MEMS Sensors Market Overview

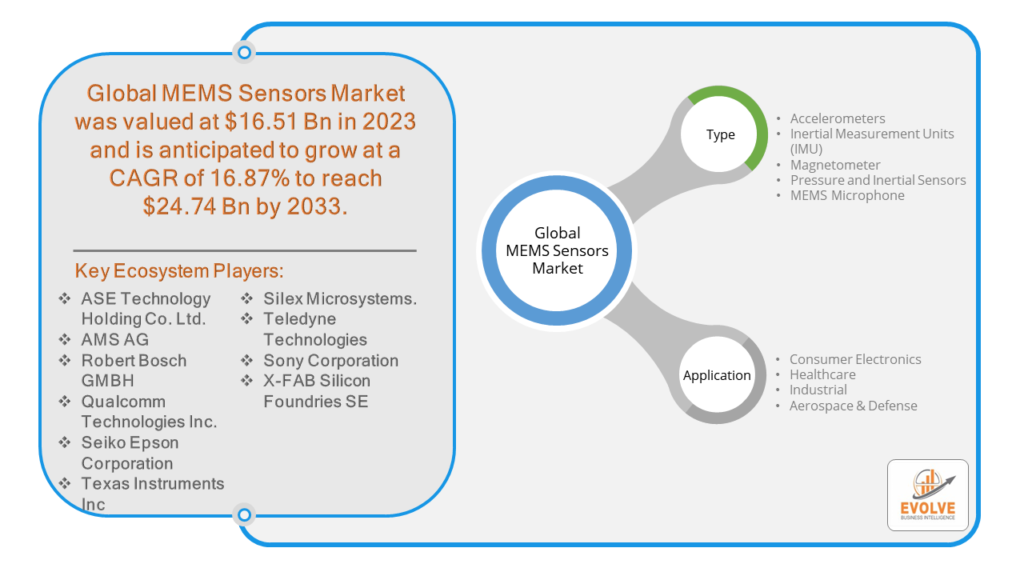

The MEMS Sensors Market Size is expected to reach USD 24.74 Billion by 2033. The MEMS Sensors Market industry size accounted for USD 16.51 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.87% from 2023 to 2033. MEMS stands for Micro-Electro-Mechanical Systems. MEMS sensors are miniature devices that integrate mechanical and electrical components on a single chip. These sensors are capable of measuring various physical quantities such as pressure, temperature, acceleration, and motion.

The demand for MEMS sensors has been steadily increasing due to their small size, low cost, and high performance, making them ideal for various applications where traditional sensors may be impractical or too expensive. The MEMS sensors market is driven by factors such as the growing adoption of IoT (Internet of Things) devices, advancements in MEMS technology, and increasing demand for smart consumer electronics and automotive safety systems.

Global MEMS Sensors Market Synopsis

The COVID-19 pandemic had a mixed impact on the MEMS sensors market. In the early stages of the pandemic, the MEMS sensors market experienced disruptions in the supply chain and manufacturing operations due to lockdowns, restrictions on movement, and temporary closures of factories. This led to delays in production and delivery of MEMS sensors. The pandemic triggered a shift in demand for certain types of MEMS sensors. For instance, there was increased demand for sensors used in healthcare applications such as ventilators, patient monitoring devices, and diagnostic equipment. However, demand for sensors used in automotive and consumer electronics sectors initially declined due to reduced consumer spending and production halts. The pandemic accelerated the adoption of digital technologies across various industries. This increased the demand for MEMS sensors used in IoT devices, wearables, and smart home systems as people relied more on remote connectivity and digital solutions for work, education, and entertainment.

MEMS Sensors Market Dynamics

The major factors that have impacted the growth of MEMS Sensors Market are as follows:

Drivers:

Ø Technological Advancements

Continuous advancements in microfabrication, packaging techniques, and material science contribute to the development of smaller, more accurate, and cost-effective MEMS sensors. These technological innovations expand the potential applications of MEMS sensors across various industries. The increasing popularity of wearable devices such as smartwatches, fitness trackers, and medical wearables creates a significant demand for MEMS sensors, particularly for motion tracking, biometric sensing, and environmental monitoring. The continuous innovation in consumer electronics, including smartphones, tablets, gaming consoles, and virtual reality (VR) devices, relies heavily on MEMS sensors for features such as motion sensing, gesture recognition, image stabilization, and environmental sensing.

Restraint:

- Perception of Cost Constraints

Despite advancements in manufacturing processes, MEMS sensors can still be relatively expensive to produce compared to conventional sensors. Cost constraints may limit their adoption in price-sensitive markets or applications where cost reduction is critical. MEMS sensors face technical challenges such as accuracy, reliability, and stability over time. Meeting stringent performance requirements across various applications can be challenging and may hinder their adoption in certain industries. MEMS sensors face competition from alternative sensing technologies such as optical sensors, piezoelectric sensors, and thin-film sensors. Depending on the specific application requirements, these alternative technologies may offer advantages in terms of performance, size, or cost, posing a restraint on the MEMS sensors market.

Opportunity:

⮚ Healthcare Wearables and Remote Monitoring

The increasing adoption of wearable devices for health and wellness monitoring creates a significant opportunity for MEMS sensors. These sensors enable the tracking of vital signs, physical activity, and environmental factors, facilitating remote patient monitoring, telehealth services, and personalized healthcare solutions. The automotive industry’s focus on vehicle safety, connectivity, and autonomous driving technologies drives the demand for MEMS sensors. These sensors are used in applications such as advanced driver assistance systems (ADAS), tire pressure monitoring, inertial navigation, and vehicle-to-vehicle communication systems. MEMS sensors are essential components in smartphones, tablets, gaming consoles, and other consumer electronics devices. As consumers demand more advanced features such as augmented reality (AR), virtual reality (VR), and gesture recognition, there is a growing opportunity for MEMS sensor manufacturers to innovate and deliver solutions that meet these demands.

MEMS Sensors Market Segment Overview

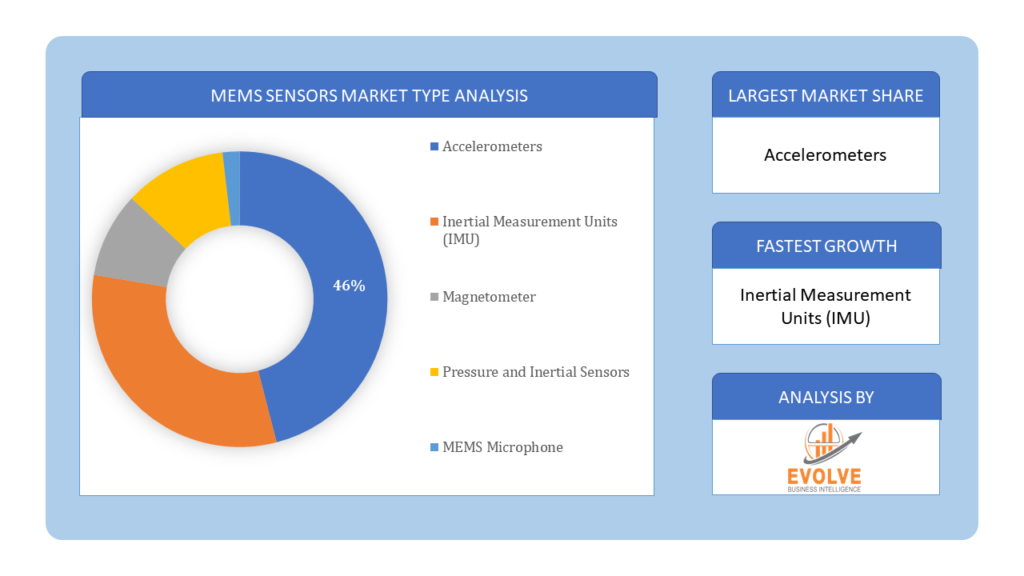

By Type

Based on Type, the market is segmented based on Accelerometers, Inertial Measurement Units (IMU), Magnetometer, Pressure and Inertial Sensors and MEMS Microphone. Accelerometers will be the fastest growing segment. Accelerometers are fundamental sensors widely used in a diverse range of applications due to their ability to measure static and dynamic accelerations. In industrial applications, accelerometers are used for monitoring machinery health, vibration analysis, and predictive maintenance. They help detect unusual vibrations or shocks that could indicate potential malfunctions or maintenance needs.

Based on Type, the market is segmented based on Accelerometers, Inertial Measurement Units (IMU), Magnetometer, Pressure and Inertial Sensors and MEMS Microphone. Accelerometers will be the fastest growing segment. Accelerometers are fundamental sensors widely used in a diverse range of applications due to their ability to measure static and dynamic accelerations. In industrial applications, accelerometers are used for monitoring machinery health, vibration analysis, and predictive maintenance. They help detect unusual vibrations or shocks that could indicate potential malfunctions or maintenance needs.

By Application

Based on Application, the market segment has been divided into the Consumer Electronics, Healthcare, Industrial and Aerospace & Defense. Consumer Electronics will be the fastest growing segment. MEMS sensors are extensively integrated into smartphones and tablets. These sensors include accelerometers, gyroscopes, magnetometers, pressure sensors, and proximity sensors. MEMS sensors are a fundamental component of wearable devices such as smartwatches, fitness trackers, and hearables. Sensors include accelerometers, gyroscopes, heart rate monitors, and pressure sensors. MEMS sensors are vital for VR/AR devices, enabling precise tracking of head movements and gestures, enhancing the immersive experience.

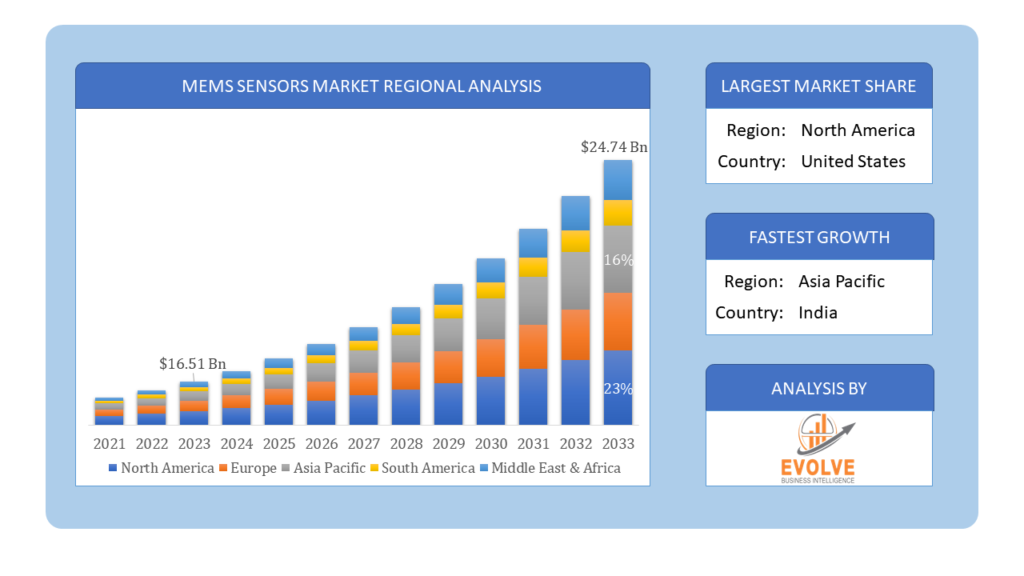

Global MEMS Sensors Market Regional Analysis

Based on region, the global MEMS Sensors Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the MEMS Sensors Market followed by the Asia-Pacific and Europe regions.

MEMS Sensors North America Market

MEMS Sensors North America Market

North America holds a dominant position in the MEMS Sensors Market. North America is a significant hub for MEMS sensors, with a strong presence of leading sensor manufacturers, research institutions, and technology companies. The region benefits from robust demand for MEMS sensors in industries such as automotive, consumer electronics, healthcare, aerospace, and industrial automation. Major players in North America focus on innovation and product development, particularly in emerging areas such as IoT, autonomous vehicles, and healthcare wearables.

MEMS Sensors Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the MEMS Sensors Market industry. Asia-Pacific is a rapidly growing region for the MEMS sensors market, driven by increasing demand from automotive, consumer electronics, and industrial sectors. Countries like China, Japan, South Korea, and Taiwan are major manufacturing hubs for MEMS sensors, benefiting from a skilled workforce and advanced semiconductor fabrication capabilities. The region also experiences strong demand for MEMS sensors in emerging applications such as smartphones, wearables, IoT devices, and robotics.

Competitive Landscape

The global MEMS Sensors Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ASE Technology Holding Co. Ltd.

- AMS AG

- Robert Bosch GMBH

- Qualcomm Technologies Inc.

- Seiko Epson Corporation

- Texas Instruments Inc

- Silex Microsystems.

- Teledyne Technologies

- Sony Corporation

- X-FAB Silicon Foundries SE.

Key Development

In June 2022, X-FAB Silicon Foundries SE collaborated with Spectricity for a unique imaging solution. High-volume manufacturing facilities at X-FAB use Spectricity’s proprietary spectral imaging technology. As a result, mobile devices can manufacture low-cost spectral image sensors for the first time.

Scope of the Report

Global MEMS Sensors Market, by Type

- Accelerometers

- Inertial Measurement Units (IMU)

- Magnetometer

- Pressure and Inertial Sensors

- MEMS Microphone

Global MEMS Sensors Market, by Application

- Consumer Electronics

- Healthcare

- Industrial

- Aerospace & Defense

Global MEMS Sensors Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $24.74 Billion |

| CAGR | 16.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ASE Technology Holding Co. Ltd., AMS AG, Robert Bosch GMBH, Qualcomm Technologies Inc., Seiko Epson Corporation, Texas Instruments Inc, Silex Microsystems., Teledyne Technologies, Sony Corporation and X-FAB Silicon Foundries SE. |

| Key Market Opportunities | • Healthcare Wearables and Remote Monitoring • Automotive Safety and Autonomous Driving |

| Key Market Drivers | • Technological Advancements • Rising Adoption of Wearable Devices |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future MEMS Sensors Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- MEMS Sensors Market historical market size for the year 2021, and forecast from 2023 to 2033

- MEMS Sensors Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global MEMS Sensors Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.