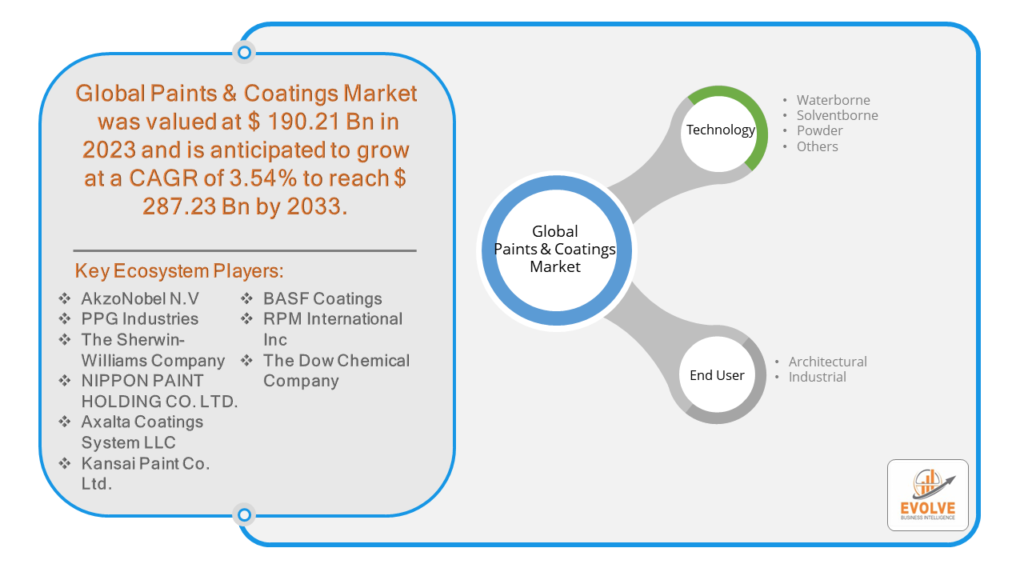

Paints & Coatings Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Paints & Coatings Market Research Report: Information By Technology (Waterborne, Solventborne, Powder, Others), By End User (Architectural, Industrial), and by Region — Forecast till 2033

Page: 178

Paints & Coatings Market Overview

The Paints & Coatings Market Size is expected to reach USD 287.23 Billion by 2033. The Paints & Coatings Market industry size accounted for USD 190.21 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.54% from 2023 to 2033. Paints and coatings are substances applied to surfaces to enhance their appearance, protect them from damage, or provide specific functional properties. They consist of components such as binders, pigments, solvents, and additives, which work together to form a solid, adherent film when the product dries or cures. Paints are typically used for decorative purposes, adding color and aesthetic appeal to surfaces like walls, furniture, and vehicles. Coatings, on the other hand, are often formulated to provide protective functions, such as resistance to corrosion, weathering, and chemical exposure, or to impart special properties like antimicrobial activity or improved durability. These products are widely used across various industries, including construction, automotive, aerospace, and manufacturing, to enhance both the visual and functional qualities of materials and structures.

Global Paints & Coatings Market Synopsis

The COVID-19 pandemic has significantly impacted the paints and coatings market, causing a range of disruptions and shifts. Supply chain interruptions, driven by factory shutdowns and logistical challenges, led to shortages of raw materials and delayed product deliveries. The market saw a decline in demand from major industrial sectors such as automotive and construction due to project postponements and reduced manufacturing activities. Conversely, the pandemic spurred an increase in DIY home improvement projects as people spent more time at home, boosting sales of decorative paints. Additionally, there was a heightened demand for coatings with antimicrobial properties, reflecting increased consumer awareness of hygiene. Overall, the market experienced volatility but also adapted to new trends and demands emerging from the pandemic’s influence.

Paints & Coatings Market Dynamics

The major factors that have impacted the growth of Paints & Coatings Market are as follows:

Drivers:

Ø Growing Construction and Automotive Industries

The paints and coatings market is significantly driven by the expansion of the construction and automotive industries. Increased urbanization, infrastructure development, and rising automobile production and sales boost the demand for paints and coatings used for protection and aesthetic purposes.

Restraint:

- Volatile Raw Material Prices

The paints and coatings market is the volatility in raw material prices. Many key ingredients, such as resins, pigments, and solvents, are derived from petrochemicals, whose prices can fluctuate widely due to changes in crude oil prices and supply chain disruptions, impacting production costs and profit margins.

Opportunity:

⮚ Rising Demand for Eco-friendly and Sustainable Products

The growing awareness and regulatory pressure regarding environmental sustainability create a significant opportunity for the paints and coatings market. The development and adoption of eco-friendly, low-VOC (volatile organic compounds), and sustainable paint products are increasingly demanded by consumers and industries aiming to reduce their environmental impact.

Paints & Coatings Market Segment Overview

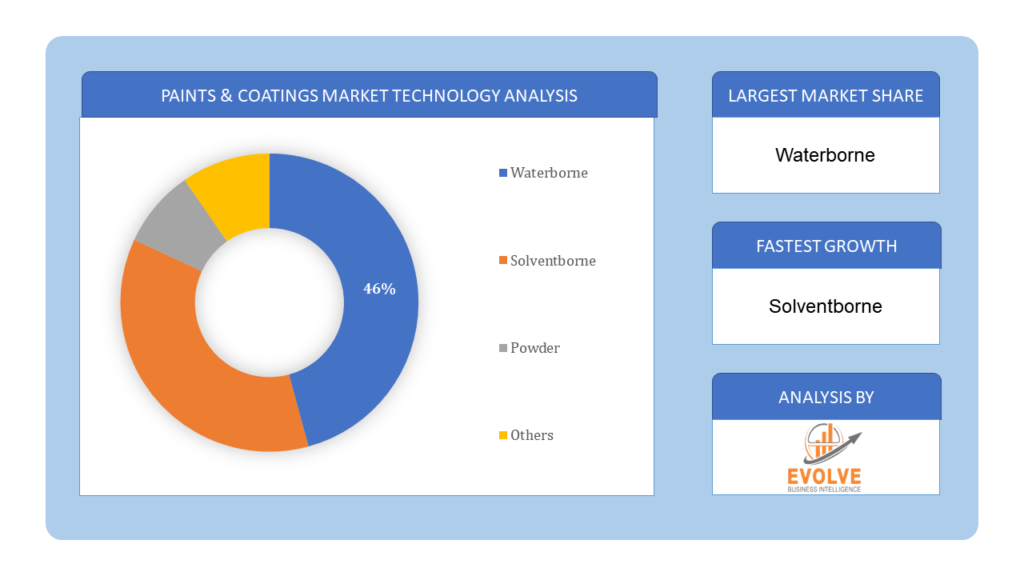

By Technology

Based on Technology, the market is segmented based on Waterborne, Solventborne, Powder, Others. Waterborne is the dominating segment in the Paints & Coatings market due to its low levels of volatile organic compounds (VOCs), making it environmentally friendly and compliant with stringent environmental regulations. Additionally, its ease of application, quick drying times, and reduced health risks enhance its appeal across various industries.

Based on Technology, the market is segmented based on Waterborne, Solventborne, Powder, Others. Waterborne is the dominating segment in the Paints & Coatings market due to its low levels of volatile organic compounds (VOCs), making it environmentally friendly and compliant with stringent environmental regulations. Additionally, its ease of application, quick drying times, and reduced health risks enhance its appeal across various industries.

By End User

Based on End User, the market segment has been divided into the Architectural, Industrial. Architectural paints and coatings are the dominating segment in the Paints & Coatings market due to the continuous growth in residential and commercial construction activities. This segment benefits from increasing urbanization and the rising demand for aesthetically pleasing and protective coatings for buildings, which drive its widespread application and market dominance.

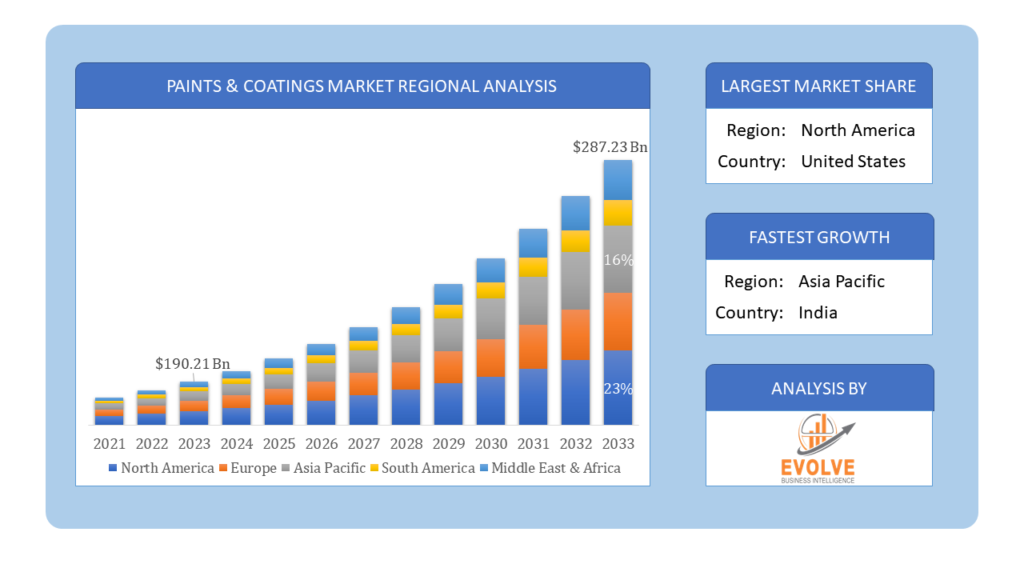

Global Paints & Coatings Market Regional Analysis

Based on region, the global Paints & Coatings Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Paints & Coatings Market followed by the Asia-Pacific and Europe regions.

Paints & Coatings North America Market

Paints & Coatings North America Market

North America holds a dominant position in the Paints & Coatings market due to its robust construction and automotive industries, which drive substantial demand for both architectural and industrial coatings. The region’s focus on innovation and sustainability has led to the development of advanced, eco-friendly paint formulations. Additionally, strict environmental regulations necessitate the use of low-VOC and waterborne coatings, further bolstering market growth. The presence of major market players, coupled with strong R&D investments and technological advancements, also contributes to North America’s leading position in the global paints and coatings market.

Paints & Coatings Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Paints & Coatings industry due to rapid industrialization, urbanization, and economic development in countries like China, India, and Southeast Asia. The booming construction sector, expanding automotive industry, and increasing infrastructure investments drive the demand for paints and coatings in this region. Additionally, rising disposable incomes and changing lifestyle preferences contribute to higher consumption of decorative paints, further fueling market growth in the Asia-Pacific.

Competitive Landscape

The global Paints & Coatings Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- AkzoNobel N.V

- PPG Industries

- The Sherwin-Williams Company

- NIPPON PAINT HOLDING CO. LTD.

- Axalta Coatings System LLC

- Kansai Paint Co. Ltd.

- BASF Coatings

- RPM International Inc

- The Dow Chemical Company

Key Development

In February 2022, The Sherwin-Williams Company entered into an agreement with the state of North Carolina, Iredell County, and the city of Statesville to significantly expand its architectural paint and coatings manufacturing capacity and establish a larger distribution facility in Statesville, North Carolina. Sherwin-Williams plans to invest at least USD 300 million in this project.

In February 2022, PPG announced its intention to acquire the powder coating manufacturing business of Arsonsisi, an industrial coating company based in Milan, Italy. This acquisition aims to support PPG’s backward integration efforts.

Scope of the Report

Global Paints & Coatings Market, by Technology

- Waterborne

- Solventborne

- Powder

- Others

Global Paints & Coatings Market, by End User

- Architectural

- Industrial

Global Paints & Coatings Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $287.23 Billion |

| CAGR | 3.54% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | AkzoNobel N.V, PPG Industries, The Sherwin-Williams Company, NIPPON PAINT HOLDING CO. LTD., Axalta Coatings System LLC, Kansai Paint Co. Ltd, BASF Coatings, RPM International Inc, The Dow Chemical Company |

| Key Market Opportunities | • Rising Demand for Eco-friendly and Sustainable Products |

| Key Market Drivers | • Growing Construction and Automotive Industries |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Paints & Coatings Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Paints & Coatings Market historical market size for the year 2021, and forecast from 2023 to 2033

- Paints & Coatings Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Paints & Coatings Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Paints & Coatings Market?

The study period for the Paints & Coatings Market is from 2023 to 2033.

What is the growth rate of the Paints & Coatings Market?

The Paints & Coatings Market is expected to grow at a compound annual growth rate (CAGR) of 3.54% from 2023 to 2033.

Which region has the highest growth rate in the Paints & Coatings Market?

The Asia-Pacific region has the highest growth rate in the Paints & Coatings Market.

Which region has the largest share of the Paints & Coatings Market?

North America holds the largest share of the Paints & Coatings Market.

Who are the key players in the Paints & Coatings Market?

Key players in the Paints & Coatings Market include AkzoNobel N.V., PPG Industries, The Sherwin-Williams Company, NIPPON PAINT HOLDING CO. LTD., and Axalta Coatings System LLC.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Paints & Coatings Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Paints & Coatings Market 4.8. Import Analysis of the Paints & Coatings Market 4.9. Export Analysis of the Paints & Coatings Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Paints & Coatings Market, By Technology 6.1. Introduction 6.2. Waterborne 6.3. Solventborne 6.4. Powder 6.5. Others Chapter 7. Global Paints & Coatings Market, By End User 7.1. Introduction 7.2. Architectural 7.3. Industrial Chapter 8. Global Paints & Coatings Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Technology, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Technology, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Technology, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Technology, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Technology, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Technology, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Technology, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Technology, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Technology, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Technology, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Technology, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Technology, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Technology, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Technology, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Technology, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Technology, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. AkzoNobel N.V 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. PPG Industries 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. The Sherwin-Williams Company 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. NIPPON PAINT HOLDING CO. LTD. 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Axalta Coatings System LLC 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Kansai Paint Co. Ltd. 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. BASF Coatings 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 RPM International Inc 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 The Dow Chemical Company 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis

Connect to Analyst

Research Methodology