Global Carpooling Software Market Overview

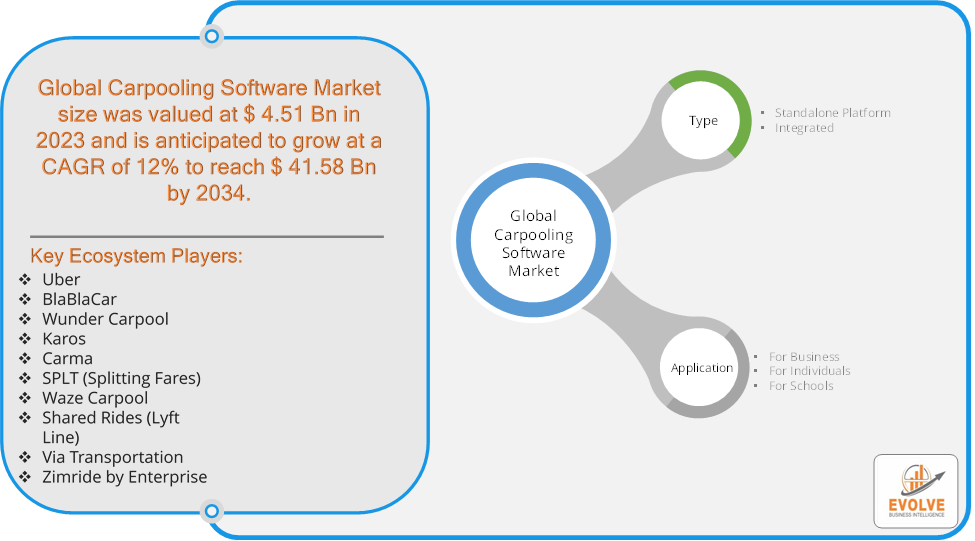

The Global Carpooling Software Market size accounted for USD 4.51 Billion in 2023 and is estimated to account for 6.87 Billion in 2024. The Market is expected to reach USD 41.58 Billion by 2034 growing at a compound annual growth rate (CAGR) of 12% from 2024 to 2034. The Global Carpooling Software Market refers to the market for software platforms and applications that facilitate carpooling services, enabling individuals to share rides for daily commutes, long-distance travel, or specific events. These platforms typically connect drivers with empty seats to passengers traveling in the same direction, offering a cost-effective, eco-friendly, and convenient transportation alternative.

The Global Carpooling Software Market is expected to grow as more users adopt shared mobility solutions, driven by urbanization, the need to reduce emissions, and the development of advanced technological platforms.

Global Carpooling Software Market Synopsis

Global Carpooling Software Market Dynamics

Global Carpooling Software Market Dynamics

The major factors that have impacted the growth of Global Carpooling Software Market are as follows:

Drivers:

Ø Technological Advancements

Advances in GPS technology, mapping, and real-time data analytics have made it easier for carpooling platforms to match drivers with passengers based on their proximity and routes, enhancing the overall user experience. The widespread adoption of smartphones has enabled the growth of carpooling apps, making it easy for users to access carpooling services through mobile platforms. Carpooling enables drivers to share fuel and toll costs with passengers, making transportation more affordable. This is particularly appealing in regions with high fuel prices or limited public transportation options. Fluctuating and often rising fuel prices are motivating drivers to explore cost-saving alternatives such as carpooling. By sharing rides, drivers can offset fuel costs, making carpooling more appealing.

Restraint:

- Perception of Lack of User Trust and Safety Concerns

Despite the introduction of safety features like background checks and user verification, many users remain hesitant to share rides with strangers. Concerns over personal safety and privacy can discourage potential users from participating in carpooling services. Building trust between drivers and passengers, especially in less-regulated or peer-to-peer carpooling setups, is a challenge. Users are often cautious about sharing rides with people they do not know.

Opportunity:

⮚ Expansion of Corporate Carpooling Programs

There is a growing demand for corporate carpooling solutions as businesses look for sustainable and cost-effective ways to transport their employees. By offering carpooling services as part of employee benefits or mobility programs, companies can reduce parking congestion, lower transportation costs, and enhance employee satisfaction. Many companies are implementing sustainability strategies to reduce their carbon footprint, and carpooling is an effective way to align with these goals. Carpooling platforms can partner with businesses to provide customized solutions for corporate fleets and employee commuting. Carpooling platforms can leverage artificial intelligence (AI) and machine learning to enhance route optimization, improve ride-matching algorithms, and personalize the user experience. By analyzing data on travel patterns and user preferences, platforms can offer more accurate ride matches and reduce wait times.

Global Carpooling Software Market Segment Overview

Based on Type, the market is segmented based on Standalone Platform and Integrated. The Integrated segment dominant the market. Integrated carpooling platforms often support seamless payment options by linking to existing digital wallets or public transport payment systems. Users can pay for carpooling rides and public transport fares through one platform, making it easier to switch between different modes of transport.

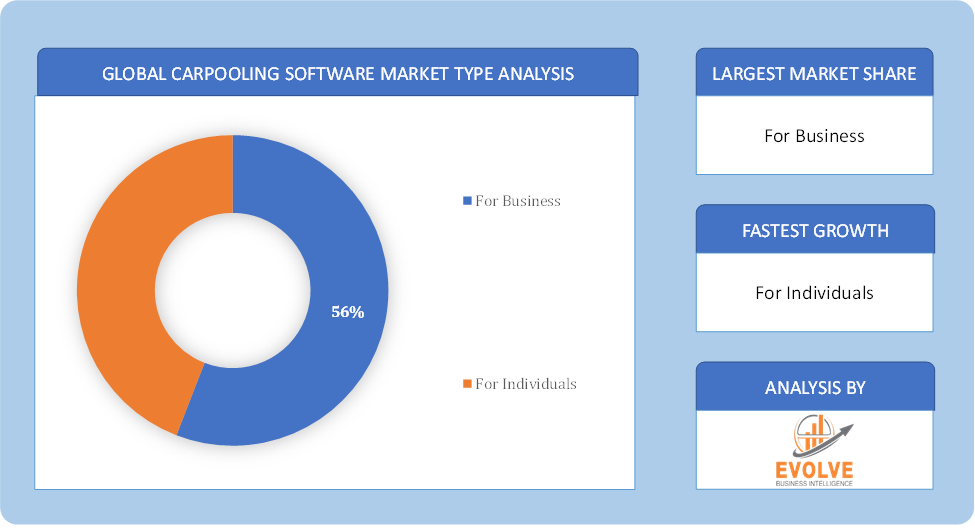

By Application

Based on Application, the market segment has been divided into For Business, For Individuals and For Schools. The Business segment dominant the market. Business carpooling platforms often include robust safety features, such as verified user profiles, ride tracking, and emergency support, to ensure the well-being of employees. Carpooling solutions help companies reduce the costs associated with providing employee transportation services, such as corporate shuttles, parking, and vehicle maintenance.

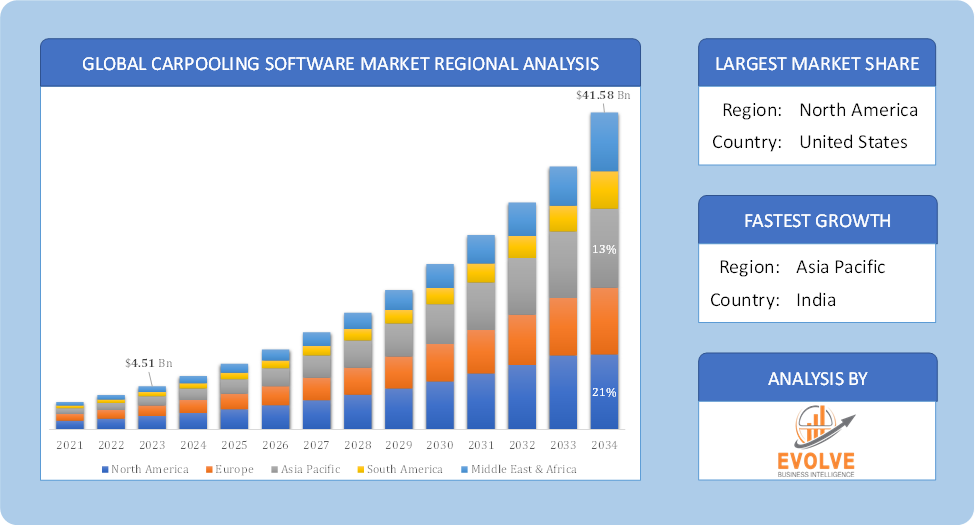

Global Carpooling Software Market Regional Analysis

Based on region, the Global Carpooling Software Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Carpooling Software Market followed by the Asia-Pacific and Europe regions.

Global Carpooling Software North America Market

Global Carpooling Software North America Market

North America holds a dominant position in the Global Carpooling Software Market. North America, particularly the U.S. and Canada, is one of the leading regions for carpooling software, driven by a strong focus on reducing traffic congestion and promoting green transportation. High urbanization, advanced technology infrastructure, and awareness of environmental issues contribute to the market’s growth and high smartphone penetration and technological readiness enable widespread adoption of carpooling apps.

Global Carpooling Software Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Carpooling Software Market industry. The Asia-Pacific region represents a fast-growing market for carpooling software, with high demand for affordable and efficient transportation solutions due to rapid urbanization and traffic congestion. Countries like China, India, Japan, and Southeast Asian nations are key markets and the rising adoption of smartphones and mobile internet, especially in densely populated areas.

Competitive Landscape

The Global Carpooling Software Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Uber

- BlaBlaCar

- Wunder Carpool

- Karos

- Carma

- SPLT (Splitting Fares)

- Waze Carpool

- Shared Rides (Lyft Line)

- Via Transportation

- Zimride by Enterprise

Scope of the Report

Global Carpooling Software Market, by Type

- Standalone Platform

- Integrated

Global Carpooling Software Market, by Application

- For Business

- For Individuals

- For Schools

Global Carpooling Software Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 41.58 Billion |

| CAGR (2024-2034) | 12% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Uber, BlaBlaCar, Wunder Carpool, Karos, Carma, SPLT (Splitting Fares), Waze Carpool, Shared Rides (Lyft Line), Via Transportation and Zimride by Enterprise. |

| Key Market Opportunities | · Expansion of Corporate Carpooling Programs

· Advancements in Technology |

| Key Market Drivers | · Technological Advancements

· Cost Efficiency and Rising Fuel Prices |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Carpooling Software Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Carpooling Software Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Carpooling Software Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the Global Carpooling Software Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.