Pet Food Ingredients Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Pet Food Ingredients Market Research Report: By Source (Synthetic, Plant-Based, Animal-Based), By Form (Dry, Wet, Others), By Ingredients (Cereals, Vegetables & Fruits, Fats, Meat And Meat Products, Additives, Others), By Pet (Dog, Cat, Fish, Others), and by Region — Forecast till 2033.

Page: 162

Pet Food Ingredients Market Overview

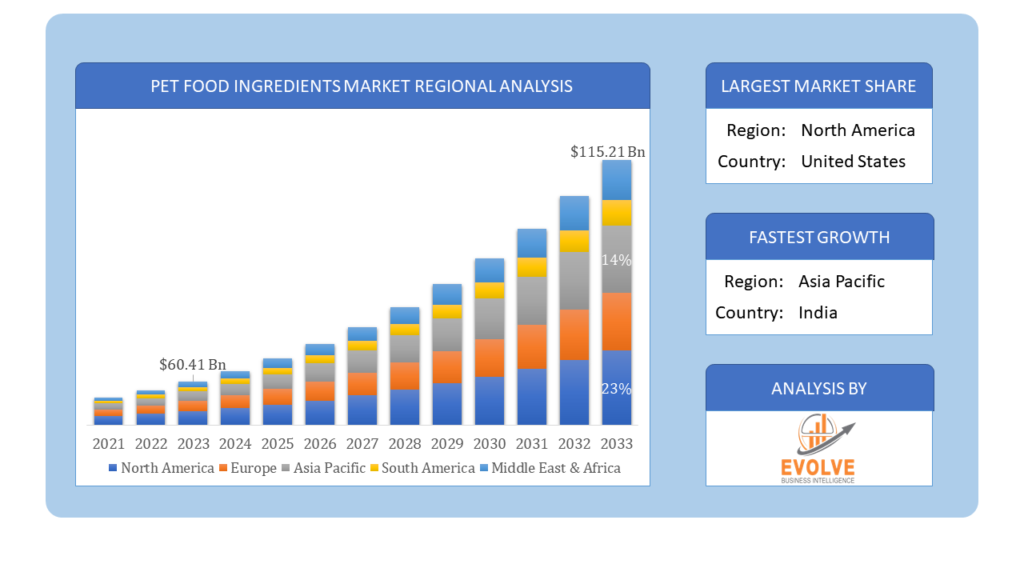

Pet Food Ingredients Market Size is expected to reach USD 115.21 Billion by 2033. The Pet Food Ingredients industry size accounted for USD 60.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.24% from 2023 to 2033. Pet food ingredients are listed in descending order by weight, with major ingredients like meat appearing first. Minor ingredients include additives like amino acids, chemical preservatives, and other agents for flavor and texture. Ingredient splitting may elevate certain components on the label. Terms like “grain-free” and “natural” can be misleading, and pet foods can have fixed or variable formulas. Certified organic is a regulated term, ensuring compliance with organic standards. Understanding labels is crucial as they reveal the composition and quality of pet food ingredients

Global Pet Food Ingredients Market Synopsis

The Pet Food Ingredients market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic has caused to supply chain disruptions leading to supply shortages or lower demand in the Pet Food Ingredients sector. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Global Pet Food Ingredients Market Dynamics

The major factors that have impacted the growth of Pet Food Ingredients are as follows:

Drivers:

⮚ Product Innovation

Manufacturers in the pet food industry are continually innovating to meet the evolving preferences of pet owners. This includes introducing novel ingredients, formulations tailored to specific dietary needs (e.g., grain-free, hypoallergenic), and incorporating ingredients sourced from alternative protein and plant-based sources to cater to vegetarian and vegan pet owners.

Restraint:

- Ingredient Safety Concerns

Instances of ingredient contamination, adulteration, or product recalls can erode consumer trust and confidence in pet food products. Safety concerns related to ingredients sourced from certain regions or suppliers may lead to reputational damage and financial losses for manufacturers, further complicating market dynamics.

Opportunity:

⮚ E-commerce Expansion

The rapid growth of e-commerce channels for pet food sales presents opportunities for ingredient suppliers to reach a broader audience and expand their market presence. Partnering with e-commerce platforms and pet food subscription services allows ingredient suppliers to tap into the convenience-driven purchasing behavior of consumers and capitalize on the growing online pet food market.

Pet Food Ingredients Market Segment Overview

By Source

Based on the Source, the market is segmented based on Synthetic, Plant-based, Animal-based and Others. Synthetic ingredients are expected to lead in revenue share, with a focus on nutritional benefits like minerals, dietary fiber, carotenoids, and omega-3 fatty acids crucial for pet nutrition. The market dynamics are influenced by the growing awareness of these nutritional advantages, driving the demand for pet food ingredients

Based on the Source, the market is segmented based on Synthetic, Plant-based, Animal-based and Others. Synthetic ingredients are expected to lead in revenue share, with a focus on nutritional benefits like minerals, dietary fiber, carotenoids, and omega-3 fatty acids crucial for pet nutrition. The market dynamics are influenced by the growing awareness of these nutritional advantages, driving the demand for pet food ingredients

By Form

Based on Form, the market has been divided into Dry, Wet and Others. Dry pet food ingredients, known for convenience and longer shelf life, dominate the market due to their affordability and dental hygiene benefits. Wet pet food ingredients enhance palatability and nutrient absorption, driving their growth in the market

By Ingredients

Based on the Ingredients, the market has been divided into Cereals, Vegetables & Fruits

Fats, Meat and meat products, Additives and Others. The ingredients segment of the pet food industry encompasses a diverse range of components used in formulating pet foods, including proteins (such as meat, fish, and plant-based sources), carbohydrates (grains, vegetables), fats, vitamins, minerals, and additives (flavor enhancers, preservatives). The quality and composition of these ingredients play a crucial role in determining the nutritional value, palatability, and overall health benefits of pet food products.

By Pet

Based on Pet, the market has been divided into Dog, Cat, Fish and Others. dogs dominated the market with a share of over 40% in 2023. Growing consumer concerns towards pet health have increased the spending on healthy dog foods. Dog obesity is one of the most common heath concerns amongst dog owners

Global Pet Food Ingredients Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Pet Food Ingredients market, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

The North American region holds a dominant position in the Pet Food Ingredients market. Due to growing concerns about the well-being of pet owners and their animals, North America currently dominates the industry. The US and Canada’s rising standards for daily comforts and pet adaption have led to a positive response to pets, which has been a major market driver. Due to growing pet adaption and increased pet food knowledge through the internet and other media, Europe consistently holds a share of the pet food market.

Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Pet Food Ingredients industry. The pet food ingredients market in Asia-Pacific is expected to grow at the fastest rate due to an increase in the buying power of pet owners who are spending more on their pets’ food, which in turn is driving up local prices. Japan is the largest market for pet food ingredients and pet food fixes. Local businesses in developing countries provide pet food ingredients at the lowest prices, which increases demand for pet food ingredients in this area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BASF , Bluestar Adisseo Company, Darling Ingredients, Omega Protein Corporation, and Archer Daniels Midland Company are some of the leading players in the global Pet Food Ingredients Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BASF

- Bluestar Adisseo Company

- Darling Ingredients

- Omega Protein Corporation

- Archer Daniels Midland Company

- CARGILL

- Nutreco

- The Scoular Company

- Kemin Industries, Inc

- Sunopta

Key Development:

In January 2020, Darling Ingredients procured EnviroFlight, LLC. (US), which is possessed by Intrexon Corporation (US) to extend in the creature feed market, which incorporates pet food ingredients by giving a climate cordial, poison free, a supportable wellspring of high-esteem supplements.

Scope of the Report

Global Pet Food Ingredients Market, by Source

- Synthetic

- Plant-based

- Animal-based

- Others

Global Pet Food Ingredients Market, by Form

- Dry

- Wet

- Others

Global Pet Food Ingredients Market, by Ingredients

- Cereals

- Vegetables & Fruits

- Fats

- Meat and meat products

- Additives

- Others

Global Pet Food Ingredients Market, by Pet

- Dog

- Cat

- Fish

- Others

Global Pet Food Ingredients Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $115.21 Billion |

| CAGR | 5.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, Form, Ingredients, Pet |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF , Bluestar Adisseo Company, Darling Ingredients, Omega Protein Corporation, Archer Daniels Midland Company, CARGILL, Nutreco, The Scoular Company, Kemin Industries, Inc, Sunopta |

| Key Market Opportunities | turning attention to natural and products free of grains |

| Key Market Drivers | Replace mass-produced items with organic ingredients for pet food |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Pet Food Ingredients Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Pet Food Ingredients market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Pet Food Ingredients market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Pet Food Ingredients Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

Pet Food Ingredients manufacturers ?

Some of the leading pet food ingredient manufacturers and suppliers include:

- Darling Ingredients: A worldwide market leader in pet food ingredients derived from co-products of the meat industry and other sustainable sources. They offer a unique combination of innovative ingredients, expert knowledge, and entrepreneurial flair to ensure their customers' products stand out in today’s competitive market.

- Scoular: They offer pet food manufacturers clean label solutions, bulk commodities, and niche ingredients, plus operations expertise and access to a consistent supply. They have an expansive portfolio of interchangeable proteins, including many niche ingredients, and are open to developing new solutions for their customers.

- Gillco Ingredients: They partner with reputable and innovative ingredient manufacturers to put together a portfolio of clean-label and functional ingredients for various pet food applications. Their product specialists can help in creating pet treats, dry foods, wet foods, or refrigerated foods.

- Petsource by Scoular: A leading contract manufacturing partner for clean-label, minimally processed freeze-dried pet foods, treats, and toppers. They provide access to product development, commercialization, raw meat processing, and custom ingredient blends, forming and dicing, freeze-drying, and bulk and retail packaging under one roof.

- Maypro Industries: They offer a wide portfolio of pet health ingredients, including vitamins, minerals, amino acids, and other nutritional supplements for pet food and pet health applications.

Pet Food Ingredients market size ?

The pet food ingredients market size was valued at over USD 1.34 billion in 2022 and is estimated to reach USD 2.25 billion by 2032, with a compound annual growth rate (CAGR) of 5% from 2023 to 2032. Another report from Grand View Research estimates the global pet food ingredients market size at USD 60.48 billion in 2023, with a CAGR of 4.9% from 2024 to 2030, reaching USD 83.60 billion by 2030. MarketsandMarkets projects the pet food ingredients market to reach USD 47.4 billion by 2028, with a CAGR of 6.8% during the forecast period. These figures indicate a growing market driven by factors such as rising pet ownership, evolving consumer preferences, and a focus on pet health and wellness.

What are Pet Food Ingredients products ?

Pet food ingredients encompass a wide array of components used in the formulation of pet food products. These ingredients are carefully selected to provide essential nutrients and ensure the overall quality and nutritional value of the food. Some common pet food ingredients include:

- Proteins: Derived from animal or plant sources, proteins are essential for muscle development and overall health. Examples include chicken, beef, fish, and soy.

- Carbohydrates: These provide energy and fiber. Common sources include rice, corn, wheat, and potatoes.

- Fats and Oils: These are a concentrated source of energy and provide essential fatty acids. Examples include chicken fat, fish oil, and sunflower oil.

- Vitamins and Minerals: Essential for overall health, these include vitamin A, vitamin D, vitamin E, and minerals such as calcium, phosphorus, and zinc.

- Fiber: Important for digestive health, fiber can be sourced from ingredients such as beet pulp and rice bran.

- Flavor Enhancers and Additives: These are used to improve palatability and may include natural and artificial flavors, as well as preservatives.

- Functional Ingredients: Increasingly popular, these include probiotics, prebiotics, and antioxidants, which offer specific health benefits.

Wholesale Pet Food Ingredients ?

- North Central Companies: Offers a wide range of pet food ingredients, including flours, meat products, meals, fats and oils, and more

- Darling Ingredients: A worldwide market leader in pet food ingredients derived from co-products of the meat industry and other sustainable sources

- Petagogy: Provides high-quality pet food ingredients, focusing on animal nutrition

- Tilley Distribution: Offers a variety of pet food ingredients, including customized additives to enhance flavor and shelf life

Pet Food Ingredients companies ?

Some of the leading pet food ingredients companies and suppliers include:

- Darling Ingredients: A worldwide market leader in pet food ingredients derived from co-products of the meat industry and other sustainable sources. They offer a unique combination of innovative ingredients, expert knowledge, and entrepreneurial flair to ensure their customers' products stand out in today’s competitive market

- North Central Companies: A leading pet food ingredient supplier offering a wide range of pet food ingredients, including flours, meat products, meals, fats and oils, and more

- Tilley Distribution: A pet food ingredients supplier that offers a wide range of animal nutrition ingredients, including vitamins, minerals, acids, enzymes, and other essential components for pet food and animal nutrition applications

These companies provide a comprehensive range of pet food ingredients, catering to the needs of pet food manufacturers and supporting animal nutrition.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Source Segement – Market Opportunity Score 4.1.2. Form Segment – Market Opportunity Score 4.1.3. Ingredients Segment – Market Opportunity Score 4.1.4. Pet Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Source 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Pet Food Ingredients Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Pet Food Ingredients Market, By Source 7.1. Introduction 7.1.1. Synthetic 7.1.2. Plant-based 7.1.3. Animal-based 7.1.4. Others CHAPTER 8. Global Pet Food Ingredients Market, By Form 8.1. Introduction 8.1.1. Dry 8.1.2. Wet 8.1.3. Others CHAPTER 9. Global Pet Food Ingredients Market, By Ingredients 9.1. Introduction 9.1.1. Cereals 91.2. Vegetables & Fruits 9.1.3. Fats 9.1.4. Meat and meat products 9.1.5. Additives 9.1.6. Others CHAPTER 10. Global Pet Food Ingredients Market, By Pet 10.1. Introduction 10.1.1. Dog 10.1.2. Cat 10.1.3. Fish 10.1.4. Others CHAPTER 11. Global Pet Food Ingredients Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Pet,, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Source,2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Source, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Form, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Ingredients, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Pet, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BASF 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Bluestar Adisseo Company 13.3. Darling Ingredients 13.4. Omega Protein Corporation 13.5. Archer Daniels Midland Company 13.6. CARGILL 13.7. Nutreco 13.8. The Scoular Company 13.9. Kemin Industries, Inc 13.10. Sunopta

Connect to Analyst

Research Methodology