Silicone Structural Glazing Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

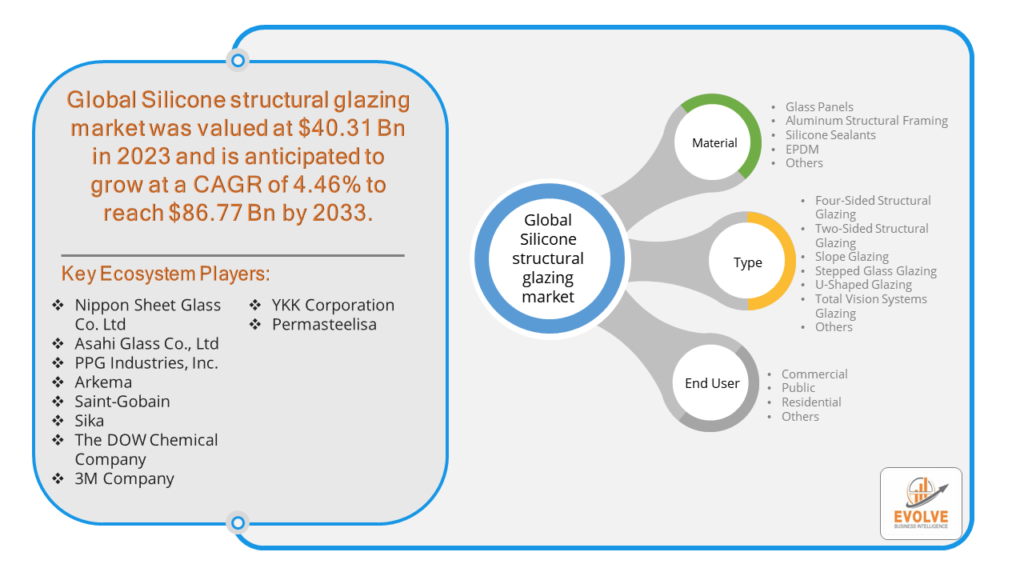

Silicone Structural Glazing Market Research Report: By Material (Glass Panels, Aluminum Structural Framing, Silicone Sealants, EPDM, Others) By Type (Four-Sided Structural Glazing, Two-Sided Structural Glazing, Slope Glazing, Stepped Glass Glazing, U-Shaped Glazing, Total Vision Systems Glazing, Others), By End-User (Commercial, Public, Residential Others), and by Region — Forecast till 2033

Page: 154

Silicone Structural Glazing Market Overview

The Silicone Structural Glazing Market Size is expected to reach USD 86.77 Billion by 2033. The Silicone Structural Glazing industry size accounted for USD 40.31 Billion in 2023 and is expected to expand at a CAGR of 4.46% from 2023 to 2033. Silicone Structural Glazing is a construction technique utilized for bonding glass or other transparent materials to a building’s structural framework using high-strength silicone sealants. This method serves both adhesive and weatherproofing purposes, enabling seamless integration of glass panels while maintaining structural integrity. Silicone Structural Glazing finds widespread application in modern architectural design, particularly in the creation of sleek and visually striking building facades, curtain walls, and glass assemblies. The technique offers numerous benefits, including enhanced aesthetics, improved thermal performance, and increased structural resilience. Its use contributes to the creation of contemporary, energy-efficient, and aesthetically pleasing built environments.

Global Silicone Structural Glazing Market Synopsis

The COVID-19 pandemic had a multifaceted impact on the Silicone Structural Glazing market, characterized by initial disruptions followed by gradual recovery and shifting market dynamics. As construction activities slowed or halted in response to lockdown measures and supply chain disruptions, the demand for silicone structural glazing solutions temporarily waned. However, as construction projects resumed and the industry adapted to new health and safety protocols, the market witnessed a resurgence driven by increased focus on sustainable and energy-efficient building solutions. Furthermore, heightened awareness of health and hygiene considerations in building design, coupled with a renewed emphasis on indoor air quality, stimulated demand for silicone structural glazing products known for their durability, weather resistance, and ability to create aesthetically pleasing, light-filled spaces.

Global Silicone Structural Glazing Market Dynamics

The major factors that have impacted the growth of Silicone Structural Glazing are as follows:

Drivers:

⮚ Increasing Emphasis on Sustainable Building Practices

The Silicone Structural Glazing market is the growing emphasis on sustainable building practices worldwide. With rising environmental concerns and stringent regulations aimed at reducing carbon emissions, there is a heightened demand for building materials and techniques that enhance energy efficiency and minimize environmental impact. Silicone structural glazing, known for its durability, thermal performance, and ability to facilitate natural lighting, aligns well with these sustainability objectives, driving its adoption in modern architectural design and construction projects.

Restraint:

- Regulatory Compliance and Standards

The complexity of regulatory compliance and adherence to industry standards. The construction industry operates within a framework of stringent regulations and building codes governing safety, structural integrity, and environmental performance. Compliance with these standards requires thorough testing, certification, and documentation, which can pose challenges for manufacturers and suppliers of silicone structural glazing systems. Additionally, variations in regulatory requirements across different regions and jurisdictions further complicate market entry and expansion efforts, constraining the growth potential of the market.

Opportunity:

⮚ Technological Advancements and Innovation</p >

An opportunity for the Silicone Structural Glazing market lies in technological advancements and innovation in materials and manufacturing processes. Continuous research and development efforts aimed at improving the performance, aesthetics, and sustainability of silicone structural glazing systems present avenues for market differentiation and expansion. Innovations such as enhanced weather resistance, self-cleaning coatings, and integration with smart building technologies offer the potential for addressing evolving customer needs and preferences. Moreover, advancements in digital design tools and simulation techniques enable architects and designers to explore new possibilities in architectural expression and functionality, driving demand for innovative silicone structural glazing solutions.

Silicone Structural Glazing Market Segment Overview

By Material

Based on the Material, the market is segmented based on Glass Panels, Aluminum Structural Framing, Silicone Sealants, EPDM, and Others. The Glass Panels segment was anticipated to lead the Silicone Structural Glazing market due to its widespread application in modern architectural designs, such as curtain walls and facades, driving demand for high-performance silicone sealants to bond and weatherproof glass panels efficiently. Additionally, the growing trend towards energy-efficient building envelopes and the emphasis on maximizing natural light penetration further bolstered the demand for silicone structural glazing solutions tailored for glass panel installations.

Based on the Material, the market is segmented based on Glass Panels, Aluminum Structural Framing, Silicone Sealants, EPDM, and Others. The Glass Panels segment was anticipated to lead the Silicone Structural Glazing market due to its widespread application in modern architectural designs, such as curtain walls and facades, driving demand for high-performance silicone sealants to bond and weatherproof glass panels efficiently. Additionally, the growing trend towards energy-efficient building envelopes and the emphasis on maximizing natural light penetration further bolstered the demand for silicone structural glazing solutions tailored for glass panel installations.

By Type

Based on the Type, the market has been divided into Four-Sided Structural Glazing, Two-Sided Structural Glazing, Slope Glazing, Stepped Glass Glazing, U-Shaped Glazing, Total Vision Systems Glazing, and Others. The Four-Sided Structural Glazing segment is expected to dominate the Silicone Structural Glazing market, primarily driven by its ability to offer seamless, uninterrupted views and sleek aesthetics in modern architectural designs, coupled with the increasing demand for energy-efficient building solutions that optimize natural lighting and minimize heat transfer. Additionally, advancements in silicone sealant technology, enabling strong adhesion and weatherproofing for four-sided glass installations, further contribute to the segment’s anticipated growth and market dominance.

By End User

Based on End Users, the market has been divided into Commercial, Public, Residential, and Others. The Commercial segment is positioned to capture the largest market share in the Silicone Structural Glazing market due to robust commercial construction activities, particularly in urban areas, and increasing demand for energy-efficient and aesthetically pleasing building solutions driving the adoption of silicone structural glazing systems in commercial buildings such as offices, shopping malls, and hotels. Additionally, stringent building codes and regulations emphasizing safety and sustainability further bolster the demand for silicone structural glazing solutions in the commercial sector.

Global Silicone Structural Glazing Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Silicone Structural Glazing, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

North America asserts dominance in the Silicone Structural Glazing market due to several key factors such as significant demand for silicone structural glazing solutions in commercial, residential, and institutional projects. Additionally, stringent building codes and regulations governing safety, energy efficiency, and environmental performance incentivize the adoption of high-quality building materials like silicone structural glazing systems. Moreover, the presence of leading manufacturers and suppliers, coupled with extensive research and development activities, ensures the availability of advanced products tailored to meet the evolving needs of the North American market. Overall, North America’s robust construction activity, regulatory environment, and technological advancements solidify its position as a dominant force in the Silicone Structural Glazing market.

Asia Pacific Market

The Asia-Pacific region has witnessed remarkable growth in the Silicone Structural Glazing market attributed to rapid urbanization and infrastructure development initiatives across emerging economies such as China and India has fueled extensive construction activities, driving demand for advanced building materials and techniques like silicone structural glazing. Additionally, the region’s growing population and increasing disposable incomes have led to a surge in commercial and residential construction projects, further boosting the adoption of silicone structural glazing solutions.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Asahi Glass Co., Ltd, PPG Industries, Inc., Arkema, and Saint-Gobain Sika are some of the leading players in the global Silicone Structural Glazing Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Nippon Sheet Glass Co. Ltd

- Asahi Glass Co., Ltd

- PPG Industries, Inc.

- Arkema

- Saint-Gobain

- Sika

- The DOW Chemical Company

- 3M Company

- YKK Corporation

- Permasteelisa

Key Development

In April 2022, YKK AP America Inc., a US-based manufacturer of commercial facade systems and residential doors and windows, launched the YWW 60 XT Window Wall, expanding its window wall systems. The YWW 60 XT offers various options, including pre-glazed or field-glazed, inside or externally glazed, captured, 2, 3, or 4-sided structural silicone glazing (SSG) combinations, and dual-finish capacity, supporting diverse architectural designs. Its key features include improved thermal performance, enhanced by 40 mm polyamide iso-struts, increased structural load capacity, and up to 12-foot mullion span.

In April 2022, Recticel Group, a Belgium-based manufacturer of polyurethane-based products, acquired Trimo for $179.87 million. This acquisition marks a significant step in Recticel’s portfolio reorientation towards becoming a pure insulation player and expanding its geographical presence across central and southern European markets. Trimo Group, based in Slovenia, offers unique solutions for steel structures, facades, structural silicone glazing systems, roofing materials, containers, sound, and insulating systems.

Scope of the Report

Global Silicone Structural Glazing Market, by Material

- Glass Panels

- Aluminum Structural Framing

- Silicone Sealants

- EPDM

- Others

Global Silicone Structural Glazing Market, by Type

- Four-Sided Structural Glazing

- Two-Sided Structural Glazing

- Slope Glazing

- Stepped Glass Glazing

- U-Shaped Glazing

- Total Vision Systems Glazing

- Others

Global Silicone Structural Glazing Market, by End User

- Commercial

- Public

- Residential

- Others

Global Silicone Structural Glazing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $86.77 Billion |

| CAGR | 4.46% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material, Type, End-User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Nippon Sheet Glass Co. Ltd, Asahi Glass Co., Ltd, PPG Industries, Inc., Arkema, Saint-Gobain, Sika The DOW Chemical Company, 3M Company, YKK Corporation, Permasteelisa |

| Key Market Opportunities | • Technological advancements and innovation in materials and manufacturing processes. • Supportive government policies promoting sustainable construction. |

| Key Market Drivers | • Increasing emphasis on sustainable building practices. • Growing urbanization and infrastructure development. • Rising demand for energy-efficient building solutions. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Silicone Structural Glazing Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Silicone Structural Glazing market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Silicone Structural Glazing market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Silicone Structural Glazing Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

Silicone Structural Glazing manufacturers ?

Leading silicone structural glazing manufacturers include GE Silicones, known for their pioneering work on iconic structures like the Shanghai World Financial Center; Dow, offering specialized sealants for bonding glass and metal components; Pecora Corporation, renowned for high-performance sealants with non-staining technology; and Tremco, providing a range of silicone and acrylic latex sealants for glazing applications. These companies are driving innovation in sustainable construction solutions.

Silicone Structural Glazing Market size ?

The global Silicone Structural Glazing market size is expected to reach $52.03 Billion by 2028 growing at the CAGR of 7.16% from 2021 to 2028.

What are Silicone Structural Glazing products ?

Silicone structural glazing products are vital in construction, securing glass and metal to buildings. Types include four-sided structural, total vision systems, and more. Utilizing silicone sealants, aluminum framing, and glass panels, these products find applications in commercial, public, and residential buildings. Key players in this market include Nippon Sheet Glass Co. Ltd., The Dow Chemical Company, Asahi Glass Co., Ltd., and others.

Wholesale Silicone Structural Glazing ?

The global silicone structural glazing market is set to grow to USD 50.25 billion by 2030 at a CAGR of 7.81% from 2024-2030, dominated by key players like Nippon Sheet Glass and Dow Chemical. Segmented by product types and applications, with Asia-Pacific expected to lead in growth due to widespread adoption in various building sectors. Innovations drive market expansion, fueled by rising investments in residential and commercial construction projects favoring glass facades.

Silicone Structural Glazing companies ?

Top silicone structural glazing companies like Nippon Sheet Glass Co. Ltd., Dow Chemical, Asahi Glass Co., Arkema SA, and Saint-Gobain SA offer various silicone-based sealants and adhesives for building construction. These products are utilized for fastening glass and other materials to building frameworks. With growing investments in construction projects and the demand for glass facades in commercial buildings, the market is poised for substantial growth.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Material Segement – Market Opportunity Score 4.1.2. Type Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Silicone Structural Glazing Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Silicone Structural Glazing Market, By Material 7.1. Introduction 7.1.1. Glass Panels 7.1.2. Aluminum Structural Framing 7.1.3. Silicone Sealants 7.1.4 EPDM 7.1.5. Others CHAPTER 8. Global Silicone Structural Glazing Market, By Type 8.1. Introduction 8.1.1. Four-Sided Structural Glazing 8.1.2. Two-Sided Structural Glazing 8.1.3. Slope Glazing 8.1.4. Stepped Glass Glazing 8.1.5. U-Shaped Glazing 8.1.6. Total Vision Systems Glazing 8.1.7. Others CHAPTER 9. Global Silicone Structural Glazing Market, By End User 9.1. Introduction 9.1.1. Commercial 9.1.2. Public 9.1.3. Residential 9.1.4. Others CHAPTER 10. Global Silicone Structural Glazing Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Nippon Sheet Glass Co. Ltd 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Asahi Glass Co., Ltd 13.3. PPG Industries, Inc. 13.4. Arkema 13.5. Saint-Gobain 13.6. Sika 13.7. The DOW Chemical Company 13.8. 3M Company 13.9. YKK Corporation 13.10. Permasteelisa

Connect to Analyst

Research Methodology