Sensitive Data Discovery Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

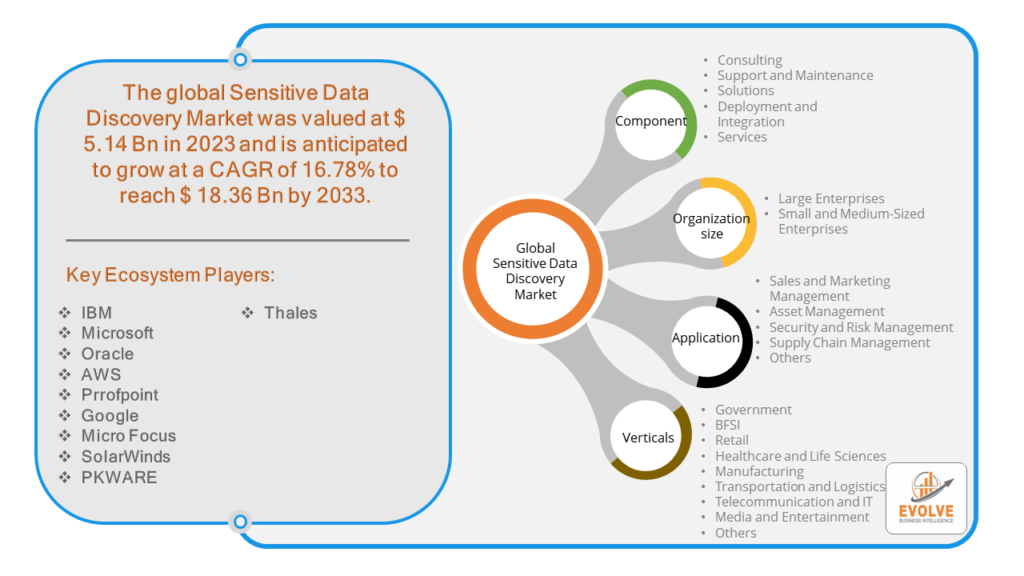

Sensitive Data Discovery Market Research Report: Information By Component (Consulting, Support and Maintenance, Solutions, Deployment and Integration, Services), By Organization Size (Large Enterprises, (SMEs) Small and Medium-Sized Enterprises), By Application (Sales and Marketing Management, Asset Management, Security and Risk Management, Supply Chain Management, Others), By Vertical (Government, BFSI, Retail, Healthcare and Life Sciences, Manufacturing, Transportation and Logistics, Telecommunication and IT, Media and Entertainment, Others), and by Region — Forecast till 2033

RPage: 146

Sensitive Data Discovery Market Overview

The Sensitive Data Discovery Market Size is expected to reach USD 18.36 Billion by 2033. The Sensitive Data Discovery Market industry size accounted for USD 5.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.78% from 2023 to 2033. The Sensitive Data Discovery Market refers to the industry segment focused on tools, technologies, and services designed to identify, classify, and manage sensitive data within an organization’s digital environment. Sensitive data includes personal identifiable information (PII), financial data, health records, intellectual property, and other confidential information that, if disclosed or mishandled, could lead to significant legal, financial, or reputational harm.

The market is driven by increasing regulatory pressures, the growing volume of data, the rising incidence of data breaches, and the need for organizations to protect their sensitive information. Major players in this market often include cybersecurity firms, data management companies, and specialized software vendors.

Global Sensitive Data Discovery Market Synopsis

The COVID-19 pandemic had several significant impacts on the Sensitive Data Discovery Market. The rapid shift to remote work and digital transformation initiatives during the pandemic led to an exponential increase in data generation and storage across various platforms. This surge in data volume and complexity heightened the need for robust sensitive data discovery solutions to manage and protect sensitive information. The pandemic saw a rise in cyberattacks, including phishing, ransomware, and data breaches, as attackers exploited vulnerabilities in remote work setups. Organizations became more aware of the importance of discovering and securing sensitive data to mitigate these threats, driving demand for sensitive data discovery tools. The accelerated adoption of cloud services and digital transformation initiatives during the pandemic necessitated enhanced data discovery and classification capabilities. Organizations needed to ensure that sensitive data stored in cloud environments was adequately identified and protected. With employees working remotely, organizations faced challenges in maintaining visibility and control over sensitive data. Sensitive data discovery tools became essential for monitoring and managing data across decentralized environments.

Sensitive Data Discovery Market Dynamics

The major factors that have impacted the growth of Sensitive Data Discovery Market are as follows:

Drivers:

Ø Rising Data Breaches and Cybersecurity Threats

The growing number of data breaches and cyberattacks has heightened awareness about the importance of protecting sensitive information. Organizations are investing in sensitive data discovery tools to identify and secure sensitive data, mitigating the risk of breaches and ensuring data integrity. The shift to remote work and accelerated digital transformation initiatives have expanded the digital footprint of organizations, making it more challenging to track and manage sensitive data. Sensitive data discovery solutions help organizations maintain visibility and control over their sensitive information in a decentralized and dynamic environment. Growing awareness about data privacy among consumers and businesses has led to increased demand for solutions that protect sensitive information. Organizations are investing in sensitive data discovery tools to address privacy concerns and build trust with customers and stakeholders.

Restraint:

- Perception of High Implementation Costs

The initial cost of acquiring and implementing sensitive data discovery solutions can be significant, especially for small and medium-sized enterprises (SMEs). These costs include software purchase, integration, training, and ongoing maintenance. While sensitive data discovery tools aim to protect sensitive information, there can be concerns about the privacy and security of the data being scanned and analysed. Organizations may be hesitant to use these tools due to fears of exposing sensitive data during the discovery process.

Opportunity:

⮚ Growing demand for Rapid Digital Transformation

The accelerated adoption of digital technologies, cloud services, and remote work arrangements has expanded the digital footprint of organizations. This trend increases the need for effective sensitive data discovery tools to manage and secure data across diverse environments. Heightened awareness among consumers and businesses about data privacy issues is driving demand for solutions that protect sensitive information. Organizations are seeking tools that can help them demonstrate compliance with privacy regulations and build trust with their stakeholders. The global expansion of data protection laws and regulations is driving international demand for sensitive data discovery solutions. Companies operating in multiple jurisdictions require tools that can ensure compliance with varying legal requirements.

Sensitive Data Discovery Market Segment Overview

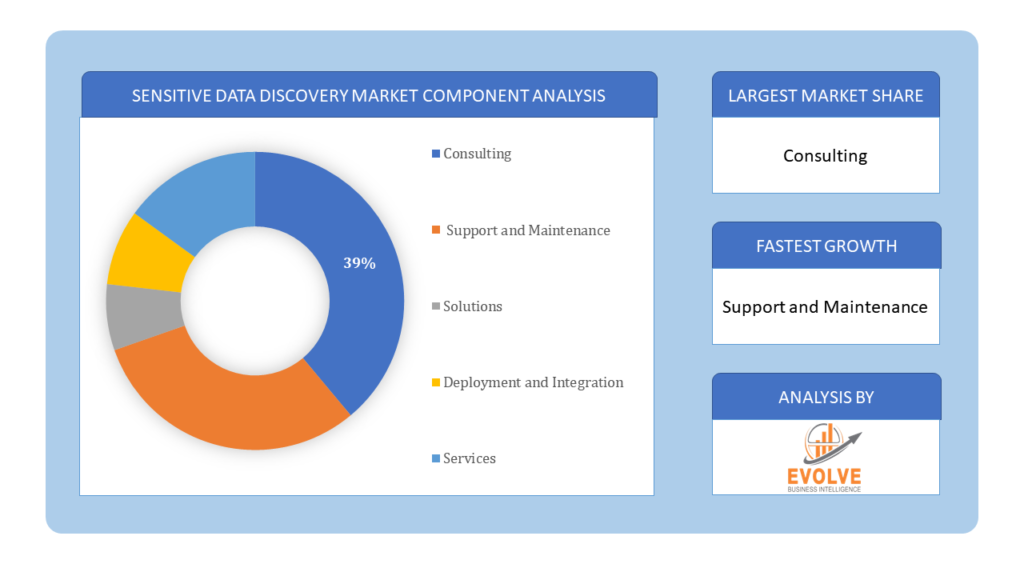

By Component

Based on Component, the market is segmented based on Consulting, Support and Maintenance, Solutions, Deployment and Integration and Services. The services market segment is estimated to increase at a significant rate over the forecast period. This growth is due to the rising demand for deployment & integration and consulting services by the end-users to efficiently incorporate these tools of sensitive data discovery to collect the structured and unstructured data from various sources.

Based on Component, the market is segmented based on Consulting, Support and Maintenance, Solutions, Deployment and Integration and Services. The services market segment is estimated to increase at a significant rate over the forecast period. This growth is due to the rising demand for deployment & integration and consulting services by the end-users to efficiently incorporate these tools of sensitive data discovery to collect the structured and unstructured data from various sources.

By Organization Size

Based on Organization Size, the market segment has been divided into the Large Enterprises, (SMEs) Small and Medium-Sized Enterprises. The Small and Medium-Sized Enterprises segment dominant the market. SMEs handle significant amounts of sensitive data, including customer information, financial records, and intellectual property. Protecting this data from breaches and ensuring compliance with data protection regulations is critical for SMEs.

By Application

Based on Application, the market segment has been divided into the Sales and Marketing Management, Asset Management, Security and Risk Management, Supply Chain Management and Others. The Security and Risk Management segment dominant the market. The primary goal is to identify potential security threats and vulnerabilities associated with sensitive data. Solutions in this segment help detect unauthorized access, data breaches, and other security incidents.

By Vertical

Based on Vertical, the market segment has been divided into the Government, BFSI, Retail, Healthcare and Life Sciences, Manufacturing, Transportation and Logistics, Telecommunication and IT, Media and Entertainment and Others. he BFSI domain is estimated to witness the largest market share over the forecast period. Additionally, the healthcare & life sciences domain would exhibit highest CAGR over the forecast period. At the time of the COVID-19 pandemic, healthcare researchers and hospitals dealt with various data that created a huge requirement for efficient data discovery and management. Data preparation and graphical user interface help the customers to use integrated intelligence with automatic data prep tasks.

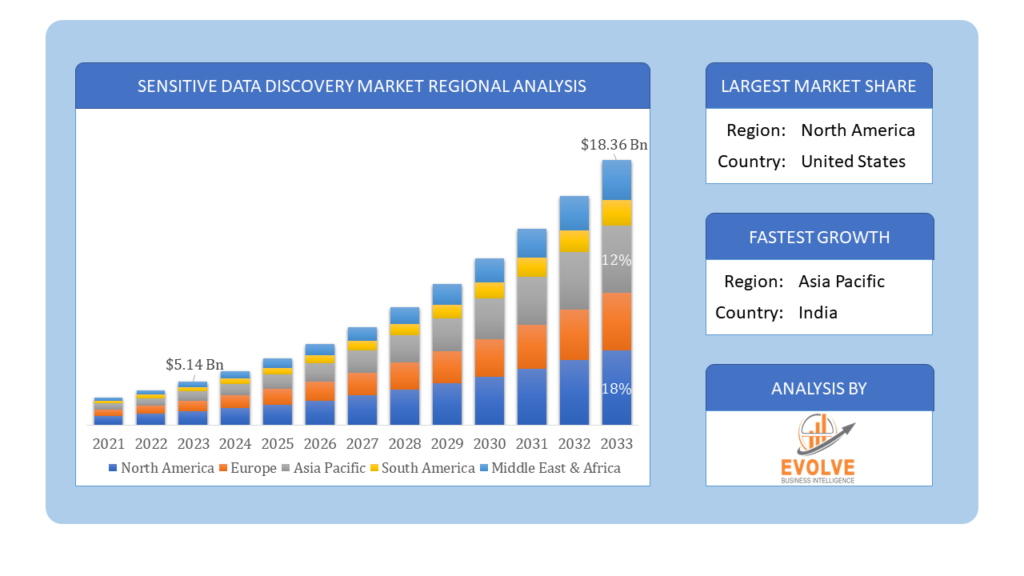

Global Sensitive Data Discovery Market Regional Analysis

Based on region, the global Sensitive Data Discovery Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Sensitive Data Discovery Market followed by the Asia-Pacific and Europe regions.

Sensitive Data Discovery North America Market

Sensitive Data Discovery North America Market

North America holds a dominant position in the Sensitive Data Discovery Market. United States and Canada lead the market due to stringent data protection regulations (like CCPA in California and GDPR-like regulations), high cybersecurity awareness, and a large number of cybersecurity firms. Significant adoption in industries such as healthcare, finance, and technology, driven by strict regulatory compliance requirements.

Sensitive Data Discovery Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Sensitive Data Discovery Market industry. China, Japan, and India are emerging as key markets due to rapid digital transformation and increasing cybersecurity threats. Growing adoption in sectors such as BFSI (Banking, Financial Services, and Insurance), healthcare, and IT services. Rising awareness about data protection laws and regulations contributing to market growth.

Competitive Landscape

The global Sensitive Data Discovery Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- IBM

- Microsoft

- Oracle

- AWS

- Prrofpoint

- Micro Focus

- SolarWinds

- PKWARE

- Thales

Key Development

In January 2021, Netwrix merged with stealthbits, and the combined entity will offer data privacy and security solutions to organizations of any size in any region around the world.

Scope of the Report

Global Sensitive Data Discovery Market, by Component

- Consulting

- Support and Maintenance

- Solutions

- Deployment and Integration

- Services

Global Sensitive Data Discovery Market, by Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

Global Sensitive Data Discovery Market, by Application

- Sales and Marketing Management

- Asset Management

- Security and Risk Management

- Supply Chain Management

- Others

Global Sensitive Data Discovery Market, by Vertical

- Government

- BFSI

- Retail

- Healthcare and Life Sciences

- Manufacturing

- Transportation and Logistics

- Telecommunication and IT

- Media and Entertainment

- Others

Global Sensitive Data Discovery Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $18.36 Billion/strong> |

| CAGR | 16.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Organization Size, Application, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | IBM, Microsoft, Oracle, AWS, Prrofpoint, Google, Micro Focus, SolarWinds, PKWARE and Thales |

| Key Market Opportunities | • Rapid Digital Transformation • Growing Awareness of Data Privacy |

| Key Market Drivers | • Rising Data Breaches and Cybersecurity Threats • Remote Work and Digital Transformation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Sensitive Data Discovery Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Sensitive Data Discovery Market historical market size for the year 2021, and forecast from 2023 to 2033

- Sensitive Data Discovery Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Sensitive Data Discovery Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Sensitive Data Discovery Market is 2021- 2033

2.What is the growth rate of the global Sensitive Data Discovery Market?

- The global Sensitive Data Discovery Market is growing at a CAGR of 16.78% over the next 10 years

3.Which region has the highest growth rate in the market of Sensitive Data Discovery Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Sensitive Data Discovery Market?

- North America holds the largest share in 2022

5.Who are the key players in the global Sensitive Data Discovery Market?

- IBM, Microsoft, Oracle, AWS, Prrofpoint, Google, Micro Focus, SolarWinds, PKWARE and Thales. are the major companies operating in the market.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Component Segement – Market Opportunity Score 4.1.2. Organization Size Segment – Market Opportunity Score 4.1.3. Vertical Segment – Market Opportunity Score 4.1.4. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End Users 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Sensitive Data Discovery Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Sensitive Data Discovery Market, By Component 7.1. Introduction 7.1.1. Consulting 7.1.2. Support and Maintenance 7.1.3. Solutions 7.1.4. Deployment and Integration 7.1.5. Services CHAPTER 8. Sensitive Data Discovery Market, By Organization Size 8.1. Introduction 8.1.1. Large Enterprises 8.1.2. Small and Medium-Sized Enterprises CHAPTER 9. Sensitive Data Discovery Market, By Vertical 9.1. Introduction 9.1.1. Government 9.1.2. BFSI 9.1.3. Retail 9.1.4. Healthcare and Life Sciences 9.1.5. Manufacturing 9.1.6. Transportation and Logistics 9.1.7. Telecommunication and IT 9.1.8. Media and Entertainment 9.1.9. Others CHAPTER 10. Sensitive Data Discovery Market, By Application 10.1.Introduction 10.1.1. Sales and Marketing Management 10.1.2. Asset Management 10.1.3. Security and Risk Management 10.1.4. Supply Chain Management 10.1.5. Others CHAPTER 11. Sensitive Data Discovery Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Organization Size, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. IBM 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Microsoft 13.3. Oracle 13.4. AWS 13.5. Prrofpoint 13.6. Google 13.7. Micro Focus 13.8. SolarWinds 13.9. PKWARE 13.10. Thales

Connect to Analyst

Research Methodology