Global Electric Bus Market Overview

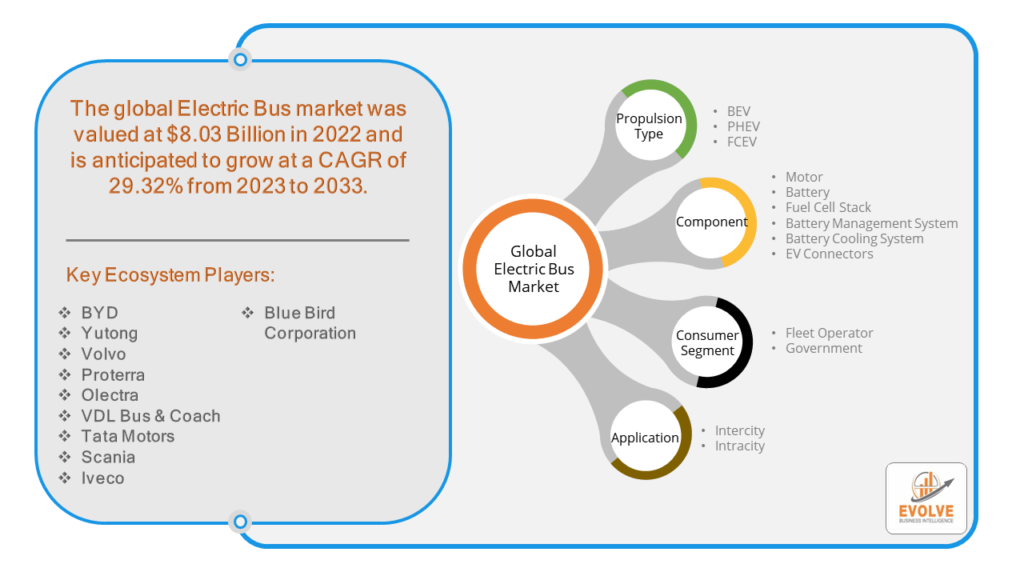

The global Electric Bus market was valued at $8.03 Billion in 2022 and is anticipated to grow at a CAGR of 29.32% from 2023 to 2033. The Global Electric Bus Market refers to the collective marketplace encompassing the production, distribution, and sale of electric buses on a worldwide scale. This market includes various types of electric buses, such as battery electric buses (BEBs), hybrid electric buses (HEBs), and fuel cell electric buses (FCEBs). Factors driving the growth of this market include increasing concerns about environmental pollution, government initiatives to promote the adoption of electric vehicles (EVs), advancements in battery technology, and a growing emphasis on sustainable transportation solutions.

The market involves manufacturers, suppliers of electric vehicle components, government bodies, transportation authorities, and end-users such as public transit agencies and private operators. It’s characterized by ongoing technological advancements, evolving regulations, and competitive dynamics among industry players striving to capture market share in the rapidly expanding electric transportation sector.

Global Electric Bus Market Synopsis

The COVID-19 pandemic had a significant impact on the Global Electric Bus Market. The pandemic disrupted global supply chains, affecting the production of electric buses. Factory closures, logistical challenges, and shortages of essential components hindered manufacturing operations, leading to delays in delivery schedules for electric buses. The pandemic resulted in reduced demand for public transportation services as lockdowns, social distancing measures, and travel restrictions were implemented worldwide to curb the spread of the virus. Consequently, transit agencies and operators scaled back their procurement plans for new electric buses. Despite the short-term challenges, the pandemic underscored the importance of sustainable transportation solutions and resilience in urban mobility systems. As cities reevaluate their transportation strategies to prioritize environmental sustainability and public health, there may be renewed interest and investment in electric buses in the post-pandemic recovery phase.

Global Electric Bus Market Dynamics

The major factors that have impacted the growth of Global Electric Bus Market are as follows:

Drivers:

Ø Technological Advancements

Ongoing advancements in battery technology, electric drivetrains, and charging infrastructure contribute to improving the performance, range, and affordability of electric buses. Innovations such as fast-charging capabilities, lightweight materials, and energy-efficient components enhance the feasibility and attractiveness of electric buses for fleet operators. Despite higher upfront costs, electric buses offer potential long-term cost savings over their lifetime due to lower fuel and maintenance expenses. Electric propulsion systems have fewer moving parts and require less maintenance compared to internal combustion engines, resulting in reduced operational costs for fleet operators. Rapid urbanization and increasing traffic congestion in cities drive the demand for efficient and sustainable public transportation solutions. Electric buses can help alleviate congestion, improve air quality, and enhance mobility options for urban residents, making them a compelling choice for municipal transit systems.

Restraint:

- Perception of High Initial Cost

Electric buses typically have higher upfront costs compared to conventional diesel or natural gas buses. The initial investment includes not only the higher purchase price of electric buses but also the cost of charging infrastructure installation and upgrades. This higher initial cost can be a barrier for some transit agencies, especially those with limited budgets or competing priorities. Charging electric buses can take significantly longer than refueling diesel buses, leading to increased downtime and reduced operational efficiency. Transit agencies must carefully plan charging schedules to minimize disruption to service while ensuring that buses have sufficient charge to complete their routes. Fast-charging technologies are emerging to address this challenge, but they may require additional investment and infrastructure.

Opportunity:

⮚ Government Support and Policies

Many governments worldwide are implementing ambitious policies and providing financial incentives to promote the adoption of electric vehicles, including buses. These initiatives aim to reduce greenhouse gas emissions, improve air quality, and stimulate economic growth in the clean energy sector. Government support creates a favorable regulatory environment and provides funding opportunities for electric bus manufacturers, operators, and infrastructure developers. Ongoing advancements in battery technology, electric drivetrains, and charging infrastructure are improving the performance, range, and affordability of electric buses. Innovations such as fast-charging technology, lightweight materials, and energy-efficient components enhance the feasibility and attractiveness of electric buses for fleet operators. Continued research and development efforts drive technological innovation and open new opportunities for market growth. Growing public awareness of environmental issues and the benefits of electric vehicles contributes to increasing demand for electric buses. Positive public perception, coupled with the availability of reliable and comfortable electric bus services, encourages greater adoption by transit agencies and private operators. Education and outreach efforts raise awareness about the advantages of electric buses and help overcome barriers to adoption.

Global Electric Bus Market Segment Overview

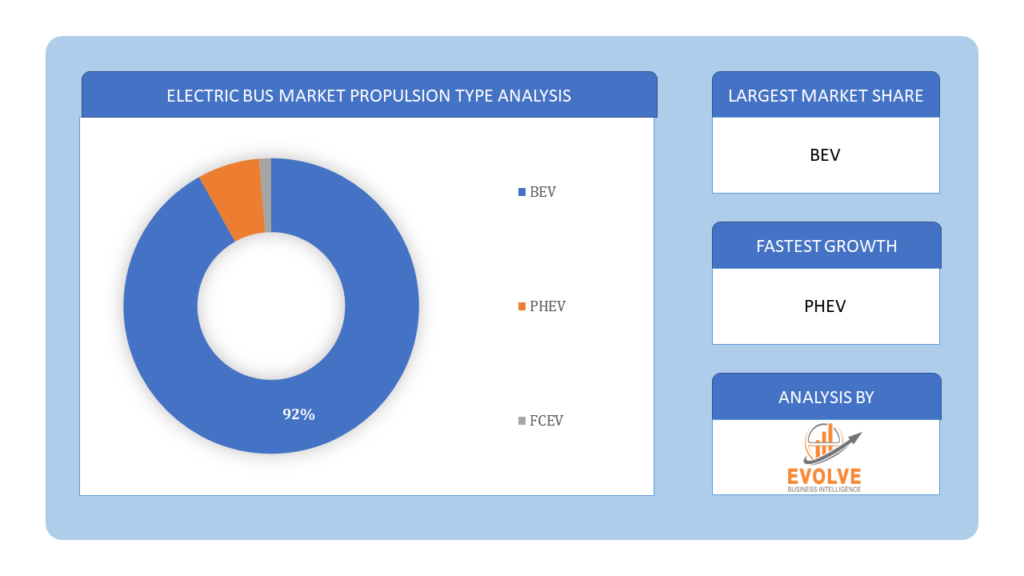

By Propulsion Type

Based on Propulsion Type, the market is segmented based on BEV and PHEV. The Battery Electric Vehicle (BEV) segment is dominant the market. Battery electric vehicles or BEVs are vehicle class with no supplementary source of propulsion, an electric vehicle (EV) that solely relies on chemical energy stored in rechargeable battery packs (e.g. hydrogen fuel cell, internal combustion engine, etc.). Internal combustion engines (ICEs) are replaced with electric motors and motor controllers in BEVs. They have no internal combustion engine, fuel cell, or gasoline tank because they get all their power from battery packs.

Based on Propulsion Type, the market is segmented based on BEV and PHEV. The Battery Electric Vehicle (BEV) segment is dominant the market. Battery electric vehicles or BEVs are vehicle class with no supplementary source of propulsion, an electric vehicle (EV) that solely relies on chemical energy stored in rechargeable battery packs (e.g. hydrogen fuel cell, internal combustion engine, etc.). Internal combustion engines (ICEs) are replaced with electric motors and motor controllers in BEVs. They have no internal combustion engine, fuel cell, or gasoline tank because they get all their power from battery packs.

By Component

Based on Component, the market segment has been divided into Motor, Battery, Fuel Cell Stack, Battery Management System, Battery Cooling System and EV Connectors. Batteries are the primary energy storage devices in electric buses. They store electrical energy for propulsion and auxiliary systems. Lithium-ion batteries are commonly used in electric buses due to their high energy density, power output, and cycle life. The capacity and energy density of the battery pack affect the range and performance of the electric bus.

By Consumer

Based on Consumer, the market segment has been divided into Fleet Operator and Government. Fleet operators segment is dominant the market. Fleet operators, which can include public transportation agencies, private bus companies, play a pivotal role in the adoption of electric buses. These operators are responsible for purchasing, operating, and maintaining bus fleets, making decisions that directly impact the transition to electric buses. Many fleet operators are increasingly recognizing the environmental and economic benefits of electric buses, such as reduced emissions, lower fuel and maintenance costs, and enhanced public image, leading to growing investments in electrification.

By Length of the bus

Based on Length of the bus, the market segment has been divided into Less than 9m, 9-14m and Above 14m. The 9 to 14m segment is dominant the market. 9–14-meter buses are large size buses and can carry anywhere from 40-90 people at the same time, these types of electric buses are used for intercity and long-distance travels, these buses are especially used as a passengers bus.

By Application

Based on Application, the market segment has been divided into Intercity and Intracity. The intracity segment anticipated to dominant the market. The segment is expanding as developing economies become more aware of the need to decrease carbon emissions and as severe emission regulations encourage the usage of electric buses. Clean mobility solutions are now essential due to rising urbanization. Urban population growth would necessitate widespread urban transit, which offers tremendous possibilities for electric mobility.

By Vehicle Range

Based on Vehicle Range, the market segment has been divided into Less than 200 miles and Above 200 miles. Electric buses with a driving range of above 200 miles are considered long-range or intercity buses. These buses are designed to cover longer distances on a single charge, making them suitable for regional, intercity, or commuter routes that require extended range capabilities. They are equipped with larger battery packs or alternative power sources, such as hydrogen fuel cells, to support extended operation between charging or refueling stops. Long-range electric buses offer the potential to replace diesel or natural gas-powered buses on longer routes, reducing emissions and operating costs while providing passengers with a quieter, smoother, and more sustainable transportation experience.

By Battery Capacity

Based on Battery Capacity, the market segment has been divided into Upto 400 Kwh and Above 400 Kwh. Electric buses with a battery capacity above 400 kWh are designed for longer routes or applications that demand extended range and higher energy storage capabilities. These buses are commonly used for intercity, regional, or commuter routes where charging infrastructure may be less dense or where longer distances need to be covered on a single charge. Buses in this segment typically feature larger battery packs or alternative power sources, such as hydrogen fuel cells, to support extended operation between charging or refueling stops.

By Power Output

Based on Power Output, the market segment has been divided into Upto 250 KW and Above 250 KW. Electric buses with a power output above 250 kW are designed for applications that demand higher performance, such as intercity or regional routes with higher speed requirements and longer distances between stops. These buses are equipped with larger motors and drivetrains to provide enhanced acceleration, hill climbing capability, and overall performance. They offer the potential to replace diesel or natural gas-powered buses on longer routes while delivering zero-emission operation and reduced operating costs.

By Battery Type

Based on Battery Type, the market segment has been divided into Lithium-Nickel-Maganese-Cobalt-Oxide and Lithium-Iron-Phosphate. The lithium nickel manganese cobalt oxide segment is dominant the market. The minerals in this type of rechargeable lithium-ion batteries are used in powder form in batch numbers as a cathode material. Extremely great thermal stability characterizes this material. The nickel magnesium cobalt battery has become more popular for use in electric buses because of its beneficial characteristics, which include a high capacity, cycle rate, and power, in addition to a low self-heating rate.

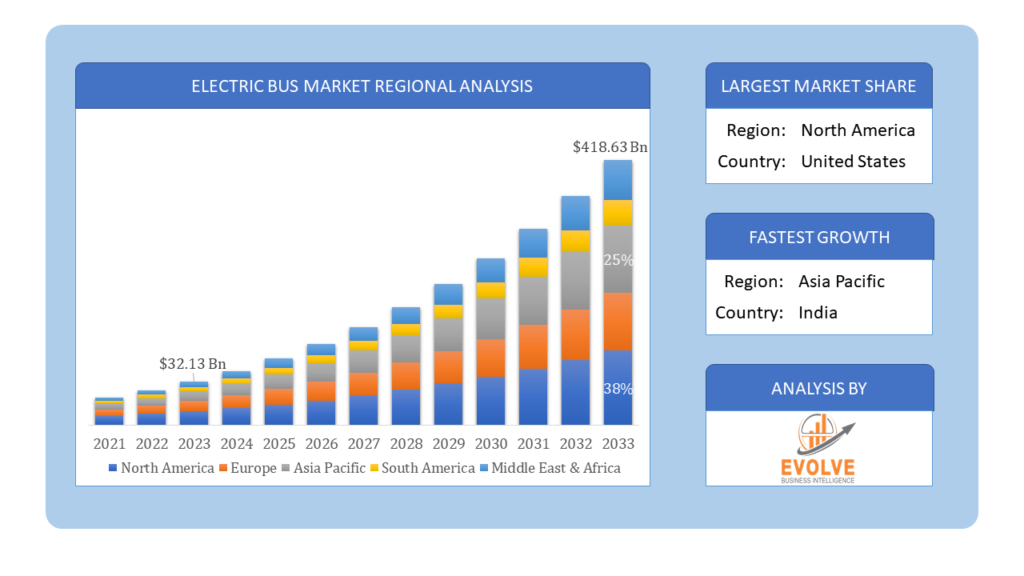

Global Electric Bus Market Regional Analysis

Based on region, the global Electric Bus Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Electric Bus Market followed by the Asia-Pacific and Europe regions.

Electric Bus North America Market

Electric Bus North America Market

North America holds a dominant position in the Global Electric Bus Market. The electric bus market in North America is growing steadily, driven by a combination of federal and state incentives, environmental regulations, and local government initiatives. Transit agencies in cities such as Los Angeles, New York, and Seattle have committed to transitioning their bus fleets to electric vehicles. However, adoption rates vary across regions due to factors such as funding availability, infrastructure readiness, and regulatory frameworks. North American manufacturers and international companies are competing in the market to meet the growing demand for electric buses.

Electric Bus Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Electric Bus Market industry. China leads the global electric bus market, accounting for a significant portion of electric bus sales and deployment. The Chinese government has implemented ambitious policies and subsidies to promote the adoption of electric vehicles, including buses, as part of efforts to address air pollution and reduce dependence on fossil fuels. Major Chinese manufacturers dominate the market, supplying electric buses domestically and internationally. Chinese cities have also made substantial investments in charging infrastructure and electric bus fleets, making China a major player in the global electric bus market.

Competitive Landscape

The global Electric Bus Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BYD

- Yutong

- Volvo

- Proterra

- Olectra

- VDL Bus & Coach

- Tata Motors

- Scania

- Iveco

- Blue Bird Corporation

Key Development

In April 2022, Volvo Buses launches Volvo Connect which is a new customer portal. With the connected services in one place, together with services for workshop efficiency, Volvo’s customers will have a new set of tools to increase uptime and productivity and improve safety.

In January 2022, BYD introduces an innovative and safe type of battery-electric school bus with v2g technology. It is a zero-emission school bus that combines design, performance, and safety together in a package built to meet the needs of students and administrators.

Scope of the Report

Global Electric Bus Market, by Propulsion Type

- BEV

- PHEV

Global Electric Bus Market, by Component

- Motor

- Battery

- Fuel Cell Stack

- Battery Management System

- Battery Cooling System

- EV Connectors

Global Electric Bus Market, by Consumer

- Fleet Operator

- Government

Global Electric Bus Market, by Length of the bus

- Less than 9m

- 9-14m

- Above 14m

Global Electric Bus Market, by Application

- Intercity

- Intracity

Global Electric Bus Market, by Vehicle Range

- Less than 200 miles

- Above 200 miles

Global Electric Bus Market, by Battery Capacity

- Upto 400 Kwh

- Above 400 Kwh

Global Electric Bus Market, by Power Output

- Upto 250 KW

- Above 250 KW

Global Electric Bus Market, by Battery Type

- Lithium-Nickel-Maganese-Cobalt-Oxide

- Lithium-Iron-Phosphate

Global Electric Bus Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.03 Billion |

| CAGR | 7.57% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Propulsion Type, Component, Consumer, Length of the bus, Application, Vehicle Range, Battery Capacity, Power Output, Battery Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BYD, Yutong, Volvo, Proterra, Olectra, VDL Bus & Coach, Tata Motors, Scania, Iveco and Blue Bird Corporation. |

| Key Market Opportunities | • Government Support and Policies • Public Perception and Awareness |

| Key Market Drivers | • Technological Advancements • Urbanization and Congestion |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Electric Bus Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Electric Bus Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Electric Bus Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Global Electric Bus Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.