Metamaterial Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

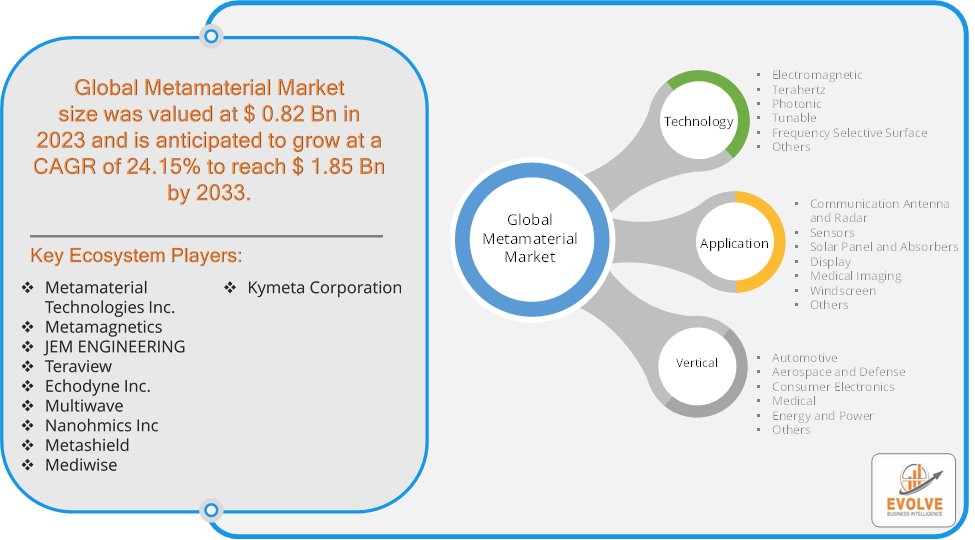

Metamaterial Market Research Report: By Technology (Electromagnetic, Terahertz, Photonic, Tunable, Frequency Selective Surface, Others), By Application (Communication Antenna And Radar, Sensors, Solar Panel And Absorbers, Display, Medical Imaging, Windscreen, Others), By Vertical (Automotive, Aerospace And Defense, Consumer Electronics, Medical, Energy And Power, Others), and by Region — Forecast till 2033

Page: 153

Metamaterial Market Overview

The Metamaterial Market Size is expected to reach USD 1.85 Billion by 2033. The Metamaterial industry size accounted for USD 0.82 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 24.15% from 2023 to 2033. The metamaterial market involves advanced materials engineered to have properties not found in naturally occurring materials. These properties arise from their unique structures, often smaller than the wavelength of the phenomena they influence. Metamaterials can manipulate electromagnetic waves in novel ways, enabling applications in optics, telecommunications, radar, and medical imaging. Key segments include electromagnetic, terahertz, and photonic metamaterials. The market is driven by demand for advanced technologies in sectors such as defense, aerospace, and consumer electronics. Ongoing research and development are crucial, as innovations continue to expand potential applications.

Global Metamaterial Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Metamaterial market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Metamaterial Market Dynamics

The major factors that have impacted the growth of Metamaterial are as follows:

Drivers:

⮚ Technological Advancements

The continuous development of advanced fabrication techniques has significantly lowered production costs and increased the scalability of metamaterials. This progress is crucial for integrating these materials into commercial applications, making them more accessible for industries like telecommunications, optics, and electronics.

Restraint:

- High Production Costs

Despite advancements in fabrication techniques, the production of metamaterials remains costly. The complex manufacturing processes and the precision required to achieve the desired material properties often result in high expenses. This cost factor limits the widespread adoption of metamaterials, particularly in price-sensitive markets.

Opportunity:

⮚ Advancements in Telecommunications

The roll-out of 5G and the upcoming 6G technologies present substantial opportunities for metamaterials. They can enhance signal processing, reduce interference, and improve antenna performance. As the demand for high-speed, reliable communication networks grows, the use of metamaterials in telecommunication infrastructure will expand.

Metamaterial Market Segment Overview

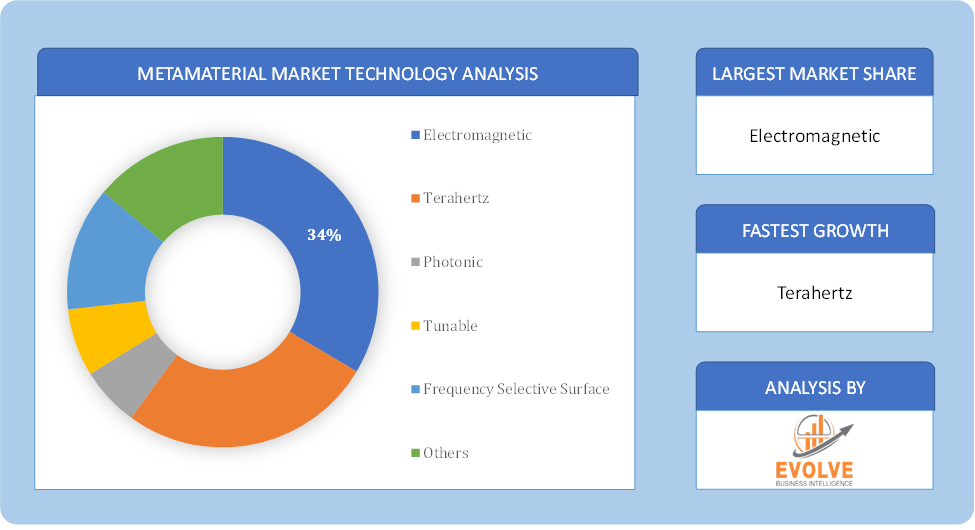

By Technology

By Technology

Based on the Technology, the market is segmented based on Electromagnetic, Terahertz, Photonic, Tunable, Frequency Selective Surface, Others. the Electromagnetic segment often dominates due to its extensive applications in improving antenna performance, enhancing electromagnetic wave manipulation, and its crucial role in telecommunications and defense technologies.

By Application

Based on the Application, the market has been divided into Communication Antenna And Radar, Sensors, Solar Panel And Absorbers, Display, Medical Imaging, Windscreen, Others. the Communication Antenna and Radar segment often dominates due to the high demand for advanced antenna systems and radar technologies in telecommunications, aerospace, and defense sectors, where metamaterials significantly enhance performance and efficiency.

By Vertical

Based on Vertical, the market has been divided into Automotive, Aerospace And Defense, Consumer Electronics, Medical, Energy And Power, Others. the Aerospace and Defense segment often dominates due to the significant demand for advanced stealth technologies, radar absorption materials, and enhanced communication systems, making it a critical application area for metamaterials.

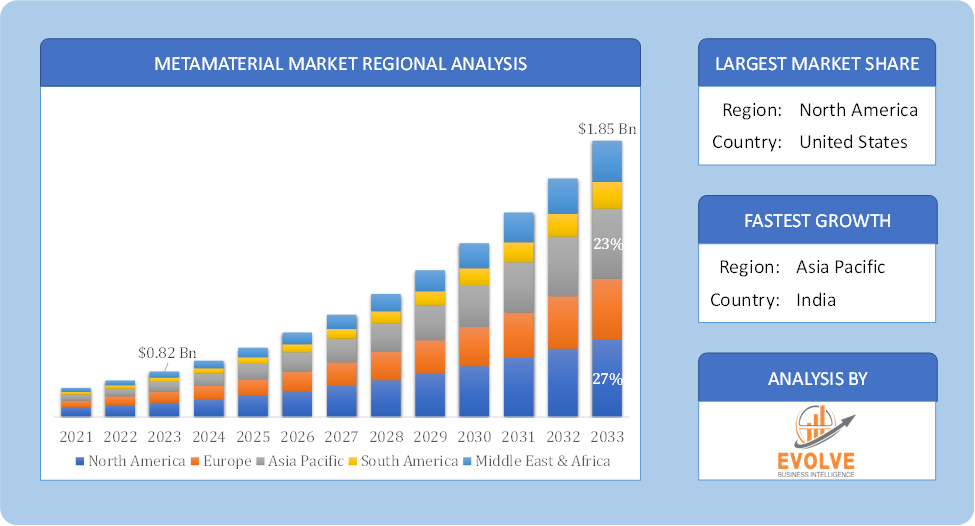

Global Metamaterial Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Metamaterial, followed by those in Asia-Pacific and Europe.

Metamaterial North America Market

Metamaterial North America Market

North America dominates the Metamaterial market due to several factors. From 2022 to 2030, the metamaterial market in North America will hold the largest market share. Government agencies including the DOD, DARPA, and NASA are providing substantial funds to research universities and commercial enterprises to build metamaterial-based antennas. The market for metamaterials has grown significantly in recent years, mostly due to the growth of the aerospace and defense, automotive, consumer electronics, medical, and energy and power industries.

Metamaterial Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. The Asia-Pacific region is expected to have a significant demand for Metamaterial due to the growth of the electronics and telecommunications industries in the area, which is being driven by increased foreign investment and 5G progress. Furthermore, it is projected that as additional nations, like China and India, boost their efforts in building and fortifying their warships, the metamaterial market in the Asia-Pacific region would expand. Europe’s metamaterial industry is expected to grow steadily as a result of the growing need for advanced materials as well as the growth of the power and automotive industries.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Metamaterial Technologies Inc., Metamagnetics, JEM ENGINEERING, Teraview, and Echodyne Inc. are some of the leading players in the global Metamaterial Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Metamaterial Technologies Inc.

- Metamagnetics

- JEM ENGINEERING

- Teraview

- Echodyne Inc.

- Multiwave

- Nanohmics Inc

- Metashield

- Mediwise

- Kymeta Corporation

Key development:

In September 2022, Metamaterial Technologies Inc. announced that they had completed the sale of shares of the medical device company, GlucoWise®, for $4.5 million to an unnamed third party

Scope of the Report

Global Metamaterial Market, by Technology

- Electromagnetic

- Terahertz

- Photonic

- Tunable

- Frequency Selective Surface

- Others

Global Metamaterial Market, by Application

- Communication Antenna and Radar

- Sensors

- Solar Panel and Absorbers

- Display

- Medical Imaging

- Windscreen

- Others

Global Metamaterial Market, by Vertical

- Automotive

- Aerospace and Defense

- Consumer Electronics

- Medical

- Energy and Power

- Others

Global Metamaterial Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 1.85 Billion |

| CAGR (2023-2033) | 24.15% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Application, Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Metamaterial Technologies Inc., Metamagnetics, JEM ENGINEERING, Teraview, Echodyne Inc., Multiwave, Nanohmics Inc, Metashield, Mediwise, Kymeta Corporation. |

| Key Market Opportunities | · Advancement in 5G |

| Key Market Drivers | · Adoption of metamaterials in the aerospace, defense, and high-end military applications |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Metamaterial Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Metamaterial market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Metamaterial market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Metamaterial Market.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Metamaterial market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Metamaterial market?

The global Metamaterial market is growing at a CAGR of ~24.15% over the next 10 years

Which region has the highest growth rate in the market of Metamaterial?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Metamaterial?

North America holds the largest share in 2022

Major Key Players in the Market of Metamaterial?

Metamaterial Technologies Inc., Metamagnetics, JEM ENGINEERING, Teraview, Echodyne Inc., Multiwave, Nanohmics Inc, Metashield, Mediwise, Kymeta Corporation

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Technology Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. Vertical Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Metamaterial Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Metamaterial Market, By Technology 7.1. Introduction 7.1.1. Electromagnetic 7.1.2. Terahertz 7.1.3. Photonic 7.1.4. Tunable 7.1.5. Frequency Selective Surface 7.1.6. Others CHAPTER 8. Global Metamaterial Market, By Application 8.1. Introduction 8.1.1. Communication Antenna and Radar 8.1.2. Sensors 8.1.3. Solar Panel and Absorbers 8.1.4. Display 8.1.5. Medical Imaging 8.1.6. Windscreen 8.1.7. Others CHAPTER 9. Global Metamaterial Market, By Vertical 9.1. Introduction 9.1.1. Automotive 9.1.2. Aerospace and Defense 9.1.3. Consumer Electronics 9.1.4. Medical 9.1.5. Energy and Power 9.1.6. Others CHAPTER 10. Global Metamaterial Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Vertical, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Metamaterial Technologies Inc. 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Metamagnetics 13.3. JEM ENGINEERING 13.4. Teraview 13.5. Echodyne Inc. 13.6. Multiwave 13.7. Nanohmics Inc 13.8. Metashield 13.9. Mediwise 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology

Metamaterial North America Market

Metamaterial North America Market