Soil Conditioners Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

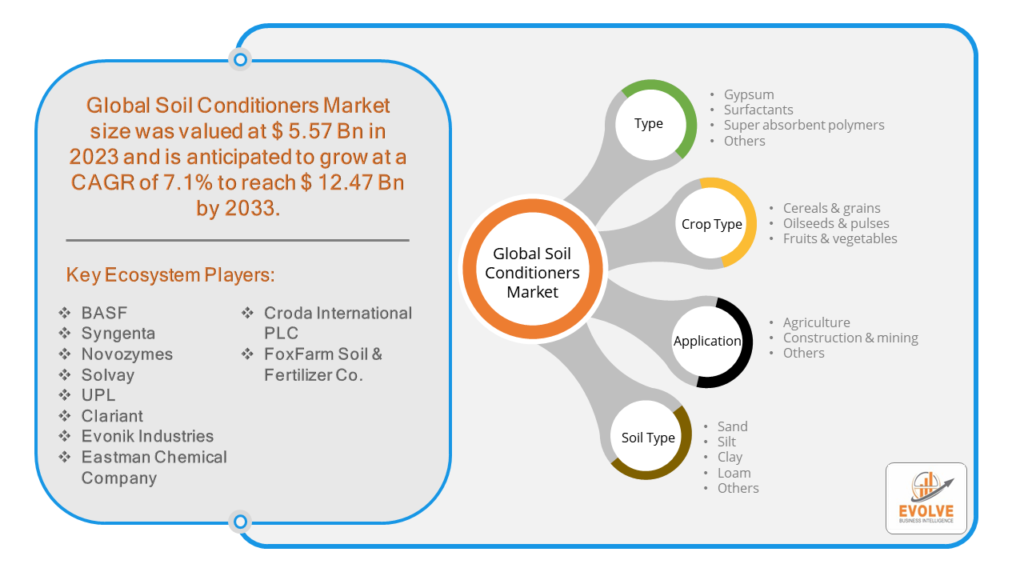

Soil Conditioners Market Research Report: By Type (Gypsum, Surfactants, Super absorbent polymers, Others), By Soil Type (Sand, Silt, Clay, Loam, Others), By Application (Agriculture, Construction & mining, Others), By Crop Type (Cereals & grains, Oilseeds & pulses Fruits & vegetables), and by Region — Forecast till 2033

Page: 113

Soil Conditioners Market Overview

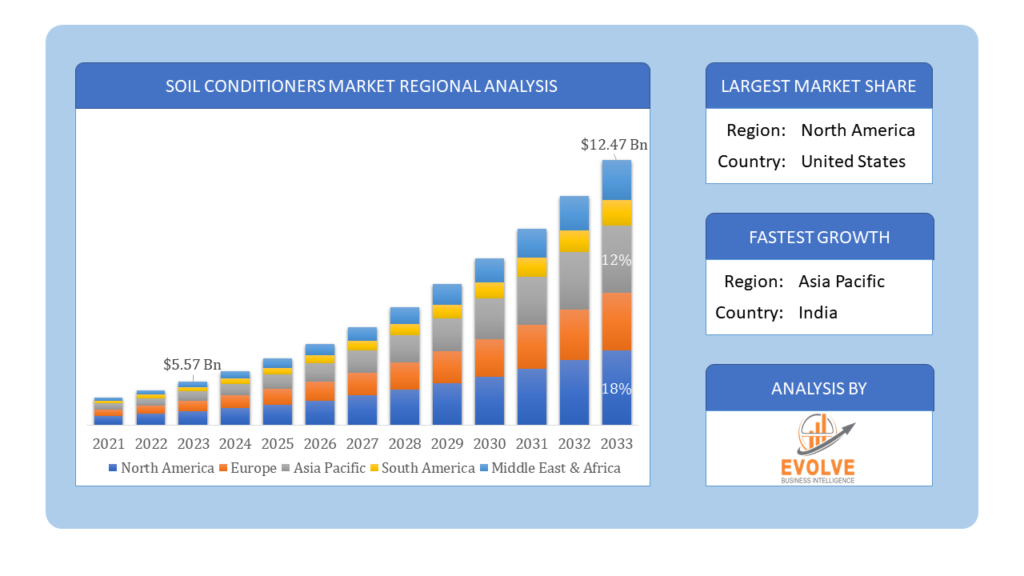

Soil Conditioners Market Size is expected to reach USD 12.47 Billion by 2033. The Soil Conditioners industry size accounted for USD 5.57 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2033. The Soil Conditioners market is experiencing significant growth globally, with particular prominence in the Asia-Pacific region. This expansion can be attributed to various factors including the escalating demand for enhanced agricultural productivity, the increasing adoption of sustainable farming practices, and the rising awareness of soil health management. Countries within the Asia-Pacific region, such as China and India, are emerging as key contributors to this growth due to their large agricultural sectors and the implementation of governmental initiatives promoting soil conservation and fertility improvement. The Soil Conditioners industry is thus witnessing a notable surge in demand, driven by the imperative need to address soil degradation, enhance crop yields, and ensure long-term agricultural sustainability.

Global Soil Conditioners Market Synopsis

The Soil Conditioners market faced significant challenges as a result of the COVID-19 pandemic. The widespread disruptions to global supply chains, labor shortages, and economic downturns impacted various sectors, including agriculture. Restrictions on movement and trade barriers hindered the distribution of soil conditioning products, leading to delays in agricultural activities and reduced demand from farmers. Additionally, uncertainties surrounding market conditions and financial constraints among agricultural businesses further dampened investment in soil health management solutions. Despite these challenges, the pandemic also highlighted the importance of resilient and sustainable agricultural practices, potentially driving long-term awareness and investment in soil conditioners to mitigate future risks and enhance food security.

Global Soil Conditioners Market Dynamics

The major factors that have impacted the growth of Soil Conditioners are as follows:

Drivers:

⮚ Increasing Adoption of Sustainable Agriculture Practices

The growing adoption of sustainable agriculture practices globally. With rising environmental concerns and the need to address soil degradation, farmers are increasingly turning towards soil conditioners to improve soil health, enhance crop yields, and promote long-term sustainability. This driver is fueled by various factors such as government regulations promoting sustainable farming practices, consumer demand for environmentally friendly products, and the imperative need to mitigate the adverse effects of conventional agricultural practices on soil fertility and ecosystem health.

Restraint:

- Economic Uncertainty and Farming Budget Constraints

Economic uncertainty, particularly exacerbated by events like the COVID-19 pandemic, poses a significant restraint on the Soil Conditioners market. Farmers facing financial constraints may prioritize essential inputs over soil conditioners, leading to reduced demand. Moreover, fluctuations in commodity prices and income levels can impact farmers’ ability to invest in soil health management solutions. Economic downturns and market instability can thus impede the growth of the Soil Conditioners market by limiting farmers’ discretionary spending and investment in agricultural inputs.

Opportunity:

⮚ Technological Advancements and Product Innovation

A significant opportunity for the Soil Conditioners market lies in technological advancements and product innovation. Continuous research and development efforts are leading to the introduction of innovative soil conditioning products with enhanced effectiveness, efficiency, and environmental sustainability. Advancements in biotechnology, nanotechnology, and precision agriculture are revolutionizing soil management practices, offering tailor-made solutions to address specific soil health challenges. Furthermore, the development of organic and environmentally friendly soil conditioners presents opportunities to tap into the growing demand for sustainable agricultural inputs.

Soil Conditioners Market Segment Overview

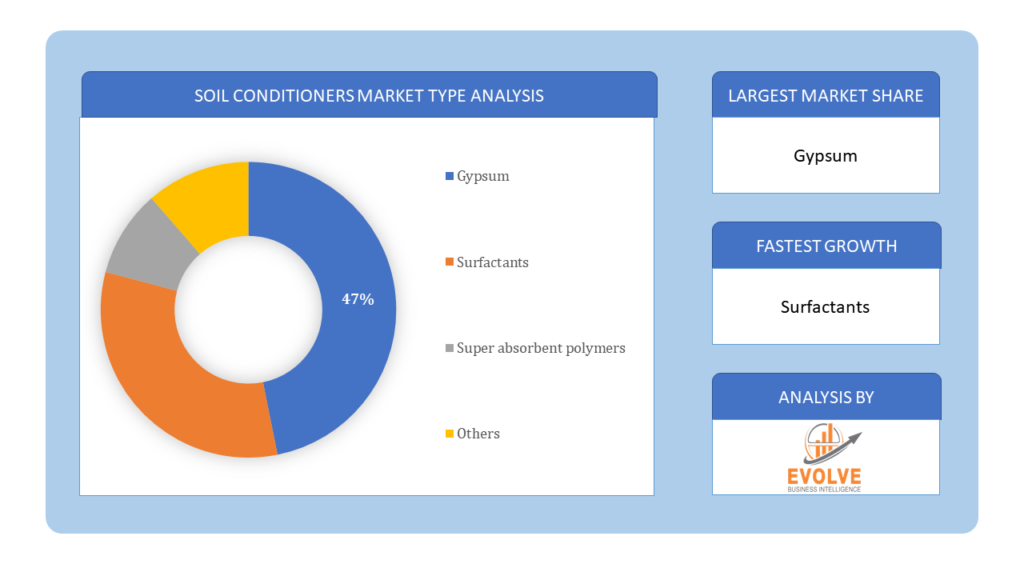

By Type

Based on the Type, the market is segmented based on Gypsum, Surfactants, Super absorbent polymers, and Others. The Gypsum segment dominates the Soil Conditioners Market due to its widespread application in improving soil structure, enhancing water retention, and ameliorating soil salinity, contributing to increased crop productivity and yield quality. Additionally, its cost-effectiveness and environmental benefits further bolster its prominence in the market.

Based on the Type, the market is segmented based on Gypsum, Surfactants, Super absorbent polymers, and Others. The Gypsum segment dominates the Soil Conditioners Market due to its widespread application in improving soil structure, enhancing water retention, and ameliorating soil salinity, contributing to increased crop productivity and yield quality. Additionally, its cost-effectiveness and environmental benefits further bolster its prominence in the market.

By Crop Type

Based on Crop Type, the market has been divided into Cereals & grains, Oilseeds & pulses, and Fruits & vegetables. The Cereals & grains segment dominates the Soil Conditioners Market due to the substantial demand for soil conditioners to enhance soil fertility, moisture retention, and nutrient availability, crucial for optimizing yields and quality in cereal and grain production. Additionally, the segment’s resilience to fluctuating market conditions and its fundamental role in global food security solidify its position as a key driver of market dominance.

By Application

Based on the Application, the market has been divided into Agriculture, Construction & mining Others. The agriculture segment dominates the Soil Conditioners Market due to its extensive application across diverse agricultural practices, including crop cultivation, horticulture, and landscaping, driving consistent demand for soil conditioning products to improve soil health, boost crop yields, and ensure sustainable agricultural productivity. Additionally, the segment’s versatility and indispensability in addressing soil degradation and enhancing overall farm efficiency further solidify its leading position in the market.

By Soil Type

Based on Soil Type, the market has been divided into Sand, Silt, Clay, Loam, and Others. The Sand segment dominates the Soil Conditioners Market due to its widespread use in improving soil drainage, aeration, and structure, particularly in arid and sandy soil regions, where it plays a crucial role in enhancing soil fertility and supporting plant growth. Additionally, its affordability and availability make it a preferred choice for soil conditioning in various agricultural and landscaping applications, further reinforcing its dominance in the market.

Global Soil Conditioners Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market, followed by those in Asia-Pacific and Europe.

Soil Conditioners North America Market

Soil Conditioners North America Market

The North American region asserts a dominant position in the Soil Conditioners market due to several factors. With advanced agricultural practices, robust infrastructure, and a strong emphasis on sustainability, North America leads in the adoption of soil conditioning solutions. The region’s mature agricultural sector, particularly in countries like the United States and Canada, drives significant demand for soil conditioners to enhance soil fertility, mitigate erosion, and improve crop yields. Moreover, increasing awareness among farmers and regulatory support for soil health management further bolsters market growth in North America. Additionally, the presence of key market players and ongoing technological advancements contribute to maintaining the region’s dominant position in the Soil Conditioners market.

Soil Conditioners Asia Pacific Market

The Asia-Pacific region is experiencing rapid growth and emerging as a significant market for the Soil Conditioners industry. Several factors contribute to this trend, including the region’s expanding agricultural sector, increasing adoption of modern farming practices, and rising awareness of the importance of soil health management. Countries like China and India, with large agricultural landscapes and growing populations, are driving substantial demand for soil conditioners to improve soil fertility, enhance crop yields, and address environmental concerns such as soil erosion and degradation. Furthermore, supportive government initiatives and investments in agriculture, along with a shift towards sustainable farming practices, are fueling the growth of the Soil Conditioners market in the Asia-Pacific region. As a result, it is poised to become a key growth hub for the industry in the coming years.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BASF, Syngenta, Novozymes, Solvay, and UPL are some of the leading players in the global Soil Conditioners Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BASF

- Syngenta

- Novozymes

- Solvay

- UPL

- Clariant

- Evonik Industries

- Eastman Chemical Company

- Croda International PLC

- FoxFarm Soil & Fertilizer Co.

Key Development:

In December 2022, the Government of Ontario finalized revisions to the On-Site and Excess Soil Regulation (Excess Soil Regulation) and the Rules for Soil Management and Excess Soil Quality Standards (Soil Rules). Effective January 1, 2023, these amendments include the elimination of reuse planning requirements for select projects and the removal of restrictions on soil storage piles.

In May 2022, Koppert India and UPL India entered into a partnership agreement, under which Koppert will manufacture a biofertilizer for UPL. UPL will introduce this product, named Copio, through its new global business unit, NPP, to Indian growers. Copio biofertilizer aids in enhancing soil health, resulting in improved plant establishment and overall output.

Scope of the Report

Global Soil Conditioners Market, by Type

- Gypsum

- Surfactants

- Super absorbent polymers

- Others

Global Soil Conditioners Market, by Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

Global Soil Conditioners Market, by Application

- Agriculture

- Construction & mining

- Others

Global Soil Conditioners Market, by Soil Type

- Sand

- Silt

- Clay

- Loam

- Others

Global Soil Conditioners Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $12.47 Billion |

| CAGR | 7.1% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Crop Type, Application, Soil Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF, Syngenta, Novozymes, Solvay, UPL, Clariant, Evonik Industries, Eastman Chemical Company, Croda International PLC, FoxFarm Soil & Fertilizer Co. |

| Key Market Opportunities | • Technological advancements in soil conditioning products. • Adoption of precision agriculture techniques. • Expansion of the organic farming industry. |

| Key Market Drivers | • Growing awareness of sustainable agriculture practices. • Increasing demand for higher crop yields and quality. • Rising concerns about soil degradation and erosion. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Soil Conditioners Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Soil Conditioners market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Soil Conditioners market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Soil Conditioners Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Soil Conditioners market?

The study period spans from historical data in 2021 to forecasts covering the years 2023 to 2033.

What is the growth rate of the Soil Conditioners market?

The Soil Conditioners market is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2033.

Which region has the highest growth rate in the Soil Conditioners market?

The Asia-Pacific region exhibits the highest growth rate in the Soil Conditioners market, driven by factors such as increasing agricultural productivity, adoption of sustainable farming practices, and rising awareness of soil health management.

Which region has the largest share of the Soil Conditioners market?

North America holds the largest share of the Soil Conditioners market, attributed to advanced agricultural practices, strong infrastructure, and a focus on sustainability, particularly in countries like the United States and Canada.

Who are the key players in the Soil Conditioners market?

Key players in the Soil Conditioners market include BASF, Syngenta, Novozymes, Solvay, UPL, Clariant, Evonik Industries, Eastman Chemical Company, Croda International PLC, and FoxFarm Soil & Fertilizer Co., among others.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Crop Type Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.1.4. Soil Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Soil Conditioners Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Soil Conditioners Market, By Type 7.1. Introduction 7.1.1. Gypsum 7.1.2 Surfactants 7.1.3. Super absorbent polymers 7.1.4 Others CHAPTER 8. Global Soil Conditioners Market, By Crop Type 8.1. Introduction 8.1.1. Cereals & grains 8.1.2. Oilseeds & pulses 8.1.3. Fruits & vegetables CHAPTER 9. Global Soil Conditioners Market, By Application 9.1. Introduction 9.1.1. Agriculture 9.1.2. Construction & mining 9.1.3. Others CHAPTER 10. Global Soil Conditioners Market, By Soil Type 10.1.Introduction 10.1.1. Sand 10.1.2. Silt 10.1.3. Clay 10.1.4. Loam 10.1.5. Others CHAPTER 11. Global Soil Conditioners Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Soil Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BASF 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Syngenta 13.3. Novozymes 13.4. Solvay 13.5. UPL 13.6. Clariant 13.7. Evonik Industries 13.8. Eastman Chemical Company 13.9. Croda International PLC 13.10. FoxFarm Soil & Fertilizer Co.

Connect to Analyst

Research Methodology