Jewelry Retail Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

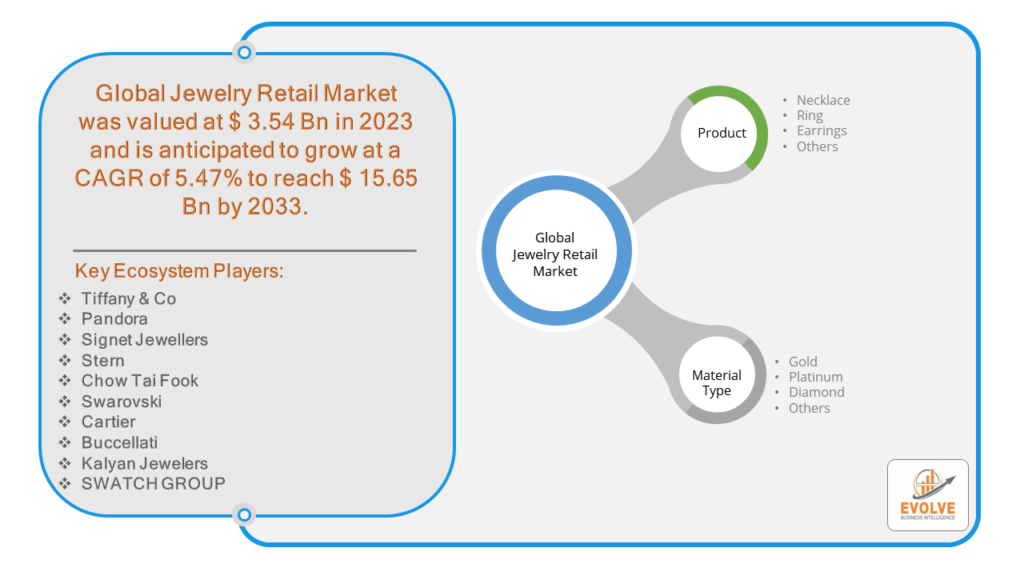

Jewelry Retail Market Research Report: Information By Product Type (Necklace, Ring, Earrings, Others), By Material Type (Gold, Platinum, Diamond, Others), and by Region — Forecast till 2033

Page: 160

Jewelry Retail Market Overview

The Jewelry Retail Market Size is expected to reach USD 15.65 Billion by 2033. The Jewelry Retail industry size accounted for USD 3.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.47% from 2023 to 2033. The jewelry retail market encompasses the buying and selling of various adornments made from precious metals, gemstones, and other materials. It spans a wide range of products, including rings, necklaces, bracelets, and earrings, catering to diverse tastes and occasions. Characterized by craftsmanship, design innovation, and cultural significance, it serves both luxury and everyday consumers. Market trends are influenced by fashion, cultural preferences, and economic factors, with online platforms increasingly shaping consumer behavior. Sustainability and ethical sourcing are emerging as key considerations, driving demand for responsibly produced jewelry.

Global Jewelry Retail Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Jewelry Retail market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Jewelry Retail Market Dynamics

The major factors that have impacted the growth of Jewelry Retail are as follows:

Drivers:

Ø Technological Advancements

Technological innovations have transformed various aspects of the jewelry industry, from design and manufacturing to distribution and marketing. CAD/CAM technology allows for precise and intricate jewelry designs, while 3D printing enables rapid prototyping and customization. Online platforms and e-commerce have expanded market reach and accessibility, providing consumers with a convenient way to browse, compare, and purchase jewelry.

Restraint:

- Rising Costs of Raw Materials

Fluctuations in the prices of raw materials, such as gold, silver, and gemstones, can impact the profitability of jewelry retailers. Rising costs of raw materials can squeeze profit margins and force businesses to adjust pricing strategies or seek alternative materials to maintain competitiveness.

Opportunity:

⮚ Innovative Marketing Strategies

Creative marketing strategies, including influencer collaborations, experiential retail concepts, and immersive brand experiences, can help jewelry retailers differentiate themselves and engage with customers in meaningful ways. Leveraging social media platforms and storytelling techniques can build brand loyalty and drive customer advocacy.

Jewelry Retail Segment Overview

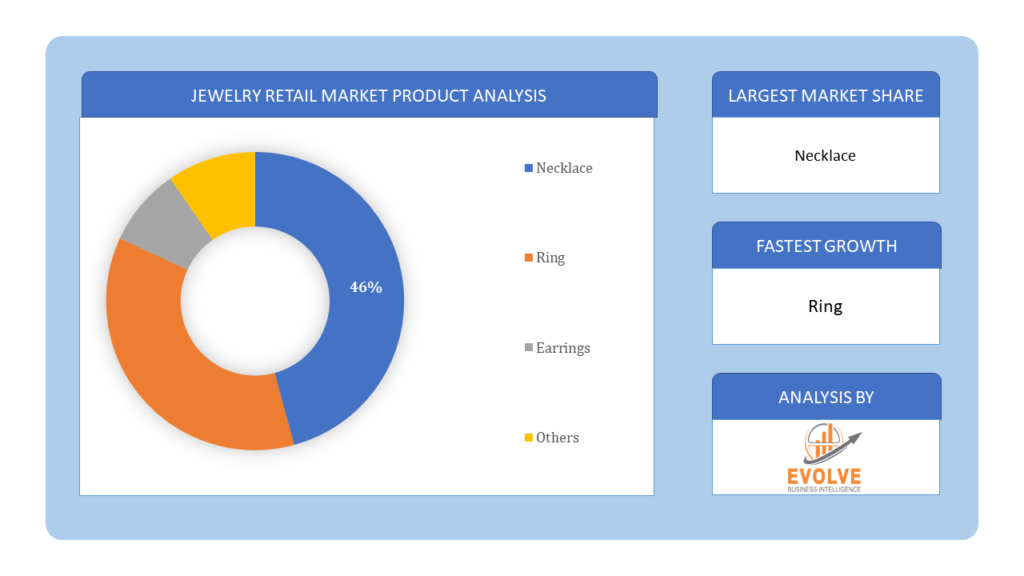

By Product Type

Based on Product Type, the market is segmented based on Necklace, Ring, Earrings, Others. In the jewelry retail market, gold remains a dominant segment due to its timeless appeal, cultural significance, and perceived value as a safe investment. Additionally, diamonds command a significant share, prized for their brilliance, rarity, and enduring status as symbols of luxury and romance.

Based on Product Type, the market is segmented based on Necklace, Ring, Earrings, Others. In the jewelry retail market, gold remains a dominant segment due to its timeless appeal, cultural significance, and perceived value as a safe investment. Additionally, diamonds command a significant share, prized for their brilliance, rarity, and enduring status as symbols of luxury and romance.

By Material Type

Based on Material Types, the market has been divided into the Gold, Platinum, Diamond, Others. Among product types, rings stand out as a dominant segment in the jewelry retail market, owing to their versatility as symbols of commitment, fashion accessories, and expressions of personal style. Additionally, necklaces hold a prominent position, appreciated for their adornment and ability to complement various outfits and occasions.

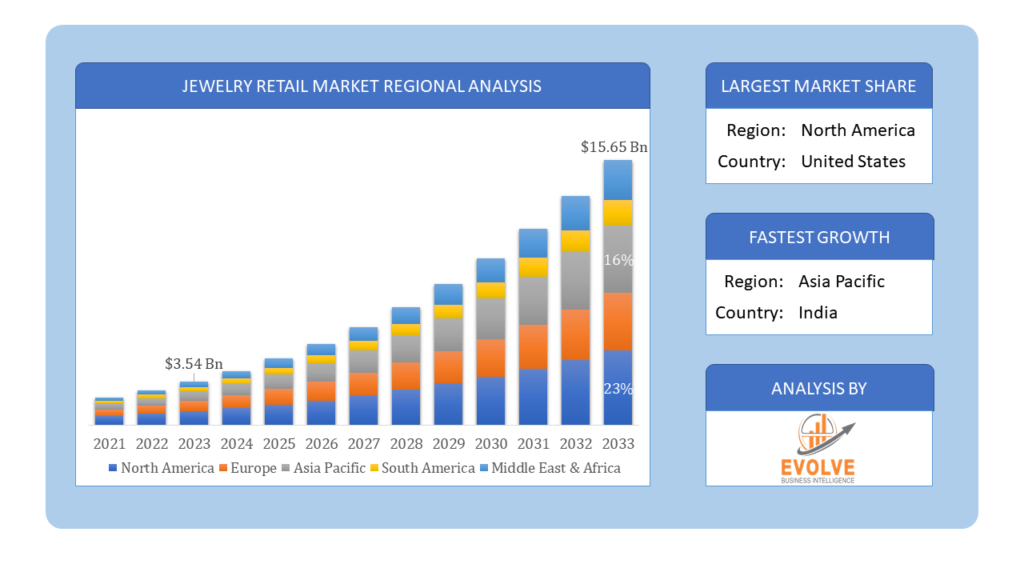

Global Jewelry Retail Market Regional Analysis

Based on region, the global Jewelry Retail market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Europe is projected to dominate the use of the Jewelry Retail market followed by the Asia-Pacific and north America regions.

Jewelry Retail Europe Market

Jewelry Retail Europe Market

Europe holds a dominant position in the Jewelry Retail Market. The market for luxury jewelry in Europe, which was valued at USD 56.5 billion in 2022, is anticipated to increase at a substantial CAGR during the course of the study. This is due to the well-established market for luxury jewelry items, which has seen growth in Europe due to major trends including personalization, the growing appeal of pop-up stores, and the blending of costume jewelry with current fashion trends.

Jewelry Retail Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Jewelry Retail industry. The luxury jewelry market in Asia-Pacific is anticipated to expand at the quickest rate possible between 2022 and 2030. This is a result of factors such as growing personal disposable income, modernity, globalization, and an ever-increasing population. The availability of fine jewelry will further contribute to the market’s expansion in this area. In addition, the luxury jewelry market in China accounted for the greatest portion of the Asia-Pacific market, while the luxury jewelry market in India grew at the fastest rate.

Competitive Landscape

The global Jewelry Retail market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Tiffany & Co

- Pandora

- Signet Jewellers

- Stern

- Chow Tai Fook

- Swarovski

- Cartier

- Buccellati

- Kalyan Jewelers

- SWATCH GROUP

Key Development

May 2021: Tiffany and Co., a US-based driving gems brand, reported its arrangement of delivering its first men’s wedding bands. The design extends their purchaser base and taps the developing business sector because of the expanding same-sex relationships and sexual orientation liquid style.

Scope of the Report

Global Jewelry Retail Market, by Product

- Necklace

- Ring

- Earrings

- Others

Global Jewelry Retail Market, by Material Type

- Gold

- Platinum

- Diamond

- Others

Global Jewelry Retail Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $15.65 Billion |

| CAGR | 5.47% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Material Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Tiffany & Co, Pandora, Signet Jewellers, Stern, Chow Tai Fook, Swarovski, Cartier, Buccellati, Kalyan Jewelers, SWATCH GROUP |

| Key Market Opportunities | • Expanding interest in men’s adornments, Expanding the impact of online media |

| Key Market Drivers | • Raising discretionary cash flow levels, Expanded interest for very good quality style things |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Jewelry Retail market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Jewelry Retail market historical market size for the year 2021, and forecast from 2023 to 2033

- Jewelry Retail market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Jewelry Retail market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Jewelry Retail Market?

The study period for the Jewelry Retail Market is from 2023 to 2033.

What is the growth rate of the Jewelry Retail Market?

The Jewelry Retail Market is expected to expand at a compound annual growth rate (CAGR) of 5.47% from 2023 to 2033.

Which region has the highest growth rate in the Jewelry Retail Market?

The Asia-Pacific region is the fastest-growing market for the Jewelry Retail industry.

Which region has the largest share of the Jewelry Retail Market?

Europe holds the dominant position in the global Jewelry Retail Market.

Who are the key players in the Jewelry Retail Market?

Key players in the Jewelry Retail Market include Tiffany & Co, Pandora, Signet Jewellers, Stern, Chow Tai Fook, Swarovski, Cartier, Buccellati, Kalyan Jewelers, and SWATCH GROUP.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Types Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Jewelry Retail Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Jewelry Retail Market 4.8. Import Analysis of the Jewelry Retail Market 4.9. Export Analysis of the Jewelry Retail Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Jewelry Retail Market, By Product Type 6.1. Introduction 6.2. Necklace 6.3. Ring 6.4. Earrings 6.5. Others Chapter 7. Global Jewelry Retail Market, By Material Type 7.1. Introduction 7.2. Gold 7.3. Platinum 7.4. Diamond 7.5. Others Chapter 8. Global Jewelry Retail Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By Material Type, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Material Type, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Material Type, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Material Type, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Material Type, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Material Type, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Material Type, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Material Type, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Material Type, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Material Type, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Material Type, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Material Type, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Material Type, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Material Type, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Material Type, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Material Type, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Tiffany & Co 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Pandora 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Signet Jewellers 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Stern 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Chow Tai Fook 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Swarovski 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Cartier 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Buccellati 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Kalyan Jewelers 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. SWATCH GROUP 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology