Global Security Robots Market Analysis and Global Forecast 2022-2030

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

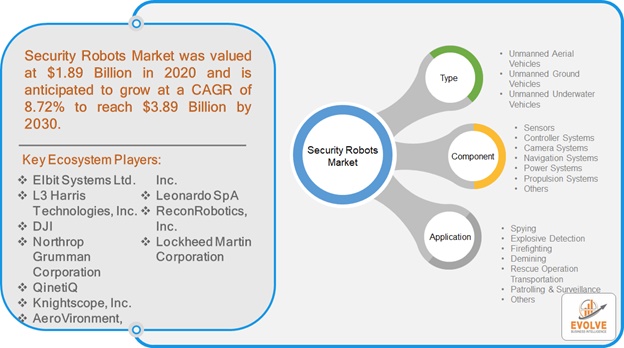

The global Security Robots market size is projected to reach approximately $ 3.89 Billion by 2030, at a CAGR of 8.72% from 2022 to 2030

Report Code: EB_ICT | Page: 150 | Published Date: Upcoming

The global Security Robots market size is projected to reach approximately $ 3.89 Billion by 2030, at a CAGR of 8.72% from 2022 to 2030. Security robots are machines that provide security in public places without requiring human supervision. Security robots obtain and gather data through the use of infrared devices, radars, and thermal sensors. Security robots are designed to provide mobile CCTV monitoring and replace patrol guards. Security robots are capable of moving around a restricted area without human interference. Furthermore, they can send images due to their built-in cameras to the monitoring center. Due to the rapid advancements and developments in technology, the demand for unmanned vehicles and aircraft solutions by the defense sector has grown significantly.

COVID-19 Impact Analysis

With the functionality of security robots growing and a pandemic on the rise, more companies are beginning to look at AI security options. They identify autonomous security robots as an attractive way to cut costs and increase efficiency during a time when their number one concern is COVID-19. With the escalation of the pandemic COVID-19, privatized security and asset protection companies began using security robots in their business. Occupational risks have continually arisen with the remote worker-to-worker exposure.

Market Dynamics

The factors driving the growth of the global Security Robots market include rising geopolitical instabilities and territorial conflicts, increasing demand from military and defense forces globally, increasing defense expenditure of emerging economies such as India and China as well as the growing adoption of autonomous systems for security robots.

Drivers:

⮚ Increasing Geopolitical Instabilities and Territorial Conflicts

The number of active conflicts all over the world is rising constantly, particularly over the last decade. The European refugee crisis which started in 2015, witnessed an increasing number of refugees and migrants traveling to the European Union (EU) to seek asylum. Furthermore, in 2014, Russian- backed forces seized control of Crimea, a Ukrainian peninsula, which is situated on the northern coast of the Black Sea. Moreover, Pakistan and India have constant friction and disputes along the line of control (LoC) as well as over Pakistan-occupiedPakistan-occupied Kashmir (PoK). There have also been disputes in the South and the East China Sea since many countries are trying to gain control over many strategically important islands. Security robots such as UAVs provide enhanced capabilities to resist violent extremism. The identifying and refuting constituents provide proactive measures to identify terrorist activities. Therefore, the use of unmanned systems and advanced security robots is a major driver of the security robots market.

Restraint:

- Stringent Regulations and Privacy Concerns

The stringent regulations related to the development of unmanned system solutions may hamper the growth of the market, as these machines usually have a level of accuracy that must be adhered to. Another important part of the Security Robots market is Privacy Intrusion. Due to this security concern that has been working as a barrier to growth, it will be necessary to assess other risk factors and integrate robots with those risks

Opportunity:

⮚ Growing Adoption of Unmanned Vehicles

The demand for unmanned vehicles by the army and defense forces is increasing rapidly. The growth in the defense budgets of developed nations further fuels the demand. Security robots are used for military operations, to enter dangerous areas, as well as to handle and disable bombs in unknown regions. They can fulfill different tasks with help of cameras and sensors. The operator can control the robot from a safe distance. Security robots thus save human lives from unexpected dangers and are safer as well as more effective, thereby driving the growth of the security robots market considerably.

Segment Overview

By Type

Based on the Type the Security Robots market is segmented based on Unmanned Aerial Vehicles, Unmanned Ground Vehicles, and Unmanned Underwater Vehicles. Unmanned aerial vehicles are expected to hold a large market share as it is a valuable strategy for dealing with terrorist activities. The unmanned autonomous vehicle performs roles such as surveillance, mine countermeasures, intelligence, and delivery of ammunition and sensor deployment. It also boasts certain roles in anti-submarine warfare.

By Component

Based on Components, the global Security Robots market has been divided into Sensors, Controller Systems, Camera Systems, Navigation Systems, Power Systems, Propulsion Systems, and Others. The Camera Systems segment is expected to hold the largest market share. Some companies and organizations use camera systems for round-the-clock monitoring, investigation, surveillance, border control, and infrastructure protection. Other uses include field inspection of inaccessible buildings as well as thermography inspections.

By Application

Based on Application, the global Security Robots market has been divided into Spying, Explosive Detection, Firefighting, Demining, Rescue Operations, Transportation, Patrolling & Surveillance, and Others. The Patrolling & Surveillance segment is expected to hold the largest market share due to the growing demand for the highest level of security on the premises to guard commercial facilities and promising government investment to set up Managed Security Robotics Services. In October 2020, SEO launched the “ARVO” service robot in South Korea which provides security services such as patrol and inspection with the combination of CCTV and various sensors.

Global Security Robots Market Share, by Segmentation

Regional Analysis

Regional Analysis

Based on region, the global Security Robots market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to dominate the use of the Security Robots market followed by the Asia-Pacific and Europe regions.

North America Market

North America contributed the largest share to the global Security Robots market. The increased adoption of unmanned aerial vehicles in the US by forces including US Navy Seals, Delta Force, and security and surveillance force, combined with the military expansion is driving the creation of new opportunities in the industry. The drone manufacturing market within North America is set to grow as more major companies are expanding their operations. While there will continue to be healthy consumer demand, growth amongst the region’s homegrown companies is also expected.

Asia-Pacific Market

The The Asia Pacific is expected to witness the highest growth during the forecast period which is attributed to the rising investment inin strengthening the surveillance and weapon guidance capabilities in India, Japan,, and China, along with the surge in expenditures by the government to tackle terrorist attacks, criminal activities, infiltration, and illegal immigration.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. Because of their strategic innovations and broad regional presence, companies such as Elbit Systems Ltd., L3 Harris Technologies, Inc., DJI, Northrop Grumman Corporation, QinetiQ, Knightscope, Inc., AeroVironment, Inc., Leonardo SpA, ReconRobotics, Inc., and Lockheed Martin Corporation, lead the global Security Robots business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- Elbit Systems Ltd.

- L3 Harris Technologies, Inc.

- DJI

- Northrop Grumman Corporation

- QinetiQ

- Knightscope, Inc.

- AeroVironment, Inc.

- Leonardo SpA

- ReconRobotics, Inc.

- Lockheed Martin Corporation

In January 2020, ReconRobotics Inc., the world leader in tactical micro-robot systems, announced the approval of their 6th US patent, US 10,526,029 B2 for a Two Wheeler Robot with Covertibitly and Accessories. ReconRobotics constantly innovates and develops proprietary combinations of engineering, durability, and technology.

Scope of the Report

Global Security Robots Market, by Type

- Unmanned Aerial Vehicles

- Unmanned Ground Vehicles

- Unmanned Underwater Vehicles

Global Security Robots Market, by Component

- Sensors

- Controller Systems

- Camera Systems

- Navigation Systems

- Power Systems

- Propulsion Systems

- Others

Global Security Robots Market, by Application

- Spying

- Explosive Detection

- Firefighting

- Demining

- Rescue Operation Transportation

- Patrolling & Surveillance

- Others

Global Security Robots Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- Rest of the World

| Parameters | Indicators |

|---|---|

| Market Size | 2030: $ 3.89 Billion |

| CAGR | 8.72% CAGR (2022-2030) |

| Base year | 2021 |

| Forecast Period | 2022-2030 |

| Historical Data | 2020 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Component, and Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Elbit Systems Ltd., L3 Harris Technologies, Inc., DJI, Northrop Grumman Corporation, QinetiQ, Knightscope, Inc., AeroVironment, Inc., Leonardo SpA, ReconRobotics, Inc., and Lockheed Martin Corporation |

| Key Market Opportunities | Growing Adoption of Unmanned Vehicles |

| Key Market Drivers | Increasing Geopolitical Instabilities and Territorial Conflicts |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Security Robots market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Security Robots market historical market size for the year 2020, and forecast from 2021 to 2028

- Security Robots market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Security Robots market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Security Robots market is 2020 - 2030

What is the growth rate of the global Security Robots market?

The global Security Robots market is growing at a CAGR of ~ 8.72% over the next 7 years

Which region has the highest growth rate in the global Security Robots market?

Asia Pacific is expected to register the highest CAGR during 2022-2030

Which region has the largest share in the global Security Robots market?

North America holds the largest share in 2021

Who are the key players in the global Security Robots market?

Elbit Systems Ltd., L3 Harris Technologies, Inc., DJI, Northrop Grumman Corporation, QinetiQ, Knightscope, Inc., AeroVironment, Inc., Leonardo SpA, ReconRobotics, Inc., and Lockheed Martin Corporation are the major companies operating in the global Security Robots market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Application Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End Users 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on Security Robots 4.3.1. Impact on Market Size 4.3.2. End-User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of Security Robots 4.8. Import Analysis of Security Robots 4.9. Export Analysis of Security Robots Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Security Robots Market, By Type 6.1. Introduction 6.2. Unmanned Aerial Vehicles 6.3. Unmanned Ground Vehicles 6.4. Unmanned Underwater Vehicles Chapter 7. Global Security Robots Market, By Application 7.1. Introduction 7.2. Spying 7.3. Explosive Detection 7.4. Firefighting 7.5. Demining 7.6. Rescue Operation Transportation 7.7. Patrolling & Surveillance 7.8. Others Chapter 8. Global Security Robots Market, By Component 8.1. Introduction 8.2. Sensors 8.3. Controller Systems 8.4. Camera Systems 8.5. Navigation Systems 8.3. Power Systems 8.4. Propulsion Systems 8.5. Others Chapter 9. Global Security Robots, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.6. US 9.2.6.1. Introduction 9.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.2.7. Canada 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.6. Germany 9.3.6.1. Introduction 9.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.7. France 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.8. UK 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.9. Italy 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.10. Rest Of Europe 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.6. China 9.4.6.1. Introduction 9.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.7. India 9.4.7.1. Introduction 9.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.8. Japan 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.9. South Korea 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.10. Rest Of Asia-Pacific 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Application, 2020 - 2028 9.5.5. Market Size and Forecast, By Region, 2020 - 2028 9.5.6. South America 9.5.6.1. Introduction 9.5.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.5.7. Middle East and Africa 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 11. Company Profiles 11.1. Elbit Systems Ltd 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.2.1. Financial – Existing/Funding 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. L3 Harris Technologies, Inc 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.2.1. Financial – Existing/Funding 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. DJI 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.2.1. Financial – Existing/Funding 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Northrop Grumman Corporation 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.2.1. Financial – Existing/Funding 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. QinetiQ 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.2.1. Financial – Existing/Funding 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Knightscope, Inc 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.2.1. Financial – Existing/Funding 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. AeroVironment, Inc 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.2.1. Financial – Existing/Funding 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Leonardo SpA 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.2.1. Financial – Existing/Funding 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. ReconRobotics, Inc 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.2.1. Financial – Existing/Funding 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Lockheed Martin Corporation 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.2.1. Financial – Existing/Funding 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology