Oil storage Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Oil storage Market Research Report: Information By Material (Steel, Carbon Steel, Fiberglass Reinforced Plastic), By Type (Crude Oil, Gasoline, Aviation Fuel, Naphtha, Diesel, Kerosene, Liquefied Petroleum Gas), By Product Design (Open Top Tank, Fixed Roof Tank, Floating Roof Tank, Others), and by Region — Forecast till 2034

Page: 172

Oil storage Market Overview

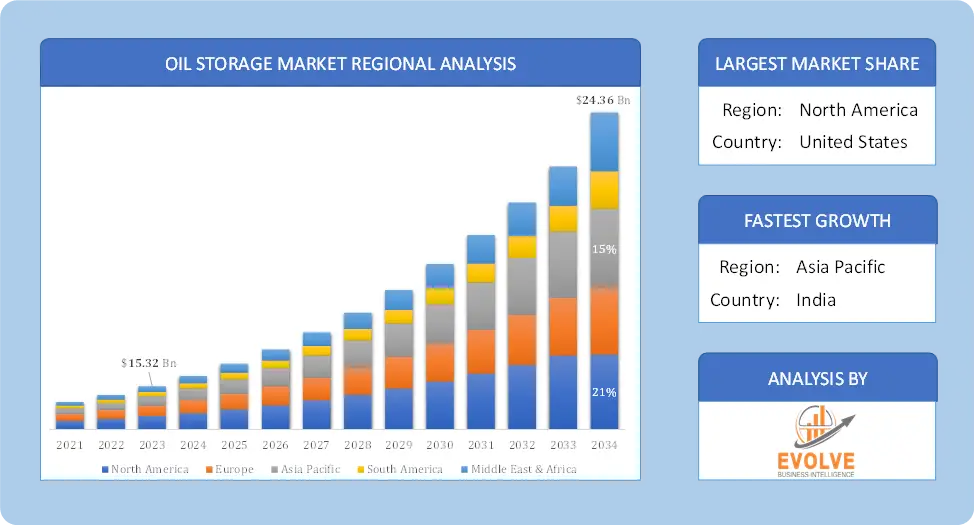

The Oil storage Market size accounted for USD 15.32 Billion in 2023 and is estimated to account for 16.99 Billion in 2024. The Market is expected to reach USD 24.36 Billion by 2034 growing at a compound annual growth rate (CAGR) of 7.25% from 2024 to 2034. The oil storage market refers to the industry that provides storage facilities for crude oil and refined petroleum products. These facilities, often consisting of tanks or terminals, play a crucial role in the energy supply chain by ensuring a steady and reliable supply of oil to various industries such as transportation, manufacturing, and petrochemicals.

The oil storage market is a vital component of the global energy infrastructure. It plays a crucial role in ensuring a stable and reliable supply of oil, managing market volatility, and maintaining strategic reserves. This market is critical for ensuring the balance between oil supply and demand and mitigating disruptions in the global oil supply chain.

Global Oil storage Market Synopsis

Oil storage Market Dynamics

Oil storage Market Dynamics

The major factors that have impacted the growth of Oil storage Market are as follows:

Drivers:

Ø Oil Price Volatility and Trade and Export Policies

Fluctuations in oil prices, often due to geopolitical tensions, production cuts, or demand changes, create opportunities for oil storage. When prices are low, companies may store oil, waiting for price increases before selling. Changes in trade policies, including import/export restrictions or tariffs on oil products, can lead to temporary surpluses that require additional storage until new markets are found. Innovations in storage technologies, such as floating roof tanks and underground storage, improve storage efficiency, reduce costs, and drive investment in the oil storage market.

Restraint:

- Perception of High Capital Investment and Volatility in Oil Prices

Building and maintaining oil storage infrastructure requires significant upfront capital. This includes the construction of storage tanks, pipelines, and terminals, as well as meeting safety and environmental regulations. These costs can be prohibitive, especially in times of low oil prices. While oil price volatility can drive storage demand, it can also act as a restraint. Prolonged periods of low oil prices may reduce profitability for oil producers and storage operators, discouraging investments in new storage capacity.

Opportunity:

⮚ Energy Transition and Storage Flexibility

The ongoing energy transition presents an opportunity for oil storage providers to diversify their offerings by integrating storage solutions for liquid natural gas (LNG), hydrogen, and other emerging fuels. Storage facilities that can accommodate both traditional oil products and new energy sources will be well-positioned for future growth. During the energy transition, oil storage can play a role in providing backup fuel for power generation in regions transitioning to renewable energy sources like wind or solar. Oil storage facilities can offer flexible solutions to store oil as a backup energy source for grid stability.

Oil storage Market Segment Overview

By Material

Based on Material, the market is segmented based on Steel, Carbon Steel and Fiberglass Reinforced Plastic. The carbon steel segment dominant the market because of the high demand and need for carbon steel in manufacturing oil storage tanks due to its high affordability than stainless steel. Tanks, which are constructed with carbon steel, can be easily painted or lined to enhance their water and chemical resistance that, which allows them to hold most types of fluids or even gases more conveniently, which has fueled their popularity among a large number of manufacturers and expected to drive the segment growth at a significant pace.

Based on Material, the market is segmented based on Steel, Carbon Steel and Fiberglass Reinforced Plastic. The carbon steel segment dominant the market because of the high demand and need for carbon steel in manufacturing oil storage tanks due to its high affordability than stainless steel. Tanks, which are constructed with carbon steel, can be easily painted or lined to enhance their water and chemical resistance that, which allows them to hold most types of fluids or even gases more conveniently, which has fueled their popularity among a large number of manufacturers and expected to drive the segment growth at a significant pace.

By Type

Based on Type, the market segment has been divided into Crude Oil, Gasoline, Aviation Fuel, Naphtha, Diesel, Kerosene and Liquefied Petroleum Gas. The Crude Oil segment dominant the market. crude oil output is anticipated to enhance storage, combined with declining downstream and midstream demand. The development of more cutting-edge refinery facilities and the increased demand for low-sulfur distillates are responsible for the expansion. The installation of upgrade units, which increase the productivity of middle distillates and consequently fuel its storage market expansion, is anticipated to be a result of expanding refining investments throughout Asia-Pacific nations.

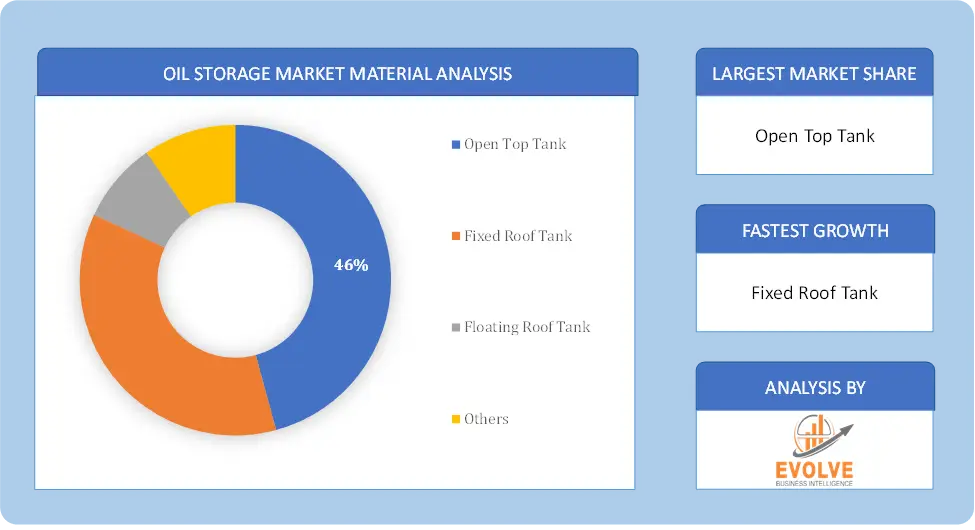

By Product Design

Based on Product Design, the market segment has been divided into Open Top Tank, Fixed Roof Tank, Floating Roof Tank and Others. The floating roof tank segment dominant the market. The market’s growth can be attributed to the efficient design of the floating roof that helps reduce evaporative losses and corrosion, along with the rapid increase in the demand for storage of medium and low flash point hydrocarbons. Moreover, the advancements in technology and new innovative product launches introduced by major market players will further propel the growth of the segment market.

Global Oil storage Market Regional Analysis

Based on region, the global Oil storage Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Oil storage Market followed by the Asia-Pacific and Europe regions.

Oil storage North America Market

Oil storage North America Market

North America holds a dominant position in the Oil storage Market. The North American oil storage market is relatively mature, with a focus on maintaining existing infrastructure and optimizing operations. The U.S. is one of the largest producers and consumers of oil globally. Major oil storage hubs include Cushing, Oklahoma, which serves as a key pricing point for West Texas Intermediate (WTI) crude and The region benefits from a well-developed infrastructure, including pipelines and rail networks, facilitating efficient oil transportation and storage.

Oil storage Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Oil storage Market industry. China is heavily investing in strategic oil reserves to ensure energy security. The country has been building large-scale storage facilities along its coastline and India is also expanding its strategic oil reserves to enhance energy security. The establishment of new storage facilities, particularly along the eastern and western coasts, is a key focus and increasing energy consumption driven by economic growth is likely to sustain demand for oil storage in the country.

Competitive Landscape

The global Oil storage Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Vitol Tank Terminals International

- Koninklijke

- Oiltanking

- Shawcor Ltd

- Buckeye Partners

- Containment Solutions

- ZCL Composites

- Belco Manufacturing

- Zepnotek Storage

- Columbian Steel Tank

Key Development

In November 2021, Trico Corporation introduced its bulk oil-storage systems that provide a cleaner, safer, & easier alternative to the 55-gallon drums for effective handling of the lubricants. The new oil storage systems are available in three tiers to meet the unique and specific requirements of applications.

In May 2021, PSO introduced its first-ever digitally integrated oil storage and dispatch terminal at the PSO’s Keamari Terminal in the southern port city, which will boost the company’s operational capabilities while improving efficiency and strengthening controls. Digitalizing the filling and dispatch operations will further result in significant growth and improvement in dispatch rates.

Scope of the Report

Global Oil storage Market, by Material

- Steel

- Carbon Steel

- Fiberglass Reinforced Plastic

Global Oil storage Market, by Type

- Crude Oil

- Gasoline

- Aviation Fuel

- Naphtha, Diesel

- Kerosene

- Liquefied Petroleum Gas

Global Oil storage Market, by Product Design

- Open Top Tank

- Fixed Roof Tank

- Floating Roof Tank

- Others

Global Oil storage Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $24.36 Billion |

| CAGR | 7.25% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material, Type, Product Design |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Vitol Tank Terminals International, Koninklijke, Oiltanking, Shawcor Ltd, Buckeye Partners, Containment Solutions, ZCL Composites, Belco Manufacturing, Zepnotek Storage and Columbian Steel Tank |

| Key Market Opportunities | • Energy Transition and Storage Flexibility • Oil Storage for Renewable Energy Backup |

| Key Market Drivers | • Oil Price Volatility and Trade and Export Policies • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Oil storage Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Oil storage Market historical market size for the year 2021, and forecast from 2023 to 2033

- Oil storage Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Oil storage Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Oil storage Market is 2021- 2033

What is the growth rate of the global Oil storage Market?

The global Oil storage Market is growing at a CAGR of 7.25% over the next 10 years

Which region has the highest growth rate in the market of Oil storage Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Oil storage Market?

North America holds the largest share in 2022

Who are the key players in the global Oil storage Market?

Vitol Tank Terminals International, Koninklijke, Oiltanking, Shawcor Ltd, Buckeye Partners, Containment Solutions, ZCL Composites, Belco Manufacturing, Zepnotek Storage and Columbian Steel Tank are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Oil storage Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Oil storage Market, By Material 6.1. Introduction 6.2. Steel 6.3. Carbon Steel 6.4. Fiberglass Reinforced Plastic Chapter 7. Global Oil storage Market, By Type 7.1. Introduction 7.2. Crude Oil 7.3. Gasoline 7.4. Aviation Fuel 7.5. Naphtha 7.6. Diesel 7.7. Kerosene 7.8. Liquefied Petroleum Gas Chapter 8. Global Oil storage Market, By Product Design 8.1. Introduction 8.2. Open Top Tank 8.3. Fixed Roof Tank 8.4. Floating Roof Tank 8.5. Others Chapter 9. Global Oil storage Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Material, 2020 - 2028 9.2.5. Market Size and Forecast, By Component, 2020 – 2028 9.2.6. Market Size and Forecast, By Product Design, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Material, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.2.7.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Material, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Component, 2020 – 2028 9.2.8.6. Market Size and Forecast, By Product Design, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Material, 2020 - 2028 9.3.5. Market Size and Forecast, By Component, 2020 – 2028 9.3.6. Market Size and Forecast, By Product Design, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.7.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.8.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.9.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.10.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.3.11. Rest Of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Material, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Component, 2020 – 2028 9.3.11.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Material, 2020 - 2028 9.4.5. Market Size and Forecast, By Component, 2020 – 2028 9.4.7. Market Size and Forecast, By Product Design, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.8.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.9.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.10.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.11.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.4.12. Rest Of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Material, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Component, 2020 – 2028 9.4.12.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Material, 2020 - 2028 9.5.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Material, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.7.5. Market Size and Forecast, By Product Design, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Material, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Component, 2020 – 2028 9.5.8.5. Market Size and Forecast, By Product Design, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Vitol Tank Terminals International 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Koninklijke 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Oiltanking 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Shawcor Ltd 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Buckeye Partners 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Containment Solutions 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. ZCL Composites 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Belco Manufacturing 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Zepnotek Storage 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Columbian Steel Tank 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology