Global Taxi Booking Software Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Global Taxi Booking Software Market Research Report: Information By Software (Android, iOS), By End-User (Driver, Passenger), and by Region — Forecast till 2034

Page: 170

Global Taxi Booking Software Market Overview

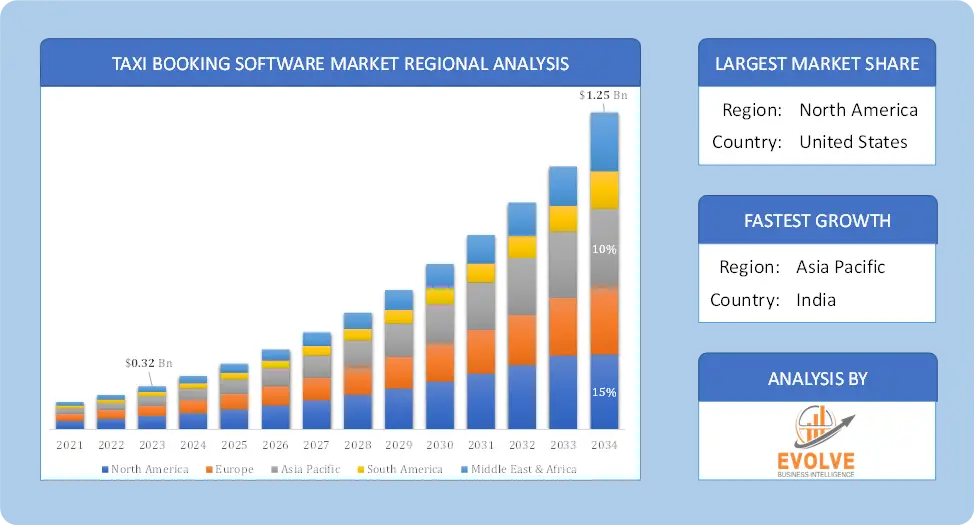

The Global Taxi Booking Software Market size accounted for USD 0.32 Billion in 2023 and is estimated to account for 0.45 Billion in 2024. The Market is expected to reach USD 1.25 Billion by 2034 growing at a compound annual growth rate (CAGR) of 14.52% from 2024 to 2034. Taxi booking software allows users to order a taxi without waiting for hours in the queue. It helps customers find their nearest taxi, which is often nearby and easier to identify. The software can also provide information about prices, past customer reviews, and more. The taxi booking software revolutionizes the taxi industry. It’s a new service, which is available in many cities around the world. It provides customers with convenience and drivers with more business. Many cities have regulations that require a taxi to accept credit cards, or at least have the capability to do so. This is typically done through a payment machine within the car.

Global Taxi Booking Software Market Synopsis

Global Taxi Booking Software Market Dynamics

Global Taxi Booking Software Market Dynamics

The major factors that have impacted the growth of Global Taxi Booking Software are as follows:

Drivers:

Ø Technological Advancements in Software Development

Platforms for taxi booking software are being improved by technological advancements like machine learning (ML), artificial intelligence (AI), and big data analytics. Real-time fare forecasts, demand forecasting, driver behavior analysis, and customized recommendations are made possible by these technologies. Furthermore, improvements in GPS and navigation systems aid in route optimization and waiting time reduction, increasing the effectiveness and user appeal of taxi booking software.

Restraint:

- Perception of Lower Quality

The taxi booking software market is restrained by the strict rules and regulations given by the government. The government has imposed certain restrictions on the taxi booking software market to maintain public safety and security. The policy-makers believe that this would reduce the number of taxi drivers committing crimes against passengers, such as sexual assault, robbery, and kidnapping. The restriction on the taxi booking software market has proved to be a blessing for many companies. The competition has led to the development of more features and functions in these apps, making them easier to use.

Opportunity:

- The growing popularity of online taxi service

The taxi booking software market has recently witnessed significant growth due to the growing popularity of online taxi services. Additionally, many small taxi companies have begun to develop their apps, which has created an opportunity for new entrants in the market.

Taxi booking software has seen significant growth in popularity over the past few years. This is due to the growing popularity of online taxi service providers such as Uber and Lyft, which have made it easier for taxi companies to compete with these popular ride-sharing apps. Many other taxi companies have begun to enter this market that offers their services at a lower price than Uber/Lyft. The taxi industry has been the primary source of income for drivers.

Global Taxi Booking Software Segment Overview

By Software

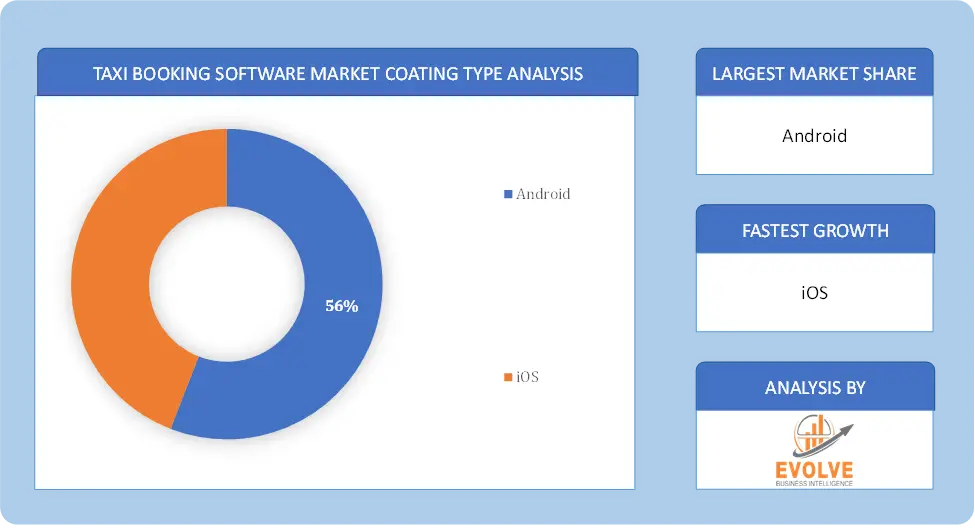

Based on software, the global Taxi Booking Software Market has been segmented based on Android and iOS. The android segment is the fastest growing in the global Taxi Booking Software Market.

Based on software, the global Taxi Booking Software Market has been segmented based on Android and iOS. The android segment is the fastest growing in the global Taxi Booking Software Market.

By End User

Based on end-user, the global Taxi Booking Software Market has been segmented based on Driver and Passenger. The passenger segment holds a significant market share in the global Taxi Booking Software Market.

Global Taxi Booking Software Market Regional Analysis

Based on region, the Global Taxi Booking Software market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Taxi Booking Software market followed by the Asia-Pacific and Europe regions.

Global Taxi Booking Software North America Market

Global Taxi Booking Software North America Market

North America is anticipated to account for the major share of the global taxi booking software market during the forecast period, due to the rising adoption of advanced online booking technologies and increasing smartphone penetration, indicating potential demand. The region is expected to witness significant growth in the adoption of new technologies such as smartphones and apps, which are likely to boost the demand for taxi booking software. However, this has led to a surge in the number of applications that have emerged in recent years. As a result, there are high levels of competition among vendors looking to provide cloud services, and large vendors have been particularly important to the market.

Global Taxi Booking Software Asia-Pacific Market

The Asia Pacific is the fastest growing taxi booking software market. The rise of ridesharing apps such as Uber and Lyft has pushed taxi companies to innovate their business models. This has led them to develop new software platforms, which will ultimately benefit consumers and operators.

Competitive Landscape

The global Global Taxi Booking Software market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as Softwarelaunches, and strategic alliances.

Prominent Players:

- Fare Bookings

- FATbit Technologies

- Infinite Cab

- Mindster

- Negup Solutions

- Tagmytaxi

- TaxiCaller

- TaxiMobility

- TaxiPulse

- UBER TECHNOLOGIES INC

Key Development

In October 2019, TaxiCaller announced that it has become the dispatch system provider for the United Nations in the Democratic Republic of the Congo.

Scope of the Report

Global Global Taxi Booking Software Market, by Software

- Android

- iOS

Global Global Taxi Booking Software Market, by End-User

- Driver

- Passenger

Global Global Taxi Booking Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.25 Billion |

| CAGR | 14.52% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Software, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Fare Bookings, FATbit Technologies, Infinite Cab, Mindster, Negup Solutions, Tagmytaxi, TaxiCaller, TaxiMobility, TaxiPulse, UBER TECHNOLOGIES INC |

| Key Market Opportunities | • The growing popularity of online taxi service |

| Key Market Drivers | • Increasing Adoption of Smartphones |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Taxi Booking Software market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Taxi Booking Software market historical market size for the year 2022, and forecast from 2021 to 2034

- Global Taxi Booking Software market share analysis at each Software level

- Competitor analysis with detailed insight into its Software segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including Software launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global Taxi Booking Software market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, Software offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the Global Taxi Booking Software market is 2021- 2034

What is the growth rate of the Global Taxi Booking Software market?

The Global Taxi Booking Software market is growing at a CAGR of 14.52% over the next 10 years

Which region has the highest growth rate in the market of Global Taxi Booking Software?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region has the largest share of the Global Taxi Booking Software market?

North America holds the largest share in 2023

Who are the key players in the Global Taxi Booking Software market?

Fare Bookings, FATbit Technologies, Infinite Cab, Mindster, Negup Solutions, Tagmytaxi, TaxiCaller, TaxiMobility, TaxiPulse, and UBER TECHNOLOGIES INC are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Application Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End Users 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on Taxi Booking Software Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of Taxi Booking Software Market 4.8. Import Analysis of Taxi Booking Software Market 4.9. Export Analysis of Taxi Booking Software Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Taxi Booking Software Market, By Software 6.1. Introduction 6.2. Android 6.3. iOS Chapter 7. Global Taxi Booking Software Market, By End-User 7.1. Introduction 7.2. Driver 7.3. Passenger Chapter 8. Global Taxi Booking Software Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2030 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2030 8.2.5. Market Size and Forecast, By Application, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2030 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2030 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2030 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2030 8.3.5. Market Size and Forecast, By Application, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2030 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2030 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2030 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2030 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2030 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2030 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2030 8.4.5. Market Size and Forecast, By Application, 2020 - 2030 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2030 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2030 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2030 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2030 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2030 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.5.4. Market Size and Forecast, By Application, 2020 - 2030 8.5.5. Market Size and Forecast, By Region, 2020 - 2030 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2030 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2030 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2030 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2021/Key Players Positioning, 2021 Chapter 10. Company Profiles 10.1. Fare Bookings 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. FATbit Technologies 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Infinite Cab 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Mindster 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Negup Solutions 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Tagmytaxi 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. TaxiCaller 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. TaxiMobility 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. TaxiPulse 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Uber Technologies Inc 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis 10.11. Yelowsoft 10.11.1. Business Overview 10.11.2. Financial Analysis 10.11.3. Product Portfolio 10.11.4. Recent Development and Strategies Adopted 10.11.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology