Global Blind Spot Object Detection System Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

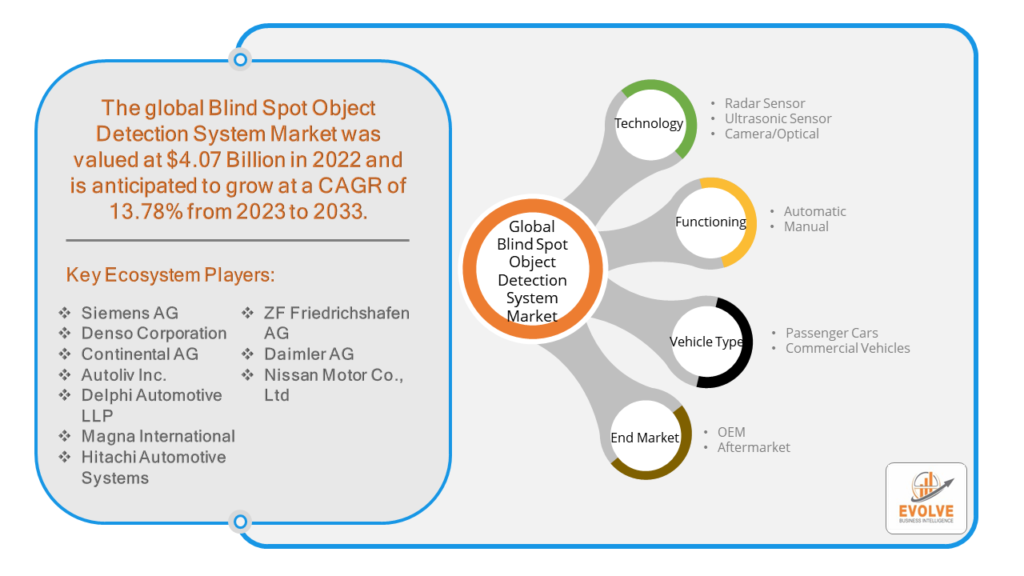

Global Blind Spot Object Detection System Market Research Report: Information By Technology (Radar Sensor, Ultrasonic Sensor, Camera/Optical), By Functioning (Automatic, Manual), By Vehicle Type (Passenger Cars, Commercial Vehicles), By End Market (OEM, Aftermarket), and by Region — Forecast till 2033

Page: 114

Global Blind Spot Object Detection System Market Overview

The global Blind Spot Object Detection System market was valued at $4.07 Billion in 2022 and is anticipated to grow at a CAGR of 13.78% from 2023 to 2033. A Blind Spot Object Detection System is a safety feature in vehicles designed to detect and alert drivers to the presence of objects or vehicles in their blind spots, areas not visible through the rearview or side mirrors. Using sensors, cameras, or radar technology, the system continuously monitors the vehicle’s surroundings, particularly adjacent lanes, and detects objects that may not be visible to the driver during lane-changing maneuvers or merging. When an object or vehicle is detected in the blind spot, the system typically provides visual or audible warnings to alert the driver, helping to prevent accidents caused by unintended lane changes or collisions with vehicles in adjacent lanes.

Global Blind Spot Object Detection System Market Synopsis

The COVID-19 pandemic had significant impacts on the Global Blind Spot Object Detection System Market, initially causing disruptions in automotive production and supply chains, leading to delays in the adoption of advanced safety features. However, heightened awareness of safety and the growing emphasis on advanced driver assistance systems (ADAS) in vehicles spurred demand for blind spot detection systems, driving market recovery and growth.

Global Blind Spot Object Detection System Market Dynamics

The major factors that have impacted the growth of the Global Blind Spot Object Detection System Market are as follows:

Drivers:

Ø Increasing Focus on Vehicle Safety

the Blind Spot Object Detection System Market is the growing emphasis on vehicle safety globally. With a rising number of road accidents attributed to blind spot-related incidents, there’s heightened awareness among consumers, automakers, and regulatory bodies about the importance of advanced safety features like blind spot detection systems in vehicles.

Restraint:

- Cost Constraints

A primary restraint for the Blind Spot Object Detection System Market is the cost associated with implementing these systems in vehicles. The integration of sensors, cameras, and other technologies required for blind spot detection can increase the overall cost of vehicles, potentially limiting their adoption, especially in price-sensitive market segments.

Opportunity:

⮚ Technological Advancements

An opportunity for the Blind Spot Object Detection System Market lies in technological advancements aimed at improving the accuracy, reliability, and cost-effectiveness of these systems. Continued innovation in sensor technologies, machine learning algorithms, and integration with other advanced driver assistance systems (ADAS) presents opportunities to enhance the performance and functionality of blind spot detection systems, making them more attractive to automakers and consumers alike.

Global Blind Spot Object Detection System Market Segment Overview

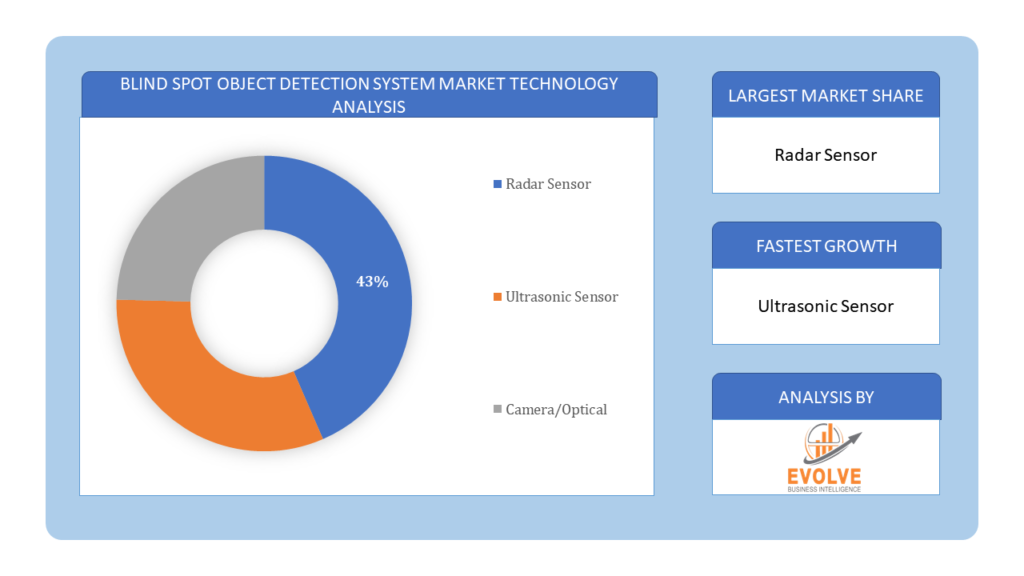

By Technology

Based on Technology, the market is segmented based on Radar Sensor, Ultrasonic Sensor, and Camera/Optical. The Radar Sensor segment dominates the Blind Spot Object Detection System market due to its high accuracy, reliability, and effectiveness in detecting objects or vehicles in blind spots. Radar sensors utilize radio waves to detect objects’ presence, offering robust performance in various weather conditions and lighting environments. Additionally, radar sensors provide longer detection ranges compared to other sensor technologies, enabling timely and accurate alerts to drivers. Their widespread adoption by automakers and integration into advanced driver assistance systems (ADAS) contribute to the dominance of the Radar Sensor segment in the Blind Spot Object Detection System market.

Based on Technology, the market is segmented based on Radar Sensor, Ultrasonic Sensor, and Camera/Optical. The Radar Sensor segment dominates the Blind Spot Object Detection System market due to its high accuracy, reliability, and effectiveness in detecting objects or vehicles in blind spots. Radar sensors utilize radio waves to detect objects’ presence, offering robust performance in various weather conditions and lighting environments. Additionally, radar sensors provide longer detection ranges compared to other sensor technologies, enabling timely and accurate alerts to drivers. Their widespread adoption by automakers and integration into advanced driver assistance systems (ADAS) contribute to the dominance of the Radar Sensor segment in the Blind Spot Object Detection System market.

By Functioning

Based on Functioning, the market segment has been divided into Automatic and Manual. The Automatic segment dominates the Blind Spot Object Detection Systems market due to its convenience and effectiveness in detecting objects or vehicles in blind spots without requiring manual intervention from the driver. Automatic blind spot detection systems typically use sensors, cameras, or radar technology to continuously monitor the vehicle’s surroundings and provide alerts to the driver when objects are detected in the blind spot zones. These systems offer seamless integration with the vehicle’s existing safety features and can operate independently, enhancing overall safety and driving experience. Additionally, the increasing adoption of advanced driver assistance systems (ADAS) in vehicles contributes to the dominance of the Automatic segment in the Blind Spot Object Detection Systems market.

By Vehicle Type

Based on Vehicle Type, the market segment has been divided into Passenger Cars and Commercial Vehicles. The Passenger Cars segment holds the largest market share in the Blind Spot Object Detection Systems market due to the widespread adoption of advanced safety features in passenger vehicles. As safety concerns become increasingly prominent among consumers, automakers are integrating blind spot detection systems into their vehicles to enhance driver safety and prevent accidents caused by blind spot-related incidents.

By End Market

Based on the End Market, the market segment has been divided into OEM and Aftermarket. The OEM (Original Equipment Manufacturer) segment dominates the Blind Spot Object Detection Systems market due to several factors. Firstly, OEMs play a crucial role in integrating blind spot detection systems into new vehicles during the manufacturing process, ensuring seamless integration with other vehicle systems and components. As safety regulations become more stringent worldwide, OEMs are increasingly incorporating advanced driver assistance systems (ADAS), including blind spot detection, as standard or optional features in their vehicle models to enhance safety and meet regulatory requirements.

Global Blind Spot Object Detection System Market Regional Analysis

Based on region, the global Blind Spot Object Detection System Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Blind Spot Object Detection System Market followed by the Asia-Pacific and Europe regions.

Blind Spot Object Detection System North America Market

North America holds a dominant position in the Global Blind Spot Object Detection System Market, primarily driven by stringent safety regulations, high consumer awareness of advanced driver assistance systems (ADAS), and the widespread adoption of premium vehicles equipped with advanced safety features. The region boasts a robust automotive industry, with leading OEMs integrating blind spot detection systems into their vehicle models to enhance safety and meet regulatory requirements. Moreover, increasing investments in research and development, coupled with technological advancements in sensor technology and connectivity, further bolster North America’s position as a leader in the Blind Spot Object Detection System Market. Additionally, collaborations between automakers and technology suppliers, along with government initiatives promoting vehicle safety, contribute to the market’s dominance in the region.

Blind Spot Object Detection System Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Blind Spot Object Detection System Market, driven by several key factors. Firstly, the region’s rapidly expanding automotive industry, particularly in countries like China, Japan, and South Korea, has led to increased demand for advanced safety features in vehicles, including blind spot detection systems. Additionally, rising consumer awareness of road safety and the benefits of advanced driver assistance systems (ADAS) have fueled adoption rates in the region. Furthermore, supportive government regulations and initiatives aimed at improving vehicle safety standards have further accelerated market growth. Moreover, the increasing integration of blind spot detection systems by leading OEMs in their vehicle models to cater to the preferences of tech-savvy consumers in the Asia-Pacific region has contributed to its rapid market expansion.

Competitive Landscape

The global Blind Spot Object Detection System Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Siemens AG

- Denso Corporation

- Continental AG

- Autoliv Inc.

- Delphi Automotive LLP

- Magna International

- Hitachi Automotive Systems

- ZF Friedrichshafen AG

- Daimler AG

- Nissan Motor Co., Ltd

Scope of the Report

Global Blind Spot Object Detection System Market, by Technology

- Radar Sensor

- Ultrasonic Sensor

- Camera/Optical

Global Blind Spot Object Detection System Market, by Functioning

- Automatic

- Manual

Global Blind Spot Object Detection System Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Blind Spot Object Detection System Market, by End Market

- OEM

- Aftermarket

Global Blind Spot Object Detection System Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $4.07 Billion |

| CAGR | 13.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Technology, Functioning, Vehicle Type, End Market |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Siemens AG, Denso Corporation, Continental AG, Autoliv Inc., Delphi Automotive LLP, Magna International, Hitachi Automotive Systems, ZF Friedrichshafen AG, Daimler AG, Nissan Motor Co., Ltd. |

| Key Market Opportunities | • Technological advancements improve the accuracy and effectiveness of blind spot detection systems. • The growing integration of blind spot detection systems by OEMs into new vehicle models to meet regulatory requirements and consumer demand for safety features. |

| Key Market Drivers | • Increasing emphasis on vehicle safety standards globally. • Rising consumer awareness of advanced driver assistance systems (ADAS) and their benefits in preventing accidents. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Blind Spot Object Detection System Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Blind Spot Object Detection System Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Blind Spot Object Detection System Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Blind Spot Object Detection System Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Blind Spot Object Detection System Market?

The study period for the Blind Spot Object Detection System Market spans from 2021 to 2033, offering insights into long-term trends and forecasts in vehicle safety technology.

What is the growth rate of the Blind Spot Object Detection System Market?

The Blind Spot Object Detection System Market is expected to grow at a robust compound annual growth rate (CAGR) of 13.78% from 2023 to 2033, driven by increasing emphasis on vehicle safety globally and rising consumer awareness of advanced driver assistance systems (ADAS).

Which region has the highest growth rate in the Blind Spot Object Detection System Market?

The Asia-Pacific region is witnessing the highest growth rate in the Blind Spot Object Detection System Market, attributed to factors such as rapidly expanding automotive industry, rising consumer awareness of road safety, and supportive government regulations promoting vehicle safety standards.

Which region has the largest share of the Blind Spot Object Detection System Market?

North America currently holds the largest share of the Blind Spot Object Detection System Market, driven by stringent safety regulations, high consumer awareness of advanced driver assistance systems (ADAS), and widespread adoption of premium vehicles equipped with advanced safety features.

Who are the key players in the Blind Spot Object Detection System Market?

Key players in the Blind Spot Object Detection System Market include Siemens AG, Denso Corporation, Continental AG, Autoliv Inc., Delphi Automotive LLP, Magna International, Hitachi Automotive Systems, ZF Friedrichshafen AG, Daimler AG, and Nissan Motor Co., Ltd., leading innovation and development in vehicle safety technology.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Technology Segement – Market Opportunity Score 4.1.2. Functioning Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.1.4. End Market Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Global Blind Spot Object Detection System Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Blind Spot Object Detection System Market, By Technology 7.1. Introduction 7.1.1. Radar Sensor 7.1.2 Ultrasonic Sensor 7.1.3. Camera/Optical CHAPTER 8. Global Blind Spot Object Detection System Market, By Functioning 8.1. Introduction 8.1.1. Automatic 8.1.2. Manual CHAPTER 9. Global Blind Spot Object Detection System Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial Vehicles CHAPTER 10. Global Biopesticides Market, By End Market 10.1.Introduction 10.1.1. OEM 10.1.2. Aftermarket CHAPTER 11. Global Blind Spot Object Detection System Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Functioning, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By End Market, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Siemens AG 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Denso Corporation 13.3. Continental AG 13.4. Autoliv Inc. 13.5. Delphi Automotive LLP 13.6. Magna International 13.7. Hitachi Automotive Systems 13.8. ZF Friedrichshafen AG 13.9. Daimler AG 13.10. Nissan Motor Co., Ltd

Connect To Analyst

Research Methodology