Silica flour Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

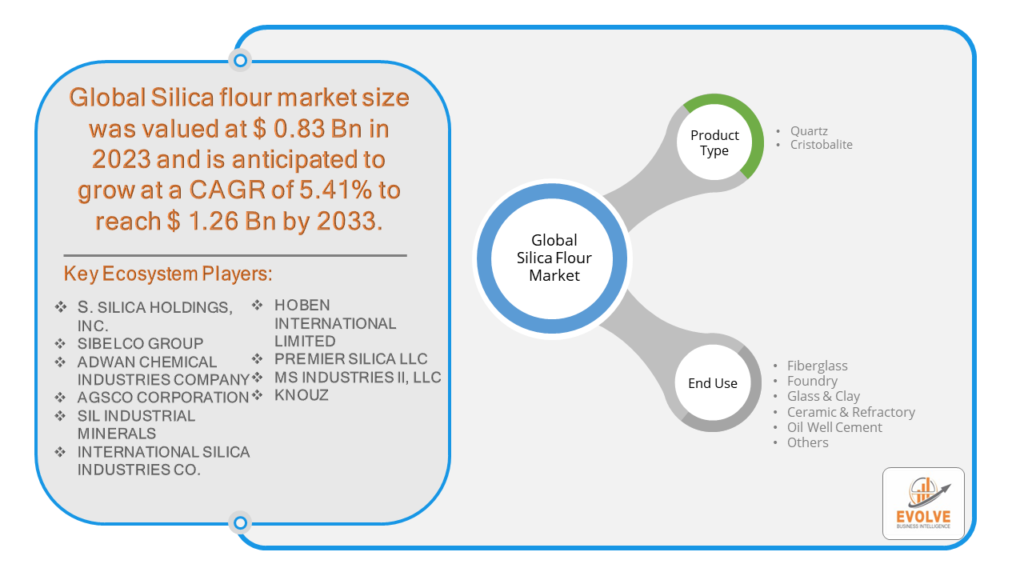

Silica flour Market Research Report: Information By Product Type (Quartz, Cristobalite), By End Use (Fiberglass, Foundry, Glass & Clay, Ceramic & Refractory, Oil Well Cement, Others), and by Region — Forecast till 2033.

Page: 118

Silica flour Market Overview

The Silica flour Market Size is expected to reach USD 1.26 Billion by 2033. The Silica flour industry size accounted for USD 0.83 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.41% from 2023 to 2033. Silica flour is a fine, white powder made from crystalline silica rocks or high-purity silica sand. It is a pozzolanic material, meaning it reacts with lime to form cementitious compounds, making it useful in various industries such as construction, fiberglass, glass, ceramics, and cosmetics. The global silica flour market is expected to grow due to the increasing demand in these industries, particularly in the fiberglass and glass sectors. The market is segmented by type (quartz and cristobalite) and end-use (fiberglass, glass, ceramics, and others). The quartz segment held the largest share in the market due to its significant influence on the final product’s properties. The fiberglass segment is expected to dominate the market due to the growing need for silica flour in the U.S. fiberglass industry. The market is also influenced by the growing construction industry, which uses silica flour in concrete and mortar production. The market is expected to grow at a CAGR of 5.3% during the forecast period, with the Asia Pacific region leading the market due to increasing construction projects and the presence of major manufacturers in the region.

Global Silica flour Market Synopsis

The Silica flour market was significantly influenced by the COVID-19 pandemic, as global lockdowns and restrictions were implemented to mitigate the virus’s spread. The COVID-19 pandemic has caused supply chain disruptions, resulting in supply shortages or decreased demand in the Silica Flour market. The travel restrictions and social distancing measures have resulted in a severe decline in consumer and company spending, which is expected to continue for some time. The epidemic has affected end-user trends and tastes, prompting manufacturers, developers, and service providers to implement a variety of tactics to stabilize the organization.

Silica flour Market Dynamics

The major factors that have impacted the growth of Silica flour are as follows:

Drivers:

Ø Advancements in Technology

Technological advancements in the production process of silica flour have led to improved product quality and cost-effectiveness, making it more attractive for various End uses. This continuous innovation is expected to support the long-term growth of the silica flour market.

Restraint:

- Trade Barriers and Tariffs

Trade barriers, tariffs, and geopolitical tensions can disrupt the global supply chain and hinder market growth by increasing costs, limiting market access, or creating uncertainty for manufacturers and suppliers operating in the silica flour market. Uncertain trade policies and international relations can dampen investor confidence and impede long-term investment in the market.

Opportunity:

⮚ Expansion of Infrastructure in Developing Economies

Developing economies are undergoing rapid urbanization and infrastructure development, driving demand for construction materials such as concrete, mortar, and glass. Silica flour, as a key ingredient in these materials, stands to benefit from the expansion of infrastructure projects in emerging markets. Investments in infrastructure, including transportation networks, residential buildings, and commercial complexes, present significant growth opportunities for the silica flour market in the long term.

Silica flour Segment Overview

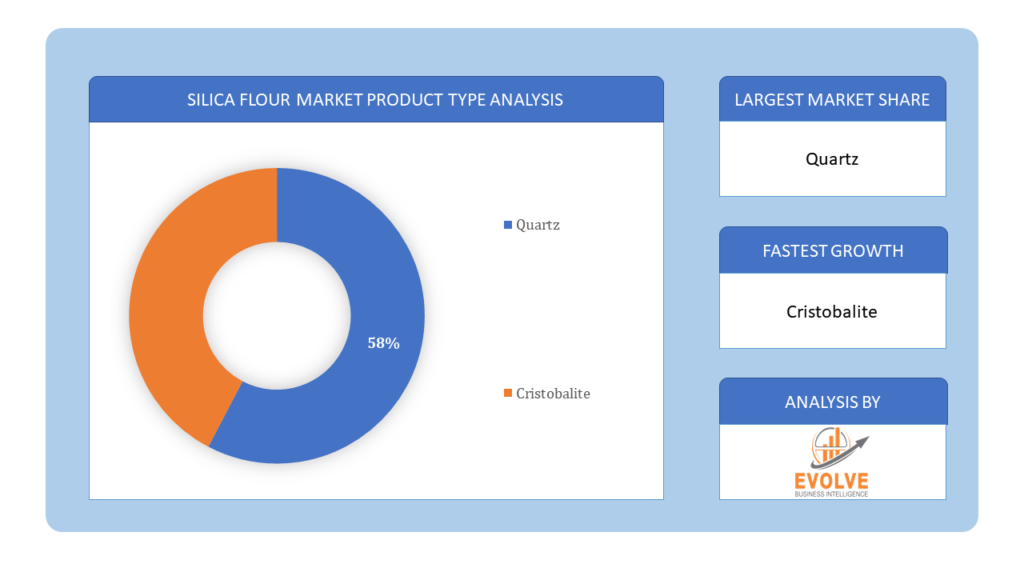

By Product Type

Based on Product Type, the market is segmented based on Quartz and Cristobalite. Quartz silica flour, derived from natural quartz deposits, is prized for its high purity and consistent particle size distribution, making it ideal for use in various End uses such as glass manufacturing, construction materials, and foundry casting. Cristobalite silica flour, formed at higher temperatures from quartz, offers enhanced thermal stability and is often preferred for specialized End uses in industries like ceramics, electronics, and refractories.

Based on Product Type, the market is segmented based on Quartz and Cristobalite. Quartz silica flour, derived from natural quartz deposits, is prized for its high purity and consistent particle size distribution, making it ideal for use in various End uses such as glass manufacturing, construction materials, and foundry casting. Cristobalite silica flour, formed at higher temperatures from quartz, offers enhanced thermal stability and is often preferred for specialized End uses in industries like ceramics, electronics, and refractories.

By End Use

Based on End Use, the market has been divided into the Fiberglass, Foundry, Glass & Clay, Ceramic & Refractory, Oil Well Cement and Others. Hydraulic fracturing dominated the market in 2022. Silica sand has grown in popularity in the oil and gas industry, owing to its particular qualities, which make it a crucial component in the fracturing fluid utilized.

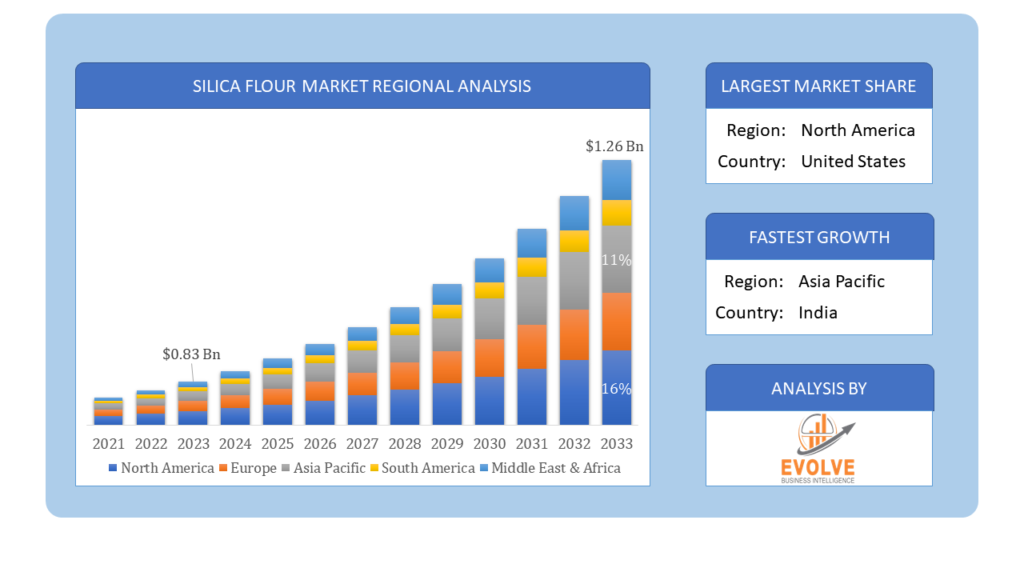

Global Silica flour Market Regional Analysis

Based on region, the global Silica flour market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Asia-Pacific is projected to dominate the use of the Silica flour market followed by the North America and Europe regions.

Silica flour Asia-Pacific Market

Silica flour Asia-Pacific Market

Asia-Pacific holds a dominant position in the Silica flour Market. The region’s dominance can be attributed to various factors. The Asia-Pacific Silica Sand Market was valued at USD 17,018.6 million in 2022 and is predicted to grow at a 5.85% CAGR over the forecast period. This is due to increased oil and gas exploration, as well as the existence of emerging markets in the region.

Silica flour North America Market

The North America region has indeed emerged as the fastest-growing market for the Silica flour industry. The market for silica sand in North America is anticipated to develop significantly, with the majority of demand coming from the US and Canada. The US is seeing an increase in shale exploration activity, which is driving up demand for silica sand. The region’s need for silica sand has increased as a result of increased hydraulic fracturing activities and a push to lessen reliance on imported crude and utilize shale gas as an alternative.

Competitive Landscape

The global Silica flour market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Silica Holdings, Inc

- Sibelco Group

- Adwan Chemical Industries Company

- Agsco Corporation

- Sil Industrial Minerals

- International Silica Industries Co

- Hoben International Limited

- Premier Silica Llc

- Ms Industries Ii, Llc

- Knouz

Key Development

August 2022: Sibelco Group acquired Echasa, a mining company that extracts silica sand at Laminoria Quarry near Vitoria in northern Spain’s Basque Country and is approximately 160 km from Sibelco’s nearest silica sand mine in Arija.

January 2019: U.S. Silica Holdings, Inc. has acquired a former ceramic proppant factory in Millen, GA, which will be turned into a high-end product manufacturing facility for the Company’s Industrial and Specialties Products (ISP) division. The Millen facility will help to increase capacity to fulfill growing customer demand for ISPs. This new feature will help industrial customers by accelerating new product launches, improving product quality, and facilitating key product customizations.

Scope of the Report

Global Silica flour Market, by Product

- Quartz

- Cristobalite

Global Silica flour Market, by End use

- Fiberglass

- Foundry

- Glass & Clay

- Ceramic & Refractory

- Oil Well Cement

- Others

Global Silica flour Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.26 Billion |

| CAGR | 5.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | S. Silica Holdings, Inc, Sibelco Group, Adwan Chemical Industries Company, Agsco Corporation, Sil Industrial Minerals, International Silica Industries Co, Hoben International Limited, Premier Silica Llc, Ms Industries Ii, Llc, Knouz |

| Key Market Opportunities | Growing use in the oil & gas industry and increasing shale gas exploration activities in the US |

| Key Market Drivers | • Increasing consumption of silica sand in glassmaking applications· • Use of silica in foundry |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Silica flour market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Silica flour market historical market size for the year 2021, and forecast from 2023 to 2033

- Silica flour market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Silica flour market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Silica flour Market?

The study period covers historical data from 2021 and forecasts for the years 2023 to 2033.

What is the growth rate of the Silica flour market?

The Silica flour market is expected to expand at a compound annual growth rate (CAGR) of 5.41% from 2023 to 2033.

Which region has the highest growth rate in the Silica flour market?

The Asia-Pacific region is projected to witness the highest growth rate in the Silica flour market due to increasing construction projects and the presence of major manufacturers in the region.

Which region has the largest share of the Silica flour market?

North America currently holds the largest share of the Silica flour market, driven by factors such as shale gas exploration activities and increasing consumption of silica sand in glassmaking applications.

Who are the key players in the Silica flour market?

Key players in the Silica flour market include U.S. Silica Holdings, Inc, Sibelco Group, Adwan Chemical Industries Company, Agsco Corporation, Sil Industrial Minerals, International Silica Industries Co, Hoben International Limited, Premier Silica Llc, Ms Industries Ii, Llc, and Knouz, among others.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Silica flour Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Silica flour Market 4.8. Import Analysis of the Silica flour Market 4.9. Export Analysis of the Silica flour Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Silica flour Market, By Product Type 6.1. Introduction 6.2. Quartz 6.3. Cristobalite Chapter 7. Global Silica flour Market, By End Use 7.1. Introduction 7.2. Fiberglass 7.3. Foundry 7.4. Glass & Clay 7.5. Ceramic & Refractory 7.6. Oil Well Cement 7.7. Others Chapter 8. Global Silica flour Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End Use, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End Use, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End Use, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End Use, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End Use, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End Use, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End Use, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End Use, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End Use, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End Use, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End Use, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End Use, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End Use, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End Use, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End Use, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End Use, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. S. SILICA HOLDINGS, INC 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. SIBELCO GROUP 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. ADWAN CHEMICAL INDUSTRIES COMPANY 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. AGSCO CORPORATION 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. SIL INDUSTRIAL MINERALS 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. INTERNATIONAL SILICA INDUSTRIES CO 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. HOBEN INTERNATIONAL LIMITED 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 PREMIER SILICA LLC 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 MS INDUSTRIES II, LLC 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. KNOUZ 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology