Security as a Service Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

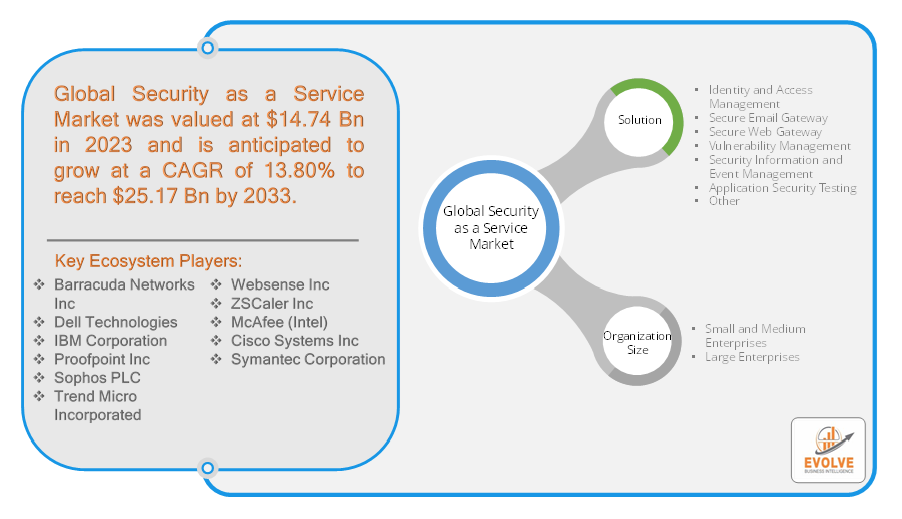

Security as a Service Market Research Report: Information By Solution (Identity and Access Management, Secure Email Gateway, Secure Web Gateway, Vulnerability Management, Security Information and Event Management, Application Security Testing, Other), By Organization Size (Small and Medium Enterprises, Large Enterprises), and Region — Forecast till 2033

Security as a Service Market Overview

The Security as a Service Market Size is expected to reach USD 25.17 Billion by 2033. The Security as a Service industry size accounted for USD 14.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 13.80% from 2023 to 2033. Security as a Service (SECaaS) is a cloud-based model that provides organizations and individuals with security services through a subscription-based approach. It involves outsourcing the management and delivery of security solutions to third-party service providers. SECaaS offers a wide range of security capabilities, such as threat intelligence, intrusion detection and prevention, data encryption, access control, and more. It enables businesses to enhance their security posture without the need for heavy investment in infrastructure and expertise while benefiting from continuous monitoring, updates, and support from the service provider.

Global Security as a Service Market Synopsis

The COVID-19 pandemic had a significant positive impact on the Security as a Service (SECaaS) market. As organizations quickly transitioned to remote work and increased their digital presence, the need for robust cybersecurity solutions became paramount. This led to a surge in demand for SECaaS offerings. Businesses sought cloud-based security services to protect their sensitive data, networks, and systems from escalating cyber threats. SECaaS provided scalability, flexibility, and cost-effectiveness, enabling organizations to adapt their security measures to the changing work landscape. The pandemic acted as a catalyst, driving the adoption of SECaaS as businesses recognized the importance of outsourcing their security needs to specialized service providers, resulting in the market’s growth and expansion.

Security as a Service Market Dynamics

The major factors that have impacted the growth of Security as a Service are as follows:

Drivers:

Increasing Cybersecurity Threats

One of the key drivers for the Security as a Service (SECaaS) market is the escalating cybersecurity threats. As cyberattacks become more sophisticated and prevalent, organizations are realizing the need for robust security solutions to safeguard their digital assets. SECaaS offers specialized expertise and advanced security measures that can help protect against evolving threats, including malware, data breaches, ransomware, and phishing attacks.

Restraint:

- Concerns about Data Privacy and Control

A significant restraint for the SECaaS market is the concern about data privacy and control. Some organizations may be hesitant to adopt SECaaS solutions due to apprehensions about relinquishing control of their sensitive data to third-party service providers. Compliance with data protection regulations and ensuring the secure handling of data are critical factors that need to be addressed to alleviate these concerns and gain trust in the market.

Opportunity:

Rising Adoption of Cloud Computing

The widespread adoption of cloud computing presents a significant opportunity for the SECaaS market. As businesses increasingly migrate their operations to the cloud, they seek integrated security solutions that align with their cloud-based infrastructure. SECaaS provides the advantage of scalable, on-demand security services that can seamlessly integrate with cloud environments. The growing demand for cloud-based services and the need for comprehensive security solutions create a favorable environment for the growth and expansion of the SECaaS market.

Security as a Service Segment Overview

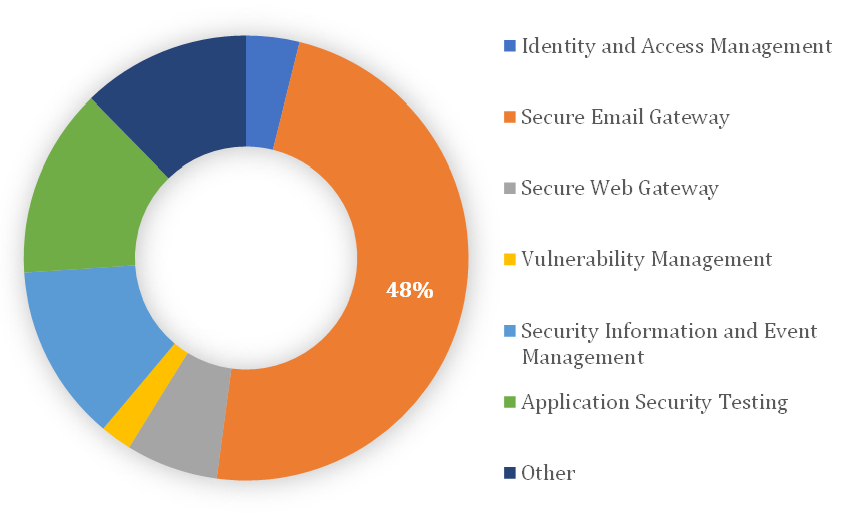

By Solution

Based on the Solution, the market is segmented based on Identity and Access Management, Secure Email Gateway, Secure Web Gateway, Vulnerability Management, Security Information and Event Management, Application Security Testing, Other. The Secure Email Gateway segment is expected to have significant growth during the forecast period. This growth is driven by the increasing prevalence of email-based threats, including phishing and malware attacks. Organizations are recognizing the need for advanced security solutions to protect their email communication and prevent malicious content from reaching users’ inboxes. The emphasis on data protection and compliance, along with the adoption of cloud-based email services, further fuels the demand for SEG solutions.

By Organization Size

Based on Organization Size, the market has been divided into Small and Medium Enterprises and Large Enterprises. Large Enterprises dominate the Security as a Service Market. These organizations typically have significant resources, including financial capabilities, robust IT infrastructure, and dedicated cybersecurity teams. As a result, they are more inclined to adopt SECaaS solutions to bolster their security posture.

Global Security as a Service Market Regional Analysis

Based on region, the global Security as a Service market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Security as a Service market followed by the Asia-Pacific and Europe regions.

North America Market

North America holds a prominent position in the Security as a Service (SECaaS) market due to its advanced technological infrastructure, early adoption of cloud-based services, and the presence of leading technology and cybersecurity companies. The region has a mature market for SECaaS, driven by the high demand for robust security solutions and the presence of established service providers. North American businesses recognize the importance of outsourcing their security needs to specialized providers, contributing to the growth and dominance of the SECaaS market in the region.

Asia-Pacific Market

The Asia Pacific region is emerging as the fastest-growing market for Security as a Service (SECaaS). The region’s rapid digital transformation across sectors, increasing cyber threats, and growing adoption of cloud-based services is driving the demand for SECaaS solutions. With a large and expanding population of businesses and consumers, Asia Pacific presents significant opportunities for SECaaS providers to cater to the increasing cybersecurity needs. The region’s strong economic growth, advancements in technology, and increasing awareness of the importance of cybersecurity contribute to its emergence as a key market for SECaaS.

Competitive Landscape

The global Security as a Service market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Barracuda Networks Inc

- Dell Technologies

- IBM Corporation

- Proofpoint Inc

- Sophos PLC

- Trend Micro Incorporated

- Websense Inc

- ZSCaler Inc

- McAfee (Intel)

- Cisco Systems Inc

- Symantec Corporation

Key Development:

In December 2022, Allot Ltd announced that Far EasTone Telecommunications (FET) in Taiwan has implemented cybersecurity threat protection and comprehensive content control services for its mobile customers using the Allot NetworkSecure solution. Allot has collaborated with CommVerge for solution integration and local support.

In May 2022, Intel introduced Project Amber, a new Security as a Service (SeCaaS) offering designed to remotely verify the trustworthiness of computing assets in edge, on-premise, and cloud environments. This solution represents Intel’s latest initiative to enhance its confidential computing services, providing advanced security measures to protect sensitive data.

Scope of the Report

Global Security as a Service Market, by Solution

- Identity and Access Management

- Secure Email Gateway

- Secure Web Gateway

- Vulnerability Management

- Security Information and Event Management

- Application Security Testing

- Other

Global Security as a Service Market, by Organization Size

- Small and Medium Enterprises

- Large Enterprises

Global Security as a Service Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $25.17 Billion |

| CAGR | 13.80% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Solution, Organization Size |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Barracuda Networks Inc, Dell Technologies, IBM Corporation, Proofpoint Inc, Sophos PLC, Trend Micro Incorporated, Websense Inc, ZSCaler Inc, McAfee (Intel), Cisco Systems Inc, Symantec Corporation |

| Key Market Opportunities | Increasing Cybersecurity Threats |

| Key Market Drivers | Rising Adoption of Cloud Computing |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Security as a Service market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Security as a Service market historical market size for the year 2021, and forecast from 2023 to 2033

- Security as a Service market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Security as a Service market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Security as a Service market is 2021- 2033

What is the growth rate of the global Security as a Service market?

The global Security as a Service market is growing at a CAGR of 13.21% over the next 10 years

Which region has the highest growth rate in the market of Security as a Service?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Security as a Service market?

North America holds the largest share in 2022

Who are the key players in the global Security as a Service market?

Barracuda Networks Inc, Dell Technologies, IBM Corporation, Proofpoint Inc, Sophos PLC, Trend Micro Incorporated, Websense Inc, ZSCaler Inc, McAfee (Intel), Cisco Systems Inc, and Symantec Corporation are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Security as a Service Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Security as a Service Market 4.8. Import Analysis of the Security as a Service Market 4.9. Export Analysis of the Security as a Service Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Security as a Service Market, By Solution 6.1. Introduction 6.2. Identity and Access Management 6.3. Secure Email Gateway 6.4. Secure Web Gateway 6.5. Vulnerability Management 6.6. Security Information and Event Management 6.7. Application Security Testing 6.8. Other Chapter 7. Global Security as a Service Market, By Organization Size 7.1. Introduction 7.2. Small and Medium Enterprises 7.3. Large Enterprises Chapter 8. Global Security as a Service Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Solution, 2023-2033 8.2.5. Market Size and Forecast, By Organization Size, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Solution, 2023-2033 8.2.6.4. Market Size and Forecast, By Organization Size, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Solution, 2023-2033 8.2.7.5. Market Size and Forecast, By Organization Size, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Solution, 2023-2033 8.3.5. Market Size and Forecast, By Organization Size, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Solution, 2023-2033 8.3.6.4. Market Size and Forecast, By Organization Size, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Solution, 2023-2033 8.3.7.4. Market Size and Forecast, By Organization Size, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Solution, 2023-2033 8.3.8.4. Market Size and Forecast, By Organization Size, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Solution, 2023-2033 8.3.9.4. Market Size and Forecast, By Organization Size, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Solution, 2023-2033 8.3.11.4. Market Size and Forecast, By Organization Size, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Solution, 2023-2033 8.4.5. Market Size and Forecast, By Organization Size, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Solution, 2023-2033 8.4.6.4. Market Size and Forecast, By Organization Size, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Solution, 2023-2033 8.4.7.4. Market Size and Forecast, By Organization Size, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Solution, 2023-2033 8.4.8.4. Market Size and Forecast, By Organization Size, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Solution, 2023-2033 8.4.9.4. Market Size and Forecast, By Organization Size, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Solution, 2023-2033 8.4.10.4. Market Size and Forecast, By Organization Size, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Solution, 2023-2033 8.5.4. Market Size and Forecast, By Organization Size, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Barracuda Networks Inc 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Dell Technologies 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. IBM Corporation 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Proofpoint Inc 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Sophos PLC 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Trend Micro Incorporated 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Websense Inc 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 ZSCaler Inc 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. McAfee (Intel) 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Cisco Systems Inc 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology