Heat Exchanger Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

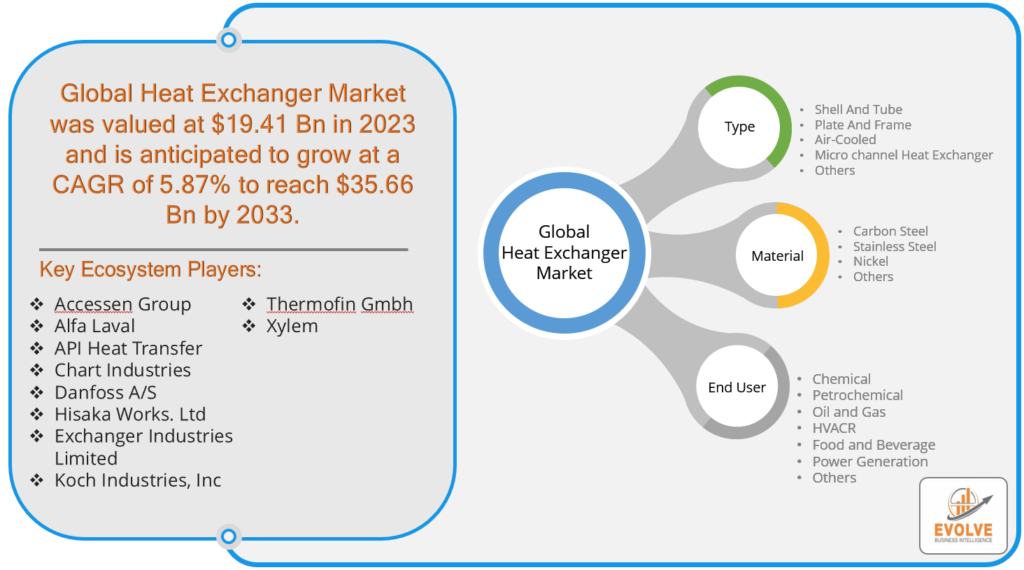

Heat Exchanger Market By Material (Steel, Non-Steel), By End-Use (Chemical, Energy, Power, Food & Beverages, Pulp & Paper, and others), By Type (Shell & Tube, Plate & Frame, Air Cooled, and Others) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2023-2033

Page: 161

Heat Exchanger Market Overview

The Heat Exchanger Market Size is expected to reach USD 35.66 Billion by 2033. The Heat Exchanger industry size accounted for USD 19.41 Billion in 2023 and is expected to expand at a CAGR of 5.87% from 2023 to 2033. A heat exchanger is a mechanical device designed to facilitate the efficient transfer of thermal energy (heat) between two or more fluids, typically at different temperatures, without allowing them to mix. It consists of a set of heat transfer surfaces, often in the form of plates, tubes, or coils, that enable the transfer of heat from one fluid to another through conduction. Heat exchangers find extensive application in various industries, including HVAC systems, power generation, chemical processing, and refrigeration, to optimize temperature control, energy utilization, and overall system efficiency.

Global Heat Exchanger Market Synopsis

The Heat Exchanger market experienced a dual effect from the COVID-19 pandemic. In the initial stages, supply chains, manufacturing, and project schedules were disrupted due to lockdowns and reduced economic activity. This led to decreased demand in industries heavily reliant on heat exchangers, such as automotive, aerospace, and construction. Conversely, the healthcare and pharmaceutical sectors witnessed heightened demand for heat exchangers, driven by vaccine production and testing needs. Concurrently, essential sectors like food processing and energy continued to rely on heat exchangers. As the pandemic evolved, the market gradually rebounded as businesses adapted to new safety protocols. Notably, the HVAC sector experienced growth due to a heightened focus on ventilation and air quality, underscoring the pandemic’s multifaceted impact on the heat exchanger market.

Global Heat Exchanger Market Dynamics

The major factors that have impacted the growth of Heat Exchanger are as follows:

Drivers:

⮚ Energy Efficiency Regulations

The Heat Exchanger market is the increasing emphasis on energy efficiency and sustainability across industries. Stricter energy efficiency regulations and environmental standards are compelling businesses to adopt heat exchangers as they offer efficient heat transfer and reduce energy consumption. This driver stimulates demand as companies seek to optimize their processes and reduce carbon footprints through the use of heat exchangers.

Restraint:

- High Initial Costs

A significant restraint in the Heat Exchanger market is the high initial capital costs associated with purchasing and installing heat exchanger systems. These costs encompass the equipment itself, installation, maintenance, and related infrastructure modifications. For many businesses, especially smaller ones, these upfront expenses can be a barrier to entry. Overcoming this restraint may require financial incentives, improved financing options, or innovative cost-sharing models.

Opportunity:

⮚ Growing Demand in Emerging Markets

An opportunity in the Heat Exchanger market lies in the growing demand for heat exchangers in emerging markets. Rapid industrialization and urbanization in countries within Asia, Africa, and Latin America are driving increased demand for industrial heat exchangers in applications like manufacturing, construction, and energy production. The expansion of these markets presents a significant growth opportunity for heat exchanger manufacturers and suppliers willing to tap into these regions and adapt their products to local requirements.

Heat Exchanger Market Segment Overview

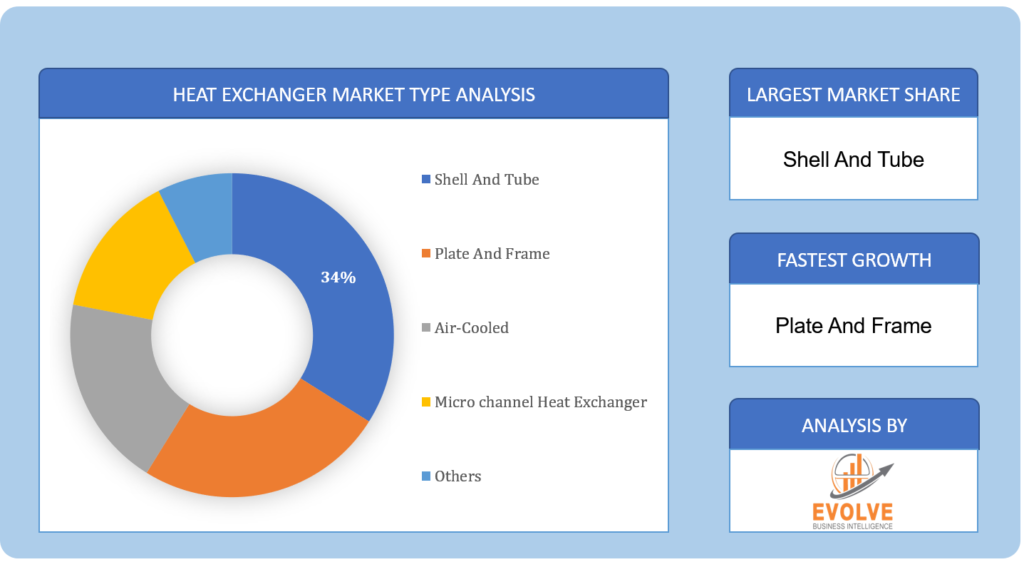

By Type

Based on the Type, the market is segmented based on Shell And Tube, Plate And Frame, Air-Cooled, Microchannel Heat Exchanger, and Others. The Shell and Tube segment was projected to hold the largest market share in the Heat Exchanger market due to its widespread use in various industries and efficient heat transfer capabilities.

Based on the Type, the market is segmented based on Shell And Tube, Plate And Frame, Air-Cooled, Microchannel Heat Exchanger, and Others. The Shell and Tube segment was projected to hold the largest market share in the Heat Exchanger market due to its widespread use in various industries and efficient heat transfer capabilities.

By Material

Based on the Material, the market has been divided into Carbon Steel, Stainless Steel, Nickel, and Others. The Carbon Steel segment is expected to hold the largest market share in the Heat Exchanger market due to its cost-effectiveness and high corrosion resistance properties, making it a preferred choice in various industrial applications.

By End User

Based on End User, the market has been divided into Chemical, Petrochemical, Oil and Gas, HVACR, Food and Beverage, Power Generation, and Others. The Chemical segment is expected to hold the largest market share in the Heat Exchanger market due to its extensive usage in chemical processing applications, where precise temperature control and material compatibility are crucial.

Global Heat Exchanger Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Heat Exchangers, followed by those in Asia-Pacific and Europe.

Heat Exchanger North America Market

North America asserts dominance in the Heat Exchanger market due to several compelling factors. The region benefits from a robust industrial landscape, including the presence of advanced manufacturing, petrochemical, and energy sectors, all of which have substantial demand for heat exchangers. Moreover, North America’s stringent environmental regulations drive the adoption of heat exchangers for emissions control, further boosting market growth. The region’s focus on energy efficiency, coupled with a mature HVAC industry and investments in renewable energy projects, continues to stimulate demand for heat exchanger technologies. Additionally, a well-established infrastructure and technological advancements contribute to North America’s leading position in the global Heat Exchanger market.

Heat Exchanger Asia Pacific Market

The Asia-Pacific region has been experiencing remarkable growth in the Heat Exchanger market, propelled by several key factors. Rapid industrialization, urbanization, and infrastructure development across countries like China, India, and Southeast Asian nations have led to increased demand for heat exchangers in various sectors, including manufacturing, construction, and power generation. The booming automotive and electronics industries, coupled with substantial investments in energy and renewable projects, further contribute to the region’s heat exchanger market expansion. Additionally, Asia-Pacific’s focus on energy efficiency and adherence to environmental regulations drives the adoption of heat exchanger technologies, making it a pivotal growth hub for the global market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Accessen Group, Alfa Laval, API Heat Transfer, Chart Industries, and Danfoss A/S are some of the leading players in the global Heat Exchanger Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Accessen Group

- Alfa Laval

- API Heat Transfer

- Chart Industries

- Danfoss A/S

- Hisaka Works Ltd

- Exchanger Industries Limited

- Koch Industries, Inc

- Thermofin Gmbh

- Xylem

Key development:

In April 2023, Indian researchers achieved a breakthrough by designing a photovoltaic (PV)-powered earth-to-air heat exchanger, intended for efficient space heating and cooling within buildings. Their study suggests that this innovative system has the potential to generate an annual energy surplus of 8116.7 kWh.

In February 2022, Tranter secured a significant European EPC business contract for a petrochemical venture located in Eastern Europe. The company’s project scope encompasses the supply of 37 large-scale heat exchangers, representing all product lines. Notably, this includes the inclusion of four oversized shell-and-plate heat exchangers, specifically employed for heat recovery services operating at elevated temperatures.

Scope of the Report

Global Heat Exchanger Market, by Type

- Shell And Tube

- Plate And Frame

- Air-Cooled

- Microchannel Heat Exchanger

- Others

Global Heat Exchanger Market, by Material

- Carbon Steel

- Stainless Steel

- Nickel

- Others

Global Heat Exchanger Market, by End User

- Chemical

- Petrochemical

- Oil and Gas

- HVACR

- Food and Beverage

- Power Generation

- Others

Global Heat Exchanger Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $35.66 Billion |

| CAGR | 5.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Material, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Accessen Group, Alfa Laval, API Heat Transfer, Chart Industries, Danfoss A/S, Hisaka Works Ltd, Exchanger Industries Limited, Koch Industries, Inc, Thermofin Gmbh, and Xylem |

| Key Market Opportunities | • Rapid industrialization and urbanization in emerging markets |

| Key Market Drivers | • Energy Efficiency Regulations |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Heat Exchanger Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Heat Exchanger market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Heat Exchanger market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Heat Exchanger Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Heat Exchanger market is 2022- 2033

What is the 10-year CAGR (2023 to 2033) of the global Heat Exchanger market?

The global Heat Exchanger market is growing at a CAGR of ~87% over the next 10 years

Which region has the highest growth rate in the market of Heat Exchanger?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Heat Exchanger?

North America holds the largest share in 2022

Major Key Players in the Market of Heat Exchanger Manufacturers?

Accessen Group, Alfa Laval, API Heat Transfer, Chart Industries, Danfoss A/S, Hisaka Works Ltd, Exchanger Industries Limited, Koch Industries, Inc, Thermofin Gmbh, and Xylem.

Do you offer post-sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Heat Exchanger Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Heat Exchanger Market, By Material 6.1. Introduction 6.2. Steel 6.3. Non-Steel Chapter 7. Global Heat Exchanger Market, By End-Use 7.1. Introduction 7.2. Chemical 7.3. Energy 7.4. Power 7.5. Food & Beverages 7.6. Pulp & Paper 7.7. Others Chapter 8. Global Heat Exchanger Market, By Type 8.1. Introduction 8.2. Shell & Tube 8.3. Plate & Frame 8.4. Air Cooled 8.5. Others Chapter 9. Global Heat Exchanger Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Material, 2020 - 2028 9.2.5. Market Size and Forecast, By End-Use, 2020 – 2028 9.2.6. Market Size and Forecast, By Type, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Material, 2020 - 2028 9.2.7.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.2.7.5. Market Size and Forecast, By Type, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Material, 2020 - 2028 9.2.8.5. Market Size and Forecast, By End-Use, 2020 – 2028 9.2.8.6. Market Size and Forecast, By Type, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Material, 2020 - 2028 9.3.5. Market Size and Forecast, By End-Use, 2020 – 2028 9.3.6. Market Size and Forecast, By Type, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.7.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.3.7.5. Market Size and Forecast, By Type, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.8.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.3.8.5. Market Size and Forecast, By Type, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.9.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.3.9.5. Market Size and Forecast, By Type, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.10.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.3.10.5. Market Size and Forecast, By Type, 2020 - 2028 9.3.11. Rest Of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.11.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.3.11.5. Market Size and Forecast, By Type, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Material, 2020 - 2028 9.4.5. Market Size and Forecast, By End-Use, 2020 – 2028 9.4.7. Market Size and Forecast, By Type, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.8.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.4.8.5. Market Size and Forecast, By Type, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.9.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.4.9.5. Market Size and Forecast, By Type, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.10.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.4.10.5. Market Size and Forecast, By Type, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.11.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.4.11.5. Market Size and Forecast, By Type, 2020 - 2028 9.4.12. Rest Of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.12.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.4.12.5. Market Size and Forecast, By Type, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Material, 2020 - 2028 9.5.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.5.5. Market Size and Forecast, By Type, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Material, 2020 - 2028 9.5.7.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.5.7.5. Market Size and Forecast, By Type, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Material, 2020 - 2028 9.5.8.4. Market Size and Forecast, By End-Use, 2020 – 2028 9.5.8.5. Market Size and Forecast, By Type, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Alfa Laval 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Kelvion Holdings 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Danfoss 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Xylem 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. API Heat Transfer 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Gunter 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Chart Industries 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Hisaka Works 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Johnson Controls International 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Hindustan Dorr-Oliver 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology