Rolling Stock Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

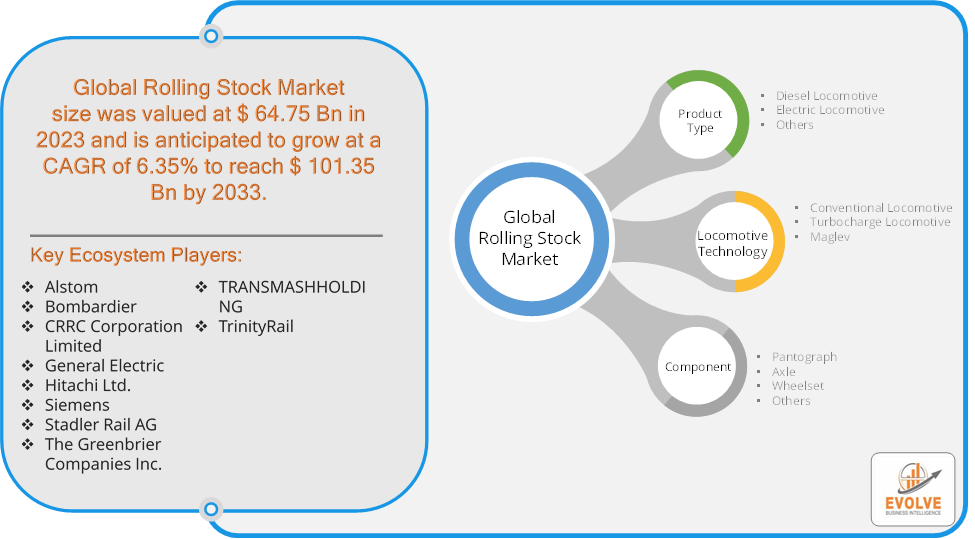

Rolling Stock Market Research Report: Information By Product Type (Diesel Locomotive, Electric Locomotive, Others), By Locomotive Technology (Conventional Locomotive, Turbocharge Locomotive, Maglev), By Component (Pantograph, Axle, Wheelset, Others), and by Region — Forecast till 2033

Page: 155

Rolling Stock Market Overview

The Rolling Stock Market Size is expected to reach USD 101.35 Billion by 2033. The Rolling Stock Market industry size accounted for USD 64.75 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.35% from 2023 to 2033. The rolling stock market encompasses the design, manufacturing, maintenance, and leasing of various rail vehicles. These vehicles, collectively known as rolling stock, are essential components of railway operations.

The Rolling Stock Market is a crucial component of the transportation sector, facilitating efficient movement of passengers and goods, and is continuously evolving with advancements in technology and growing environmental considerations.

Global Rolling Stock Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the Rolling Stock Market. Lockdowns and restrictions led to factory shutdowns, causing delays in the production of rolling stock. Reduced passenger numbers and freight volumes led to lower revenues for railway operators. A significant decline in passenger travel due to lockdowns, remote working, and health concerns led to reduced demand for passenger trains. While some freight sectors experienced a drop, essential goods transport saw increased demand, highlighting the importance of rail freight. Accelerated adoption of digital technologies for operations, maintenance, and customer service. Increased use of remote monitoring and predictive maintenance technologies to ensure operational continuity. Enhanced focus on building more resilient supply chains and operational frameworks to withstand future disruptions.

Rolling Stock Market Dynamics

The major factors that have impacted the growth of Rolling Stock Market are as follows:

Drivers:

Ø Technological Advancements

Advances in technology have led to the development of more efficient, reliable, and safer trains. Innovations include high-speed trains, automated systems, and improved propulsion technologies. The integration of digital technologies for operations, maintenance, and passenger services is enhancing the efficiency and appeal of rail transportation. The expansion of global trade and logistics networks requires efficient and reliable freight transportation, boosting demand for freight wagons and locomotives. The rise of e-commerce has led to increased demand for fast and reliable delivery services, further driving the need for efficient rail freight solutions. Growing awareness of the benefits of public transportation, such as reduced traffic congestion and pollution, is driving demand for urban rail systems.

Restraint:

- Perception of High Initial Investment Costs and Infrastructure Limitations

The high cost of purchasing new rolling stock and developing rail infrastructure requires significant capital investment, which can be a barrier for many operators and governments. Ongoing maintenance and repair costs for rolling stock are substantial, impacting the overall budget and financial planning of rail operators. In many regions, rail infrastructure is aging and in need of modernization, which can be costly and time-consuming to address. Limited capacity on existing rail networks can restrict the ability to meet growing demand, particularly in densely populated or highly industrialized areas.

Opportunity:

⮚ Sustainable and Green Solutions

Expanding electrification of rail networks offers opportunities to reduce carbon emissions and dependence on fossil fuels. This is particularly relevant for regions looking to meet stringent environmental regulations. Integrating renewable energy sources, such as solar and wind power, into rail operations can further enhance sustainability and reduce operational costs. The development and expansion of high-speed rail networks offer significant opportunities, particularly in regions with high population density and growing urbanization. High-speed trains provide faster and more efficient long-distance travel options. Enhancing cross-border rail connectivity through high-speed rail networks can boost regional trade and tourism, presenting opportunities for international collaboration and investment.

Rolling Stock Market Segment Overview

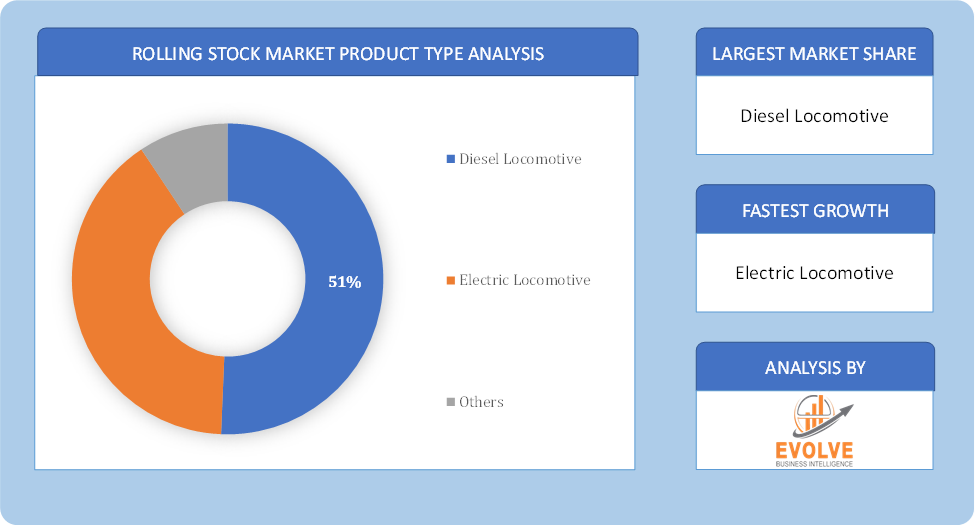

By Product Type

By Product Type

Based on Product Type, the market is segmented based on Diesel Locomotive, Electric Locomotive and Others. The Diesel Locomotive segment dominant the market. The diesel trains will continue to be used in a variety of rolling stock fleets. Because of their ability to transport massive freight trains. Because of their higher torque engines, they are often used in industrial applications. However, as the world becomes more environmentally conscious, diesel train technology is developing toward the development of low-emission engines for diesel locomotives.

By Locomotive Technology

Based on Locomotive Technology, the market segment has been divided into the Conventional Locomotive, Turbocharge Locomotive and Maglev. The Conventional Locomotive segment dominant the market. Conventional locomotives, though traditional, continue to see demand due to their reliability and cost-effectiveness, especially in freight transport and less developed rail networks, bolstering the market growth.

By Component

Based on Component, the market segment has been divided into the Pantograph, Axle, Wheelset and Others. Pantograph had a significant market share. A pantograph is equipment that is put on the roof of an electric train to gather power via an overhead tension line. The wire tension causes it to raise or lower. Typically, a single wire is utilized, with the return current passing through the track. It is a common form of current collector. The pantograph is spring-loaded and pushes a contact shoe up against the underside of the contact wire to extract the power required to run the train.

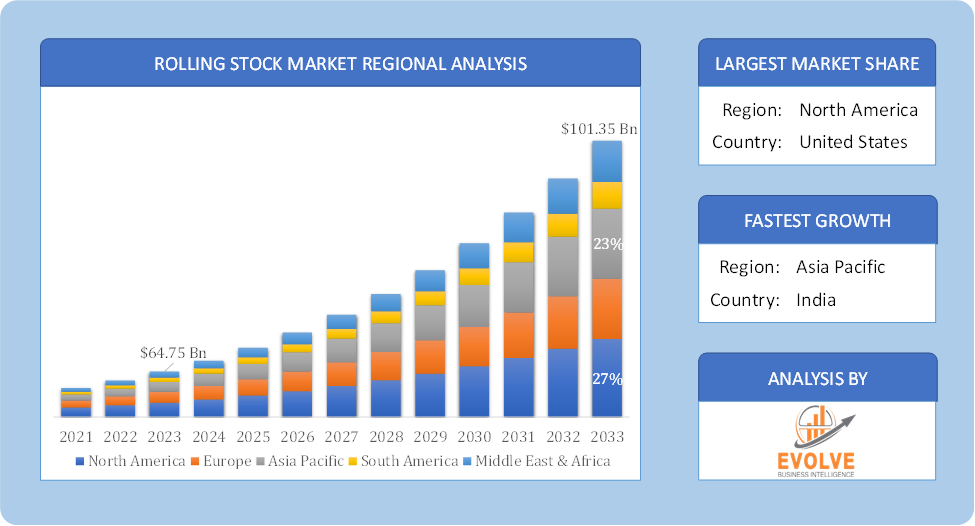

Global Rolling Stock Market Regional Analysis

Based on region, the global Rolling Stock Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Rolling Stock Market followed by the Asia-Pacific and Europe regions.

Rolling Stock North America Market

Rolling Stock North America Market

North America holds a dominant position in the Rolling Stock Market. The U.S. rail system is heavily focused on freight transportation, with a significant demand for freight locomotives and wagons. Investments in urban transit systems, such as light rail and metro, are increasing to address urban congestion and environmental concerns. Canada Country had Strong emphasis on both freight and passenger rail systems, with ongoing investments in high-speed rail and urban transit.

Rolling Stock Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Rolling Stock Market industry. Country China has Aggressive expansion of high-speed rail networks, making it the largest high-speed rail market globally. Significant investments in urban transit systems to accommodate rapid urbanization and population growth and leading in rail technology innovation, including automated and smart train systems.

Competitive Landscape

The global Rolling Stock Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Alstom

- Bombardier

- CRRC Corporation Limited

- General Electric

- Hitachi Ltd.

- Siemens

- Stadler Rail AG

- The Greenbrier Companies Inc.

- TRANSMASHHOLDING

- TrinityRail

Key Development

In January 2022, MASU’s, a prominent manufacturer of friction products for the rail and automotive industries, was bought by Wabtec Corporation. This acquisition will assist Wabtec Corporation in expanding its installed base and accelerating growth throughout its brake product portfolio.

In May 2021, France’s national state-owned railway company, SNCF, and its partners, the Railenium Technology Research Institute, Thales, Spirops, Bosch, and Alstom, have begun testing an autonomous regional train prototype based on a customized Regio 2N regional train for France’s rail network.

Scope of the Report

Global Rolling Stock Market, by Product Type

- Diesel Locomotive

- Electric Locomotive

- Others

Global Rolling Stock Market, by Locomotive Technology

- Conventional Locomotive

- Turbocharge Locomotive

- Maglev

Global Rolling Stock Market, by Component

- Pantograph

- Axle

- Wheelset

- Others

Global Rolling Stock Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 101.35 Billion |

| CAGR (2023-2033) | 6.35% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Locomotive Technology, Component |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Alstom, Bombardier, CRRC Corporation Limited, General Electric, Hitachi Ltd., Siemens, Stadler Rail AG, The Greenbrier Companies Inc., TRANSMASHHOLDING and TrinityRail. |

| Key Market Opportunities | · Sustainable and Green Solutions · Expansion of High-Speed Rail |

| Key Market Drivers | · Technological Advancements · Increased Freight Demand and Urban Mobility Solutions |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Rolling Stock Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Rolling Stock Market historical market size for the year 2021, and forecast from 2023 to 2033

- Rolling Stock Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Rolling Stock Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Rolling Stock Market is 2021- 2033

What is the growth rate of the global Rolling Stock Market?

The global Rolling Stock Market is growing at a CAGR of 6.35% over the next 10 years

Which region has the highest growth rate in the market of Rolling Stock Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Rolling Stock Market?

North America holds the largest share in 2022

Who are the key players in the global Rolling Stock Market?

Alstom, Bombardier, CRRC Corporation Limited, General Electric, Hitachi Ltd., Siemens, Stadler Rail AG, The Greenbrier Companies Inc., TRANSMASHHOLDING and TrinityRail are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Type Segement – Market Opportunity Score 4.1.2. Component Segment – Market Opportunity Score 4.1.3. Locomotive Technology Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Rolling Stock Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Rolling Stock Market, By Product Type 7.1. Introduction 7.1.1. Diesel Locomotive 7.1.2. Electric Locomotive 7.1.3. Others CHAPTER 8 Rolling Stock Market, By Component 8.1. Introduction 8.1.1. Pantograph 8.1.2. Axle 8.1.3. Wheelset 8.1.4. Others CHAPTER 9. Rolling Stock Market, By Locomotive Technology 9.1. Introduction 9.1.1. Conventional Locomotive 9.1.2 Turbocharge Locomotive 9.1.3 Maglev CHAPTER 10. Rolling Stock Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product Typess, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Locomotive Technology, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Alstom 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Bombardier 13.3. CRRC Corporation Limited 13.4. General Electric 13.5. Hitachi Ltd. 13.6. Siemens 13.7. Stadler Rail AG 13.8. The Greenbrier Companies Inc. 13.9 TRANSMASHHOLDING 13.10 TrinityRail

Connect to Analyst

Research Methodology

Rolling Stock North America Market

Rolling Stock North America Market