Photovoltaic Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

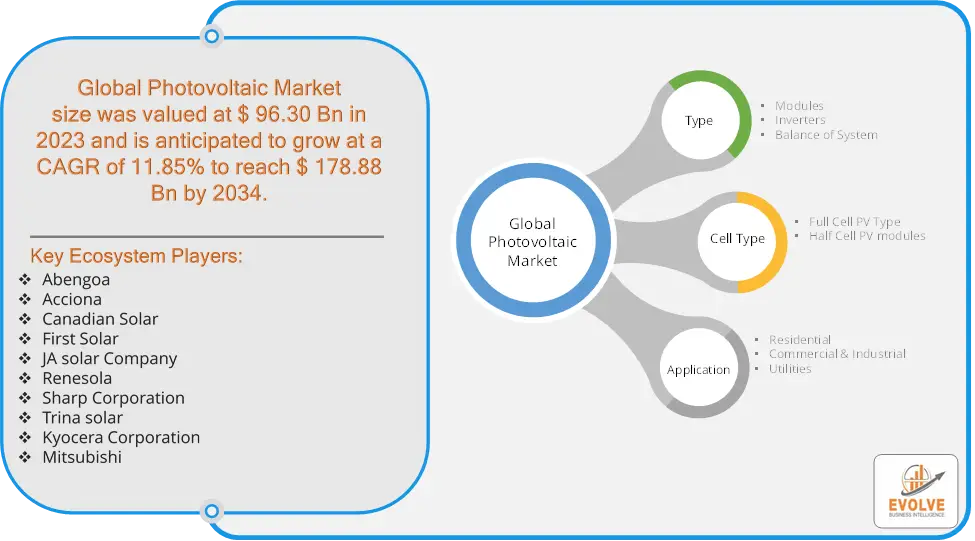

Photovoltaic Market Research Report: Information By Type (Modules, Inverters, Balance of System), By Cell Type (Full Cell PV Type., Half Cell PV modules), By Application (Residential, Commercial & Industrial, Utilities), By Installation Type (Ground Mounted, Building-Integrated Photovoltaics, Floating PV), and by Region — Forecast till 2034

Page: 176

Photovoltaic Market Overview

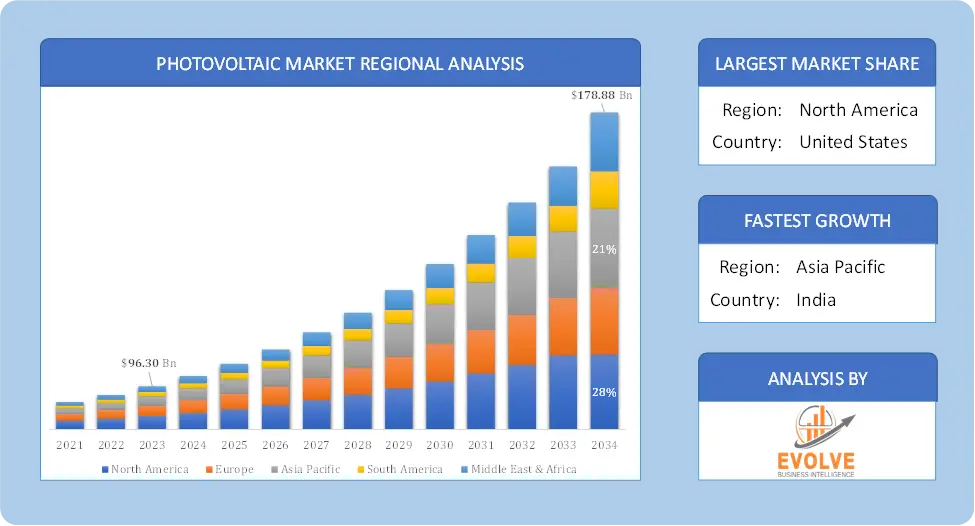

The Photovoltaic Market size accounted for USD 96.30 Billion in 2023 and is estimated to account for 98.02 Billion in 2024. The Market is expected to reach USD 178.88 Billion by 2034 growing at a compound annual growth rate (CAGR) of 11.85% from 2024 to 2034. The photovoltaic market refers to the global industry involved in the production, distribution, and installation of photovoltaic (PV) systems. These systems use solar cells to convert sunlight into electricity, providing a clean and renewable energy source. The market encompasses a wide range of components, including solar panels, inverters, racking systems, and other related equipment.

The market is driven by factors like growing awareness of renewable energy sources, government incentives for solar power, falling costs of PV systems, advancements in technology, and the global shift towards decarbonization.

Global Photovoltaic Market Synopsis

Photovoltaic Market Dynamics

Photovoltaic Market Dynamics

The major factors that have impacted the growth of Photovoltaic Market are as follows:

Drivers:

Ø Declining Costs of Solar PV Systems

Technological advancements and economies of scale have led to significant reductions in the costs of solar panels, inverters, and other components, making PV systems more affordable for both residential and commercial applications. The falling levelized cost of electricity (LCOE) for solar is making it competitive with traditional energy sources. Solar PV provides countries with the ability to generate their own electricity, reducing dependence on fossil fuels and enhancing energy security. This is particularly important for countries seeking to diversify their energy portfolios.

Restraint:

- Perception of High Initial Investment Costs and Raw Material Supply Chain Issues

While the cost of solar PV systems has declined over time, the initial capital investment required for purchasing and installing PV systems, particularly for large-scale projects, remains significant. This can be a barrier for residential consumers and small businesses with limited budgets. The production of photovoltaic panels, especially silicon-based panels, depends on the availability of raw materials like silicon, silver, and other rare earth elements. Disruptions in the supply chain or price volatility of these materials can lead to higher production costs, impacting the overall market growth.

Opportunity:

⮚ Development of Advanced Energy Storage Solutions

The integration of solar PV with advanced energy storage technologies (such as next-generation batteries, solid-state batteries, and hydrogen storage) presents a significant opportunity. These advancements will help overcome the challenge of intermittency, allowing solar power to be stored and used during periods of low sunlight, making solar PV more reliable and scalable. Ongoing research and development in new photovoltaic technologies such as perovskite solar cells, bifacial solar panels, and thin-film PV offer opportunities for more efficient, flexible, and cost-effective solar power solutions. These innovations could increase energy conversion efficiency and open up new applications, including solar-integrated building materials (Building-Integrated Photovoltaics, or BIPV).

Photovoltaic Market Segment Overview

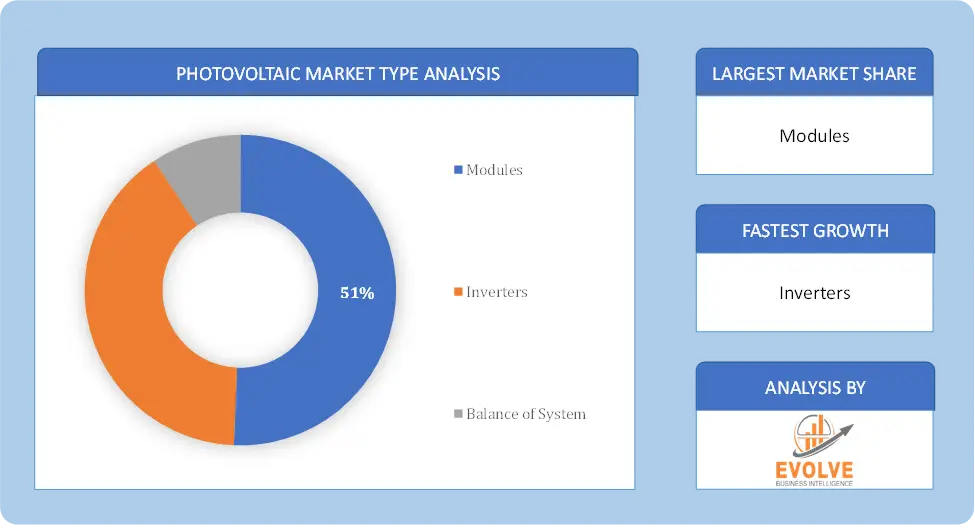

By Type

Based on Type, the market is segmented based on Modules, Inverters and Balance of System. The Modules segment dominant the market. PV modules (also known as solar panels) are made by assembling multiple photovoltaic cells. These cells are usually made from silicon or other materials, and they are designed to absorb sunlight and convert it into electrical energy. The modules are then installed on rooftops, in solar farms, or for off-grid solutions.

Based on Type, the market is segmented based on Modules, Inverters and Balance of System. The Modules segment dominant the market. PV modules (also known as solar panels) are made by assembling multiple photovoltaic cells. These cells are usually made from silicon or other materials, and they are designed to absorb sunlight and convert it into electrical energy. The modules are then installed on rooftops, in solar farms, or for off-grid solutions.

By Cell Type

Based on Cell Type, the market segment has been divided into Full Cell PV Type and Half Cell PV modules. The Full Cell PV Type segment dominant the market. Full cell PV technology involves using full-sized silicon wafers without any cutting or division of the cell. These are typically monocrystalline or polycrystalline silicon cells. These solar cells are widely used in traditional PV modules and are known for their reliability and efficiency and Full cell PV technology remains a dominant force in the solar energy market due to its established manufacturing processes, cost-effectiveness, and high energy conversion rates.

By Application

Based on Application, the market segment has been divided into Residential, Commercial & Industrial and Utilities. The residential application segment dominated the market. The growing adoption of photovoltaic technology by homeowners and residential property owners is driving the growth of this segment. Residential photovoltaic systems offer several benefits, including lower electricity bills, reduced carbon footprint, and increased energy independence. The availability of government incentives and subsidies, along with declining costs of photovoltaic technology, has made residential photovoltaic systems more accessible and affordable for homeowners.

By Installation Type

Based on Installation Type, the market segment has been divided into Ground Mounted, Building-Integrated Photovoltaics and Floating PV. The ground-mounted segment dominant the market. The rising number of utility-scale projects, solar energy targets by government bodies, and minimizing costs of solar PV installations are some of the key factors fueling ground-mounted solar PV systems. Government bodies across various countries are developing large-scale solar PV projects to minimize their reliance on fossil fuel-based power generation and diversify their energy mix.

Global Photovoltaic Market Regional Analysis

Based on region, the global Photovoltaic Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Photovoltaic Market followed by the Asia-Pacific and Europe regions.

Photovoltaic North America Market

Photovoltaic North America Market

North America holds a dominant position in the Photovoltaic Market. The US is one of the largest solar markets in the world, with a mix of residential, commercial, and utility-scale installations. The country has experienced significant growth in recent years, driven by factors such as declining costs and increasing acceptance of solar energy.

Photovoltaic Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Photovoltaic Market industry. China has been leading the way in PV installations. The country’s government has implemented ambitious targets to promote renewable energy, driving significant growth and India is another major market for PV, with a growing focus on solar energy as a solution to its energy challenges. The government has introduced various policies and incentives to encourage solar adoption.

Competitive Landscape

The global Photovoltaic Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Abengoa

- Acciona

- Canadian Solar

- First Solar

- JA solar Company

- Renesola

- Sharp Corporation

- Trina solar

- Kyocera Corporation

- Mitsubishi

Key Development

In March 2024, Waaree Energies on Monday announced its partnership with Sprng Energy to supply 220 megawatts (MW) of solar PV modules. The partnership involves Waaree Energies supplying 220 MW of AHNAY Series Bi-55 545Wp modules for Sprng Energy’s Gujarat project, as a part of the Shell Group.

In January 2024, LONGi Green Energy Technology Co., Ltd. entered a strategic cooperation agreement with Nio to collaboratively advance the usage of photovoltaic-generated clean energy in electric vehicle (EV) charging stations. The partnership was made to establish an industry-leading integrated station for solar energy storage and EV charging, which led to carbon neutrality goals in the transportation sector.

Scope of the Report

Global Photovoltaic Market, by Type

- Modules

- Inverters

- Balance of System

Global Photovoltaic Market, by Cell Type

- Full Cell PV Type.

- Half Cell PV modules

Global Photovoltaic Market, by Application

- Residential

- Commercial & Industrial

- Utilities

Global Photovoltaic Market, by Installation Type

- Ground Mounted

- Building-Integrated Photovoltaics

- Floating PV

Global Photovoltaic Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $178.88 Billion |

| CAGR | 11.85% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Cell Type, Application, Installation Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Abengoa, Acciona, Canadian Solar, First Solar, JA solar Company, Renesola, Sharp Corporation, Trina solar, Kyocera Corporation and Mitsubishi |

| Key Market Opportunities | • Development of Advanced Energy Storage Solutions • Technological Innovations in Photovoltaic Materials |

| Key Market Drivers | • Declining Costs of Solar PV Systems • Energy Security and Independence |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Photovoltaic Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Photovoltaic Market historical market size for the year 2021, and forecast from 2023 to 2033

- Photovoltaic Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Photovoltaic Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Photovoltaic Market is 2021- 2033

What is the growth rate of the global Photovoltaic Market?

The global Photovoltaic Market is growing at a CAGR of 11.85% over the next 10 years

Which region has the highest growth rate in the market of Photovoltaic Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Photovoltaic Market?

North America holds the largest share in 2022

Who are the key players in the global Photovoltaic Market?

Abengoa, Acciona, Canadian Solar, First Solar, JA sola rCompany, Renesola, Sharp Corporation, Trina solar, Kyocera Corporation and Mitsubishi are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Photovoltaic Market 4.3.1. Impact on Market Size 4.3.2. Installation Type Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Photovoltaic Market, By Type 6.1. Introduction 6.2. Module 6.3. Inverters 6.4. Balance Of System Chapter 7. Global Photovoltaic Market, By Cell Type 7.1. Introduction 7.2. Full Cell PV Modules 7.3. Half Cell PV modules Chapter 8. Global Photovoltaic Market, By Application 8.1. Introduction 8.2. Residential 8.3. Commercial & Industrial 8.4. Utilities Chapter 9. Global Photovoltaic Market, By Installation Type 9.1. Introduction 9.2. Ground Mounted. 9.3. Building-Integrated Photovoltaics 9.4. Floating PV Chapter 10. Global Photovoltaic Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Type, 2020 - 2028 10.2.5. Market Size and Forecast, By Cell Type, 2020 - 2028 10.2.6. Market Size and Forecast, By Application, 2020 – 2028 10.2.7. Market Size and Forecast, By Installation Type, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.8.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.9.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Type, 2020 - 2028 10.3.5. Market Size and Forecast, By Cell Type, 2020 - 2028 10.3.6. Market Size and Forecast, By Application, 2020 – 2028 10.3.7. Market Size and Forecast, By Installation Type, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.8.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.9.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.10.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.11.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.3.12. Rest Of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Type, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.12.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Type, 2020 - 2028 10.4.5. Market Size and Forecast, By Cell Type, 2020 - 2028 10.4.6. Market Size and Forecast, By Application, 2020 – 2028 10.4.7. Market Size and Forecast, By Installation Type, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.8.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.9.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.10.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.11.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.4.12. Rest Of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Type, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.12.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.5. Rest Of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.5.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.8.6. Market Size and Forecast, By Installation Type, 2020 - 2028 10.5.9. Middle East & Afirica 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Type, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Cell Type, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.9.6. Market Size and Forecast, By Installation Type, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Abengoa 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Acciona 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Canadian Solar 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. First Solar 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. JA sola rCompany 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Renesola 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. Sharp Corporation 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Trina solar 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Kyocera Corporation 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Mitsubishi 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology