Procurement Management Services Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

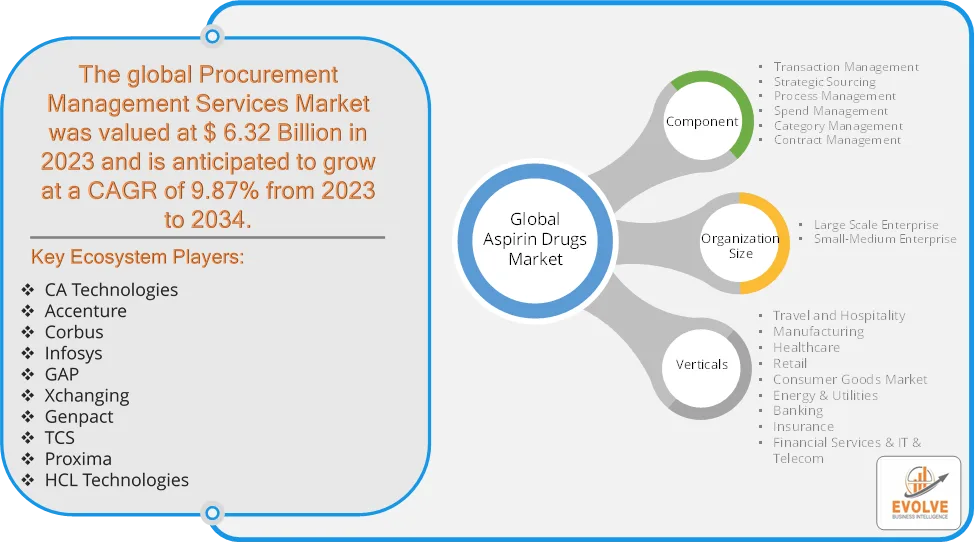

Procurement Management Services Market Research Report: Information By Component (Transaction Management, Strategic Sourcing, Process Management, Spend Management, Category Management, Contract Management), By Organization Size (Large Scale Enterprise & Small-Medium Enterprise), By Vertical (Travel and Hospitality, Manufacturing, Healthcare, Retail, Consumer Goods Market, Energy & Utilities, Banking, Insurance and Financial Services & IT & Telecom), and by Region — Forecast till 2034

Page: 165

Procurement Management Services Market Overview

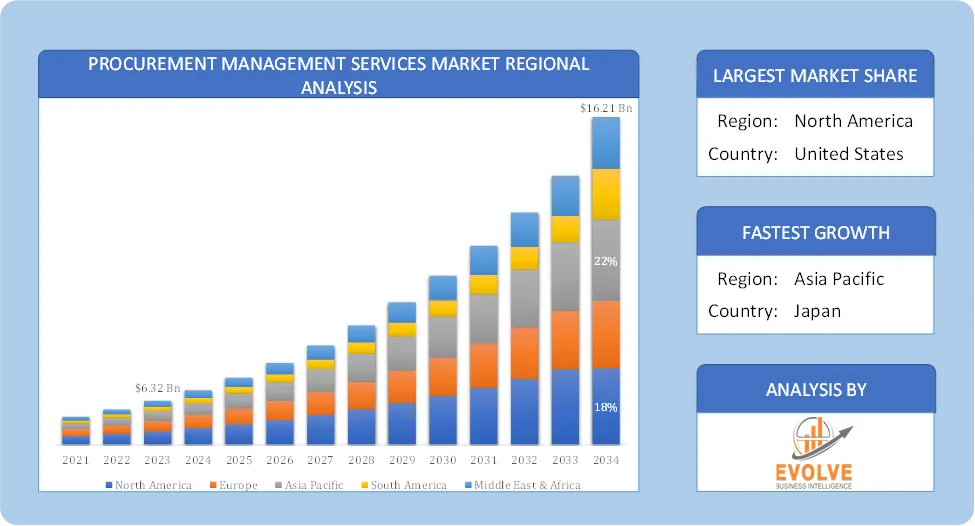

The Procurement Management Services Market size accounted for USD 6.32 Billion in 2023 and is estimated to account for 6.98 Billion in 2024. The Market is expected to reach USD 16.21 Billion by 2034 growing at a compound annual growth rate (CAGR) of 9.87% from 2024 to 2034. The Procurement Management Services Market consists of third-party providers that help businesses streamline their purchasing processes, optimize supplier relationships, and reduce procurement costs. These services include strategic sourcing, supplier management, contract negotiation, spend analysis, and risk management across various industries such as manufacturing, healthcare, retail, IT, and BFSI.

The procurement management services market is expanding rapidly due to the increasing need for organizations to optimize their procurement processes, reduce costs, and improve efficiency.

Global Procurement Management Services Market Synopsis

Procurement Management Services Market Dynamics

Procurement Management Services Market Dynamics

The major factors that have impacted the growth of Procurement Management Services Market are as follows:

Drivers:

Ø Rising Adoption of Digital Procurement Solutions

Companies are increasingly using AI, machine learning, cloud computing, and blockchain to enhance procurement efficiency. E-procurement platforms enable businesses to automate sourcing, contract management, and spend analysis and big data analytics helps optimize procurement decisions and supplier performance. Businesses are outsourcing procurement functions to reduce operational costs and improve spend visibility. Strategic sourcing and supplier consolidation help companies achieve better pricing and efficiency and procurement automation minimizes manual work and reduces procurement cycle time.

Restraint:

- High Implementation & Operational Costs and Data Security

Adopting procurement management services often requires substantial initial investment in software, infrastructure, and consulting. Small and medium-sized enterprises (SMEs) may struggle with budget constraints when adopting procurement automation and digital solutions. Ongoing subscription fees, training costs, and system maintenance expenses can be a financial burden. Procurement processes involve sensitive business and financial data, making cybersecurity threats a significant risk and companies fear data breaches, hacking incidents, and supplier fraud when using cloud-based procurement solutions.

Opportunity:

⮚ Adoption of AI & Automation in Procurement

AI-driven procurement solutions can optimize supplier selection, automate purchase orders, and improve spend analysis. Chatbots and AI-powered contract management can reduce human intervention, improving efficiency. Predictive analytics can help businesses anticipate market trends, price fluctuations, and supplier risks. Many businesses, especially SMEs, lack in-house procurement expertise, creating a demand for outsourced procurement solutions. Subscription-based procurement services allow companies to access expert procurement strategies without high investment costs. Blockchain technology can improve supplier transparency, eliminate fraud, and ensure contract integrity and smart contracts can automate payments and ensure compliance with procurement agreements.

Procurement Management Services Market Segment Overview

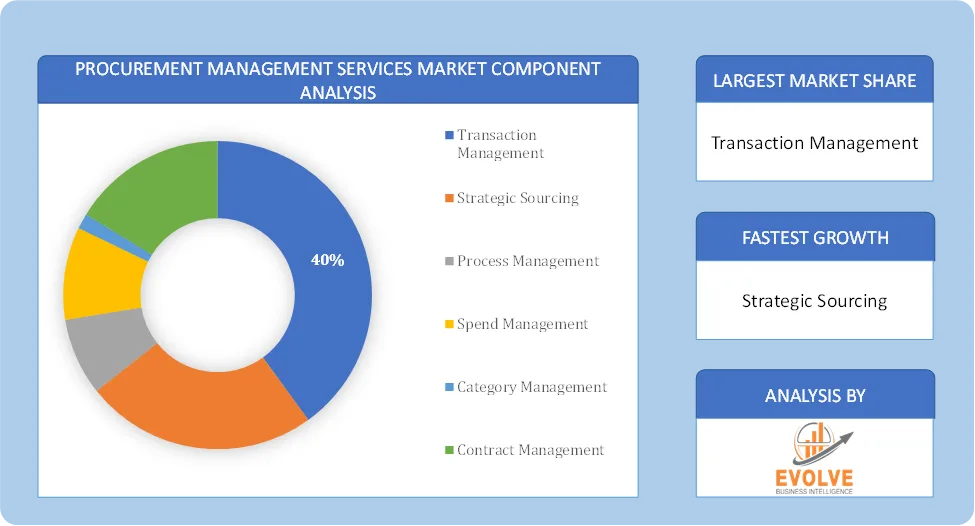

Based on Component, the market is segmented based on Transaction Management, Strategic Sourcing, Process Management, Spend Management, Category Management, Contract Management. The transaction management segment dominant the market. The efficiency of transaction management, which helps end-users to boost their company’s profitability while forming long-term business ties with suppliers, can be credited with category growth.

By Organization Size

Based on Organization Size, the market segment has been divided into Large Scale Enterprise & Small-Medium Enterprise. The large enterprise category generated the most income. Large enterprises will use these services to handle intricate contract arrangements and beg agreements, absorbing a sizable portion of the overall income share. Large enterprises choose these services because they cut operational costs while simplifying operations.

By Vertical

Based on Application, the market segment has been divided into Travel and Hospitality, Manufacturing, Healthcare, Retail, Consumer Goods Market, Energy & Utilities, Banking, Insurance and Financial Services & IT & Telecom. The manufacturing segment dominant the market. The category’s growth will be heavily influenced by how supply chains with shorter lead times are managed. Manufacturing will continue to be the main driver for the market for procurement as a service. The manufacturing sector’s services will concentrate on enhancing the supply chain dynamics regarding direct inputs and raw materials.

Global Procurement Management Services Market Regional Analysis

Based on region, the global Procurement Management Services Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Procurement Management Services Market followed by the Asia-Pacific and Europe regions.

North America Procurement Management Services Market

North America Procurement Management Services Market

North America holds a dominant position in the Procurement Management Services Market. This is attributed to the region’s mature outsourcing industry and early adoption of cloud-based technologies. The presence of major technology and consulting firms further strengthens its position. Complex global supply chains in industries such as retail, manufacturing, and automotive, necessitating advanced procurement solutions.

Asia-Pacific Procurement Management Services Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Procurement Management Services Market industry. Rapid industrialization and expanding economies, particularly in China and India, are driving this growth. Increasing focus on streamlining procurement processes through digital transformation, rising demand for cost-effective procurement solutions and growth of manufacturing and e-commerce sectors. It has significant procurement expenditures prompting firms to outsource non-core functions for cost savings.

Competitive Landscape

The global Procurement Management Services Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- CA Technologies

- Accenture

- Corbus

- Infosys

- GAP

- Xchanging

- Genpact

- TCS

- Proxima

- HCL Technologies.

Scope of the Report

Global Procurement Management Services Market, by Component

- Transaction Management

- Strategic Sourcing

- Process Management

- Spend Management

- Category Management

- Contract Management

Global Procurement Management Services Market, by Organization Size

- Large Scale Enterprise

- Small-Medium Enterprise

Global Procurement Management Services Market, by Verticals

- Travel and Hospitality

- Manufacturing

- Healthcare

- Retail

- Consumer Goods Market

- Energy & Utilities

- Banking

- Insurance

- Financial Services & IT & Telecom

Global Procurement Management Services Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 16.21 Billion |

| CAGR (2024-2034) | 9.87% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Organization Size, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | CA Technologies, Accenture, Corbus, Infosys, GAP, Xchanging, Genpact, TCS, Proxima and HCL Technologies. |

| Key Market Opportunities | · Adoption of AI & Automation in Procurement

· Blockchain for Secure & Transparent Procurement |

| Key Market Drivers | · Rising Adoption of Digital Procurement Solutions

· Growing Need for Cost Reduction & Process Optimization |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Procurement Management Services Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Procurement Management Services Market historical market size for the year 2021, and forecast from 2023 to 2033

- Procurement Management Services Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Procurement Management Services Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Procurement Management Services Market is 2021- 2033

What is the growth rate of the global Procurement Management Services Market?

The global Procurement Management Services Market is growing at a CAGR of 9.87% over the next 10 years

Which region has the highest growth rate in the market of Procurement Management Services Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Procurement Management Services Market?

North America holds the largest share in 2022

Who are the key players in the global Procurement Management Services Market?

CA Technologies, Accenture, Corbus, Infosys, GAP, Xchanging, Genpact, TCS, Proxima and HCL Technologies. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Component Segement – Market Opportunity Score

4.1.2. Organization Size Segment – Market Opportunity Score

4.1.3. Application Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Procurement Management Services Market Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Procurement Management Services Market Market, By Component

7.1. Introduction

7.1.1. Transaction Management

7.1.2 Strategic Sourcing

7.1.3. Process Management

7.1.4. Spend Management

7.1.5. Category Management

7.1.6. Contract Management

CHAPTER 8 Procurement Management Services Market Market, By Organization Size

8.1. Introduction

8.1.1. Large Scale Enterprise

8.1.2. Small-Medium Enterprise

CHAPTER 9. Procurement Management Services Market Market, By Verticals

9.1. Introduction

9.1.1. Travel and Hospitality

9.1.2. Manufacturing

9.1.3. Healthcare

9.1.4 Retail

9.1.5 Consumer Goods Market

9.1.6 Energy & Utilities

9.1.7 Banking

9.1.8 Insurance

9.1.9. Financial Services & IT & Telecom

CHAPTER 10. Procurement Management Services Market Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Organization Size, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Verticals, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. CA Technologies

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Accenture

13.3. Corbus

13.4. Infosys

13.5. GAP

13.6. Xchanging

13.7. Genpact

13.8. TCS

13.9 Proxima

13.10 HCL Technologies.

Connect to Analyst

Research Methodology