Pet Care Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

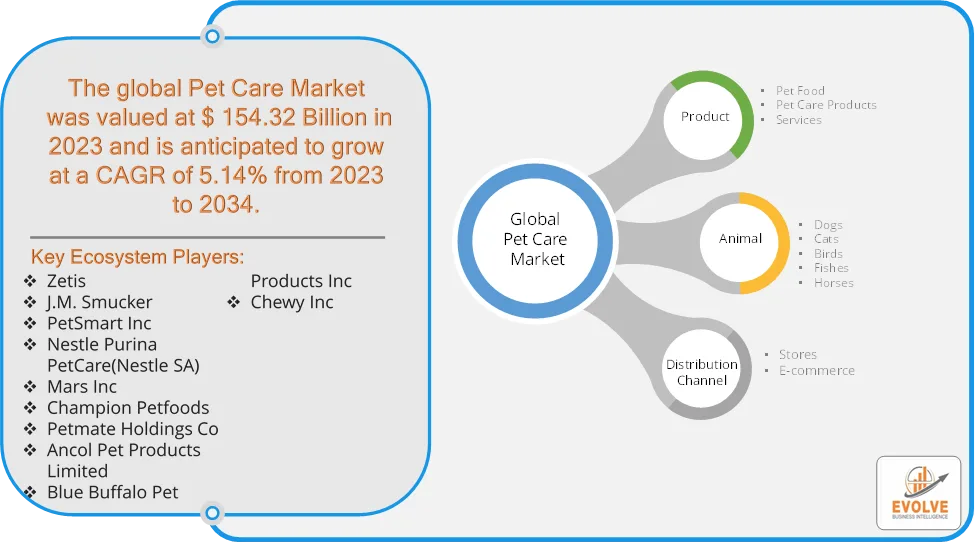

Pet Care Market Research Report: Information By Product (Pet Food, Pet Care Products, Services), By Animal (Dogs, Cats, Birds, Fishes, Horses), By Distribution Channel (Stores, E-commerce), and by Region — Forecast till 2034

Page: 165

Pet Care Market Overview

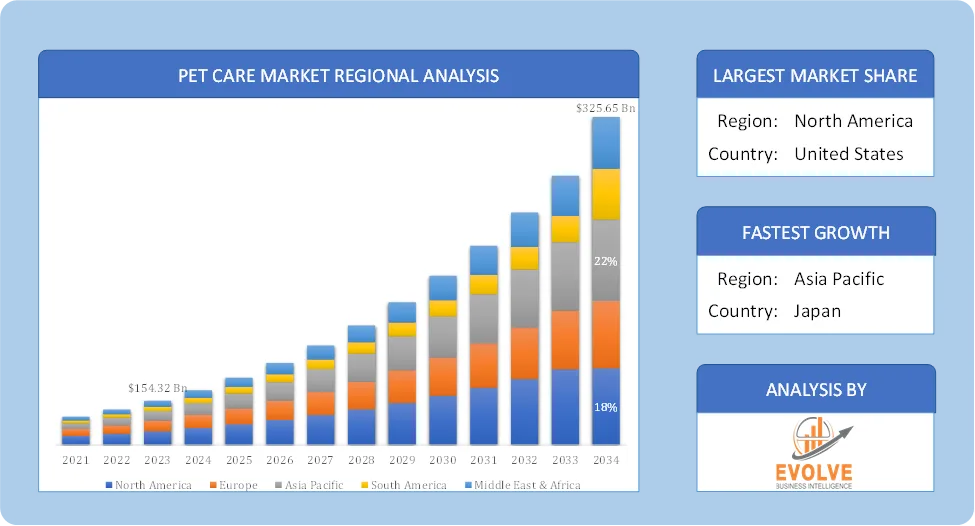

The Pet Care Market size accounted for USD 154.32 Billion in 2023 and is estimated to account for 165.33 Billion in 2024. The Market is expected to reach USD 325.65 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.14% from 2024 to 2034. The Pet Care Market encompasses a wide range of products and services dedicated to the health, well-being, and overall care of pets, including dogs, cats, fish, birds, and small mammals. This market has seen significant growth due to increasing pet ownership, humanization of pets, and rising awareness regarding pet health and wellness.

The future of the pet care market looks promising, with increased investments in pet healthcare, digitalization, and sustainable pet products. The market is competitive, with companies focusing on product innovation, marketing, and expanding their distribution channels to capture a larger share of the growing pet care market.

Global Pet Care Market Synopsis

Pet Care Market Dynamics

Pet Care Market Dynamics

The major factors that have impacted the growth of Pet Care Market are as follows:

Drivers:

Ø Growth in Pet Health Awareness & Veterinary Services

Pet owners are increasingly prioritizing pet health, leading to demand for nutritional pet food, supplements, and advanced veterinary care. Rising incidence of pet obesity, diabetes, and allergies is driving demand for specialized diets and medical treatments and growth of pet insurance to cover medical expenses. Higher income levels enable consumers to spend more on pet healthcare, premium products, and grooming services. Development of smart pet gadgets like automatic feeders, pet health trackers, and GPS collars and growth of DNA testing kits for pets to identify breed and health risks.

Restraint:

- High Cost of Pet Care Products & Services

Premium pet food, healthcare, and grooming services can be expensive, limiting affordability for lower-income groups. Veterinary treatments and pet insurance costs are rising, making pet ownership a financial burden. During economic downturns, consumers prioritize essential expenses over discretionary pet spending. High inflation and unemployment rates can reduce pet care budgets and shortage of veterinarians and pet healthcare facilities in rural areas restricts access to proper pet care.

Opportunity:

⮚ Rising Demand for Premium & Organic Pet Products

Consumers are increasingly choosing natural, organic, and grain-free pet food. High-protein, raw, and fresh pet diets are gaining traction, creating an opportunity for specialty pet food brands and growth in eco-friendly pet products, such as biodegradable litter and sustainable pet accessories. The shift towards online shopping for pet products provides brands with direct-to-consumer (DTC) sales opportunities. Subscription-based models for pet food, treats, and accessories offer recurring revenue streams and online platforms like Amazon, Chewy, and Petco continue to drive pet product sales.

Pet Care Market Segment Overview

Based on Product, the market is segmented based on Pet Food, Pet Care Products, Services. The pet food products segment dominant the market, with a growing focus on sustainability and eco-friendly options. The demand for pet food is driven by increasing consumer awareness about the health and well-being of pets. The segment includes various products such as meat, meat byproducts, grains, cereals, vitamins, and minerals. The emphasis on home delivery services by online stores and the trend toward clean labeling is expected to boost the growth of this segment.

By Animal

Based on Animal, the market segment has been divided into Dogs, Cats, Birds, Fishes, Horses. The dogs segment dominant the market. Many homeowners keep a well-trained dog as a security measure to prevent break-ins. This trend is expected to continue and result in a higher number of households owning dogs, which will consequently drive the growth of this market segment.

By Distribution Channel

Based on Application, the market segment has been divided into Stores, E-commerce. The stores segment dominated the global pet care market. Stores frequently run promotional activities, discounts, loyalty programs, and in-store events to attract customers and encourage repeat purchases, driving sales and market share in the pet care industry. Physical stores serve as hubs for community engagement, bringing together pet owners, enthusiasts, and experts through events, workshops, and social gatherings, fostering a sense of belonging and loyalty among customers.

Global Pet Care Market Regional Analysis

Based on region, the global Pet Care Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Pet Care Market followed by the Asia-Pacific and Europe regions.

North America Pet Care Market

North America Pet Care Market

North America holds a dominant position in the Pet Care Market. Countries like U.S. and Canada has high pet ownership rates and strong demand for premium pet food, veterinary services, and pet insurance. It has high disposable income & willingness to spend on premium pet products. Has strong presence of leading pet care brands and expansion of pet insurance & veterinary telemedicine services.

Asia-Pacific Pet Care Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Pet Care Market industry. Rapid urbanization, increasing disposable incomes, a rising middle-class population, and a growing awareness of pet wellness are key drivers. India is expected to be the fastest-growing country within the APAC region. E-commerce is experiencing a boom in this region for pet care products and services. There’s a rising demand for premium and specialized pet care offerings.

Competitive Landscape

The global Pet Care Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Zetis

- M. Smucker

- PetSmart Inc

- Nestle Purina PetCare(Nestle SA)

- Mars Inc

- Champion Petfoods

- Petmate Holdings Co

- Ancol Pet Products Limited

- Blue Buffalo Pet Products Inc

- Chewy Inc.

Scope of the Report

Global Pet Care Market, by Product

- Pet Food

- Pet Care Products

- Services

Global Pet Care Market, by Animal

- Dogs

- Cats

- Birds

- Fishes

- Horses

Global Pet Care Market, by Distribution Channel

- Stores

- E-commerce

Global Pet Care Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 325.65 Billion |

| CAGR (2024-2034) | 5.14% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Animal, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Zetis, J.M. Smucker, PetSmart Inc, Nestle Purina PetCare(Nestle SA), Mars Inc, Champion Petfoods, Petmate Holdings Co, Ancol Pet Products Limited, Blue Buffalo Pet Products Inc. and Chewy Inc. |

| Key Market Opportunities | · Rising Demand for Premium & Organic Pet Products |

| Key Market Drivers | · Growth in Pet Health Awareness & Veterinary Services · Innovation in Pet Care Products & Smart Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Pet Care Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Pet Care Market historical market size for the year 2021, and forecast from 2023 to 2033

- Pet Care Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Pet Care Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Pet Care Market is 2021- 2033

What is the growth rate of the global Pet Care Market?

The global Pet Care Market is growing at a CAGR of 5.14% over the next 10 years

Which region has the highest growth rate in the market of Pet Care Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Pet Care Market?

North America holds the largest share in 2022

Who are the key players in the global Pet Care Market?

Zetis, J.M. Smucker, PetSmart Inc, Nestle Purina PetCare(Nestle SA), Mars Inc, Champion Petfoods, Petmate Holdings Co, Ancol Pet Products Limited, Blue Buffalo Pet Products Inc. and Chewy Inc. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Service Segement – Market Opportunity Score

4.1.2. Firm Size Segment – Market Opportunity Score

4.1.3. End User Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on International Legal Services Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. International Legal Services Market, By Service

7.1. Introduction

7.1.1. Taxation

7.1.2 Real Estate

7.1.3. Litigation

7.1.4. Bankruptcy

7.1.5. Labor/Employment

7.1.6. Corporate

CHAPTER 8 International Legal Services Market, By Firm Size

8.1. Introduction

8.1.1. Large Firms

8.1.2. Medium Firms

8.1.3. Small Firms

CHAPTER 9. International Legal Services Market, By End User

9.1. Introduction

9.1.1. Private Practicing Attorneys

9.1.2. Legal Business Firms

9.1.3. Government Departments

CHAPTER 10. International Legal Services Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End User, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Service, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Firm Size, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By End User, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Baker McKenzie

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Allen & Overy

13.3. Linklaters

13.4. DLA Piper

13.5. Clifford Chance

13.6. Freshfields Bruckhaus Deringer

13.7. Latham & Watkins

13.8. Kirkland & Ellis

13.9 Jones Day

13.10 Hogan Lovells.

Connect to Analyst

Research Methodology