Small Satellite Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

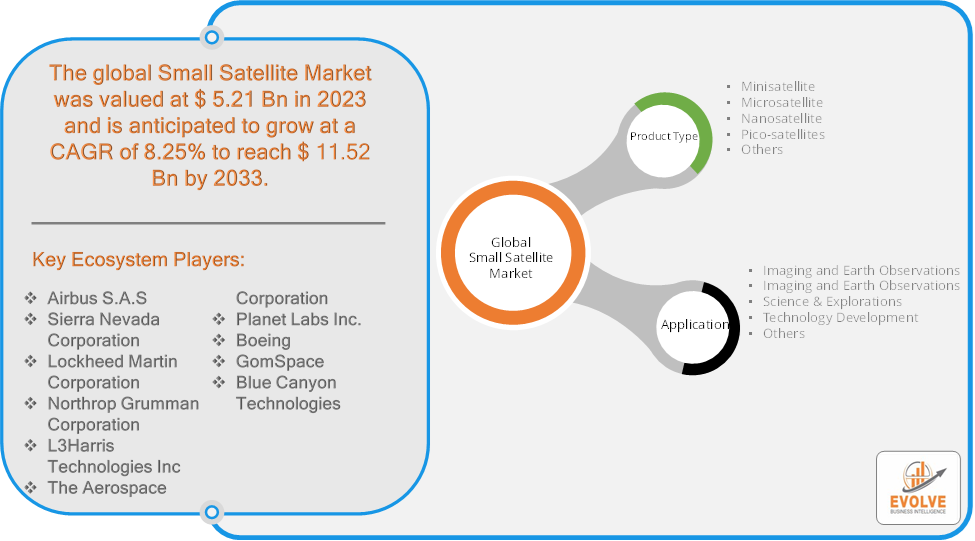

Small Satellite Market Research Report: Information By Product Type (Minisatellite, Microsatellite, Nanosatellite, Pico-satellites, Others), By Application (Imaging and Earth Observations, Imaging and Earth Observations, Science & Explorations, Technology Development, Others), and by Region — Forecast till 2033

Page: 159

Small Satellite Market Overview

The Small Satellite Market Size is expected to reach USD 11.52 Billion by 2033. The Small Satellite Market industry size accounted for USD 5.21 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.25% from 2023 to 2033. The Small Satellite Market refers to the industry focused on the development, launch, and operation of small satellites, which typically weigh between 100 kilograms (220 pounds) and 500 kilograms (1,100 pounds). These satellites are often used for a variety of purposes, including Earth observation, communication, scientific research, and technology demonstrations.

Overall, the Small Satellite Market is an evolving sector with significant potential for innovation and expansion in the coming years. The small satellite market represents a dynamic and rapidly growing sector that is transforming the space industry by providing affordable and flexible solutions for various applications.

Global Small Satellite Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had significant impacts on the Small Satellite Market. The pandemic caused disruptions in the global supply chain, affecting the production and delivery of components needed for small satellites. Lockdowns and restrictions led to delays in manufacturing and logistics, impacting satellite deployment schedules. The pandemic resulted in delays and cancellations of satellite launches. Restrictions on travel and international collaboration also affected the planning and execution of launches, leading to postponed missions. The economic uncertainty caused by the pandemic led to shifts in investment priorities. Some investors became cautious, which impacted funding for new small satellite projects and start-ups. The pandemic highlighted the importance of satellite technology for global connectivity and remote monitoring. This led to increased interest and investment in small satellites for applications like Earth observation, telecommunication, and disaster response.

Small Satellite Market Dynamics

The major factors that have impacted the growth of Small Satellite Market are as follows:

Drivers:

Ø Technological Advancements

Improvements in satellite technology, including miniaturization of components and enhanced capabilities, have made small satellites more effective and versatile. Innovations in sensors, communication systems, and propulsion technologies contribute to this trend. Small satellites are increasingly used for Earth observation applications, such as environmental monitoring, disaster management, and agriculture. Their ability to provide high-resolution imagery and data on a frequent basis drives demand. The development of large satellite constellations composed of small satellites is expanding capabilities for global communications and data collection. Companies are investing in constellations to offer services such as high-speed Internet and real-time data.

Restraint:

- Perception of Space Debris and Launch Availability

The increasing number of satellites, including small satellites, contributes to the problem of space debris. Managing and mitigating space debris is a significant challenge, as collisions with debris can damage or destroy operational satellites. Despite advancements in launch services, the availability of launch slots can still be a constraint. Launch schedules and availability can impact the timing and success of satellite deployments.

Opportunity:

⮚ Satellite Constellations

The development of large-scale satellite constellations composed of small satellites offers opportunities for global broadband coverage, Earth observation, and real-time data services. Companies are exploring constellations for high-speed Internet access and enhanced communication services. Small satellites are well-suited for providing high-resolution Earth observation data for applications such as climate monitoring, disaster response, and urban planning. Enhanced observation capabilities can support a wide range of industries and research fields. The development of cost-effective and dedicated small satellite launch vehicles presents opportunities for more frequent and affordable access to space. This can enable a higher volume of satellite deployments and reduce the cost per satellite.

Small Satellite Market Segment Overview

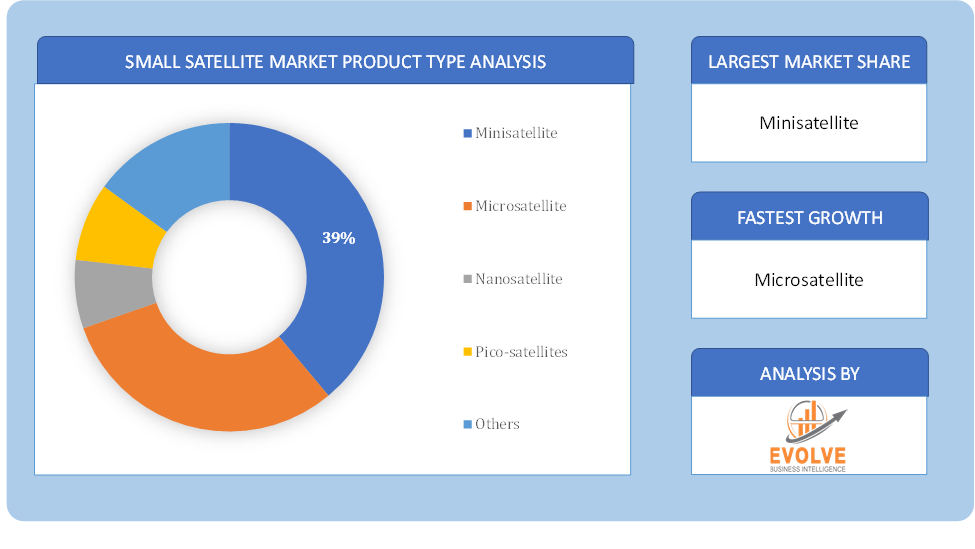

By Product Type

By Product Type

Based on Product Type, the market is segmented based on Minisatellite, Microsatellite, Nanosatellite, Pico-satellites and Others. The Nanosatellite segment dominant the Small Satellites Market. This remarkable presence can be attributed to the growing demand for compact and cost-effective satellite solutions. Nanosatellites, with their small size and weight, have become increasingly popular for various applications, including Earth observation, communication, and scientific research. Their affordability and rapid development cycles have made them a preferred choice for both government and commercial organizations. This segment’s strong performance reflects the industry’s recognition of the versatility and cost-efficiency offered by nanosatellites.

By Application

Based on Application, the market segment has been divided into Imaging and Earth Observations, Imaging and Earth Observations, Science & Explorations, Technology Development and Others. The Earth Observation & Remote Sensing segment dominant the Small Satellites Market. This commanding presence is attributed to the critical role these small satellites play in monitoring and collecting data about our planet. Earth observation and remote sensing satellites play a crucial role in diverse applications such as environmental monitoring, disaster management, agriculture, and urban planning. Their capacity to capture high-resolution imagery and collect valuable data for decision-making renders them indispensable in both the public and private sectors.

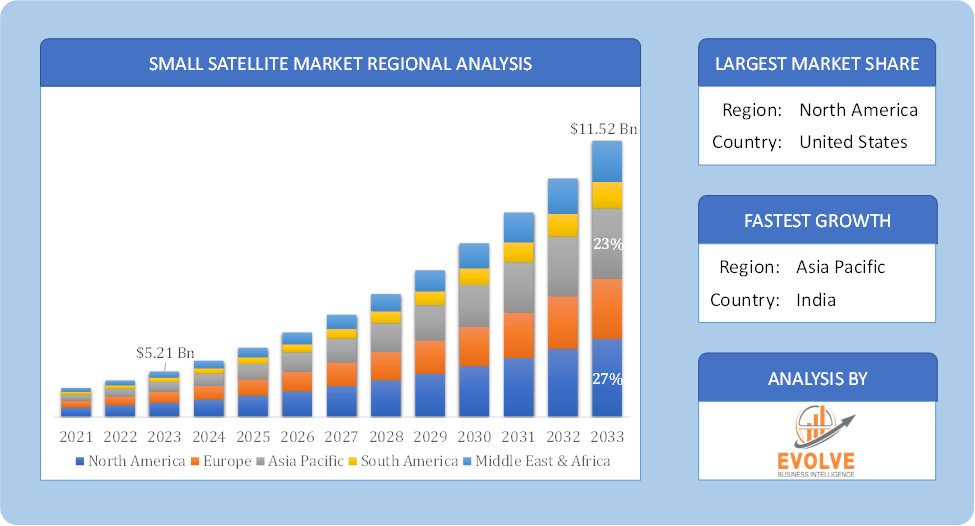

Global Small Satellite Market Regional Analysis

Based on region, the global Small Satellite Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Small Satellite Market followed by the Asia-Pacific and Europe regions.

Small Satellite North America Market

Small Satellite North America Market

North America holds a dominant position in the Small Satellite Market. North America, particularly the United States, is a leader in the small satellite market. Dominates the global small satellite market due to early adoption, strong technological advancements, and substantial investments in space exploration and focus on advanced technologies, innovative applications, and commercialization. It also has high levels of innovation and significant investment in satellite technology and launch services.

Small Satellite Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Small Satellite Market industry. The Asia-Pacific region is seeing rapid growth in the small satellite market, driven by countries like China, India, Japan, and South Korea. Rapidly emerging market with growing interest in space technology. Focus on domestic market needs and affordable space solutions and a growing number of private companies are entering the market, supported by favorable regulatory environments and increasing demand for satellite services.

Competitive Landscape

The global Small Satellite Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Airbus S.A.S

- Sierra Nevada Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- L3Harris Technologies Inc

- The Aerospace Corporation

- Planet Labs Inc.

- Boeing

- GomSpace

- Blue Canyon Technologies

Key Development

In March 2023, L3Harris Technologies declared that it received a USD 765 million contract from NASA to the National Oceanic and Atmospheric Administration to design and develop a next-generation, high-resolution imager for the Geostationary Extended Observation System.

In August 2023, the Space Development Agency (SDA) gave Lockheed Martin a firm-fixed-price order of roughly USD 816 million to manufacture 36 small satellites that will expand the agency’s communications network.

Scope of the Report

Global Small Satellite Market, by Product Type

- Minisatellite

- Microsatellite

- Nanosatellite

- Pico-satellites

- Others

Global Small Satellite Market, by Application

- Imaging and Earth Observations

- Imaging and Earth Observations

- Science & Explorations

- Technology Development

- Others

Global Small Satellite Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 11.52 Billion |

| CAGR (2023-2033) | 8.25% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Airbus S.A.S, Sierra Nevada Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc, The Aerospace Corporation, Planet Labs Inc., Boeing, GomSpace and Blue Canyon Technologies. |

| Key Market Opportunities | · Satellite Constellations · Cost-Effective Launch Solutions |

| Key Market Drivers | · Technological Advancements · Increased Demand for Earth Observation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Small Satellite Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Small Satellite Market historical market size for the year 2021, and forecast from 2023 to 2033

- Small Satellite Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Small Satellite Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Small Satellite Market is 2021- 2033

What is the growth rate of the global Small Satellite Market?

The global Small Satellite Market is growing at a CAGR of 8.25% over the next 10 years

Which region has the highest growth rate in the market of Small Satellite Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Small Satellite Market?

North America holds the largest share in 2022

Who are the key players in the global Small Satellite Market?

Airbus S.A.S, Sierra Nevada Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc, The Aerospace Corporation, Planet Labs Inc., Boeing, GomSpace and Blue Canyon Technologies are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Small Satellite Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Small Satellite Market 4.8. Import Analysis of the Small Satellite Market 4.9. Export Analysis of the Small Satellite Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Small Satellite Market, By Product Type 6.1. Introduction 6.2. Minisatellite 6.3. Microsatellite 6.4. Nanosatellite 6.5. Pico-satellites 6.6. Others Chapter 7. Global Small Satellite Market, By Application 7.1. Introduction 7.2. Imaging and Earth Observations 7.3. Imaging and Earth Observations 7.4. Science & Explorations 7.5. Technology Development 7.6. Others Chapter 8. Global Small Satellite Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Airbus S.A.S 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Sierra Nevada Corporation 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Lockheed Martin Corporation 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Northrop Grumman Corporation 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. L3Harris Technologies Inc 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. The Aerospace Corporation 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Planet Labs Inc. 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Boeing 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 GomSpace 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Blue Canyon Technologies 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology

Small Satellite North America Market

Small Satellite North America Market