Security Operations Center Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Security Operations Center Market Research Report: Information By End-user Industry (IT & Telecom, BFSI, Pharmaceutical, Others), By Enterprise Size (Small and medium Enterprises, Large Enterprises), and by Region — Forecast till 2034

Page: 169

Security Operations Center Market Overview

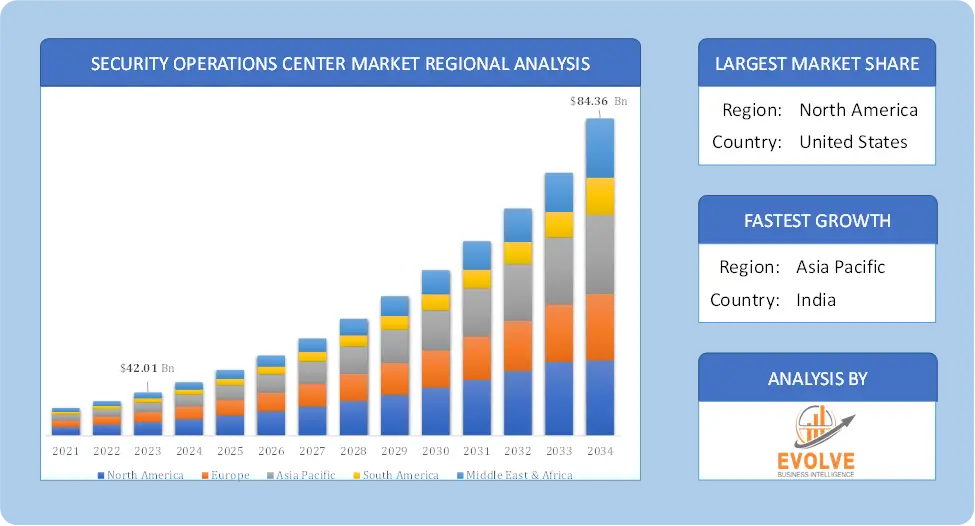

The Security Operations Center Market size accounted for USD 42.01 Billion in 2023 and is estimated to account for 43.57 Billion in 2024. The Market is expected to reach USD 84.36 Billion by 2034 growing at a compound annual growth rate (CAGR) of 11.52% from 2024 to 2034. The Security Operations Center (SOC) market involves centralized facilities that monitor, detect, analyze, and respond to cybersecurity threats in real-time. SOCs are critical for organizations to ensure constant protection against cyberattacks, manage incidents, and enhance security posture. They integrate advanced technologies like artificial intelligence, machine learning, and automation to improve threat detection and response capabilities. SOC services can be in-house or outsourced, with offerings including threat intelligence, incident response, and compliance management. The increasing frequency of cyberattacks, regulatory requirements, and the adoption of cloud-based services are key drivers of the SOC market’s growth.

Global Security Operations Center Market Synopsis

Security Operations Center Market Dynamics

Security Operations Center Market Dynamics

The major factors that have impacted the growth of Security Operations Center are as follows:

Drivers:

Ø Growing Adoption of Cloud-Based SOC Services

There is an increasing need for cloud-based SOCs as more and more businesses look for security solutions that are affordable, flexible, and scalable. Businesses of all sizes can access advanced security capabilities without requiring substantial on-premise infrastructure thanks to cloud-based SOC services. Small and medium-sized businesses (SMEs) that might not have the capacity to create and manage an internal SOC will find this model especially helpful.

Restraint:

- Data Privacy Concerns with Outsourced SOCs

As more businesses look for scalable, adaptable, and affordable security solutions, the need for cloud-based SOCs is growing. Businesses of all sizes can obtain advanced security features through cloud-based SOC services without requiring a large amount of on-premise technology. Small and medium-sized businesses (SMEs), who do not have the means to create and manage an internal SOC, can especially benefit from this strategy.

Opportunity:

⮚ Increasing Role of SOCs in Incident Response and Recovery

SOCs are becoming indispensable for incident response and recovery, going beyond simple threat detection and monitoring. Businesses are looking for more all-inclusive SOC services, such as post-event recovery, forensics, and quick incident response in addition to real-time monitoring. Detecting, detecting, and fixing security vulnerabilities rapidly is becoming more and more important as cyberattacks become more destructive. The rise of SOC services presents a significant potential for vendors providing end-to-end solutions that include detection, recovery, and prevention.

Security Operations Center Segment Overview

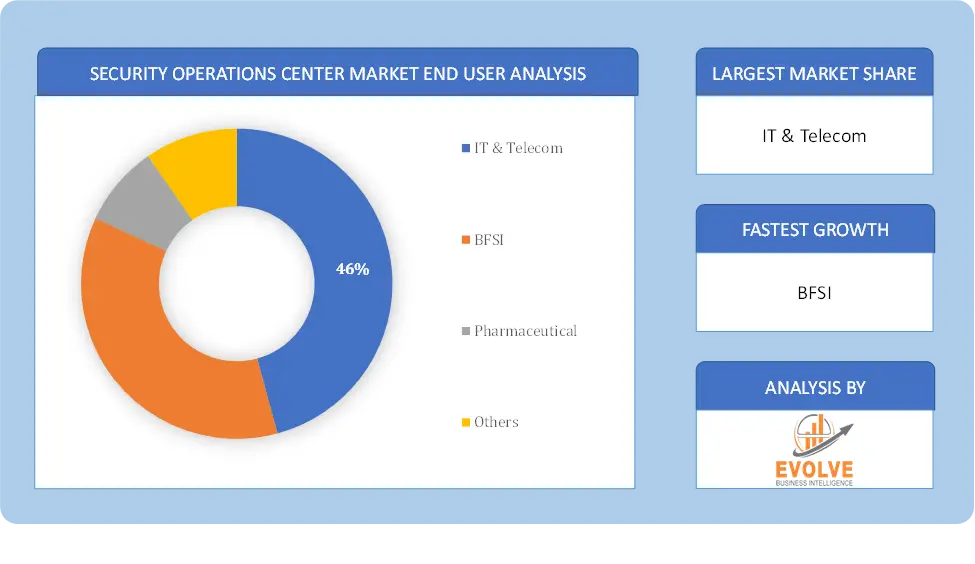

By End-user Industry

Based on End-user Industry, the market is segmented based on IT & Telecom, BFSI, Pharmaceutical, Others. the BFSI (Banking, Financial Services, and Insurance) sector dominates due to its high vulnerability to cyber threats and strict regulatory requirements, driving the need for advanced security monitoring solutions.

Based on End-user Industry, the market is segmented based on IT & Telecom, BFSI, Pharmaceutical, Others. the BFSI (Banking, Financial Services, and Insurance) sector dominates due to its high vulnerability to cyber threats and strict regulatory requirements, driving the need for advanced security monitoring solutions.

By Enterprise Size

Based on Enterprise Sizes, the market has been divided into the Small and medium Enterprises, Large Enterprises. large enterprises dominate due to their significant resources, higher cybersecurity risks, and more complex IT infrastructures, requiring advanced and comprehensive security monitoring solutions.

Global Security Operations Center Market Regional Analysis

Based on region, the global Security Operations Center market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Security Operations Center market followed by the Asia-Pacific and Europe regions.

Security Operations Center North America Market

Security Operations Center North America Market

North America holds a dominant position in the Security Operations Center Market. North America held the greatest market share for security operation centers and is anticipated to continue to lead the industry over the forecast period. The primary driver of the market’s expansion in North America is the growing necessity to monitor, detect, respond to, and look into cyber threats. The US, Canada, and Mexico make up the three countries that make up the region. In terms of security operation center market share in the area in 2021, the US market accounted for the largest proportion (55%). The nation’s industry is expanding since there are more cyberattacks and cybercrimes, which means that data security is becoming more and more important.

Security Operations Center Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Security Operations Center industry. Over the course of the forecast period, the security operation center market is anticipated to grow at the fastest rate in Asia-Pacific, with a CAGR of 12.05%. The growing requirement to centralize threat detection and prevention activities and businesses’ emphasis on system vulnerabilities and threat exposures are the main drivers propelling the market’s expansion. China, Japan, India, and the remainder of Asia-Pacific have been divided into regions based on nationality.

Competitive Landscape

The global Security Operations Center market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as End-user Industrylaunches, and strategic alliances.

Prominent Players:

- Capgemini

- Symantec

- AT&T

- Cisco

- Fortinet

- F5 network

- Secureworks Corp.

- Raytheon company

- Dark matters

- RAPID7

Key Development

June 2021: Secureworks Inc. announced the inclusion of the Secureworks Technology Alliance Partner programme to its Partner Program, which extends the Taegis ecosystem and data integrations to speed threat detection for all Taegis clients. Secureworks Technology Alliance Partners can now create powerful, comprehensive security solutions by integrating their own Taegis connectors.

Scope of the Report

Global Security Operations Center Market, by End-user Industry

- IT & Telecom

- BFSI

- Pharmaceutical

- Others

Global Security Operations Center Market, by Enterprise Size

- Small and medium Enterprises

- Large Enterprises

Global Security Operations Center Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $ 84.36 Billion |

| CAGR | 11.52% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | End-user Industry, Enterprise Size |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Capgemini, Symantec, AT&T, Cisco, Fortinet, F5 network, Secureworks Corp., Raytheon company, Dark matters, RAPID7 |

| Key Market Opportunities | • Growing Demand for Protecting Critical Data |

| Key Market Drivers | • Growing BYOD Trend Among Organizations Increasing Number of Cyber-Attacks |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Security Operations Center market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Security Operations Center market historical market size for the year 2022, and forecast from 2021 to 2034

- Security Operations Center market share analysis at each End-user Industry level

- Competitor analysis with detailed insight into its End-user Industry segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including End-user Industry launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Security Operations Center market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, End-user Industry offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Security Operations Center market is 2021- 2034

What is the growth rate of the global Security Operations Center market?

The global Security Operations Center market is growing at a CAGR of 11.52% over the next 10 years

Which region has the highest growth rate in the market of Security Operations Center?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region has the largest share of the global Security Operations Center market?

North America holds the largest share in 2023

Who are the key players in the global Security Operations Center market?

Capgemini, Symantec, AT&T, Cisco, Fortinet, F5 network, Secureworks Corp., Raytheon company, Dark matters, and RAPID7 are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Security Operations Center Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Security Operations Center Market, By End-user Industry 6.1. Introduction 6.2. IT & Telecom 6.3. BFSI 6.3. Pharmaceutical 6.4. Others Chapter 7. Global Security Operations Center Market, By Enterprise Size 7.1. Introduction 7.2. Small and medium Enterprises 7.3. Large Enterprises Chapter 8. Global Security Operations Center Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.2.5. Market Size and Forecast, By Enterprise Size, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.3.5. Market Size and Forecast, By Enterprise Size, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.4.5. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.5.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By End-user Industry, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Enterprise Size, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Capgemini 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Symantec 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. AT&T 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Cisco 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Fortinet 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. F5 network 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Secureworks Corp. 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Raytheon company 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Dark matters 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Rapid7 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology