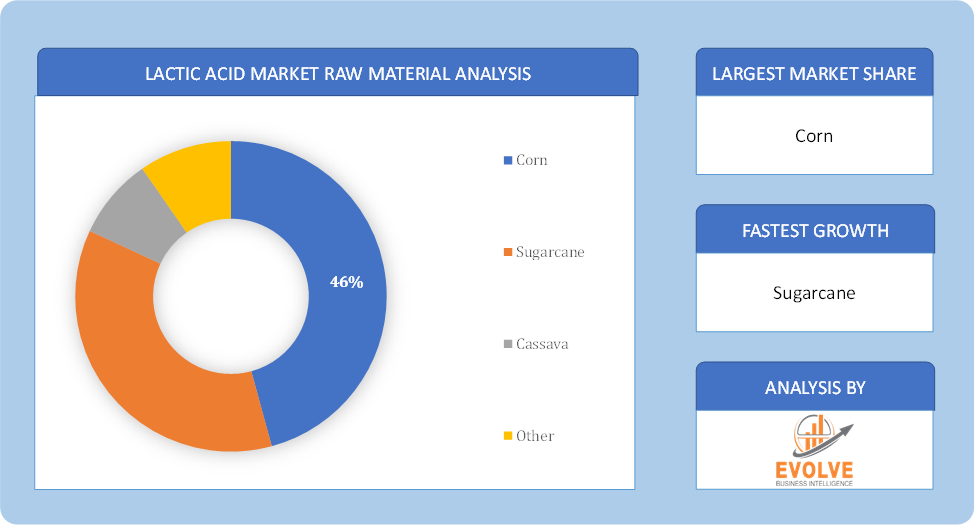

Based on Raw Material, the Market is segmented based on Corn, Sugarcane, Cassava and Other. The sugar cane segment has dominated the Market. The raw sugar which is derived from a sugar cane is one of them most important raw material used for the production of lactic acid. Grow sugar is available on a large scale and it is widely used in the manufacturing of lactic acid has the sugar cane segment is expected to dominate the Market in the coming years.

By Application

Based on Application, the Market has been divided into the Industrial, Food & Beverages, Pharmaceuticals, Personal Care, polylactic acid and Others. the Poly lactic acid segment will dominate the Market. There is a wide range of biodegradable plastic available across the globe but this segment is expected to have the largest Market share due to its characteristics of being strong as well as durable. There has been an increase in the demand for the biodegradable plastics due to its use in the automotive Market. There is a growing demand for various lightweight materials which could be used in the interior of the automobiles or the automotives.

Global Lactic Acid Market Regional Analysis

Based on region, the global Lactic Acid market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Lactic Acid market followed by the Asia-Pacific and Europe regions.

Global Lactic Acid North America Market

Global Lactic Acid North America Market

North America holds a dominant position in the Lactic Acid Market. North America region is expected to dominate the lactic acid Market due to the large consumer base of packaged foods and a well-established production infrastructure. The United States is one of the largest consumers and producers of lactic acid globally, with companies like ADM and LG Chem involved in its production for applications like food and plant-based plastics.

Global Lactic Acid Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing Market for the Lactic Acid Market industry. Asia Pacific region is anticipated to witness the fastest growth in the lactic acid Market owing to the rising disposable income, increasing urbanization, and growing demand for processed and convenience foods. China is a major producer and consumer of lactic acid in this region.

Competitive Landscape

The global Lactic Acid market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Raw Material launches, and strategic alliances.

Prominent Players:

- Corbion

- DuPont

- Cargill

- Galactic

- DOW

- Unitika

- Henan Jindan Lacic Acid Technology

- Sulzer

- Mushashino Chemical

- VIGON INTERNATIONAL

Key Development

In March 2021, LG Chem, a renowned chemical company with a diverse range of products, and ADM, a global provider of nutrition and bio solutions, have signed a memorandum of understanding (MoU) to jointly explore the production of lactic acid in the US. The objective of this partnership is to cater to the increasing demand for a variety of plant-based products, including Lactic Acid and Polylactic Acid, which are used in the production of bioplastics and other plant-based solutions Top of Form.

Scope of the Report

Global Lactic Acid Market, by Raw Material

- Corn

- Sugarcane

- Cassava

- Other

Global Lactic Acid Market, by Application

- Industrial

- Food & Beverages

- Pharmaceuticals

- Personal Care

- polylactic acid

- Others

Global Lactic Acid Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 32.56 Billion |

| CAGR (2021-2034) | 18.25% |

| Base year | 2023 |

| Forecast Period | 2021-2034. |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Raw Material, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Corbion, DuPont, Cargill, Galactic, DOW, Unitika, Henan Jindan Lacic Acid Technology, Sulzer, Mushashino Chemical, VIGON INTERNATIONAL |

| Key Market Opportunities | · Increasing Demand for Sustainable Materials and Packaging Innovations

· Advancements in Pharmaceutical and Cosmetic Applications |

| Key Market Drivers | · Increasing Demand for Biodegradable Plastics

· Expanding Pharmaceutical and Personal Care Sectors |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Lactic Acid market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Lactic Acid market historical market size for the year 2022, and forecast from 2021 to 2034

- Lactic Acid market share analysis at each Raw Material level

- Competitor analysis with detailed insight into its Raw Material segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Raw Material launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Lactic Acid market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Raw Material offering, recent developments, SWOT analysis, and key strategies.