Industrial Wearables Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

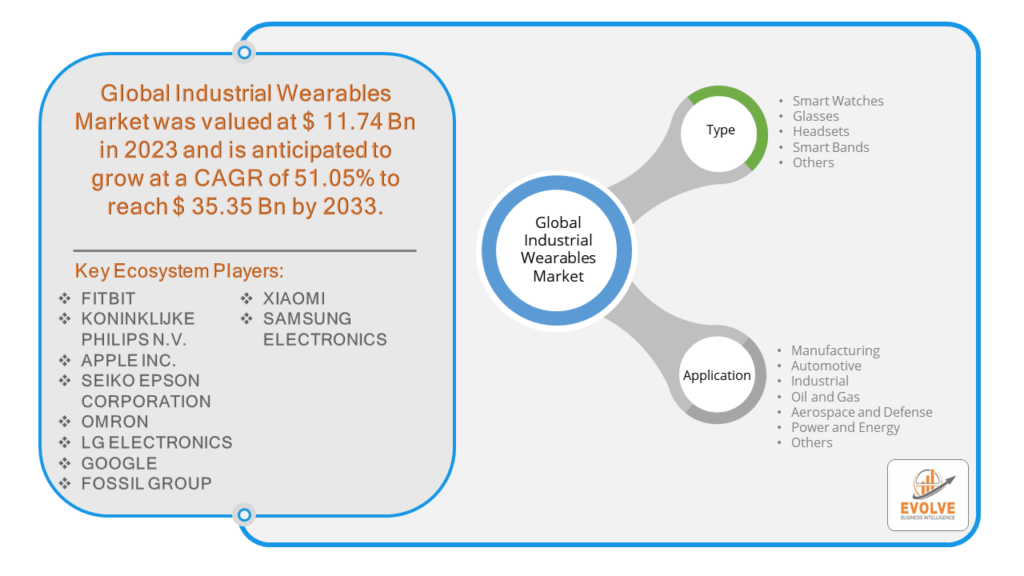

Industrial Wearables Market Research Report: Information By Type (Smart Watches, Glasses, Headsets, Smart Bands, Others), By Application (Manufacturing, Automotive, Industrial, Oil and Gas, Aerospace and Defense, Power and Energy, Others), and by Region — Forecast till 2033

Page: 100

Industrial Wearables Market Overview

The Industrial Wearables Market Size is expected to reach USD 35.35 Billion by 2033. The Industrial Wearables Market industry size accounted for USD 11.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 51.05% from 2023 to 2033. The Industrial Wearables Market refers to the sector encompassing wearable technology specifically designed for industrial applications. These devices are used to enhance worker safety, productivity, and efficiency in various industrial environments such as manufacturing, construction, logistics, and field services.

These wearables help improve operational efficiency, enhance safety protocols, provide better training and maintenance support, and enable data-driven decision-making in industrial settings. The market for industrial wearables is growing due to advancements in technology, increased emphasis on worker safety, and the demand for improved operational efficiency.

Global Industrial Wearables Market Synopsis

The COVID-19 pandemic had a significant impact on the Industrial Wearables Market. The need for monitoring worker health became more critical, driving demand for wearables that could track vital signs, detect symptoms of illness, and ensure social distancing. Wearable devices helped implement enhanced safety protocols, such as contact tracing and proximity alerts, to prevent the spread of the virus in industrial environments. With travel restrictions and social distancing measures in place, wearable devices such as smart glasses enabled remote assistance, inspections, and training, reducing the need for physical presence. Wearable technology facilitated better workforce management by providing real-time data on worker location, health status, and productivity, aiding in efficient decision-making and resource allocation.

Industrial Wearables Market Dynamics

The major factors that have impacted the growth of Industrial Wearables Market are as follows:

Drivers:

Ø Technological Advancements

Wearable technology helps streamline operations by providing workers with immediate access to information, instructions, and real-time data. This leads to improved task execution, reduced downtime, and higher overall productivity. The ability to provide remote support through wearable devices like smart glasses and wearable cameras has become increasingly valuable. This is particularly important for maintenance, inspections, and training, allowing experts to assist from a distance. Continuous advancements in wearable technology, including improved sensors, better connectivity, and integration with other industrial systems (such as IoT and AI), are driving the adoption of industrial wearables.

Restraint:

- Perception of High Initial Costs

The acquisition and implementation of industrial wearables can be expensive. The cost of devices, along with the necessary infrastructure and integration with existing systems, can be a significant barrier for many organizations, especially small and medium-sized enterprises (SMEs). Wearable devices collect and transmit large amounts of sensitive data, raising concerns about data security and privacy. Organizations must ensure robust cybersecurity measures to protect this data from breaches and misuse, which can be challenging and costly. Workers may be resistant to adopting new technologies, particularly if they perceive wearables as intrusive or cumbersome. Proper training and change management are essential to ensure user acceptance and effective utilization of wearable devices.

Opportunity:

⮚ Growing demand for Advanced Analytics and AI

While manufacturing, construction, and logistics have been early adopters of industrial wearables, there is significant potential for expansion into other sectors such as healthcare, agriculture, mining, and oil and gas, where worker safety and productivity are critical. Leveraging the data collected from wearable devices through advanced analytics and artificial intelligence (AI) can provide deeper insights into worker behavior, health, and productivity. This can help in identifying patterns, predicting potential issues, and making data-driven decisions to enhance overall efficiency and safety. Wearables with advanced health monitoring capabilities, such as stress and fatigue detection, can play a crucial role in preventing workplace accidents and improving worker well-being. These features are particularly relevant in high-stress and physically demanding environments.

Industrial Wearables Market Segment Overview

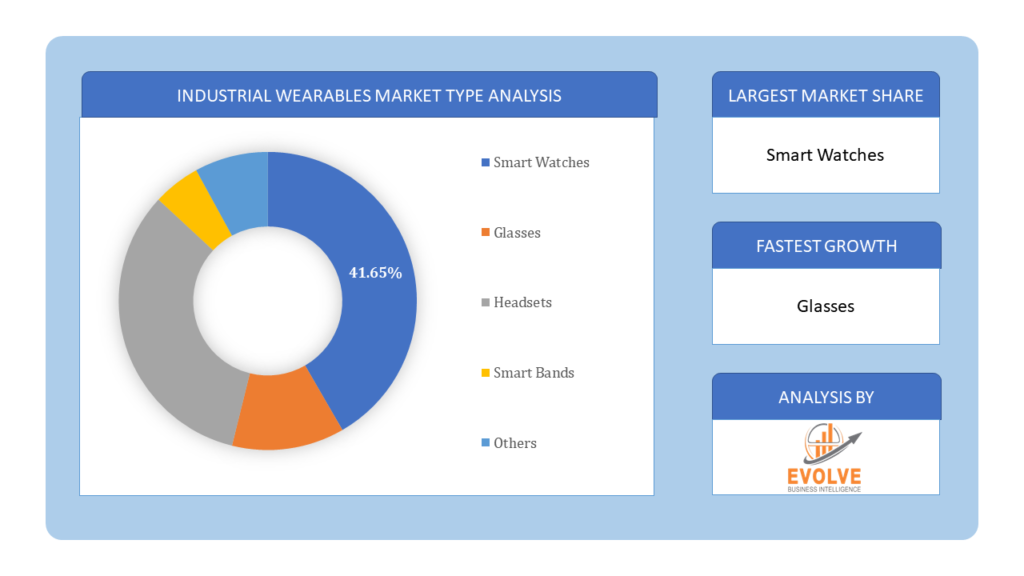

By Type

Based on Type, the market is segmented based on Smart Watches, Glasses, Headsets, Smart Bands and Others. The Glasses segment dominant the market. Industrial smart glasses are particularly useful on production lines. They can display step-by-step assembly instructions directly in the worker’s field of vision, eliminating the need to constantly switch between tasks or refer to manuals. This hands-free approach translates to smoother workflows and better overall output.

Based on Type, the market is segmented based on Smart Watches, Glasses, Headsets, Smart Bands and Others. The Glasses segment dominant the market. Industrial smart glasses are particularly useful on production lines. They can display step-by-step assembly instructions directly in the worker’s field of vision, eliminating the need to constantly switch between tasks or refer to manuals. This hands-free approach translates to smoother workflows and better overall output.

By Application

Based on Application, the market segment has been divided into the Manufacturing, Automotive, Industrial, Oil and Gas, Aerospace and Defense, Power and Energy and Others. The Manufacturing segment dominant the market. Wearables can collect valuable data on worker performance, equipment usage, and production processes. This data can be analyzed to identify areas for improvement and optimize operations. As technology advances and wearables become more affordable and user-friendly, their adoption in manufacturing is poised to increase significantly.

Global Industrial Wearables Market Regional Analysis

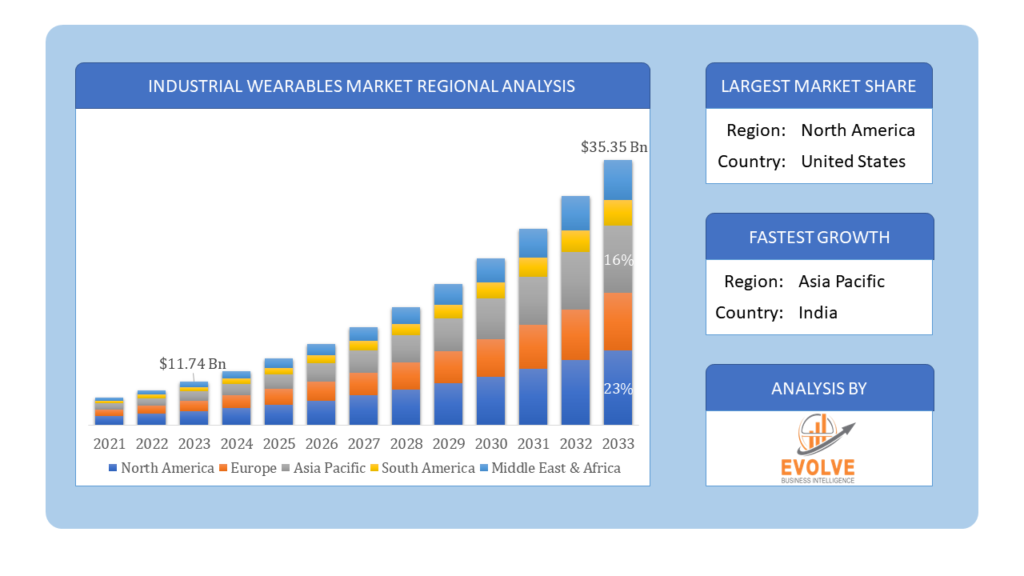

Based on region, the global Industrial Wearables Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Industrial Wearables Market followed by the Asia-Pacific and Europe regions.

Industrial Wearables North America Market

Industrial Wearables North America Market

North America holds a dominant position in the Industrial Wearables Market. North America, particularly the United States, has a high adoption rate of industrial wearables due to the presence of advanced industries, significant investment in technology, and a strong focus on worker safety. The region is home to many leading tech companies and startups driving innovation in wearable technology. The pandemic accelerated the adoption of wearables for health monitoring and remote collaboration.

Industrial Wearables Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Industrial Wearables Market industry. Rapid industrial growth and technological advancements in countries like China, Japan, and South Korea drive the market. High demand for improving operational efficiency and productivity in manufacturing sectors. Government initiatives supporting industrial automation and worker safety bolster market growth. The need to manage large industrial workforces effectively fuels the demand for wearable solutions.

Competitive Landscape

The global Industrial Wearables Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- FITBIT

- KONINKLIJKE PHILIPS N.V.

- APPLE INC.

- SEIKO EPSON CORPORATION

- OMRON

- LG ELECTRONICS

- FOSSIL GROUP

- XIAOMI

- SAMSUNG ELECTRONICS

Scope of the Report

Global Industrial Wearables Market, by Type

- Smart Watches

- Glasses

- Headsets

- Smart Bands

- Others

Global Industrial Wearables Market, by Application

- Manufacturing

- Automotive

- Industrial

- Oil and Gas

- Aerospace and Defense

- Power and Energy

- Others

Global Industrial Wearables Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $35.35 Billion |

| CAGR | 51.05% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | FITBIT, KONINKLIJKE PHILIPS N.V., APPLE INC., SEIKO EPSON CORPORATION, OMRON, LG ELECTRONICS, GOOGLE, FOSSIL GROUP, XIAOMI and SAMSUNG ELECTRONICS |

| Key Market Opportunities | • The growing demand for Advanced Analytics and AI • Enhanced Health Monitoring |

| Key Market Drivers | • Technological Advancements • Increased Productivity and Efficiency |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Industrial Wearables Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Industrial Wearables Market historical market size for the year 2021, and forecast from 2023 to 2033

- Industrial Wearables Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Industrial Wearables Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Industrial Wearables Market?

The study period for the Industrial Wearables Market spans from 2023 to 2033.

What is the growth rate of the Industrial Wearables Market?

The Industrial Wearables Market is expected to grow at a compound annual growth rate (CAGR) of 51.05% from 2023 to 2033.

Which region has the highest growth rate in the Industrial Wearables Market?

The Asia-Pacific region has the highest growth rate in the Industrial Wearables Market.

Which region has the largest share of the Industrial Wearables Market?

North America holds the largest share of the Industrial Wearables Market.

Who are the key players in the Industrial Wearables Market?

Key players in the Industrial Wearables Market include FITBIT, KONINKLIJKE PHILIPS N.V., APPLE INC., SEIKO EPSON CORPORATION, OMRON, and LG ELECTRONICS.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Industrial Wearables Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Industrial Wearables Market 4.8. Import Analysis of the Industrial Wearables Market 4.9. Export Analysis of the Industrial Wearables Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Industrial Wearables Market, By Type 6.1. Introduction 6.2. Smart Watches 6.3. Glasses 6.4. Headsets 6.5. Smart Bands 6.6. Others Chapter 7. Global Industrial Wearables Market, By Application 7.1. Introduction 7.2. Manufacturing 7.3. Automotive 7.4 Industrial 7.5 Oil and Gas 7.6 Aerospace and Defense 7.7 Power and Energy 7.8 Others Chapter 8. Global Industrial Wearables Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. FITBIT 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. KONINKLIJKE PHILIPS N.V. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. APPLE INC. 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. SEIKO EPSON CORPORATION 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. OMRON 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. LG ELECTRONICS 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. GOOGLE 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 FOSSIL GROUP 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 XIAOMI 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. SAMSUNG ELECTRONICS 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology