Liquid Dietary Supplements Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

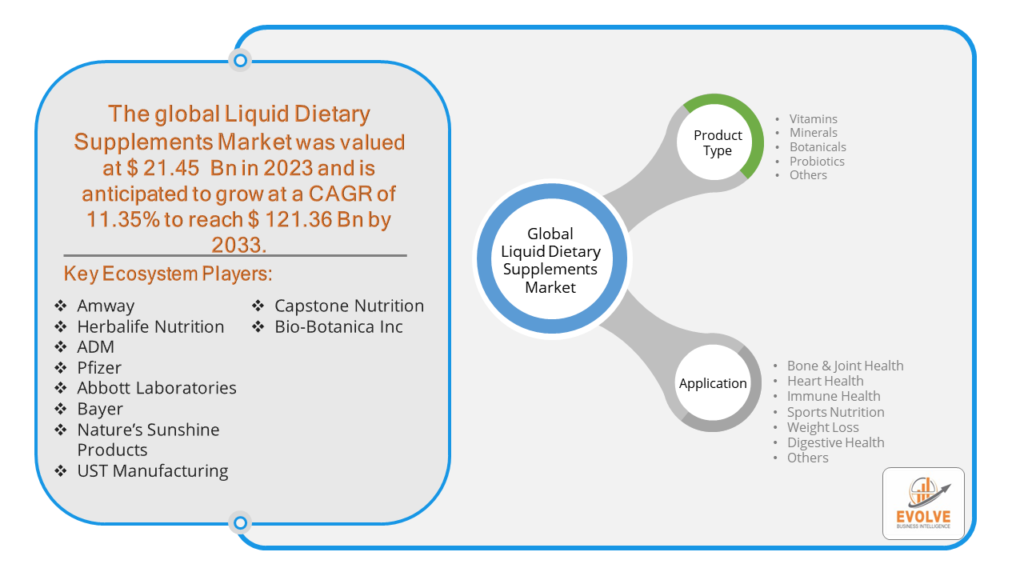

Liquid Dietary Supplements Market Research Report: Information By Product Type (Vitamins, Minerals, Botanicals, Probiotics, Others), By Application (Bone & Joint Health, Heart Health, Immune Health, Sports Nutrition, Weight Loss, Digestive Health, Others), and by Region — Forecast till 2033

Page: 163

Liquid Dietary Supplements Market Overview

The Liquid Dietary Supplements Market Size is expected to reach USD 121.45 Billion by 2033. The Liquid Dietary Supplements Market industry size accounted for USD 21.45 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.35% from 2023 to 2033. The liquid dietary supplements market refers to the sale of nutritional supplements that come in a liquid form, rather than pills, capsules, or tablets. These supplements are consumed to bridge nutrient gaps in diets and support overall health. They are particularly popular with people who have difficulty swallowing pills or prefer a more easily absorbed option.

The market is expected to grow significantly and, driven by factors like Increasing focus on personal health and wellness and growing geriatric population with specific dietary needs. Liquid dietary supplements come in various forms like syrups, drops, tinctures, and even shots. They can target a wide range of health concerns, including vitamin and mineral deficiencies, immune support, and athletic performance.

Global Liquid Dietary Supplements Market Synopsis

The COVID-19 pandemic had a significant impact on the Liquid Dietary Supplements Market. The pandemic heightened consumer awareness regarding health and immunity, leading to a surge in demand for dietary supplements, including those in liquid form. Products aimed at boosting immunity, such as vitamins C and D, zinc, and herbal supplements, saw particularly high demand. With physical stores closed or operating at limited capacity, there was a significant shift towards online shopping. E-commerce platforms saw a substantial increase in sales of liquid dietary supplements, prompting companies to enhance their online presence and direct-to-consumer sales channels. The increased focus on health and wellness drove innovation in the liquid dietary supplements market. Companies invested in research and development to create new formulations and improve the bioavailability and efficacy of their products. The pandemic influenced consumer behavior, with more people prioritizing health and wellness. This trend is expected to continue post-pandemic, supporting sustained growth in the liquid dietary supplements market.

Liquid Dietary Supplements Market Dynamics

The major factors that have impacted the growth of Liquid Dietary Supplements Market are as follows:

Drivers:

Ø Increasing Health Consciousness

A growing awareness of health and wellness among consumers is a major driver. People are increasingly looking to dietary supplements to enhance their health, boost immunity, and prevent diseases. Liquid dietary supplements are preferred by many consumers because they are easier to swallow compared to pills and capsules. This is particularly important for children, the elderly, and individuals with difficulty swallowing. The expansion of online retail platforms has made it easier for consumers to access a wide variety of liquid dietary supplements. The convenience of online shopping and the availability of detailed product information are driving market growth.

Restraint:

- Perception of High Cost of Products

Liquid dietary supplements can be more expensive to produce and purchase compared to solid forms like pills and capsules. The higher cost can be a barrier for price-sensitive consumers, particularly in developing regions. Liquid dietary supplements often have a shorter shelf life compared to their solid counterparts due to their susceptibility to microbial contamination and degradation. This can pose challenges in storage, distribution, and inventory management. The market is highly competitive with numerous players offering a wide range of products. Intense competition can lead to price wars, reducing profit margins for companies.

Opportunity:

⮚ Innovation in Product Formulation

Developing new and improved formulations that enhance the bioavailability and efficacy of nutrients can attract health-conscious consumers. Innovations such as nanoemulsion technology and liposomal delivery systems can offer competitive advantages. The growing trend towards personalized nutrition presents a significant opportunity. Companies can develop tailored liquid dietary supplements based on individual health profiles, genetic makeup, and specific nutritional needs, enhancing consumer satisfaction and loyalty. With increasing consumer demand for environmentally friendly products, adopting sustainable packaging solutions can differentiate brands and appeal to eco-conscious consumers. Innovations in biodegradable and recyclable packaging can enhance market appeal.

Liquid Dietary Supplements Market Segment Overview

By Product Type

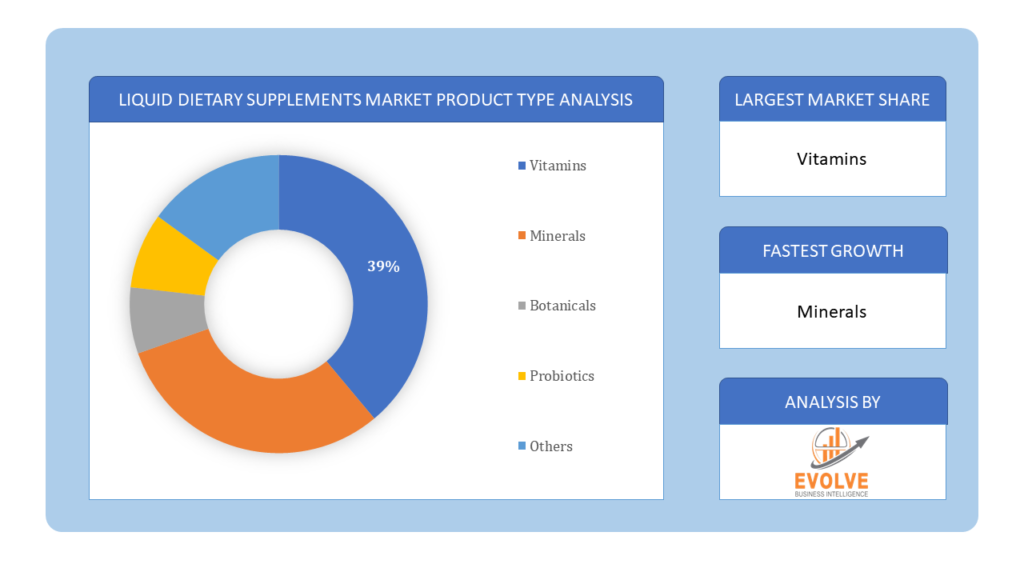

Based on Product Type, the market is segmented based on Vitamins, Minerals, Botanicals, Probiotics and Others. The Vitamins segment dominant the market. The demand for liquid dietary supplements containing vitamins has experienced significant growth across diverse applications, playing a pivotal role in addressing specific health concerns and fostering overall well-being. The expanding scope of vitamin-enriched liquid supplements is evident in their applications within distinct health domains.

Based on Product Type, the market is segmented based on Vitamins, Minerals, Botanicals, Probiotics and Others. The Vitamins segment dominant the market. The demand for liquid dietary supplements containing vitamins has experienced significant growth across diverse applications, playing a pivotal role in addressing specific health concerns and fostering overall well-being. The expanding scope of vitamin-enriched liquid supplements is evident in their applications within distinct health domains.

By Application

Based on Application, the market segment has been divided into the Bone & Joint Health, Heart Health, Immune Health, Sports Nutrition, Weight Loss, Digestive Health and Others. Liquid supplements play a significant role in sports nutrition, providing proteins, amino acids, and energy-boosting ingredients to enhance athletic performance, muscle recovery, and endurance. The burgeoning market for liquid dietary supplements catering to sports nutrition is experiencing rapid expansion, driven by the escalating consumer demand for convenient and efficacious methods to enhance athletic performance and facilitate recovery.

Global Liquid Dietary Supplements Market Regional Analysis

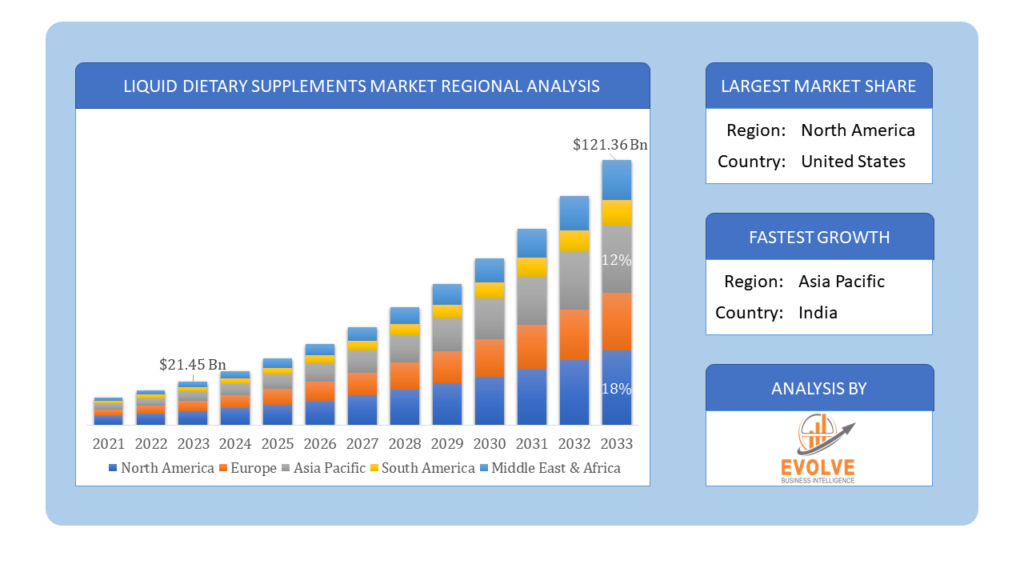

Based on region, the global Liquid Dietary Supplements Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Liquid Dietary Supplements Market followed by the Asia-Pacific and Europe regions.

Liquid Dietary Supplements North America Market

Liquid Dietary Supplements North America Market

North America holds a dominant position in the Liquid Dietary Supplements Market. North America holds the largest market share due to factors like high disposable income, established healthcare infrastructure, and rising awareness about preventive healthcare. United States is leading market with high demand for liquid dietary supplements, driven by lifestyle-related health concerns.

Liquid Dietary Supplements Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Liquid Dietary Supplements Market industry. Asia Pacific region is expected to witness the fastest growth rate due to a burgeoning middle class, increasing disposable income, and growing geriatric population. China, Japan, and India are the key markets here. Increasing awareness of health and wellness and Urbanization and changing lifestyles.

Competitive Landscape

The global Liquid Dietary Supplements Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Amway

- Herbalife Nutrition

- ADM

- Pfizer

- Abbott Laboratories

- Bayer

- Nature’s Sunshine Products

- UST Manufacturing

- Capstone Nutrition

- Bio-Botanica Inc.

Key Development

In March 2023, The Kraft Heinz Company extended its existing partnership with BEES, a digital sales platform. The objective of this expansion is to streamline and digitize the sales process of The Kraft Heinz Company, enabling them to enhance their business operations in Mexico, Colombia, and Peru.

In October 2022, General Mills, Inc., announced a collaboration between its brand Progresso and the renowned chef and restaurateur Carla Hall. This partnership aims to spark creativity and introduce exciting soup pairings that offer delightful flavors.

Scope of the Report

Global Liquid Dietary Supplements Market, by Product Type

- Vitamins

- Minerals

- Botanicals

- Probiotics

- Others

Global Liquid Dietary Supplements Market, by Application

- Bone & Joint Health

- Heart Health

- Immune Health

- Sports Nutrition

- Weight Loss

- Digestive Health

- Others

Global Liquid Dietary Supplements Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $121.36 Billion |

| CAGR | 11.35% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Amway, Herbalife Nutrition, ADM, Pfizer, Abbott Laboratories, Bayer, Nature’s Sunshine Products, UST Manufacturing, Capstone Nutrition and Bio-Botanica Inc |

| Key Market Opportunities | • Innovation in Product Formulation • Sustainable and Eco-Friendly Packaging |

| Key Market Drivers | • Increasing Health Consciousness • Growth in E-commerce |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Liquid Dietary Supplements Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Liquid Dietary Supplements Market historical market size for the year 2021, and forecast from 2023 to 2033

- Liquid Dietary Supplements Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Liquid Dietary Supplements Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the projected market size for liquid dietary supplements by 2033?

The liquid dietary supplements market is expected to reach USD 121.45 billion by 2033, growing at a CAGR of 11.35% from 2023 to 2033

How did COVID-19 impact the liquid dietary supplements market?

The pandemic increased consumer focus on health and immunity, boosting demand for liquid dietary supplements, especially those promoting immune support

Which product type dominates the liquid dietary supplements market?

Vitamins are the dominant product type, experiencing significant growth due to their role in addressing various health concerns

What are the main drivers of the liquid dietary supplements market growth?

Increasing health consciousness, growth in e-commerce, and the preference for liquid supplements over pills due to ease of consumption drive market growth

Which region holds the largest share in the liquid dietary supplements market?

North America holds the largest market share, driven by high disposable incomes, established healthcare infrastructure, and rising preventive healthcare awareness

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Liquid Dietary Supplements Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Liquid Dietary Supplements Market 4.8. Import Analysis of the Liquid Dietary Supplements Market 4.9. Export Analysis of the Liquid Dietary Supplements Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Liquid Dietary Supplements Market, By Product Type 6.1. Introduction 6.2. Vitamins 6.3. Minerals 6.4. Botanicals 6.5. Probiotics 6.6. Others Chapter 7. Global Liquid Dietary Supplements Market, By Application 7.1. Introduction 7.2. Bone & Joint Health 7.3. Heart Health 7.4 Immune Health 7.5 Sports Nutrition 7.6 Weight Loss 7.7 Digestive Health 7.8 Others Chapter 8. Global Liquid Dietary Supplements Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Amway 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Herbalife Nutrition 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. ADM 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Pfizer 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Abbott Laboratories 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Bayer 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Nature’s Sunshine Products 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 UST Manufacturing 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Capstone Nutrition 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Bio-Botanica Inc 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology