Oilwell Spacer Fluid Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

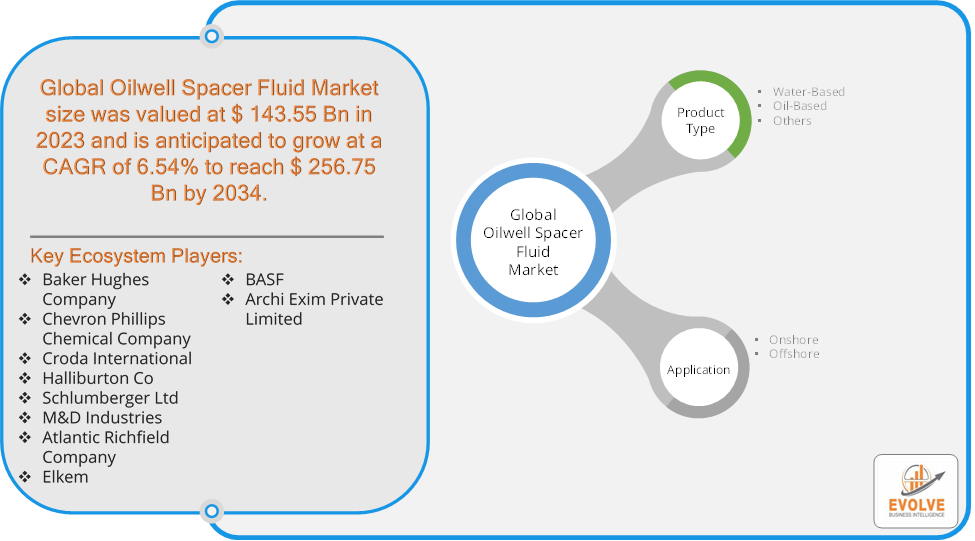

Oilwell Spacer Fluid Market Research Report: Information By Product Type (Water-Based, Oil-Based, Others), By Application (Onshore, Offshore), and by Region — Forecast till 2034

Page: 165

Oilwell Spacer Fluid Market Overview

The Oilwell Spacer Fluid Market size accounted for USD 143.55 Billion in 2023 and is estimated to account for 151.85 Billion in 2024. The Market is expected to reach USD 256.75 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.54% from 2024 to 2034. The Oilwell Spacer Fluid Market refers to the industry that focuses on the production, development, and distribution of spacer fluids used in oil well drilling operations. Spacer fluids are specialized fluids that are pumped between the drilling fluid (also called mud) and the cement slurry during the wellbore completion process. The primary function of spacer fluids is to separate incompatible fluids, such as drilling mud and cement slurry, ensuring efficient displacement of the mud from the wellbore, which is essential for a strong and effective cement bond.

The market’s growth is influenced by fluctuations in oil prices, advancements in drilling technologies, and environmental regulations governing the use of drilling fluids. The oilwell spacer fluid market is a crucial component of the oil and gas industry, ensuring the safe and efficient completion of wellbores.

Global Oilwell Spacer Fluid Market Synopsis

Oilwell Spacer Fluid Market Dynamics

Oilwell Spacer Fluid Market Dynamics

The major factors that have impacted the growth of Oilwell Spacer Fluid Market are as follows:

Drivers:

Ø Technological Advancements in Drilling Operations

Innovations in drilling technologies, such as directional drilling, deepwater drilling, and high-pressure, high-temperature (HPHT) wells, require advanced spacer fluids that can operate under extreme conditions. These developments drive the need for more effective and specialized spacer fluid formulations. Oil and gas operators prioritize well integrity to prevent operational failures and environmental hazards. Spacer fluids help ensure proper cementing, which is vital for preventing blowouts and other risks. Increasing regulations and safety standards in the oil and gas industry further amplify the demand for spacer fluids.

Restraint:

- Perception of Volatility in Crude Oil Prices and High Costs of Advanced Spacer Fluids

Fluctuating crude oil prices directly impact exploration and drilling activities. When prices drop, oil companies often reduce their capital expenditure, leading to a slowdown in drilling operations and, consequently, a decrease in the demand for spacer fluids. Specialized spacer fluids designed for high-temperature, high-pressure (HTHP) wells or other complex drilling environments can be expensive. The high cost of these advanced formulations may deter some operators, especially smaller players, from adopting them, affecting market penetration.

Opportunity:

⮚ Focus on Wellbore Integrity and Safety

The increasing emphasis on well integrity and safety standards in the oil and gas sector creates opportunities for spacer fluid manufacturers. Spacer fluids that ensure efficient mud displacement and proper cement bonding are critical for maintaining wellbore stability and preventing blowouts or leaks. Offering solutions that enhance wellbore safety and integrity can help manufacturers tap into this demand. The adoption of digital technologies and automation in drilling operations is rising. There is an opportunity to integrate smart spacer fluids with real-time monitoring systems to improve well performance and optimize fluid displacement. Spacer fluids designed for use in digitalized, automated drilling environments could be a key innovation in the market.

Oilwell Spacer Fluid Market Segment Overview

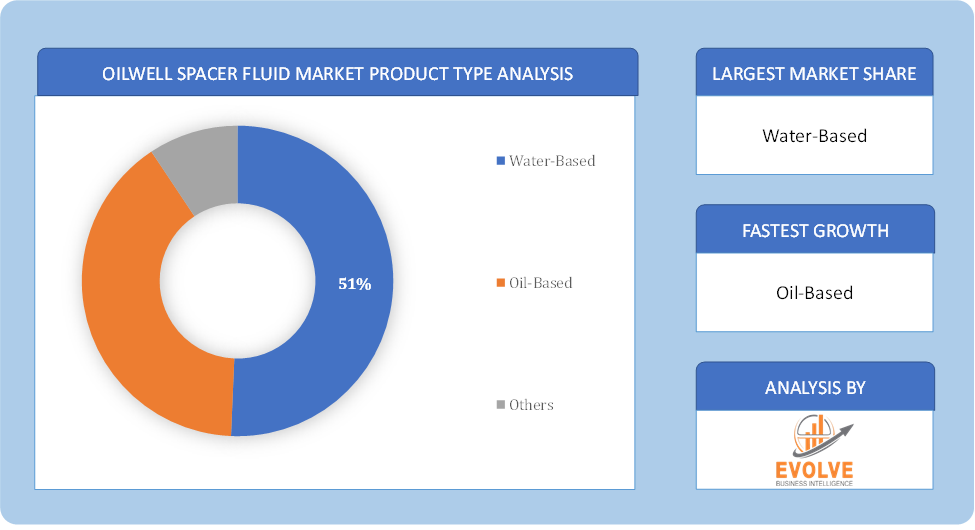

Based on Product Type, the market is segmented based on Water-Based, Oil-Based and Others. The oil-based segment dominant the market. Oil well spacer fluids are a liquid that is primarily used to separate drilling fluid from cement slurry during an oil and gas well’s cementing procedure. The rising number of operating rigs is a significant factor propelling the global market for oil well spacer fluids. Oil and gas exploration and production have increased globally due to the recovery in crude oil prices.

By Application

Based on Application, the market segment has been divided into Onshore and Offshore. The onshore segment dominant the market. An oil rig is built on the ground, and a deep well is drilled as part of onshore oil and gas production and can be completed within a few hours. The well is prepared for drilling and completion before beginning oil recovery. More than 70% of the world’s crude oil is recovered from onshore oilfields. The demand for the spacer fluid is anticipated to grow in the forecast time frame as the maximum amount of crude oil is being extracted from onshore.

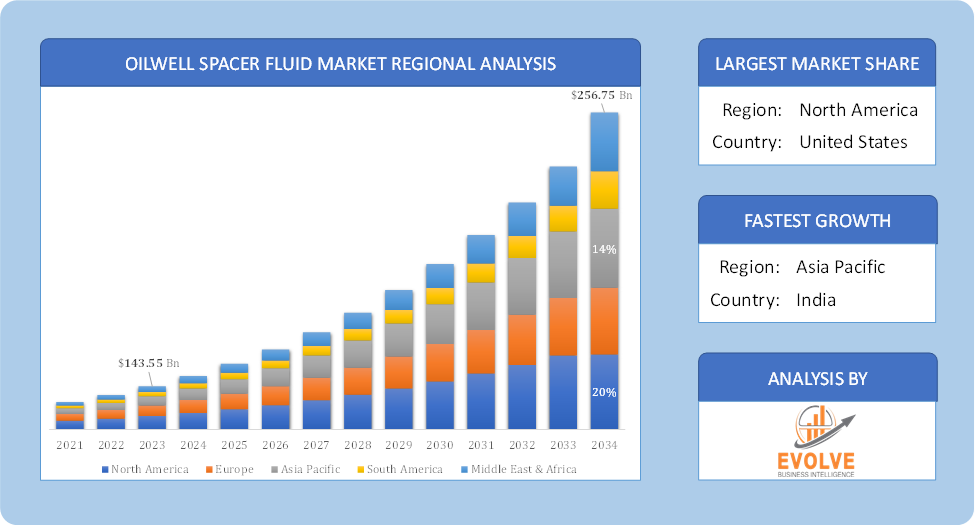

Global Oilwell Spacer Fluid Market Regional Analysis

Based on region, the global Oilwell Spacer Fluid Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Oilwell Spacer Fluid Market followed by the Asia-Pacific and Europe regions.

Oilwell Spacer Fluid North America Market

Oilwell Spacer Fluid North America Market

North America holds a dominant position in the Oilwell Spacer Fluid Market. North America, especially the United States and Canada, is a leading market for oilwell spacer fluids due to the significant oil and gas exploration and production activities. The rise of shale gas exploration in the U.S. (particularly in regions like the Permian Basin) and Canada’s oil sands production drive demand for advanced spacer fluids and the region is also at the forefront of technological innovations in drilling techniques, such as horizontal drilling and hydraulic fracturing, which require efficient wellbore cleaning, boosting the demand for high-performance spacer fluids.

Oilwell Spacer Fluid Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Oilwell Spacer Fluid Market industry. The Asia-Pacific region, led by countries like China, India, Indonesia, and Australia, is a key growth area for the oilwell spacer fluid market. Rising energy demands, industrialization, and growing exploration activities in onshore and offshore reserves drive the market in this region and the growth in energy consumption and rapid industrialization in countries like China and India present substantial opportunities for the market.

Competitive Landscape

The global Oilwell Spacer Fluid Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Baker Hughes Company

- Chevron Phillips Chemical Company

- Croda International

- Halliburton Co

- Schlumberger Ltd

- M&D Industries

- Atlantic Richfield Company

- Elkem

- BASF

- Archi Exim Private Limited

Key Development

In July 2022– Aubin Group, the leading developer and supplier of chemical solutions to the energy industry, secured a two-year contract worth USD 5 million to manufacture and supply fluid loss additives to a major drilling company in the Middle East.

In March 2021– Baker Hughes Company entered into a joint venture with Akastor ASA to combine Baker Hughes’ Subsea Drilling Systems (SDS) business with Akastor’s MHWirth AS to provide an extensive portfolio of global full-service offshore drilling equipment.

Scope of the Report

Global Oilwell Spacer Fluid Market, by Product Type

- Water-Based

- Oil-Based

- Others

Global Oilwell Spacer Fluid Market, by Application

- Onshore

- Offshore

Global Oilwell Spacer Fluid Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 256.75 Billion |

| CAGR (2024-2034) | 6.54% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Baker Hughes Company, Chevron Phillips Chemical Company, Croda International, Halliburton Co, Schlumberger Ltd, M&D Industries, Atlantic Richfield Company, Elkem, BASF and Archi Exim Private Limited |

| Key Market Opportunities | · Focus on Wellbore Integrity and Safety · Digitalization and Automation in Drilling |

| Key Market Drivers | · Technological Advancements in Drilling Operations · Rising Focus on Well Integrity and Safety |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Oilwell Spacer Fluid Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Oilwell Spacer Fluid Market historical market size for the year 2021, and forecast from 2023 to 2033

- Oilwell Spacer Fluid Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Oilwell Spacer Fluid Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Oilwell Spacer Fluid Market is 2021- 2033

What is the growth rate of the global Oilwell Spacer Fluid Market?

The global Oilwell Spacer Fluid Market is growing at a CAGR of 6.54% over the next 10 years

Which region has the highest growth rate in the market of Oilwell Spacer Fluid Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Oilwell Spacer Fluid Market?

North America holds the largest share in 2022

Who are the key players in the global Oilwell Spacer Fluid Market?

Baker Hughes Company, Chevron Phillips Chemical Company, Croda International, Halliburton Co, Schlumberger Ltd, M&D Industries, Atlantic Richfield Company, Elkem, BASF and Archi Exim Private Limited. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Oilwell Spacer Fluid Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Oilwell Spacer Fluid Market 4.8. Import Analysis of the Oilwell Spacer Fluid Market 4.9. Export Analysis of the Oilwell Spacer Fluid Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Oilwell Spacer Fluid Market, By Product Type 6.1. Introduction 6.2. Water-Based 6.3. Oil-Based 6.4. Others Chapter 7. Global Oilwell Spacer Fluid Market, By Application 7.1. Introduction 7.2. Onshore 7.3. Offshore Chapter 8. Global Oilwell Spacer Fluid Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2024-2034 8.2.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.5. Market Size and Forecast, By End User, 2024-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.2.6.4. Market Size and Forecast, By End User, 2024-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.7.5. Market Size and Forecast, By End User, 2024-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2024-2034 8.3.4. Market Size and Forecast, By Product Type, 2024-2034 8.3.5. Market Size and Forecast, By End User, 2024-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.6.4. Market Size and Forecast, By End User, 2024-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.7.4. Market Size and Forecast, By End User, 2024-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.8.4. Market Size and Forecast, By End User, 2024-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.9.4. Market Size and Forecast, By End User, 2024-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.11.4. Market Size and Forecast, By End User, 2024-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2024-2034 8.4.4. Market Size and Forecast, By Product Type, 2024-2034 8.12.28. Market Size and Forecast, By End User, 2024-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.6.4. Market Size and Forecast, By End User, 2024-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.7.4. Market Size and Forecast, By End User, 2024-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.8.4. Market Size and Forecast, By End User, 2024-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.9.4. Market Size and Forecast, By End User, 2024-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.10.4. Market Size and Forecast, By End User, 2024-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2024-2034 8.5.4. Market Size and Forecast, By End User, 2024-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Baker Hughes Company 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Chevron Phillips Chemical Company 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Croda International 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Halliburton Co 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Schlumberger Ltd 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. M&D Industries 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Atlantic Richfield Company 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Elkem 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 BASF 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Archi Exim Private Limited 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology