Industrial Valves Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

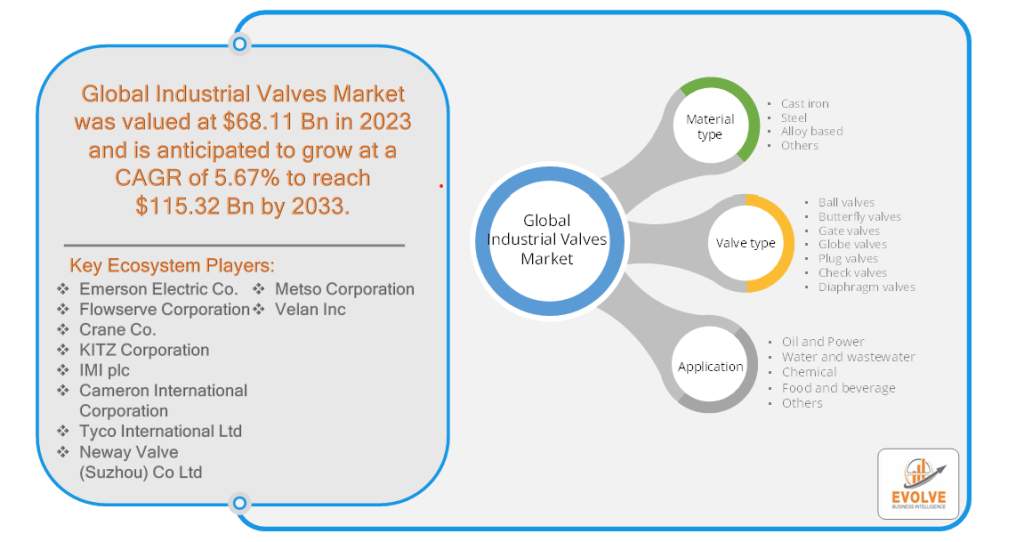

Industrial Valves Market Research Report: By Material Type (Cast Iron, Steel, Alloy Based, Others), By Valve Type (Ball Valves, Butterfly Valves, Gate Valves, Globe Valves, Plug Valves, Check Valves, Diaphragm Valves), By Valve Type (Oil And Power, Water And Wastewater, Chemical, Food And Beverage, Others), and by Region — Forecast till 2033

Industrial Valves Market Overview

Industrial Valves Market Size is expected to reach USD 115.32 Billion by 2033. The Industrial Valves industry size accounted for USD 68.11 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.67% from 2023 to 2033.

Industrial valves are mechanical devices used to control and regulate the flow of fluids (liquids, gases, or slurries) within industrial processes. These valves are specifically designed and constructed to withstand the demanding conditions encountered in industrial settings, such as high pressure, high temperature, corrosive environments, or abrasive media. Industrial valves play a critical role in various industries, including oil and gas, chemical processing, power generation, water treatment, pharmaceuticals, and manufacturing. They are utilized to start, stop, or modulate the flow of fluids, as well as to control the direction, pressure, and volume of fluid flow. These valves consist of various components, including a body or casing, an actuator for controlling the valve’s position, a closure element (such as a disc, ball, or plug) that opens or closes the flow path, and sealing elements to prevent leakage. Valves can be classified into different types based on their design, such as gate valves, globe valves, ball valves, butterfly valves, check valves, and plug valves, each suited for specific Valve Types and operating conditions.

Global Industrial Valves Market Synopsis

The COVID-19 pandemic significantly impacted the Industrial Valves market, causing disruptions and changes in demand patterns. The lockdown measures and restrictions imposed by governments worldwide resulted in reduced industrial activities and project delays, affecting the demand for industrial valves. Many industries, such as oil and gas, manufacturing, and construction, experienced slowdowns or temporary shutdowns, leading to a decline in new installations and maintenance projects. Additionally, supply chain disruptions, including raw material shortages and transportation challenges, further hampered the availability and delivery of valves. However, as economies gradually recover and industries resume operations, the Industrial Valves market is expected to regain momentum, driven by infrastructure development, increased investments in sectors like water treatment and renewable energy, and the need to upgrade existing facilities for enhanced efficiency and safety.

Global Industrial Valves Market Dynamics

The major factors that have impacted the growth of Industrial Valves are as follows:

Drivers:

Increasing global demand for industrial valves in key industries

The Industrial Valves Market is driven by the growing demand for valves in industries such as oil and gas, chemicals, water and wastewater treatment, and power generation. This demand is fueled by factors like infrastructure development, industrialization, and the need for efficient process control and safety measures.

Restraint:

- Volatility in raw material prices

The Industrial Valves Market faces the challenge of fluctuating raw material prices, particularly steel, and alloys. The cost of these materials directly impacts the production costs of valves. When raw material prices increase, it puts pressure on valve manufacturers’ profit margins, making it challenging to maintain competitive pricing.

Opportunity:

Technological advancements and the adoption of smart valves

The Industrial Valves Market presents opportunities through technological advancements. The development and adoption of smart valves, equipped with sensors, automation, and remote monitoring capabilities, offer improved efficiency, real-time data monitoring, predictive maintenance, and optimized performance. These smart valves enhance process control, reduce downtime, and enable better decision-making for industries that rely on industrial valves.

Industrial Valves Market Segment Overview

By Material Type

Based on the Material Type, the market is segmented based on Cast iron, Steel, Alloy based, and Others. The Cast iron segment was projected to hold the largest market share in the Industrial Valves market. Cast iron valves are widely used across various industries due to their excellent durability, cost-effectiveness, and resistance to corrosion and high temperatures. They are especially favored in applications where strength and reliability are critical, such as in the oil and gas, water and wastewater, and chemical industries. Additionally, cast iron valves are known for their ease of installation and maintenance, making them a popular choice among end-users. The projected dominance of the cast iron segment reflects the continued preference for these valves, driven by their reliable performance and suitability for a wide range of industrial applications.

By Valve Type

Based on the Valve Type, the market has been divided into Ball valves, Butterfly valves, Gate valves, Globe valves, Plug valves, Check valves, and Diaphragm valves. The Ball valves segment is expected to hold the largest market share in the Market. These valves are widely utilized across various industries, including oil and gas, water and wastewater, chemicals, and power generation, due to their versatility and reliability. Moreover, the growing adoption of ball valves in industrial processes, driven by their ease of operation and low maintenance requirements, further contributes to their dominant market position.

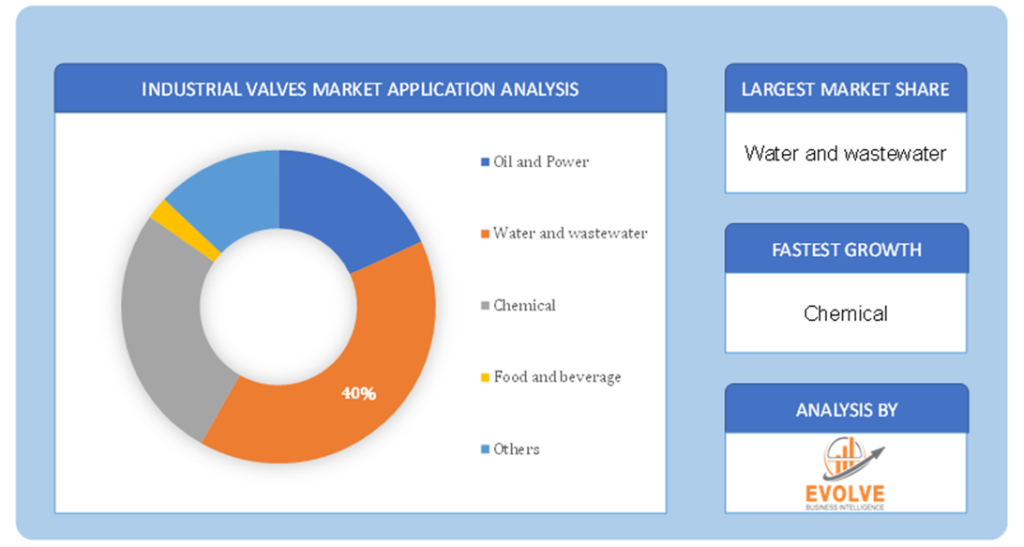

By Application

Based on Application, the market has been divided into Oil And Power, Water And Wastewater, Chemicals, Food And Beverage, and Others. The Water And Wastewater segment is projected to experience significant growth in the Industrial Valves market. This can be attributed to several factors driving the demand for valves in water and wastewater treatment applications. The increasing population, urbanization, and industrialization have led to a surge in the demand for efficient water management systems and wastewater treatment facilities.

Based on Application, the market has been divided into Oil And Power, Water And Wastewater, Chemicals, Food And Beverage, and Others. The Water And Wastewater segment is projected to experience significant growth in the Industrial Valves market. This can be attributed to several factors driving the demand for valves in water and wastewater treatment applications. The increasing population, urbanization, and industrialization have led to a surge in the demand for efficient water management systems and wastewater treatment facilities.

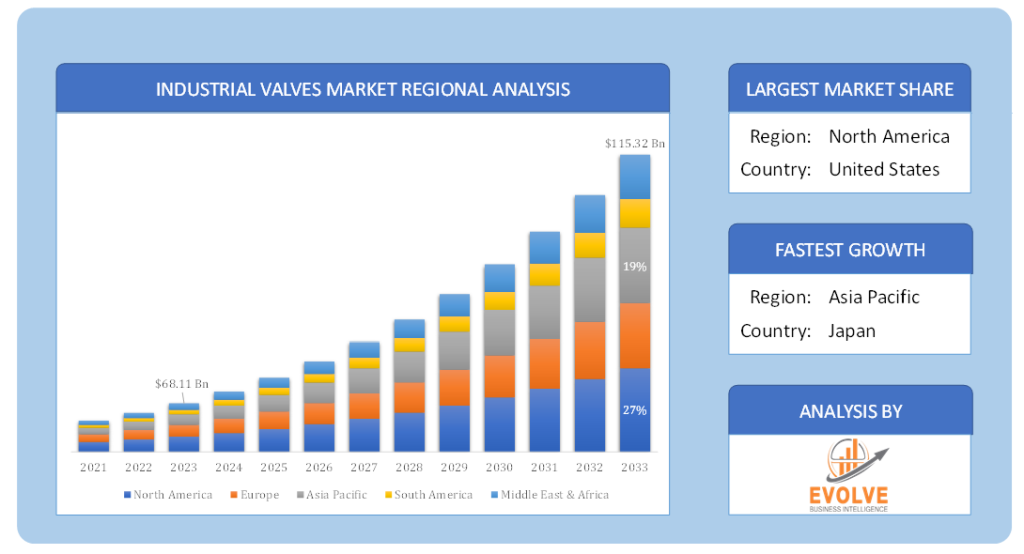

Global Industrial Valves Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Industrial Valves, followed by those in Asia-Pacific and Europe.

North America Market

North America has consistently maintained the largest market share in the Industrial Valves market. This can be attributed to several factors such as the region’s robust industrial infrastructure, advanced manufacturing capabilities, and the presence of major industries like oil and gas, chemical, and power generation. Additionally, stringent safety regulations and environmental standards in North America have compelled industries to invest in high-quality valves for process control and efficiency. Moreover, ongoing investments in infrastructure development, including pipeline networks and water treatment facilities, further drive the demand for industrial valves in the region. The strong market position of North America in the Industrial Valves sector is expected to continue due to continuous technological advancements and the region’s focus on sustainable industrial practices.

Asia Pacific Market

The Asia-Pacific region has been witnessing a significant growth rate in the Industrial Valves industry, as indicated by its growing compound annual growth rate (CAGR). This can be attributed to several factors driving market expansion in the region. The rapid industrialization and urbanization in countries like China and India have created a surge in demand for industrial valves across various sectors, including oil and gas, chemicals, water and wastewater treatment, and power generation. Additionally, increasing investments in infrastructure development, such as the construction of new manufacturing plants, pipelines, and water supply systems, has further propelled the demand for industrial valves in the Asia-Pacific region. Moreover, the presence of emerging economies, favorable government initiatives, and a rising focus on sustainable practices are contributing to the continuous growth of the Industrial Valves market in the Asia-Pacific region.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Emerson Electric Co, Flowserve Corporation, Crane Co, KITZ Corporation, and IMI plc are some of the leading players in the global Industrial Valves Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Emerson Electric Co

- Flowserve Corporation

- Crane Co

- KITZ Corporation

- IMI plc

- Cameron International Corporation

- Tyco International Ltd

- Neway Valve (Suzhou) Co Ltd

- Metso Corporation

- Velan Inc

Key development:

In November 2022, IMI Saudi Industry, a subsidiary of IMI Critical Engineering, inaugurated a state-of-the-art facility spanning 5,000 m2 in Dammam. The facility aims to provide innovative valve solutions and enhance domestic manufacturing capabilities in alignment with the Saudi Arabian government’s strategy to localize essential products.

In November 2022, James Walker introduced the Supagraf HT valve stem seal designed specifically for molten salt media. This advanced seal is capable of withstanding extremely high temperatures and effectively handling chemically aggressive and corrosive substances like molten salts. It caters to the rigorous demands of valves, process equipment, and other sealing applications operating under such challenging conditions.

Scope of the Report

Global Industrial Valves Market, by Material Type

- Cast iron

- Steel

- Alloy based

- Others

Global Industrial Valves Market, by Valve Type

- Ball valves

- Butterfly valves

- Gate valves

- Globe valves

- Plug valves

- Check valves

- Diaphragm valves

Global Industrial Valves Market, by Valve Type

- Oil and Power

- Water and wastewater

- Chemical

- Food and beverage

- Others

Global Industrial Valves Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $115.32 Billion |

| CAGR | 5.67% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material type, Valve type, Valve Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Emerson Electric Co, Flowserve Corporation, Crane Co, KITZ Corporation, IMI plc, Cameron International Corporation, Tyco International Ltd, Neway Valve (Suzhou) Co Ltd, Metso Corporation, Velan Inc |

| Key Market Opportunities | • Rising focus on renewable energy sources like wind and solar power, driving the need for valves in power generation and distribution systems. • Increasing awareness and implementation of environmental regulations, leading to the replacement and upgrade of outdated valves with more efficient and eco-friendly alternatives. • Technological advancements |

| Key Market Drivers | • Increasing demand for industrial valves in the oil and gas industry. • Growing demand for industrial valves in the water and wastewater treatment sector. • Rising focus on renewable energy sources and the subsequent need for valves in the power generation industry. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Industrial Valves Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Industrial Valves market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Industrial Valves market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Industrial Valves Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Industrial Valves market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Industrial Valves market?

The global Industrial Valves market is growing at a CAGR of ~67% over the next 10 years

Which region has the highest growth rate in the market of Industrial Valves?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Industrial Valves?

North America holds the largest share in 2022

Major Key Players in the Market of Stem Cell Manufacturers?

Emerson Electric Co, Flowserve Corporation, Crane Co, KITZ Corporation, IMI plc, Cameron International Corporation, Tyco International Ltd, Neway Valve (Suzhou) Co Ltd, Metso Corporation, and Velan Inc are the major companies operating in the Industrial Valves

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Material Type Segement – Market Opportunity Score 4.1.2. Valve Type Segment – Market Opportunity Score 4.1.3. Valve Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Industrial Valves Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Industrial Valves Market, By Material Type 7.1. Introduction 7.1.1. Cast iron 7.1.2. Steel 7.1.3. Alloy based 7.1.4. Others CHAPTER 8. Global Industrial Valves Market, By Valve Type 8.1. Introduction 8.1.1. Ball valves 8.1.2. Butterfly valves 8.1.3. Gate valves 8.1.4. Globe valves 8.1.5. Plug valves 8.1.6. Check valves 8.1.7. Diaphragm valves CHAPTER 9. Global Industrial Valves Market, By Valve Type 9.1. Introduction 9.1.1. Oil and Power 9.1.2. Water and wastewater 9.1.3. Chemical 9.1.4. Food and beverage 9.1.5. Others CHAPTER 10. Global Industrial Valves Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Valve Type, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Emerson Electric Co 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Flowserve Corporation 13.3. Crane Co 13.4. KITZ Corporation 13.5. IMI plc 13.6. Cameron International Corporation 13.7. Tyco International Ltd 13.8. Neway Valve (Suzhou) Co Ltd 13.9. Metso Corporation 13.10. Velan Inc

Connect to Analyst

Research Methodology