Military & Aerospace Sensors Market Overview

The Military & Aerospace Sensors Market Size is expected to reach USD 607.2 Billion by 2033. The Military & Aerospace Sensors Market industry size accounted for USD 397.3 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.41% from 2023 to 2033. The Military & Aerospace Sensors Market refers to the segment of the sensor industry focused on providing advanced sensor technologies for military and aerospace applications. These sensors are used to enhance the performance, safety, and operational effectiveness of military and aerospace systems.

The market encompasses a wide range of sensor types and applications, driven by the need for enhanced performance and safety in both military and aerospace sectors. The military and aerospace sensors market is expected to continue to grow in the coming years, driven by these factors and the ongoing need for advanced technologies to maintain military and national security.

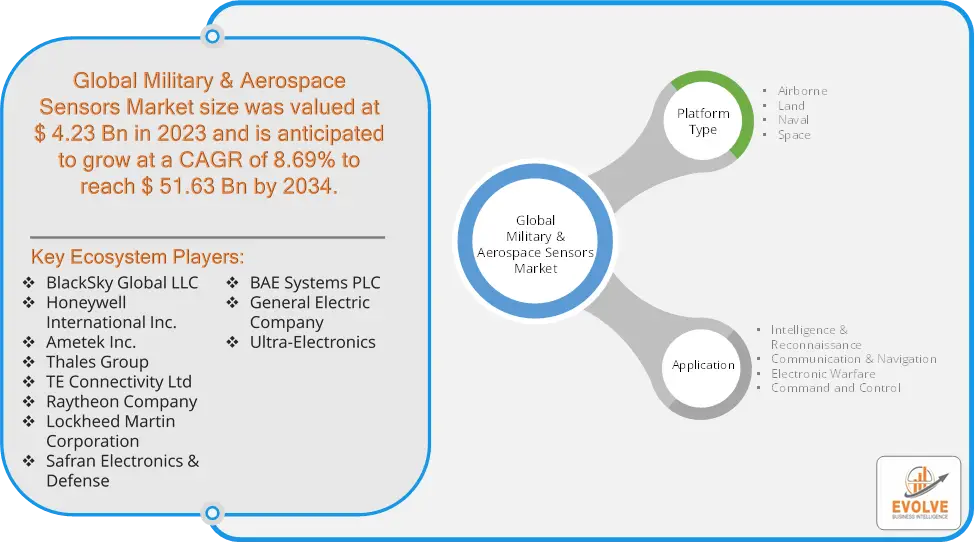

Global Military & Aerospace Sensors Market Synopsis

Military & Aerospace Sensors Market Dynamics

Military & Aerospace Sensors Market Dynamics

The major factors that have impacted the growth of Military & Aerospace Sensors Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in sensor technologies, such as miniaturization, improved accuracy, and integration with AI and machine learning, drive the development and adoption of advanced sensors in military and aerospace applications. In aerospace, the need for improved safety, reliability, and operational efficiency drives the adoption of advanced avionics sensors for navigation, flight control, and monitoring. Improvements in communication technologies enhance the performance of sensors by providing better data transmission and integration capabilities, supporting advanced military and aerospace applications.

Restraint:

- Perception of High Development and Rapid Technological Changes

Developing and manufacturing advanced sensors for military and aerospace applications often involves significant investment in research, development, and production, which can be a barrier for some companies and governments. The fast pace of technological advancements can lead to obsolescence of existing sensors, requiring continuous investment in upgrading and adapting to new technologies.

Opportunity:

⮚ Increased Focus on Modernization

Ongoing modernization and upgrades of military and aerospace systems create opportunities for the adoption of next-generation sensors to improve performance, reliability, and capabilities. The increasing need for real-time situational awareness in military and aerospace operations drives demand for sensors that provide accurate and timely information, offering opportunities for growth in this segment. The use of sensors for environmental monitoring, safety applications, and health management in aerospace platforms and military operations creates additional market opportunities.

Military & Aerospace Sensors Market Segment Overview

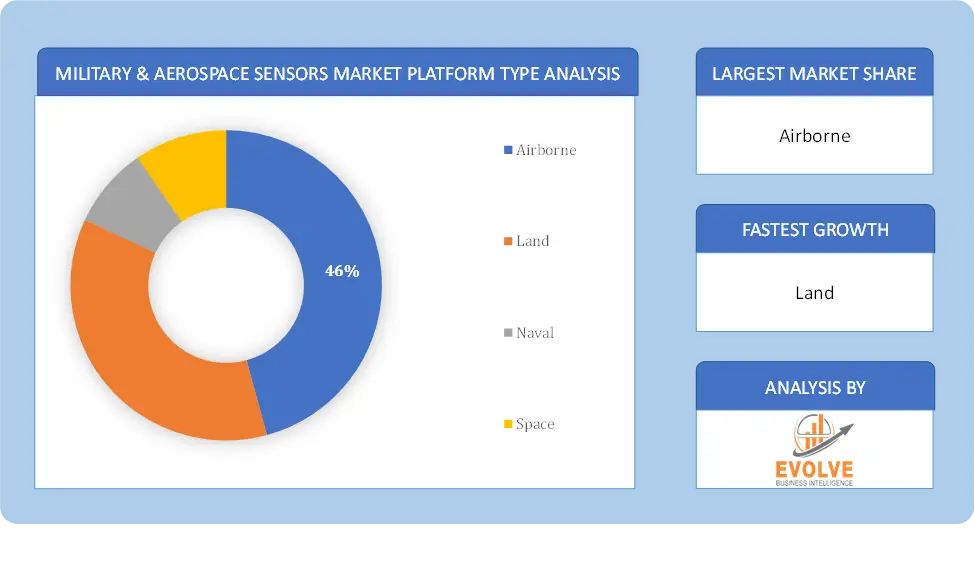

By Platform Type

Based on Platform Type, the market is segmented based on Airborne, Land, Naval and Space. The land segment dominant the market. The land segment has typically represented a significant portion of the military and aerospace sensors market. Sensors used in ground-based military equipment, such as tanks, armored vehicles, and soldier-wearable devices, have been in high demand to enhance situational awareness, target acquisition, and communication capabilities for troops in various terrains.

Based on Platform Type, the market is segmented based on Airborne, Land, Naval and Space. The land segment dominant the market. The land segment has typically represented a significant portion of the military and aerospace sensors market. Sensors used in ground-based military equipment, such as tanks, armored vehicles, and soldier-wearable devices, have been in high demand to enhance situational awareness, target acquisition, and communication capabilities for troops in various terrains.

By Application

Based on Application, the market has been divided into Intelligence & Reconnaissance, Communication & Navigation, Electronic Warfare and Command and Control. The intelligence and reconnaissance segment dominnat the military and aerospace sensors market. ISR sensors, such as synthetic aperture radar (SAR), electro-optical/infrared (EO/IR) sensors, and signals intelligence (SIGINT) sensors, play a crucial role in gathering actionable intelligence for military operations. With the growing need for real-time situational awareness and data-driven decision-making, the demand for advanced ISR sensors has been on the rise.

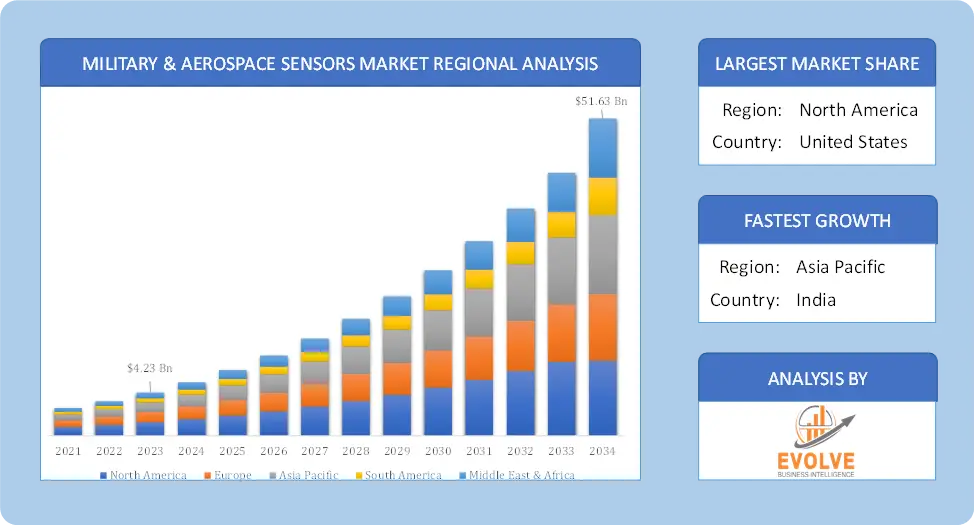

Global Military & Aerospace Sensors Market Regional Analysis

Based on region, the global Military & Aerospace Sensors Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Military & Aerospace Sensors Market followed by the Asia-Pacific and Europe regions.

Military & Aerospace Sensors North America Market

Military & Aerospace Sensors North America Market

North America holds a dominant position in the Military & Aerospace Sensors Market. North America, particularly the United States, holds the largest market share due to significant investments in defense and the presence of major defense contractors and technology companies. The U.S. has one of the largest defense budgets globally, leading to significant investment in advanced military and aerospace sensors and North America is a leader in sensor innovation and development, with numerous defense contractors and aerospace companies.

Military & Aerospace Sensors Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Military & Aerospace Sensors Market industry. The Asia-Pacific region is witnessing the most rapid growth in the military and aerospace sensors market, fueled by increasing defense spending, modernization programs, and technological advancements. Countries in this region are increasing their defense budgets, leading to greater investment in military sensors.

Competitive Landscape

The global Military & Aerospace Sensors Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Honeywell International Inc.

- Ametek Inc.

- Thales Group

- TE Connectivity Ltd

- Raytheon Company

- Lockheed Martin Corporation

- Safran Electronics & Defense

- BAE Systems PLC

- General Electric Company

- Ultra-Electronics

Scope of the Report

Global Military & Aerospace Sensors Market, by Platform Type

- Airborne

- Land

- Naval

- Space

Global Military & Aerospace Sensors Market, by Application

- Intelligence & Reconnaissance

- Communication & Navigation

- Electronic Warfare

- Command and Control

Global Military & Aerospace Sensors Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $607.2 Billion |

| CAGR | 4.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Platform Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Honeywell International Inc., Ametek Inc., Thales Group, TE Connectivity Ltd, Raytheon Company, Lockheed Martin Corporation, Safran Electronics & Defense, BAE Systems PLC, General Electric Company and Ultra-Electronics |

| Key Market Opportunities | • Increased Focus on Modernization • Growing Demand for Situational Awareness |

| Key Market Drivers | • Technological Advancements • Advancements in Communication Technologies |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Military & Aerospace Sensors Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Military & Aerospace Sensors Market historical market size for the year 2021, and forecast from 2023 to 2033

- Military & Aerospace Sensors Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Military & Aerospace Sensors Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.