Soup Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Soup Market Research Report: By Category (Vegetarian and Non-vegetarian Soup), By Product Type (Canned/Preserved, Chilled, Dehydrated, Frozen, Instant, and UHT), By Packaging (Canned, Pouched, and Other), and by Region — Forecast till 2033

Soup Market Overview

The Soup Market Size is expected to reach USD 0.98 Billion by 2033. The Soup industry size accounted for USD 0.41 Billion in 2023 and is expected to expand at a CAGR of 2.94% from 2023 to 2033. A soup is a versatile and comforting liquid dish typically made by combining various ingredients such as vegetables, meats, or legumes in a flavored broth or stock. It serves as a nourishing and easily digestible meal that transcends cultural boundaries, with countless variations worldwide reflecting local tastes and culinary traditions. Whether served hot or cold, soup provides a satisfying balance of textures and flavors, often acting as a canvas for creativity in the kitchen. From hearty stews to delicate consommés, soup has been a culinary cornerstone for centuries, offering both sustenance and a communal experience as people gather to savor its warmth and richness.

Global Soup Market Synopsis

The Soup market experienced a moderate impact during the COVID-19 pandemic as consumer behavior shifted in response to lockdowns, economic uncertainties, and lifestyle changes. While the demand for convenient and shelf-stable food products increased, including canned and packaged soups, some segments of the market faced challenges due to supply chain disruptions and fluctuations in raw material prices. On the other hand, the rise in home cooking and health-conscious choices during the pandemic contributed to a surge in demand for premium and organic soup options. Additionally, the food service sector, a significant contributor to the Soup market, saw a decline as restaurants and cafes faced closures or restrictions.

Global Soup Market Dynamics

The major factors that have impacted the growth of Soup are as follows:

Drivers:

⮚ Growing Health Consciousness

the increasing awareness and emphasis on health-conscious eating habits. Consumers are seeking nutritious and balanced meal options, and soups, particularly those with natural and organic ingredients, are perceived as wholesome choices. As people become more mindful of their dietary preferences and nutritional requirements, the demand for soups with low sodium, reduced additives, and high vegetable content is rising. This health-conscious trend provides an opportunity for soup manufacturers to innovate and introduce products that align with these preferences, catering to a broader consumer base seeking convenient yet nutritious meal solutions.

Restraint:

- Supply Chain Disruptions

The industry relies on a complex network of sourcing ingredients, manufacturing, and distribution. Disruptions, such as those experienced during the COVID-19 pandemic, natural disasters, or geopolitical events, can lead to challenges in procuring raw materials, production delays, and distribution bottlenecks. These disruptions may affect the overall efficiency of the supply chain, potentially leading to increased production costs and shortages. Navigating and mitigating these challenges is crucial for soup manufacturers to maintain a stable and reliable supply chain, ensuring consistent availability of products in the market.

Opportunity:

⮚ Innovation in Flavor Profiles and Packaging

The Soup market lies in continuous innovation in flavor profiles and packaging. Consumer preferences are dynamic, and there is an increasing demand for unique and exotic flavor combinations, as well as options catering to diverse dietary preferences such as vegan, gluten-free, and plant-based diets. Additionally, innovative packaging solutions that enhance convenience, portability, and sustainability can attract a broader consumer base. Manufacturers exploring new and distinctive flavors while embracing eco-friendly packaging practices can stay competitive in the market and capitalize on the evolving preferences of discerning consumers.

Soup Market Segment Overview

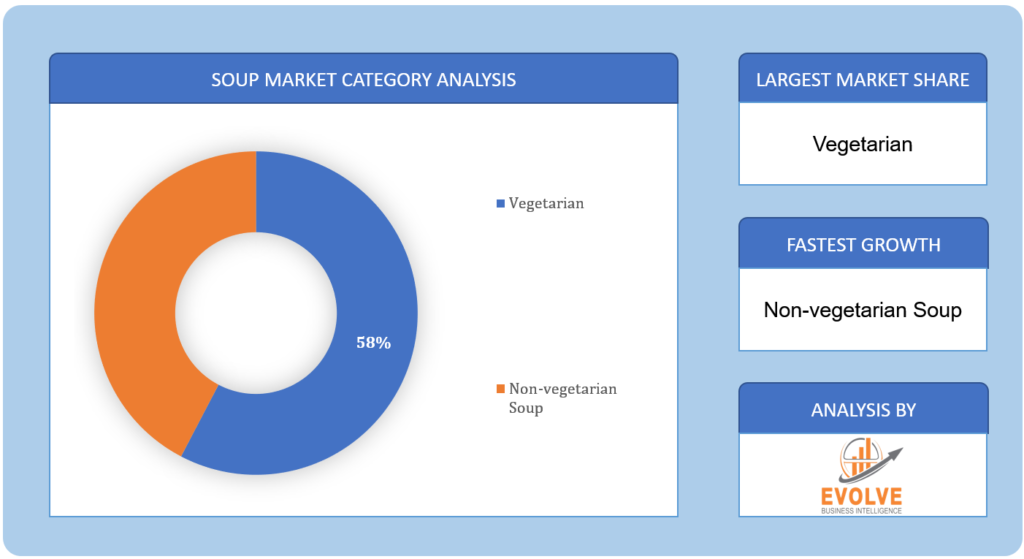

By Category

Based on the Category, the market is segmented based on Vegetarian and Non-vegetarian Soup. The Vegetarian segment was anticipated to lead the Soup market due to the growing global trend towards plant-based diets, heightened health consciousness, and the increasing preference for sustainable and ethical food choices.

Based on the Category, the market is segmented based on Vegetarian and Non-vegetarian Soup. The Vegetarian segment was anticipated to lead the Soup market due to the growing global trend towards plant-based diets, heightened health consciousness, and the increasing preference for sustainable and ethical food choices.

By Product Type

Based on the Product Type, the market has been divided into Canned/Preserved, Chilled, Dehydrated, Frozen, Instant, and UHT. The Canned/Preserved segment is expected to dominate the Soup market, primarily driven by its long shelf life, convenience, and widespread consumer demand for ready-to-eat, time-saving meal solutions.

By Packaging

Based on Packaging, the market has been divided into Canned, Pouched, and Other. The Canned segment is positioned to capture the largest market share in the Soup market, fueled by its extended shelf life, affordability, and the growing demand for convenient and easily accessible meal options, especially in fast-paced lifestyles.

Global Soup Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Soup, followed by those in Asia-Pacific and Europe.

North America asserts dominance in the Soup market owing to a combination of diverse consumer preferences, a robust food industry infrastructure, and a well-established culture of incorporating soups into daily diets. The region’s market dominance is reflected in the wide array of soup offerings catering to varying tastes, including traditional favorites and innovative, health-conscious options. Additionally, the prevalence of busy lifestyles has fueled the demand for convenient and ready-to-eat soup products. The well-established presence of major soup manufacturers, coupled with a focus on product innovation and marketing strategies, further strengthens North America’s position as a key player in the global Soup market.

Asia Pacific Market

The Asia-Pacific region has experienced remarkable growth in the Soup market, fueled by a combination of shifting consumer preferences, urbanization, and a rising awareness of convenience-oriented food choices. As the region undergoes rapid economic development, there is an increasing demand for time-saving and ready-to-eat meal options, with soup emerging as a popular choice. Local culinary traditions, diverse flavor profiles, and a penchant for nutritious eating have driven the creation of a wide range of soup varieties tailored to suit regional tastes. Additionally, the expanding middle-class population, coupled with a growing awareness of health and wellness, has contributed to the surge in demand for both traditional and innovative soup offerings. The Asia-Pacific’s dynamic and evolving food culture, coupled with the convenience factor associated with soups, positions the region as a significant and rapidly expanding market in the global soup industry.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Campbell’s, Progresso (General Mills), Knorr (Unilever), Amy’s Kitchen, and Pacific Foods are some of the leading players in the global Soup Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Campbell’s

- Progresso (General Mills)

- Knorr (Unilever)

- Amy’s Kitchen

- Pacific Foods

- Heinz

- Barilla

- Hain Celestial Group

- Panera Bread

- Imagine Foods

Key development:

In September 2022, Tideford Organics, the UK’s leading plant-based, vegan, and gluten-free soup brand, unveiled a variety of new soup flavors and enhanced recipes while doubling its retail distribution compared to the previous year. The Inspired line saw the introduction of enticing options such as Indian Cauliflower Masala, Lebanese Lentil + Kale, and Malaysian Coconut + Noodle soups. Additionally, the Favourites collection welcomed the addition of Butternut and sage.

In July 2022, Upton’s Naturals expanded its range of vegan soups by introducing three new recipes. These products boast 8-11g of plant-based protein per serving, and they are certified non-GMO (NSF), Plant-Based Certified, and allergen-free, catering to a diverse and health-conscious consumer base.

Scope of the Report

Global Soup Market, by Category

- Vegetarian

- Non-vegetarian Soup

Global Soup Market, by Product Type

- Canned/Preserved

- Chilled

- Dehydrated

- Frozen

- Instant

- UHT

Global Soup Market, by Packaging

- Canned

- Pouched

- Other

Global Soup Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $0.98 Billion |

| CAGR | 2.94% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Category, Product Type, Packaging |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Campbell’s, Progresso (General Mills), Knorr (Unilever), Amy’s Kitchen, Pacific Foods, Heinz, Barilla, Hain Celestial Group, Panera Bread, Imagine Foods |

| Key Market Opportunities | • Continuous innovation in soup flavor combinations to meet diverse consumer preferences. • Development of unique and exotic flavors to attract a broader customer base. |

| Key Market Drivers | • Increasing consumer awareness and emphasis on healthier eating habits. • Rising demand for soups with natural, organic, and nutritious ingredients. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Soup Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Soup market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Soup market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Soup Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

Soup manufacturers ?

The global soup market is dominated by several major manufacturers and brands. Some of the leading soup companies include:

- Campbell Soup Company

- The Kraft Heinz Company

- Unilever PLC

- General Mills Inc.

- Conagra Brands Inc.

- B&G Foods Inc.

- Nestlé S.A.

- Baxters Food Group Limited

- Blount Fine Foods

- Associated British Foods Plc

These companies offer a wide range of soup products, from traditional canned soups to ready-to-eat, frozen, and dehydrated soups in convenient packaging formats. They also cater to various dietary preferences, such as organic, gluten-free, and vegan soups, to meet the requirements of health-conscious consumers

Soup Market size ?

The global soup market size is expected to grow steadily in the coming years. Here are the key findings from the search results:

- The global soup market size is projected to reach $19.7 billion by 2028, with a compound annual growth rate (CAGR) of 4.2%

- The market was valued at USD 16.12 billion in 2019 and is projected to reach USD 21.0 billion by 2027, exhibiting a CAGR of 2.79% during the forecast period (2019-2027)

- The market size reached US$ 11.7 billion in 2023 and is expected to reach US$ 16.5 billion by 2032

- The worldwide soups market is projected to grow by 5.70% (2024-2028), resulting in a market volume of US$76.04 billion in 2028

- The soup market is projected to witness a CAGR of 2.9% in the upcoming five years, with increasing product varieties and the consumption of health and wellness products contributing to its growth

The market is influenced by factors such as the rising demand for convenient and healthier meal options, an aging population, increased urbanization, and the introduction of new product varieties. The key players in the market include General Mills Inc., The Kraft Heinz Company, The Campbell Soup Company, Nestlé S.A., and Unilever PLC. The market is segmented based on type, category, packaging, distribution channel, and geography. Supermarkets/hypermarkets and online retail stores are expected to hold a significant market share. The market is also witnessing an increasing demand for dehydrated and instant soups, driven by consumer awareness and the rising consumption of processed food products.

What are Soup products ?

Soup products encompass a wide variety of offerings, including:

- Canned soups (e.g., Campbell Soup Company, B&G Foods Inc., Baxters Food Group Limited)

- Condensed soups (e.g., The Kraft Heinz Company, Unilever PLC)

- Fresh and frozen soups (e.g., Blount Fine Foods, Conagra Brands Inc.)

- Ready-to-eat soups (e.g., Progresso, Pacific Foods)

- Instant soups (e.g., Knorr, Lipton Soup, Cup-a-Soup)

- Organic, gluten-free, and vegan soups (e.g., B&G Foods Inc., Blount Fine Foods)

- Soup mixes and dry soups (e.g., Sierra Soups)

These products are available in various flavors and formats, catering to diverse consumer preferences and lifestyles. The global soup market is driven by factors such as convenience, health consciousness, and the growing demand for ethnic and specialty soups

Wholesale Soup ?

Wholesale soup products are available from various suppliers, offering a wide range of options to cater to different customer needs. Some of the notable wholesale soup suppliers include:

- Bargain Wholesale, which provides bulk supply of noodle soup, soup mix, meat, vegetable soups, and chowder

- The Soup Market, which offers a variety of soups at competitive wholesale prices to restaurants and catering services

These suppliers cater to the needs of restaurants, cafes, and other food service establishments, providing fresh and high-quality soup products. The wholesale market for soup products is growing, driven by factors such as convenience, health consciousness, and the increasing demand for ethnic and specialty soups

Soup companies ?

Some of the top soup companies in the world include Campbell Soup Company, The Kraft Heinz Company, Unilever PLC, General Mills Inc., Conagra Brands Inc., B&G Foods Inc., Nestlé S.A., Baxters Food Group Limited, Blount Fine Foods, and Associated British Foods Plc. These companies offer a wide range of soup products, including canned soups, condensed soups, fresh and frozen soups, ready-to-eat soups, instant soups, organic, gluten-free, and vegan soups, and soup mixes and dry soups. The global soup market is experiencing an increasing demand for convenience food items due to rapid urbanization, a growing working population, and hectic schedules. These evolving preferences have prompted manufacturers to launch ready-to-eat, frozen, and dehydrated soups in convenient packaging formats. The soup market is expected to grow at a CAGR of 3.2% during 2023-2028

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Category Segement – Market Opportunity Score 4.1.2. Product Type Segment – Market Opportunity Score 4.1.3. Packaging Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Soup Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Soup Market, By Category 7.1. Introduction 7.1.1. Vegetarian 7.1.2. Non-vegetarian Soup CHAPTER 8. Global Soup Market, By Product Type 8.1. Introduction 8.1.1. Canned/Preserved 8.1.2. Chilled 8.1.3. Dehydrated 8.1.4. Frozen 8.1.5. Instant 8.1.6. UHT CHAPTER 9. Global Soup Market, By Packaging 9.1. Introduction 9.1.1. Canned 9.1.2. Pouched 9.1.3. Other CHAPTER 10. Global Soup Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Category, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Packaging, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Campbell's 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Progresso (General Mills) 13.3. Knorr (Unilever) 13.4. Amy's Kitchen 13.5. Pacific Foods 13.6. Heinz 13.7. Barilla 13.8. Hain Celestial Group 13.9. Panera Bread 13.10. Imagine Foods

Connect to Analyst

Research Methodology