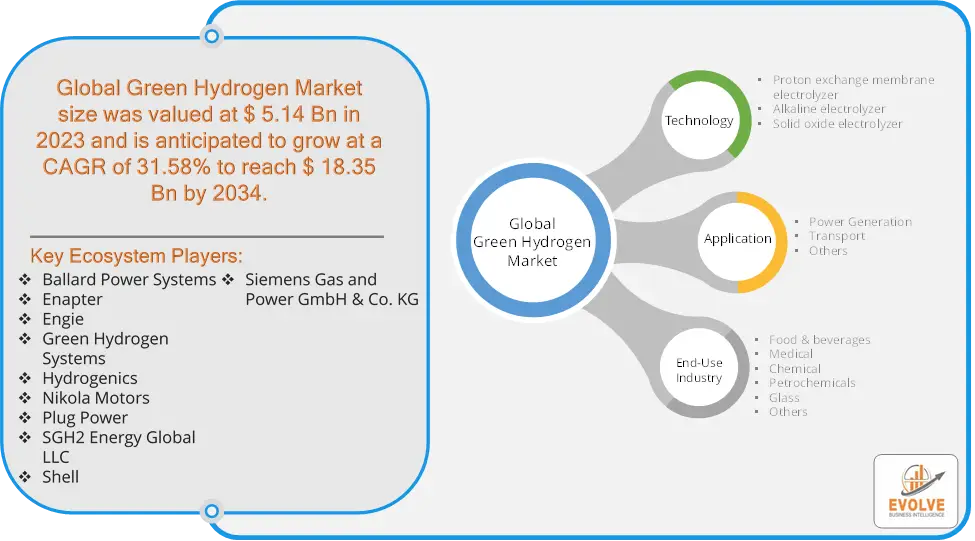

Green Hydrogen Market Overview

The Green Hydrogen Market size accounted for USD 5.14 Billion in 2023 and is estimated to account for 6.21 Billion in 2024. The Market is expected to reach USD 18.35 Billion by 2034 growing at a compound annual growth rate (CAGR) of 31.58% from 2024 to 2034. The green hydrogen market is a rapidly growing industry that focuses on the production, distribution, and utilization of hydrogen gas that is generated using renewable energy sources. It is a key component of the transition to a clean energy economy, as green hydrogen can be used as a clean fuel for transportation, energy storage, and industrial processes.

Despite these challenges, the green hydrogen market offers significant opportunities for businesses and investors. As the world transitions to a clean energy economy, green hydrogen is poised to play a vital role in meeting our energy needs while reducing greenhouse gas emissions.

Global Green Hydrogen Market Synopsis

Green Hydrogen Market Dynamics

Green Hydrogen Market Dynamics

The major factors that have impacted the growth of Green Hydrogen Market are as follows:

Drivers:

Ø Advancements in Electrolysis Technology

Improvements in electrolyzer efficiency, scalability, and cost reductions are making green hydrogen more economically viable. As electrolysis technology becomes more efficient and cheaper, the production costs of green hydrogen decrease, fostering market growth. Green hydrogen is gaining traction in energy-intensive sectors such as steel production, chemical manufacturing (e.g., ammonia), and refining, where reducing carbon emissions is challenging with current technologies. The transportation sector, particularly in areas like heavy-duty trucks, buses, trains, and shipping, is driving demand for green hydrogen as a clean fuel. Fuel cell technology using hydrogen is seen as a viable option for decarbonizing long-distance and large-scale transportation.

Restraint

Perception of High Production Costs and Resource Availability

While the cost of producing green hydrogen has decreased, it remains higher than hydrogen produced from fossil fuels (gray hydrogen) due to the initial capital investment required for electrolysis equipment and renewable energy infrastructure. The production of green hydrogen requires significant amounts of water, particularly in arid regions where renewable energy sources are abundant. Water scarcity could limit hydrogen production capabilities.

Opportunity:

⮚ Integration with Renewable Energy Systems

Green hydrogen can be integrated with existing renewable energy systems, serving as a storage solution to balance intermittent energy supply and demand. This presents opportunities for hybrid projects that combine solar, wind, and hydrogen production. The need for infrastructure, such as hydrogen pipelines, refueling stations, and storage facilities, presents opportunities for infrastructure developers and investors to build and operate critical components of the hydrogen economy.

Green Hydrogen Market Segment Overview

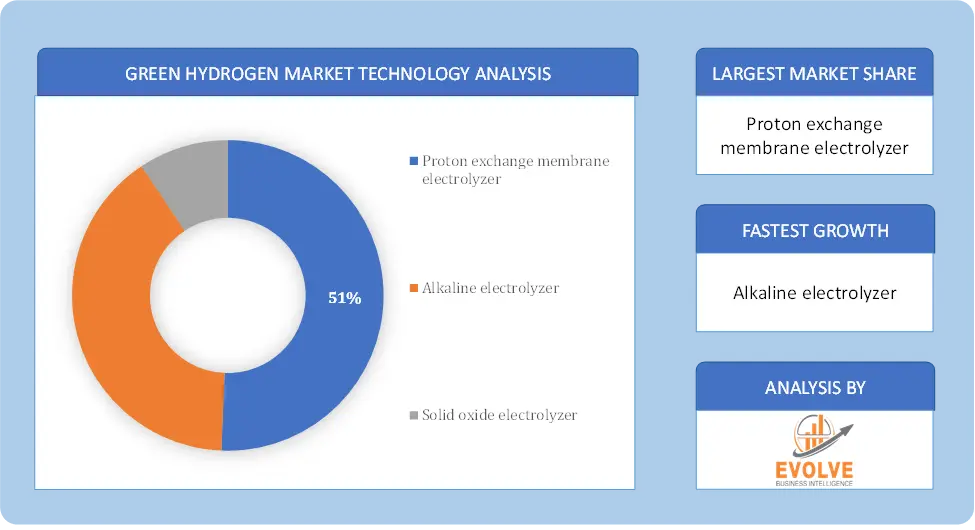

By Technology

Based on Technology, the market is segmented based on Proton exchange membrane electrolyzer, Alkaline electrolyzer and Solid oxide electrolyzer. The PEM segment dominant the market. PEM electrolyzers produce high-purity hydrogen at a faster rate compared to other technologies, making them ideal for green hydrogen production. Their compact design allows for easier integration into renewable energy systems and scalability, catering to varying energy demands. PEM electrolyzers can quickly adjust to fluctuations in renewable energy sources, such as solar and wind, ensuring stable hydrogen production.

Based on Technology, the market is segmented based on Proton exchange membrane electrolyzer, Alkaline electrolyzer and Solid oxide electrolyzer. The PEM segment dominant the market. PEM electrolyzers produce high-purity hydrogen at a faster rate compared to other technologies, making them ideal for green hydrogen production. Their compact design allows for easier integration into renewable energy systems and scalability, catering to varying energy demands. PEM electrolyzers can quickly adjust to fluctuations in renewable energy sources, such as solar and wind, ensuring stable hydrogen production.

By Application

Based on Application, the market segment has been divided into Power Generation, Transport and Others. The transport segment dominated the market. Hydrogen can be utilized in internal combustion engines or fuel cell technology for transportation. Due to its excellent energy efficiency, a hydrogen fuel cell is 2-3 times more effective than a gasoline-powered internal combustion engine. Airbus is also developing hydrogen-powered aircraft and intends to launch commercial operations by 2035, which positively impacts the market growth.

By End-Use Industry

Based on End-Use Industry, the market segment has been divided into Food & beverages, Medical, Chemical, Petrochemicals, Glass and Others. The Petrochemicals segment dominant the market. The petrochemical industry is a significant contributor to greenhouse gas emissions. Integrating green hydrogen into petrochemical processes helps companies achieve their decarbonization targets and comply with environmental regulations.

Global Green Hydrogen Market Regional Analysis

Based on region, the global Green Hydrogen Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Green Hydrogen Market followed by the Asia-Pacific and Europe regions.

Green Hydrogen North America Market

North America holds a dominant position in the Green Hydrogen Market. The U.S. and Canada are increasingly focusing on green hydrogen, with various state and federal initiatives. The U.S. has launched the Hydrogen Program, promoting clean hydrogen production, and various states are establishing hydrogen roadmaps and the United States and Canada are ramping up their efforts in the green hydrogen space, driven by a desire to reduce carbon emissions and create new economic opportunities.

Green Hydrogen Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Green Hydrogen Market industry. The Asia-Pacific region has a rapidly growing interest in green hydrogen, with significant potential for renewable energy integration. Countries like Japan and South Korea are leading in hydrogen technology development and have national hydrogen strategies. These countries are focusing on applications in transportation, energy storage, and industrial processes.

Competitive Landscape

The global Green Hydrogen Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Ballard Power Systems

- Enapter

- Engie

- Green Hydrogen Systems

- Hydrogenics

- Nikola Motors

- Plug Power

- SGH2 Energy Global LLC

- Shell

- Siemens Gas and Power GmbH & Co. KG

Key Development

In May 2022, Air Liquide S.A., Toyota Motor, and CaetanoBus made a collaboration to develop integrated hydrogen solutions jointly. The partnership aims to encompass various aspects, such as infrastructure development and the establishment of vehicle fleets. The ultimate goal is accelerating the widespread adoption of hydrogen mobility, catering to both light-duty and heavy-duty vehicles. This collaboration signifies a significant step towards advancing sustainable transportation options and promoting hydrogen as a clean energy source.

Scope of the Report

Global Green Hydrogen Market, by Technology

- Proton exchange membrane electrolyzer

- Alkaline electrolyzer

- Solid oxide electrolyzer

Global Green Hydrogen Market, by Application

- Power Generation

- Transport

- Others

Global Green Hydrogen Market, by End-Use Industry

- Food & beverages

- Medical

- Chemical

- Petrochemicals

- Glass

- Others

Global Green Hydrogen Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $18.35 Billion |

| CAGR | 31.58% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Application, End-Use Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Ballard Power Systems, Enapter, Engie, Green Hydrogen Systems, Hydrogenics, Nikola Motors, Plug Power, SGH2 Energy Global LLC, Shell and Siemens Gas and Power GmbH & Co. KG |

| Key Market Opportunities | • Integration with Renewable Energy Systems • Investment in Infrastructure Development |

| Key Market Drivers | • Advancements in Electrolysis Technology • Green Mobility and Fuel Cells |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Green Hydrogen Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Green Hydrogen Market historical market size for the year 2021, and forecast from 2023 to 2033

- Green Hydrogen Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Green Hydrogen Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.