Liquid Fertilizers Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

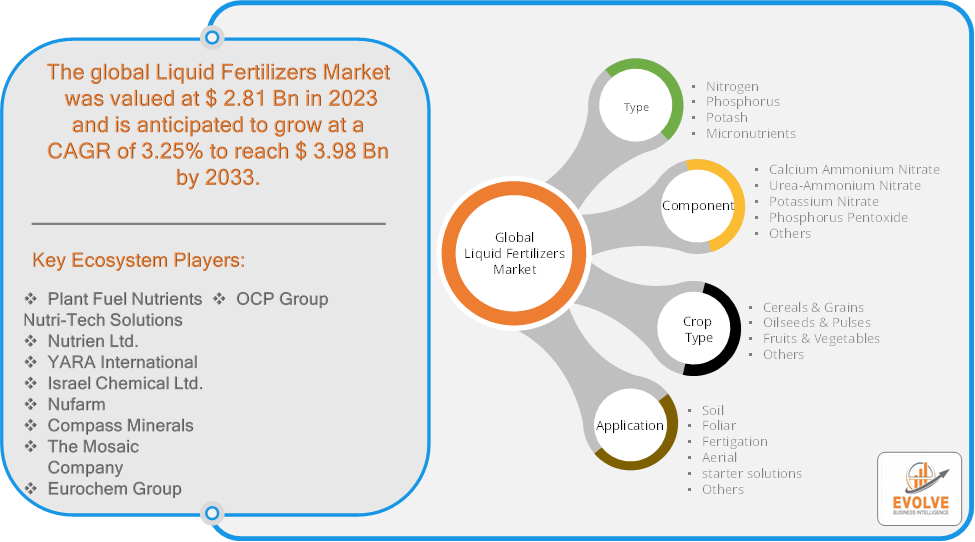

Liquid Fertilizers Market Research Report: Information By Type (Nitrogen, Phosphorus, Potash, Micronutrients), By Compounds (Calcium Ammonium Nitrate, Urea-Ammonium Nitrate, Potassium Nitrate, Phosphorus Pentoxide, Others), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), By Application (Soil, Foliar, Fertigation, aerial, starter solutions, Others), and by Region — Forecast till 2033

Page: 161

Liquid Fertilizers Market Overview

The Liquid Fertilizers Market Size is expected to reach USD 3.98 Billion by 2033. The Liquid Fertilizers Market industry size accounted for USD 2.81 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.25% from 2023 to 2033. The Liquid Fertilizers Market refers to the market for fertilizers that are in liquid form, typically dissolved in water for application to crops. These fertilizers contain nutrients essential for plant growth, such as nitrogen, phosphorus, and potassium, along with micronutrients like iron, zinc, and manganese. Liquid fertilizers are applied through irrigation systems or as foliar sprays, offering advantages such as ease of application, uniform nutrient distribution, and rapid absorption by plants. This market caters to agricultural and horticultural sectors globally, addressing the need for efficient nutrient management and maximizing crop yields.

The liquid fertilizers market is expected to witness significant growth in the coming years due to factors such as increasing global population, rising food demand, and growing adoption of sustainable farming practices. Advancements in fertilizer technology and the development of specialized products for specific crop needs will also contribute to market expansion.

Global Liquid Fertilizers Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had significant impacts on the Liquid Fertilizers Market. Restrictions on movement and trade disrupted supply chains, affecting the availability of raw materials and distribution of liquid fertilizers. Initially, there were uncertainties leading to fluctuations in demand as farmers adjusted planting schedules and budgets. However, agriculture was deemed essential, mitigating some demand shocks. Some farmers adapted to the uncertainty by altering their cropping patterns or delaying purchases, impacting the timing and volume of liquid fertilizer applications. The pandemic highlighted the importance of food security, potentially driving investments in agriculture and sustainable farming practices, including the use of liquid fertilizers.

Liquid Fertilizers Market Dynamics

The major factors that have impacted the growth of Liquid Fertilizers Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in formulation and application technologies improve the effectiveness and compatibility of liquid fertilizers with modern agricultural practices. Their ability to deliver nutrients directly to plants promotes healthier growth, increased yield, and improved crop quality. Growing awareness among farmers about the benefits of balanced nutrient management and the role of fertilizers in maximizing yield drives market adoption. Population growth, rising food demand, and shrinking arable land necessitate higher agricultural productivity, boosting the demand for efficient fertilization solutions like liquid fertilizers.

Restraint:

- Perception of High Initial Costs and Storage and Handling Challenges

The upfront costs associated with purchasing and applying liquid fertilizers, including equipment for application, can be higher compared to traditional granular fertilizers. Liquid fertilizers require proper storage facilities and handling practices to prevent degradation and ensure safety, which adds logistical complexity and costs. While liquid fertilizers can reduce nutrient runoff when applied correctly, improper application or excessive use can still contribute to environmental issues such as water pollution.

Opportunity:

⮚ Growing demand for Sustainable Agriculture Initiatives

Increasing emphasis on sustainable farming practices presents an opportunity for liquid fertilizers, which can be formulated to minimize environmental impact through reduced runoff and improved nutrient efficiency. Integration with precision agriculture technologies such as GIS (Geographic Information System), GPS (Global Positioning System), and IoT (Internet of Things) enables more accurate and efficient application of liquid fertilizers tailored to specific soil and crop conditions. Growing consumer demand for organic products drives the need for organic-certified liquid fertilizers, providing an opportunity for manufacturers to expand their product offerings in this segment.

Liquid Fertilizers Market Segment Overview

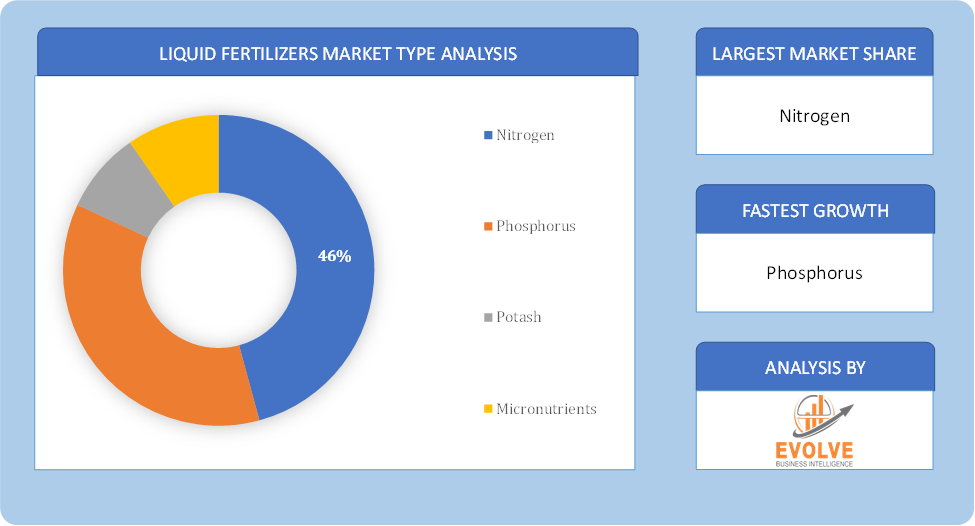

By Type

By Type

Based on Type, the market is segmented based on Nitrogen, Phosphorus, Potash and Micronutrients. The nitrogen segment dominated the market. Nitrogen is heavily ingested nutrient for all the current farming practices in the world. It’s utilized to make amino acids, which turn into proteins, and it’s involved in nearly every metabolic reaction in a plant. Farmers generally face the problem of low availability of nitrogen in the soil. As a result, more liquid nitrogen fertilizer is needed to solve the problem.

By Component

Based on Component, the market segment has been divided into the Calcium Ammonium Nitrate, Urea-Ammonium Nitrate, Potassium Nitrate, Phosphorus Pentoxide and Others. The Calcium Ammonium Nitrate (CAN) segment dominant the market. It’s the significantly and widely used nitrogen fertilizer because of its comparatively high nutrient content along with physical properties, such as high solubility that helps in quick dissolving of the fertilizer into the soil. It contains magnesium and calcium that helps in upgrading the efficiency for absorbing nitrogen by the roots along with reducing nitrogen losses that makes the fertilization more profitable; this also protects subsoil waters counter to pollution by nitrogen compounds.

By Crop Type

Based on Crop Type, the market segment has been divided into the Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables and Others. The cereals & grains crop type segment dominated the market. This is owing to the high demand for liquid fertilizers in the production of crops such as wheat, rice, and maize.

By Application

Based on Application, the market segment has been divided into the Soil, Foliar, Fertigation, aerial, starter solutions and Others. The Fertigation segment dominant the market. It is basically a profitable agriculture technique that includes fertilizer and water application by means of irrigation. The entire process offers lucrative opportunity to increase the yield capacity of land as well as to minimize the environment pollution. Moreover, increased focus of government bodies along with rising awareness among people triggers the growth and demand for such techniques. Therefore, the above mentioned factors drive the market growth for fertigation during the upcoming period.

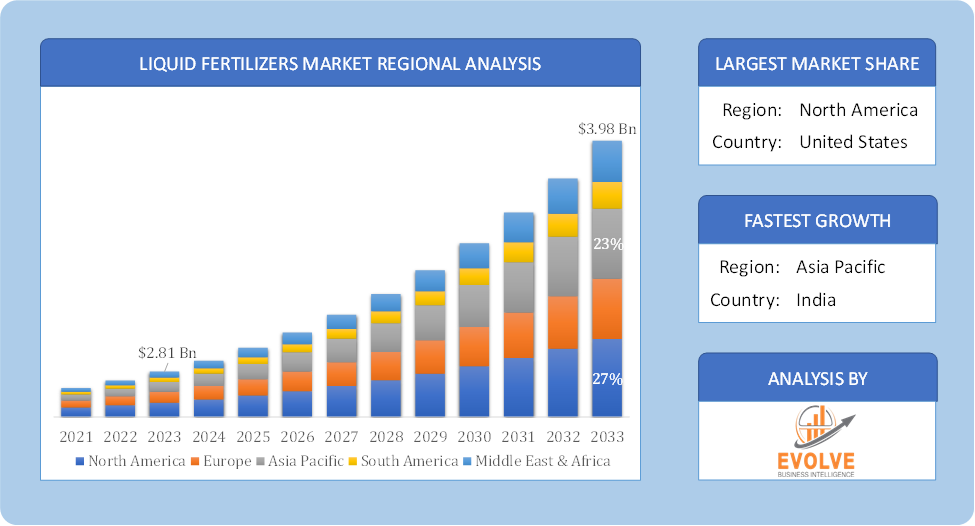

Global Liquid Fertilizers Market Regional Analysis

Based on region, the global Liquid Fertilizers Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Liquid Fertilizers Market followed by the Asia-Pacific and Europe regions.

Liquid Fertilizers North America Market

Liquid Fertilizers North America Market

North America holds a dominant position in the Liquid Fertilizers Market. United States and Canada lead in adoption of advanced agricultural technologies, driving demand for liquid fertilizers. Emphasis on sustainable agriculture practices and precision farming supports market growth. Regulatory standards for nutrient management influence product formulations and market strategies.

Liquid Fertilizers Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Liquid Fertilizers Market industry. China and India dominate the market due to large agricultural sectors and increasing adoption of modern farming practices. Rising population and food demand drive the need for higher crop yields, boosting liquid fertilizer use. Government initiatives promoting agricultural modernization and sustainability support market growth.

Competitive Landscape

The global Liquid Fertilizers Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Plant Fuel Nutrients

- Nutri-Tech Solutions

- Nutrien Ltd.

- YARA International

- Israel Chemical Ltd.

- Nufarm

- Compass Minerals

- The Mosaic Company

- Eurochem Group

- OCP Group

Key Development

In July 2022, BiOWiSH Technologies, Inc. and SABIC Agri-Nutrients Company announced the successful completion of the technical evaluation of BiOWiSH Crop Liquid technology coated on SABIC’s urea. The product is used on nine different crop types in nine countries across five continents to create an enhanced efficiency fertilizer designed to optimize yield potential and improve soil productivity.

Scope of the Report

Global Liquid Fertilizers Market, by Type

- Nitrogen

- Phosphorus

- Potash

- Micronutrients

Global Liquid Fertilizers Market, by Component

- Calcium Ammonium Nitrate

- Urea-Ammonium Nitrate

- Potassium Nitrate

- Phosphorus Pentoxide

- Others

Global Liquid Fertilizers Market, by Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Global Liquid Fertilizers Market, by Application

- Soil

- Foliar

- Fertigation

- Aerial

- starter solutions

- Others

Global Liquid Fertilizers Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 3.98 Billion |

| CAGR (2023-2033) | 3.25% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Component, Crop Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Plant Fuel Nutrients, Nutri-Tech Solutions, Nutrien Ltd., YARA International, Israel Chemical Ltd., Nufarm, Compass Minerals, The Mosaic Company, Eurochem Group and OCP Group. |

| Key Market Opportunities | · The growing demand for Sustainable Agriculture Initiatives · Precision Agriculture and Organic Farming |

| Key Market Drivers | · Technological Advancements · Global Agricultural Trends |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Liquid Fertilizers Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Liquid Fertilizers Market historical market size for the year 2021, and forecast from 2023 to 2033

- Liquid Fertilizers Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Liquid Fertilizers Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Liquid Fertilizers Market is 2021- 2033

What is the growth rate of the global Liquid Fertilizers Market?

The global Liquid Fertilizers Market is growing at a CAGR of 3.98% over the next 10 years

Which region has the highest growth rate in the market of Liquid Fertilizers Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Liquid Fertilizers Market?

North America holds the largest share in 2022

Who are the key players in the global Liquid Fertilizers Market?

Plant Fuel Nutrients, Nutri-Tech Solutions, Nutrien Ltd., YARA International, Israel Chemical Ltd., Nufarm, Compass Minerals, The Mosaic Company, Eurochem Group and OCP Group are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Component Segment – Market Opportunity Score 4.1.3. Crop Type Segment – Market Opportunity Score 4.1.4. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End Users 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Liquid Fertilizers Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Liquid Fertilizers Market, By Type 7.1. Introduction 7.1.1. Nitrogen 7.1.2. Phosphorus 7.1.3. Potash 7.1.4. Micronutrients CHAPTER 8. Liquid Fertilizers Market, By Component 8.1. Introduction 8.1.1. Calcium Ammonium Nitrate 8.1.2. Urea-Ammonium Nitrate 8.1.3. Potassium Nitrate 8.1.4. Phosphorus Pentoxide 8.1.5. Others CHAPTER 9. Liquid Fertilizers Market, By Crop Type 9.1. Introduction 9.1.1. Cereals & Grains 9.1.2. Oilseeds & Pulses 9.1.3. Fruits & Vegetables 9.1.4. Others CHAPTER 10. Liquid Fertilizers Market, By Application 10.1.Introduction 10.1.1. Soil 10.1.2. Foliar 10.1.3. Fertigation 10.1.4. aerial 10.1.5. starter solutions 10.1.6. Others CHAPTER 11. Aircraft Propeller Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Plant Fuel Nutrients 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Nutri-Tech Solutions 13.3. Nutrien Ltd. 13.4. YARA International 13.5. Israel Chemical Ltd. 13.6. Nufarm 13.7. Compass Minerals 13.8. The Mosaic Company 13.9. Eurochem Group 13.10. OCP Group

Connect to Analyst

Research Methodology

Liquid Fertilizers North America Market

Liquid Fertilizers North America Market