Power Management Integrated Circuits Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Power Management Integrated Circuits Market Research Report: Information By Product Type (Voltage Regulators, Linear Voltage Regulators, DC Regulators, Motor Control IC, Integrated ASSP Power Management IC, others), By End-Use (Automotive & Transportation, Consumer Electronics, Industrial, Others), and by Region — Forecast till 2033

Page: 165

Power Management Integrated Circuits Market Overview

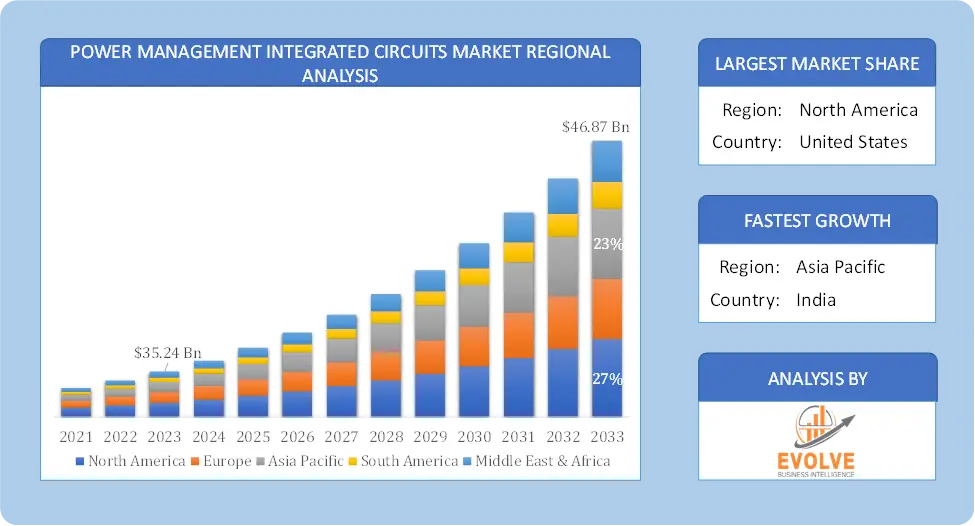

The Power Management Integrated Circuits Market Size is expected to reach USD 46.87 Billion by 2033. The Power Management Integrated Circuits Market industry size accounted for USD 35.24 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.54% from 2023 to 2033. The Power Management Integrated Circuits (PMIC) Market refers to the market for integrated circuits (ICs) that are used to manage the power requirements of various electronic devices. These ICs are designed to control the flow and distribution of electrical power within devices, ensuring that they operate efficiently and within safe power limits. PMICs are critical in minimizing power consumption, extending battery life, and enhancing the overall performance of electronic products.

The market encompasses various types of PMICs, including voltage regulators, battery management ICs, LED drivers, power switches, and others. The demand for PMICs is driven by the growing adoption of portable devices, the increasing complexity of electronic systems, and the need for energy-efficient solutions.

Global Power Management Integrated Circuits Market Synopsis

The COVID-19 pandemic had a significant impact on the Power Management Integrated Circuits (PMIC) Market. The pandemic led to a surge in demand for consumer electronics such as laptops, tablets, smartphones, and gaming consoles due to the rise in remote work, online education, and entertainment. This boosted the demand for PMICs, as these devices rely heavily on efficient power management to enhance battery life and performance. The pandemic accelerated the adoption of Internet of Things (IoT) devices and smart home technologies, both of which require efficient power management, leading to increased demand for PMICs in these applications. The pandemic exacerbated the global semiconductor chip shortage, which impacted the availability of PMICs. This shortage affected various industries, including automotive, consumer electronics, and industrial equipment, leading to production delays and increased costs. The pandemic highlighted the need for more resilient and flexible supply chains, prompting companies to diversify their supplier base and invest in local production capabilities to mitigate future disruptions. The increased demand for efficient power management in a variety of devices has spurred innovation in PMIC technologies, leading to the development of more advanced and energy-efficient solutions.

Power Management Integrated Circuits Market Dynamics

The major factors that have impacted the growth of Power Management Integrated Circuits Market are as follows:

Drivers:

Ø Rising Adoption of Electric Vehicles (EVs)

The global shift toward electric vehicles is driving the demand for advanced PMICs. EVs rely on power management solutions for battery management, energy conversion, and efficient power distribution. The increasing production and adoption of EVs are boosting the growth of the PMIC market, particularly in the automotive sector. Ongoing innovations in semiconductor technology are leading to the development of more advanced and energy-efficient PMICs. These advancements enable the integration of multiple power management functions into a single chip, reducing the size, cost, and power consumption of electronic devices.

Restraint:

- Perception of High Complexity and Design Challenges

The design and integration of PMICs are becoming increasingly complex as devices require more sophisticated power management functions. The need to integrate multiple functions into a single chip while maintaining energy efficiency and reliability poses significant challenges for designers and manufacturers, potentially slowing down innovation and increasing development costs. The development and manufacturing of advanced PMICs, particularly those used in cutting-edge applications such as electric vehicles (EVs) and 5G infrastructure, can be costly. The high cost of these components may limit their adoption, especially in price-sensitive markets or for applications where cost-efficiency is critical.

Opportunity:

⮚ Advancements in IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices and smart home technologies drives demand for PMICs. These devices require efficient power management to operate with minimal energy consumption and extended battery life. Opportunities exist in developing PMICs tailored for various IoT applications, including smart sensors, wearable devices, and home automation systems. The deployment of 5G networks and infrastructure presents opportunities for PMICs. 5G technology requires advanced power management to handle higher data rates, increased connectivity, and reduced latency. PMICs are essential for managing power in 5G base stations, network equipment, and connected devices.

Power Management Integrated Circuits Market Segment Overview

By Product Type

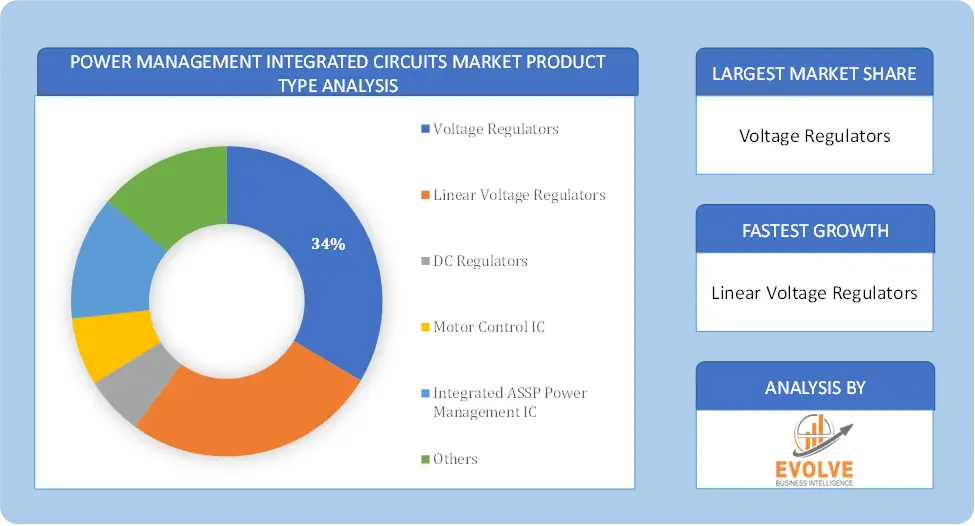

Based on Product Type, the market is segmented based on Voltage Regulators, Linear Voltage Regulators, DC Regulators, Motor Control IC, Integrated ASSP Power Management IC and others. The voltage regulators segment dominant the market. Voltage regulators are crucial for maintaining a constant voltage level in any electrical system. The rise in demand for power supplies is the main factor driving the voltage regulator market. The market is increasing due to industrialization and urbanization. During the projected period, growth possibilities for the voltage regulator segment are anticipated to result from increased demand for dependable power supply facilities and the replacement and reorganization of outdated power distribution channels and networks.

Based on Product Type, the market is segmented based on Voltage Regulators, Linear Voltage Regulators, DC Regulators, Motor Control IC, Integrated ASSP Power Management IC and others. The voltage regulators segment dominant the market. Voltage regulators are crucial for maintaining a constant voltage level in any electrical system. The rise in demand for power supplies is the main factor driving the voltage regulator market. The market is increasing due to industrialization and urbanization. During the projected period, growth possibilities for the voltage regulator segment are anticipated to result from increased demand for dependable power supply facilities and the replacement and reorganization of outdated power distribution channels and networks.

By End Use

Based on End Use, the market segment has been divided into Automotive & Transportation, Consumer Electronics, Industrial and Others. The consumer electronics segment dominates the market due to the development of the power semiconductor devices and high-voltage integrated circuits. The lightweight, good efficiency, minimized scale, and heat dissipation are the key requirement in the digital power management environment accomplished by application-specific power MOS systems with controllers and high voltage ICs. The production of different tiny and light electronic devices has been stimulated by the advancement in semiconductor interface technology.

Global Power Management Integrated Circuits Market Regional Analysis

Based on region, the global Power Management Integrated Circuits Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Power Management Integrated Circuits Market followed by the Asia-Pacific and Europe regions.

Power Management Integrated Circuits North America Market

Power Management Integrated Circuits North America Market

North America holds a dominant position in the Power Management Integrated Circuits Market. The U.S. and Canada are leading in technological innovations and the adoption of advanced electronic devices, driving demand for PMICs. Significant investments in EV technology and infrastructure boost the demand for PMICs in automotive applications. Focus on high-end applications like aerospace and defense drives market and increasing adoption of electric vehicles is a growth catalyst.

Power Management Integrated Circuits Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Power Management Integrated Circuits Market industry. Asia-Pacific is a major manufacturing hub for electronic components, including PMICs, benefiting from cost advantages and extensive production capabilities. Countries like China, South Korea, and Japan are major production hubs. Growing demand for consumer electronics and automotive components fuels growth and rapid growth in consumer electronics, including smartphones, tablets, and wearables, drives significant demand for PMICs in the region.

Competitive Landscape

The global Power Management Integrated Circuits Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Texas Instruments Inc

- ON Semiconductor Corp.

- Analog Devices Inc.

- Dialog Semiconductor PLC

- Maxim Integrated Products Inc.

- NXP Semiconductors

- Infineon Technologies AG

- Mitsubishi Group

- Renesas Electronics Corporation

- STMicroelectronics

Key Development

In September 2022, The acquisition of Heyday Integrated Circuits was announced by a leading sensor and power semiconductor solutions provider for motion control and energy-efficient systems, Allegro MicroSystems Inc. Heyday company specializes in compact, fully integrated isolated gate drivers which help provide energy conversion in high-voltage silicon chloride and gallium nitrite wide-bandgap semiconductor design.

Scope of the Report

Global Power Management Integrated Circuits Market, by Product Type

- Voltage Regulators

- Linear Voltage Regulators

- DC Regulators

- Motor Control IC

- Integrated ASSP Power Management IC

- Others

Global Power Management Integrated Circuits Market, by End Use

- Automotive & Transportation

- Consumer Electronics

- Industrial

- Others

Global Power Management Integrated Circuits Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $46.87 Billion |

| CAGR | 8.54% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Texas Instruments Inc, ON Semiconductor Corp., Analog Devices Inc., Dialog Semiconductor PLC, Maxim Integrated Products Inc., NXP Semiconductors, Infineon Technologies AG, Mitsubishi Group, Renesas Electronics Corporation and STMicroelectronics |

| Key Market Opportunities | • Advancements in IoT and Smart Devices • Increasing Demand for 5G Technology |

| Key Market Drivers | • Rising Adoption of Electric Vehicles (EVs) • Advancements in Semiconductor Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Power Management Integrated Circuits Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Power Management Integrated Circuits Market historical market size for the year 2021, and forecast from 2023 to 2033

- Power Management Integrated Circuits Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Power Management Integrated Circuits Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Power Management Integrated Circuits Market is 2021- 2033

What is the growth rate of the global Power Management Integrated Circuits Market?

The global Power Management Integrated Circuits Market is growing at a CAGR of 8.54% over the next 10 years

Which region has the highest growth rate in the market of Power Management Integrated Circuits Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Power Management Integrated Circuits Market?

North America holds the largest share in 2022

Who are the key players in the global Power Management Integrated Circuits Market?

Texas Instruments Inc, ON Semiconductor Corp., Analog Devices Inc., Dialog Semiconductor PLC, Maxim Integrated Products Inc., NXP Semiconductors, Infineon Technologies AG, Mitsubishi Group, Renesas Electronics Corporation and STMicroelectronics are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Power Management Integrated Circuits Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Power Management Integrated Circuits Market, By Product Type 6.1. Introduction 6.2. Voltage Regulators 6.3. Linear Voltage Regulators 6.3. DC Regulators 6.4. Motor Control IC 6.5. Integrated ASSP Power Management IC 6.6. others Chapter 7. Global Power Management Integrated Circuits Market, By End Use 7.1. Introduction 7.2. Automotive & Transportation 7.3. Consumer Electronics 7.4. Industrial 7.5. Others Chapter 8. Global Power Management Integrated Circuits Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By End Use, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By End Use, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By End Use, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By End Use, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By End Use, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By End Use, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By End Use, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By End Use, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By End Use, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By End Use, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By End Use, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By End Use, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By End Use, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By End Use, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By End Use, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By End Use, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By End Use, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By End Use, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Texas Instruments Inc 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. ON Semiconductor Corp. 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Analog Devices Inc. 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Dialog Semiconductor PLC 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Maxim Integrated Products Inc. 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. NXP Semiconductors 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Infineon Technologies AG 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Mitsubishi Group 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Renesas Electronics Corporation 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. STMicroelectronics 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology