Global Data Analytics Software Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

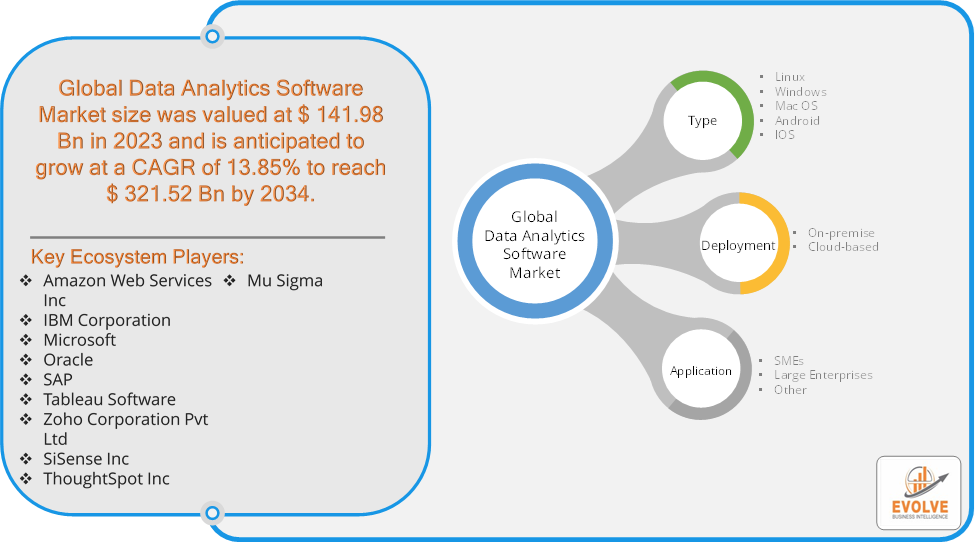

Global Data Analytics Software Market Research Report: Information By Type (Linux, Windows, Mac OS, Android, IOS), By Deployment (On-premise, Cloud-based), By Application (SMEs, Large Enterprises, Other), and by Region — Forecast till 2034

Page: 155

Global Data Analytics Software Market Overview

The Global Data Analytics Software Market size accounted for USD 141.98 Billion in 2023 and is estimated to account for 142.65 Billion in 2024. The Market is expected to reach USD 321.52 Billion by 2034 growing at a compound annual growth rate (CAGR) of 13.85% from 2024 to 2034. The Global Data Analytics Software Market refers to the global industry focused on the development, sale, and implementation of software solutions designed to analyze, process, and interpret large volumes of data. These software tools are used by organizations across various sectors to extract actionable insights from raw data, aiding in decision-making, operational efficiency, and business strategy.

The market is driven by factors such as the increasing adoption of big data technologies, growing demand for cloud-based solutions, and the rising need for businesses to gain a competitive edge through data-driven strategies. The global data analytics software market is a dynamic and rapidly evolving field that plays a crucial role in helping organizations unlock the potential of their data assets.

Global Data Analytics Software Market Synopsis

Global Data Analytics Software Market Dynamics

Global Data Analytics Software Market Dynamics

The major factors that have impacted the growth of Global Data Analytics Software Market are as follows:

Drivers:

Ø Increased Adoption of Big Data Technologies

The explosion of data generated from digital platforms, IoT devices, and social media has led businesses to seek advanced analytics tools to manage and extract insights from vast data volumes. Big data technologies help organizations handle complex and unstructured data sets, making data analytics software crucial for processing and analysis. Organizations increasingly rely on data analytics to make informed decisions, optimize processes, and improve performance. Data analytics software enables businesses to gain insights into customer behavior, market trends, and operational efficiency, fostering data-driven strategies that boost competitiveness.

Restraint:

- Perception of Data Privacy and Security Concerns

As organizations gather vast amounts of data, concerns about data security, breaches, and unauthorized access become more prominent. Compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) and other regional laws, requires stringent measures to safeguard sensitive information. The risk of cyberattacks, data breaches, and data misuse can discourage organizations from fully adopting or expanding their use of analytics software.

Opportunity:

⮚ Growing Adoption of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of AI and ML into data analytics software is transforming the way businesses extract value from data. AI-powered analytics tools can automatically detect patterns, trends, and anomalies in data sets, allowing for real-time decision-making. As AI and ML technologies continue to advance, there is a growing opportunity for vendors to develop more intelligent and automated analytics solutions. The rapid expansion of the Internet of Things (IoT) has led to massive amounts of real-time data generation from connected devices. There is a growing opportunity for analytics software that can process and analyze this data at the edge (closer to the data source) rather than sending it to centralized data centers. Edge analytics solutions will enable industries like manufacturing, logistics, and energy to make faster, data-driven decisions in real-time.

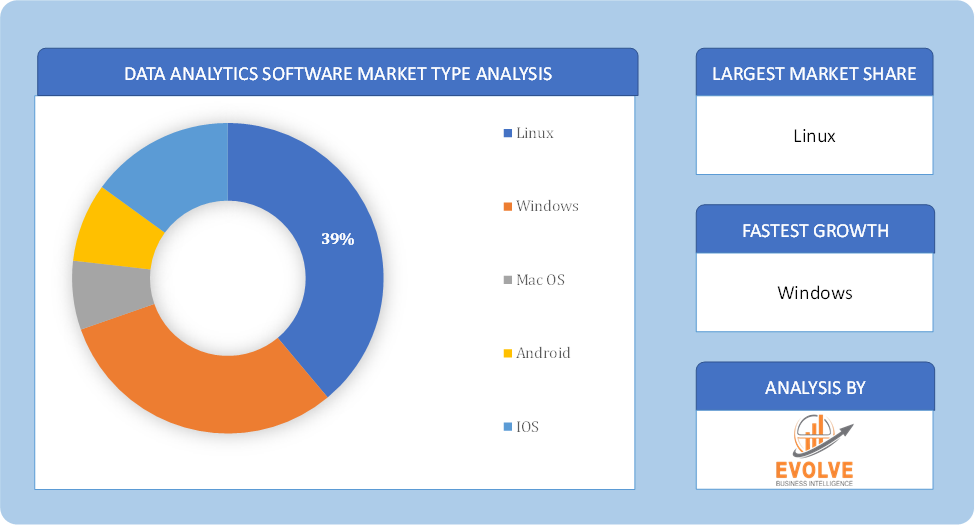

Data Analytics Software Market Segment Overview

Based on Type, the market is segmented based on Linux, Windows, Mac OS, Android and IOS. The Windows segment dominant the market. Windows is the dominant operating system in enterprises worldwide, particularly in industries like finance, healthcare, and retail. The large installed base of Windows users creates a strong demand for data analytics software compatible with the platform. Many Windows-based data analytics solutions support both on-premises and cloud environments. This flexibility allows businesses to choose the deployment model that best fits their infrastructure and data privacy requirements.

By Deployment

Based on Deployment, the market segment has been divided into On-premise and Cloud-based. The On-premise segment dominant the market. On-premise installations give businesses more freedom and control over how to tailor their IT infrastructure, also decreasing their reliance on the web and safeguarding sensitive company information from theft and fraud. It is projected that these advantages will persuade major enterprises to choose an on-premise deployment.

By Application

Based on Application, the market segment has been divided into SMEs, Large Enterprises and Other. The Large Enterprises segment dominant the market. Large enterprises often use advanced analytics techniques, such as predictive and prescriptive analytics, to forecast trends, optimize supply chains, and improve customer satisfaction. These capabilities help businesses stay competitive and make proactive decisions. Large enterprises are increasingly adopting AI and ML-powered analytics to automate processes, detect patterns in data, and provide more accurate, real-time insights. AI-driven tools help in fraud detection, risk assessment, and customer segmentation.

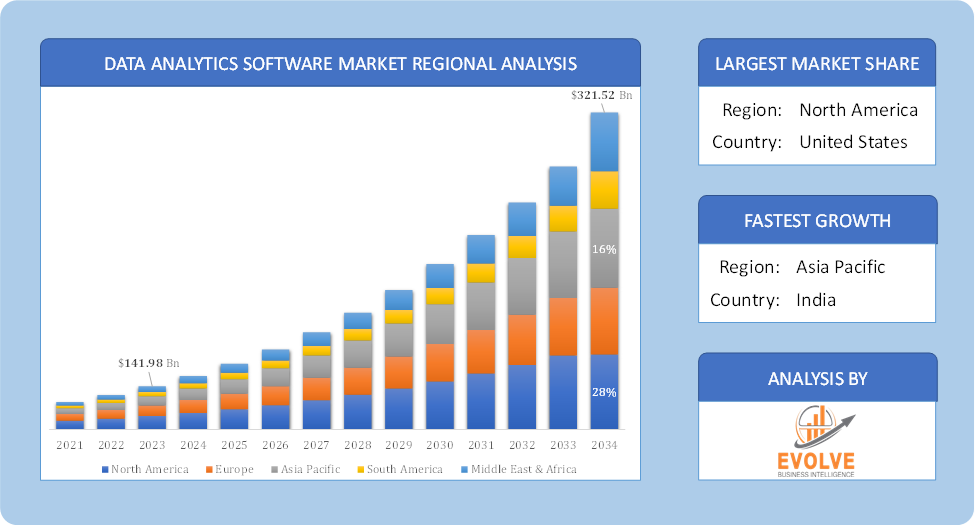

Global Data Analytics Software Market Regional Analysis

Based on region, the global Data Analytics Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Data Analytics Software Market followed by the Asia-Pacific and Europe regions.

Global Data Analytics Software North America Market

Global Data Analytics Software North America Market

North America holds a dominant position in the Data Analytics Software Market. North America remains the largest and most mature market for data analytics software, with a significant presence of established players and a strong focus on innovation and the region benefits from a well-developed IT infrastructure, a large number of data-intensive industries, and a high level of awareness about the value of data analytics.

Global Data Analytics Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Data Analytics Software Market industry. The Asia-Pacific region is the fastest-growing market for data analytics software, fueled by rapid economic growth, increasing digitalization, and a growing emphasis on data-driven decision-making and the region offers significant opportunities for growth, particularly in countries such as China, India, and Japan, which are experiencing rapid urbanization and industrialization.

Competitive Landscape

The global Data Analytics Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Amazon Web Services Inc

- IBM Corporation

- Microsoft

- Oracle

- SAP

- Tableau Software

- Zoho Corporation Pvt Ltd

- SiSense Inc

- ThoughtSpot Inc

- Mu Sigma

Key Development

In April 2022, An augmented intelligence enterprise called DataRobot entered a strategic alliance with Wipro. The alliance aims to accelerate customers’ business impact by delivering scaled augmented intelligence and helping them become AI-driven organizations. This collaboration will ensure faster implementation of AI strategies and faster time-to-value for businesses.

Scope of the Report

Global Data Analytics Software Market, by Type

- Linux

- Windows

- Mac OS

- Android

- IOS

Global Data Analytics Software Market, by Deployment

- On-premise

- Cloud-based

Global Data Analytics Software Market, by Application

- SMEs

- Large Enterprises

- Other

Global Data Analytics Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 321.52 Billion |

| CAGR (2024-2034) | 13.85% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Deployment, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Amazon Web Services Inc, IBM Corporation, Microsoft, Oracle, SAP, Tableau Software, Zoho Corporation Pvt Ltd, SiSense Inc, ThoughtSpot Inc and Mu Sigma. |

| Key Market Opportunities | · Growing Adoption of Artificial Intelligence (AI) and Machine Learning (ML) · IoT and Edge Analytics |

| Key Market Drivers | · Increased Adoption of Big Data Technologies · Rising Demand for Data-Driven Decision-Making |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Data Analytics Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Data Analytics Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Data Analytics Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Data Analytics Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Data Analytics Software Market is 2021- 2033

What is the growth rate of the global Data Analytics Software Market?

The global Data Analytics Software Market is growing at a CAGR of 13.85% over the next 10 years

Which region has the highest growth rate in the market of Data Analytics Software Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Data Analytics Software Market?

North America holds the largest share in 2022

Who are the key players in the global Data Analytics Software Market?

Conagra Brands Inc, Kellogg Company, Ajinomoto Co Inc, Nestle, Aryzta, General Mills Inc, Cargill Incorporated, Associated British Foods, The Kraft Heinz Company, and JBS S.A. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Deployment Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Global Data Analytics Software Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Data Analytics Software Market, By Type 7.1. Introduction 7.1.1. Linux 7.1.2. Windows 7.1.3. Mac OS 7.1.4. Android 7.1.5. IOS CHAPTER 8 Data Analytics Software Market, By Deployment 8.1. Introduction 8.1.1. On-Premise 8.1.2. Cloud-based CHAPTER 9. Data Analytics Software Market, By Application 9.1. Introduction 9.1.1. SMEs 9.1.2 Large Enterprises 9.1.3. Other CHAPTER 10. Data Analytics Software Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.3. North America: Market Size and Forecast, By Equipment, 2024 – 2034($ Million) 10.2.4. North America: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Phase, 2024 – 2034($ Million) 10.2.5.2. US: Market Size and Forecast, By Equipment, 2024 – 2034($ Million) 10.2.5.3. US: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.3. Europe: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.4. Europe: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Component, 2024 – 2034($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.7.2. France: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.7.3. France: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.5.2. China: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.5.3. China: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.7.2. India: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.7.3. India: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million) 10.5.4. South America: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Sourcing Type, 2024 – 2034($ Million) 10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Application, 2024 – 2034($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Amazon Web Services Inc 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. IBM Corporation, Microsoft, Oracle, SAP, Tableau Software, Zoho Corporation Pvt Ltd, SiSense Inc, ThoughtSpot Inc and Mu Sigma. 13.3. Microsoft 13.4. Oracle 13.5. SAP 13.6. Tableau Software 13.7. Zoho Corporation Pvt Ltd 13.8. SiSense Inc 13.9 ThoughtSpot Inc 13.10 Mu Sigma

Connect to Analyst

Research Methodology