Optoelectronics Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

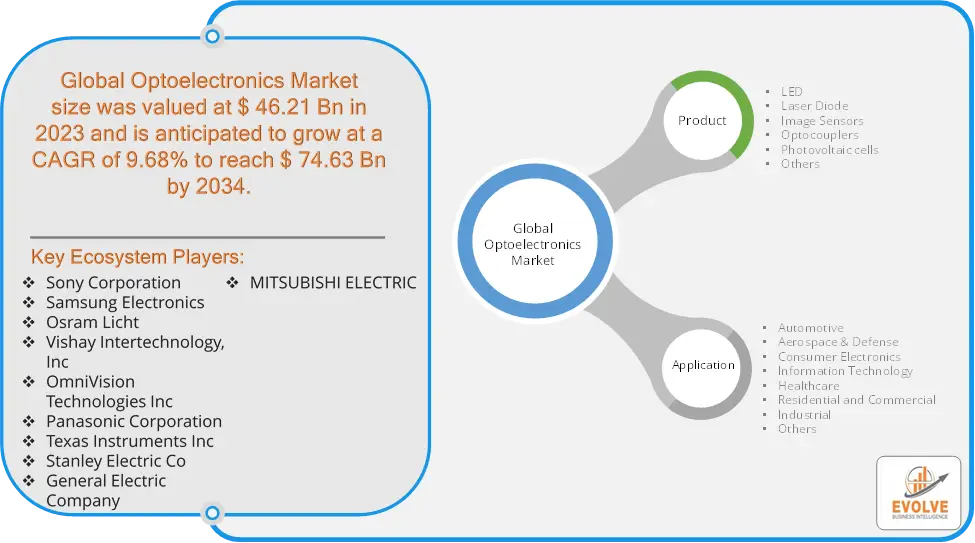

Optoelectronics Market Research Report: Information By Product Type (LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, Others), By Application (Automotive, Aerospace & Defense, Consumer Electronics, Information Technology, Healthcare, Residential and Commercial, Industrial, Others), and by Region — Forecast till 2034

Page: 151

Optoelectronics Market Overview

The Optoelectronics Market size accounted for USD 46.21 Billion in 2023 and is estimated to account for 47.84 Billion in 2024. The Market is expected to reach USD 87.23 Billion by 2034 growing at a compound annual growth rate (CAGR) of 9.68% from 2024 to 2034. Optoelectronics refers to food products that have been preserved through the process of freezing, wherein the food is subjected to extremely low temperatures, typically below 0 degrees Celsius (32 degrees Fahrenheit), to maintain its quality, nutritional value, and sensory attributes for an extended period. This preservation technique inhibits the growth of microorganisms and enzymatic activity, thereby slowing down the deterioration of the food. Optoelectronics encompasses a wide range of products, including raw ingredients, pre-cooked meals, snacks, desserts, and fully prepared dishes, which are typically packaged in airtight containers or bags to prevent freezer burn and maintain product integrity. The Optoelectronics industry is characterized by its convenience, extended shelf life, and diverse product offerings catering to consumer preferences and needs.

Global Optoelectronics Market Synopsis

Optoelectronics Market Dynamics

Optoelectronics Market Dynamics

The major factors that have impacted the growth of Optoelectronics are as follows:

Drivers:

Ø Rising Demand for Energy-Efficient Lighting Solutions

The adoption of optoelectronic devices, especially LEDs, has increased dramatically as a result of the global trend toward sustainable and energy-efficient technologies. Because LEDs last longer and use less energy than conventional lighting technologies, they are a popular option for a variety of applications, including industrial, automotive, and illumination for homes and businesses. Energy-efficient optoelectronics are in high demand due to government restrictions and incentives aimed at lowering energy usage.

Restraint:

- High Manufacturing Costs and Complexity

The high production costs in the optoelectronics business are one of the main obstacles. Advanced materials (such as gallium nitride, gallium arsenide, and indium phosphide) and specialized methods are needed for the fabrication of optoelectronic components, which include LEDs, lasers, and photodiodes. These requirements drive up production costs. Furthermore, optoelectronics requires precise tolerances and precision engineering, which raises manufacturing costs and complexity.

Opportunity:

⮚ Innovations in Consumer Electronics

The desire for superior imaging equipment, smart home technologies, and high-quality displays is driving the ongoing evolution of the consumer electronics business. Optoelectronic components play a major role in innovations like OLED displays, micro-LED technologies, and augmented reality (AR) gadgets. Advanced optoelectronic technologies can be integrated into cutting-edge products by manufacturers to cater to consumers’ desire for smarter functions and enhanced visual experiences.

Optoelectronics Segment Overview

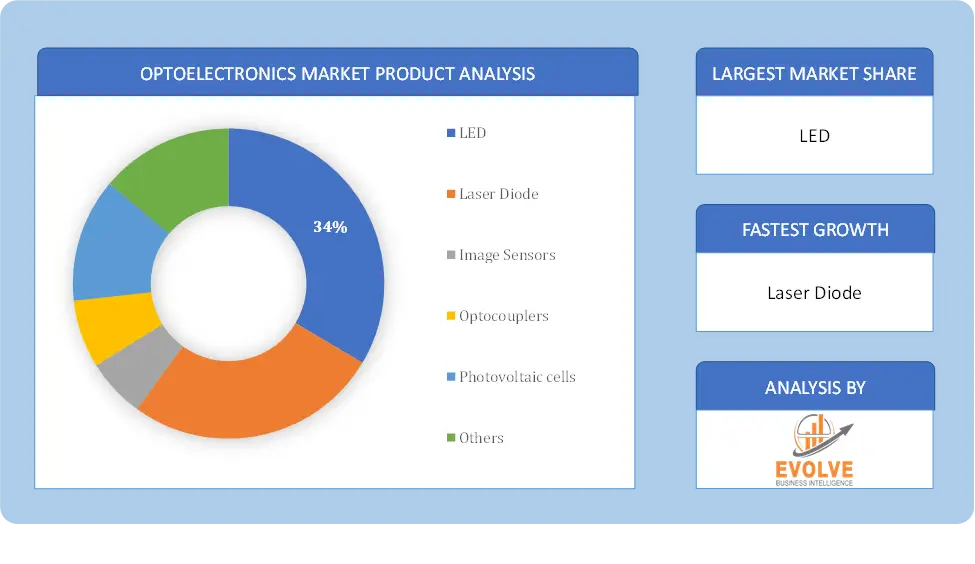

By Product Type

Based on Product Type, the market is segmented based on LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, Others. the LED segment dominates, primarily due to its widespread adoption in various applications such as general lighting, automotive lighting, and display technologies, driven by the demand for energy-efficient and long-lasting lighting solutions.

Based on Product Type, the market is segmented based on LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, Others. the LED segment dominates, primarily due to its widespread adoption in various applications such as general lighting, automotive lighting, and display technologies, driven by the demand for energy-efficient and long-lasting lighting solutions.

By Application

Based on Applications, the market has been divided into the Automotive, Aerospace & Defense, Consumer Electronics, Information Technology, Healthcare, Residential and Commercial, Industrial, Others. the Consumer Electronics segment dominates, driven by the high demand for advanced display technologies, imaging devices, and smart products. This sector benefits from continuous innovation and the rapid adoption of devices like smartphones, televisions, and wearable technology.

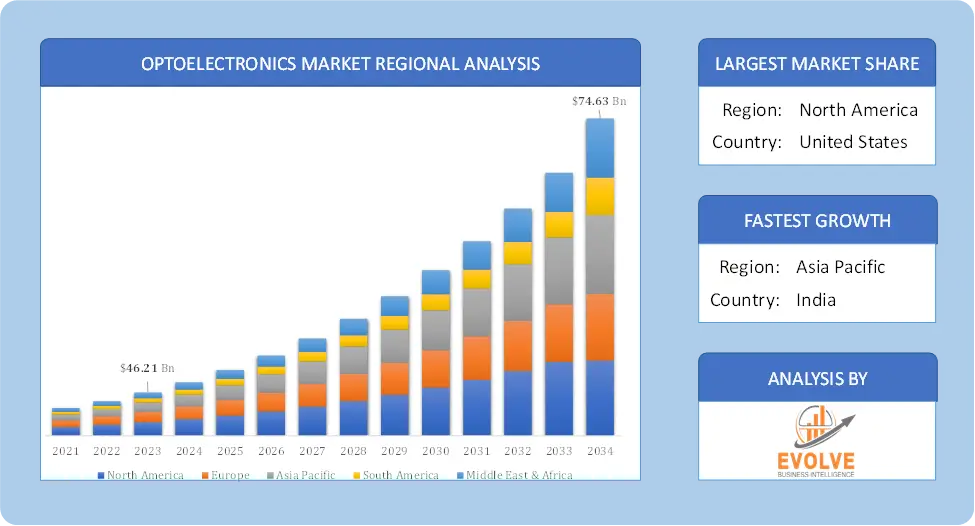

Global Optoelectronics Market Regional Analysis

Based on region, the global Optoelectronics market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Optoelectronics market followed by the Asia-Pacific and Europe regions.

Optoelectronics North America Market

Optoelectronics North America Market

North America holds a dominant position in the Optoelectronics Market. Due to a sharp rise in the demand for luxury class passenger vehicles in this region as well as increased auto manufacturing, North America currently holds a dominant market share in the optoelectronics sector. The United States and Canada are the two countries that have contributed most to the expansion of the optoelectronic market in North America.

Optoelectronics Asvia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Optoelectronics industry. Because big data, the Internet of Things, and intelligent industrial appliances are among the emerging breakthroughs and because smart city projects are prevalent in this region, the Asia-Pacific Optoelectronics Market has the second-highest revenue of any market. Furthermore, the optoelectronics market in China commanded the most market share, while the optoelectronics market in India grew at the fastest rate in the Asia-Pacific area.

Competitive Landscape

The global Optoelectronics market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Sony Corporation

- Samsung Electronics

- Osram Licht

- Vishay Intertechnology, Inc

- OmniVision Technologies Inc

- Panasonic Corporation

- Texas Instruments Inc

- Stanley Electric Co

- General Electric Company

- MITSUBISHI ELECTRIC

Key Development

In September 2023, Samsung Electronics announced the development of advanced microLED display technology, enhancing brightness and energy efficiency, positioning itself as a leader in next-generation display solutions for various applications, including consumer electronics and commercial signage.

Scope of the Report

Global Optoelectronics Market, by Product

- LED

- Laser Diode

- Image Sensors

- Optocouplers

- Photovoltaic cells

- Others

Global Optoelectronics Market, by Application

- Automotive

- Aerospace & Defense

- Consumer Electronics

- Information Technology

- Healthcare

- Residential and Commercial

- Industrial

- Others

Global Optoelectronics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $87.23 Billion |

| CAGR | 9.68% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Sony Corporation, Samsung Electronics, Osram Licht, Vishay Intertechnology, Inc, OmniVision Technologies Inc, Panasonic Corporation, Texas Instruments Inc, Stanley Electric Co, General Electric Company, MITSUBISHI ELECTRIC |

| Key Market Opportunities | • Increasing demand for optoelectronics in various sectors. |

| Key Market Drivers | • Increased utilization of infrared components in consumer electronics |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Optoelectronics market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Optoelectronics market historical market size for the year 2022, and forecast from 2021 to 2034

- Optoelectronics market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Optoelectronics market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Optoelectronics market is 2021- 2034

What is the growth rate of the global Optoelectronics market?

The global Optoelectronics market is growing at a CAGR of 9.68% over the next 10 years

Which region has the highest growth rate in the market of Optoelectronics?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region has the largest share of the global Optoelectronics market?

North America holds the largest share in 2023

Who are the key players in the global Optoelectronics market?

Sony Corporation, Samsung Electronics, Osram Licht, Vishay Intertechnology, Inc, OmniVision Technologies Inc, Panasonic Corporation, Texas Instruments Inc, Stanley Electric Co, General Electric Company, and MITSUBISHI ELECTRIC are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Optoelectronics Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Optoelectronics Market, By Product Type 6.1. Introduction 6.2. LED 6.3. Laser Diode 6.3. Image Sensors 6.4. Optocouplers 6.5. Photovoltaic cells 6.6. Others Chapter 7. Global Optoelectronics Market, By Application 7.1. Introduction 7.2. Automotive 7.3. Aerospace & Defense 7.4. Consumer Electronics 7.5. Information Technology 7.6. Healthcare 7.7. Residential and Commercial 7.8. Industrial 7.9. Others Chapter 8. Global Optoelectronics Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Sony Corporation 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Samsung Electronics 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Osram Licht 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Vishay Intertechnology, Inc 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Omnivision Technologies Inc 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Panasonic Corporation 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Texas Instruments Inc 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Stanley Electric Co 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. General Electric Company 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Mitsubishi Electric 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology