Microcontroller Market Overview

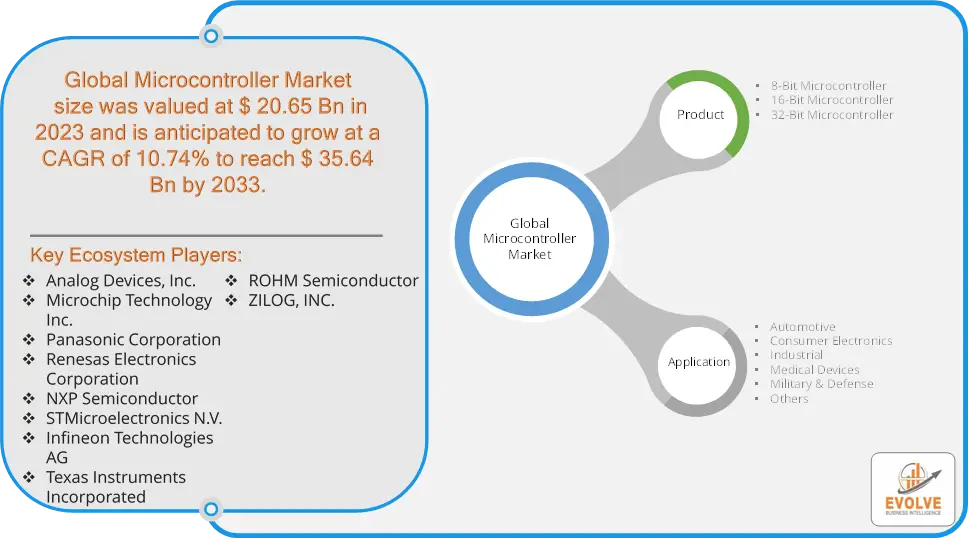

The Microcontroller Market Size is expected to reach USD 35.64 Billion by 2033. The Microcontroller industry size accounted for USD 20.65 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 10.74% from 2023 to 2033. The microcontroller market involves the production and sale of small, self-contained computing devices embedded in various electronic products. Microcontrollers integrate a processor core, memory, and programmable input/output peripherals into a single chip. They are widely used in consumer electronics, automotive systems, industrial automation, and home appliances due to their low cost, compact size, and efficiency in performing specific tasks. Key trends include the growth of the Internet of Things (IoT), advancements in microcontroller architecture, and increasing demand for smart devices. The market is driven by innovation in technology, evolving consumer needs, and the proliferation of connected devices.

Global Microcontroller Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Microcontroller market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Microcontroller Market Dynamics

The major factors that have impacted the growth of Microcontroller are as follows:

Drivers:

Ø Advancements in Technology

Technological advancements in microcontroller architecture and manufacturing processes have led to more powerful, energy-efficient, and cost-effective microcontrollers. Innovations such as integration of more functionalities into a single chip, lower power consumption, and increased processing capabilities have spurred market growth.

Restraint:

- High Competition and Price Pressure

The microcontroller market is highly competitive, with numerous players offering a wide range of products. This intense competition often leads to price pressure, which can impact profit margins for manufacturers. Companies need to continuously innovate and reduce costs to stay competitive, which can strain resources and affect profitability.

Opportunity:

⮚ Advancements in Healthcare and Medical Devices

The healthcare sector is increasingly adopting smart medical devices and health monitoring systems that rely on microcontrollers. These devices include wearable health trackers, remote patient monitoring systems, and advanced medical diagnostic equipment. As healthcare technology continues to advance, there is a growing need for microcontrollers that offer high performance, low power consumption, and reliable operation in medical applications.

Microcontroller Segment Overview

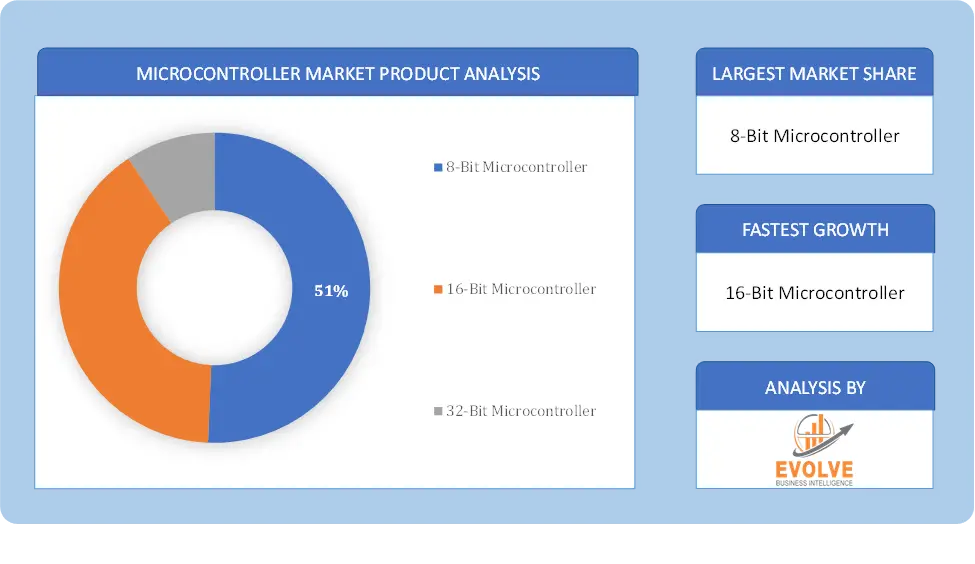

By Product Type

Based on Product Type, the market is segmented based on 8-Bit Microcontroller, 16-Bit Microcontroller, 32-Bit Microcontroller. the 32-Bit Microcontroller segment dominates due to its higher performance capabilities and versatility in handling complex applications across various industries.

Based on Product Type, the market is segmented based on 8-Bit Microcontroller, 16-Bit Microcontroller, 32-Bit Microcontroller. the 32-Bit Microcontroller segment dominates due to its higher performance capabilities and versatility in handling complex applications across various industries.

By Application

Based on Applications, the market has been divided into the Automotive, Consumer Electronics, Industrial, Medical Devices, Military & Defense, Others. he Consumer Electronics segment dominates, driven by the widespread use of microcontrollers in smartphones, wearables, and home appliances.

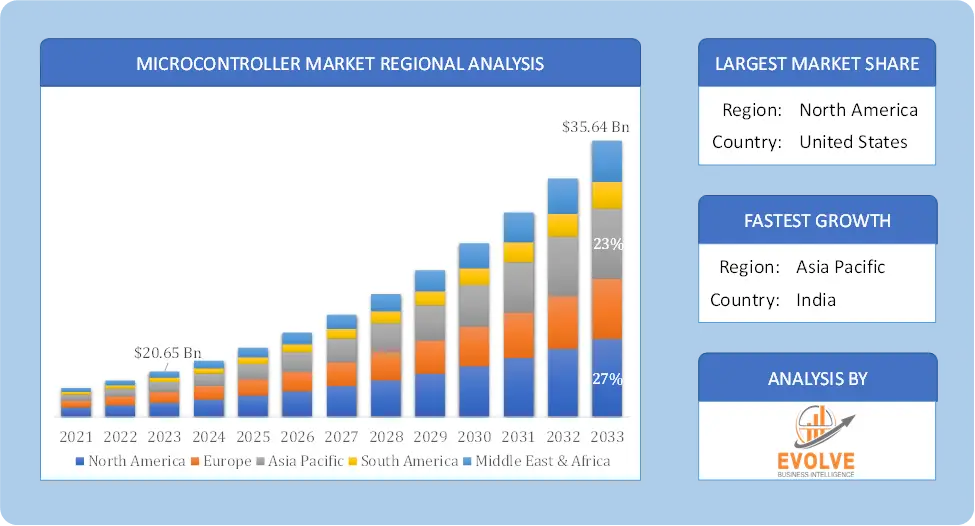

Global Microcontroller Market Regional Analysis

Based on region, the global Microcontroller market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Asia-Pacific is projected to dominate the use of the Microcontroller market followed by the North America and Europe regions.

Microcontroller Asia-Pacific Market

Microcontroller Asia-Pacific Market

Asia-Pacific holds a dominant position in the Microcontroller Market. The market for microcontrollers in Asia-Pacific accounted for about 46.2% in 2023. Rising living standards in nations like China, India, Malaysia, and Thailand are propelling the Asia-Pacific Microcontroller market’s rapid expansion. These nations are concentrating on modernizing a wide range of materialistic products like automated cars, sophisticated consumer electronics, automated equipment, and cutting-edge medical devices.

Microcontroller North America Market

The North America region has indeed emerged as the fastest-growing market for the Microcontroller industry. In North America, the microcontroller market is expanding due to the region’s advanced technological infrastructure and strong presence of key electronics manufacturers. The demand is driven by sectors such as automotive, industrial automation, and consumer electronics, with a notable focus on innovations in IoT and smart home technologies. The U.S. and Canada are leading the market, supported by significant R&D investments and a high adoption rate of advanced microcontroller applications

Competitive Landscape

The global Microcontroller market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Analog Devices, Inc.

- Microchip Technology Inc.

- Panasonic Corporation

- Renesas Electronics Corporation

- NXP Semiconductor

- STMicroelectronics N.V.

- Infineon Technologies AG

- Texas Instruments Incorporated

- ROHM Semiconductor

- ZILOG, INC.

Key Development

In April 2023, Texas Instruments (TI) unveiled a new SimpleLink family of Wi-Fi 6 companion integrated circuits (ICs), designed to support reliable, secure, and efficient Wi-Fi connections at an affordable price. These ICs cater to applications operating in high-density or high-temperature environments up to 105°C. The initial products in TI’s CC33xx family offer Wi-Fi 6 or Wi-Fi 6 and Bluetooth Low Energy 5.3 connectivity in a single IC. When paired with a microcontroller (MCU) or processor, these devices facilitate secure Internet of Things (IoT) connections with dependable RF performance across various industrial sectors like grid infrastructure, medical, and building automation.

Scope of the Report

Global Microcontroller Market, by Product

- 8-Bit Microcontroller

- 16-Bit Microcontroller

- 32-Bit Microcontroller

Global Microcontroller Market, by Application

- Automotive

- Consumer Electronics

- Industrial

- Medical Devices

- Military & Defense

- Others

Global Microcontroller Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $35.64 Billion |

| CAGR | 10.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Analog Devices, Inc., Microchip Technology Inc., Panasonic Corporation, Renesas Electronics Corporation, NXP Semiconductor, STMicroelectronics N.V., Infineon Technologies AG, Texas Instruments Incorporated, ROHM Semiconductor, ZILOG, INC |

| Key Market Opportunities | • Increasing focus on artificial intelligence in Microcontroller |

| Key Market Drivers | • Growing demand from medical and automotive sectors • Increasing adoption of smart meters in smart grid systems |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Microcontroller market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Microcontroller market historical market size for the year 2021, and forecast from 2023 to 2033

- Microcontroller market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Microcontroller market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.