Automotive Wheels Aftermarket Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

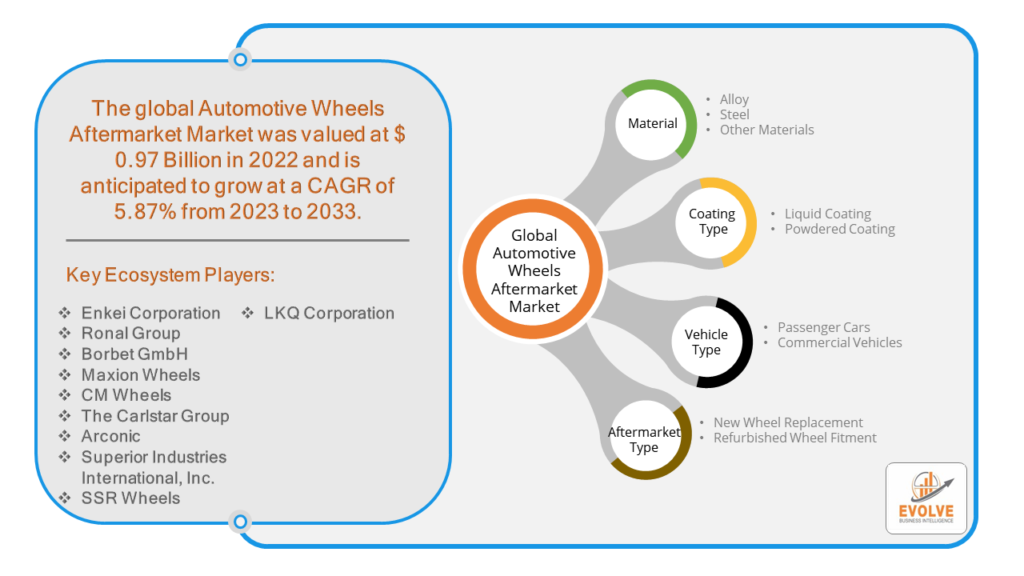

Automotive Wheels Aftermarket Market Research Report: By Material (Alloy, Steel, and Other Materials) By Coating Type (Liquid Coating and Powdered Coating) By Vehicle Type (Passenger Cars and Commercial Vehicles) By Aftermarket Type (New Wheel Replacement and Refurbished Wheel Fitment), and by Region — Forecast till 2033

Page: 141

Automotive Wheels Aftermarket Market Overview

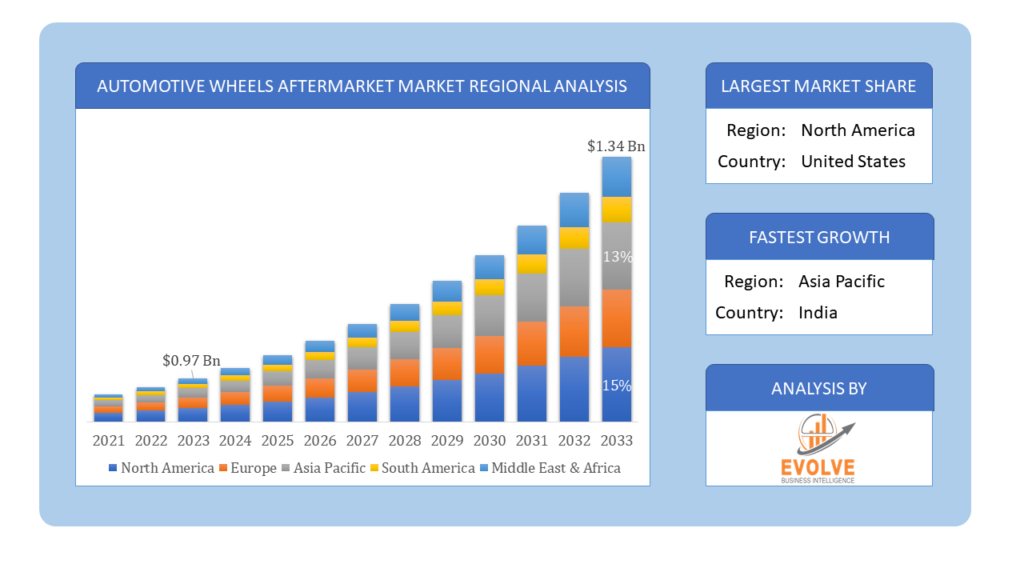

Automotive Wheels Aftermarket Market Size is expected to reach USD 1.34 Billion by 2033. The Automotive Wheels Aftermarket industry size accounted for USD 0.97 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.87% from 2023 to 2033. The automotive wheels aftermarket market refers to the segment of the automotive industry that deals with the sale of wheels (rims) for vehicles through channels other than the original equipment manufacturers (OEMs). This market includes a variety of aftermarket wheels designed for different vehicle types, styles, and performance needs. It encompasses both replacement wheels for damaged or worn-out OEM wheels, as well as custom wheels for aesthetic enhancement or performance improvement. The aftermarket offers a wide range of options in terms of materials, sizes, finishes, and designs, catering to diverse consumer preferences. This sector is driven by factors such as vehicle customization trends, technological advancements, and consumer demand for individualization and personalization of their vehicles.

Global Automotive Wheels Aftermarket Market Synopsis

The Automotive Wheels Aftermarket market experienced a detrimental effect due to the Covid-19 pandemic.The COVID-19 pandemic significantly impacted the automotive wheels aftermarket market due to disruptions in supply chains, manufacturing operations, and consumer demand. Lockdowns and restrictions led to a decline in vehicle sales and aftermarket purchases as economic uncertainty prevailed. However, as restrictions eased, there was a gradual recovery driven by pent-up demand, increased preference for personal vehicles, and a rise in DIY vehicle customization projects.

Global Automotive Wheels Aftermarket Market Dynamics

The major factors that have impacted the growth of Automotive Wheels Aftermarket are as follows:

Drivers:

⮚ Changing Consumer Preferences

Consumer preferences for wheel designs, materials, and finishes change over time. Manufacturers in the aftermarket sector continually innovate to meet these changing preferences, offering a wide variety of styles, colors, and materials to cater to diverse customer tastes.

Restraint:

- High Initial Investment

Upgrading or customizing wheels can require a significant initial investment, especially for premium or high-performance aftermarket products. This high upfront cost can deter budget-conscious consumers from purchasing aftermarket wheels, particularly during economic downturns or periods of financial uncertainty.

Opportunity:

⮚ Technological Advancements

Continued advancements in manufacturing technologies, materials science, and design innovation present opportunities for aftermarket wheel manufacturers to develop cutting-edge products with enhanced performance, durability, and aesthetics. For example, the adoption of lightweight materials like carbon fiber and advanced manufacturing techniques such as 3D printing can lead to the production of high-performance aftermarket wheels that offer superior strength-to-weight ratios and improved fuel efficiency.

Automotive Wheels Aftermarket Market Segment Overview

By Material

Based on the Material, the market is segmented based on Alloy, Steel, and Other Materials. Steel wheels remain a popular choice for budget-conscious consumers and certain heavy-duty applications, while other materials cater to niche preferences and specialized requirements within the aftermarket segment.

By Coating Type

Based on Coating Type , the market has been divided into Liquid Coating and Powdered Coating. due to its superior durability, resistance to chipping, and ability to create a wide range of finishes. This coating type offers enhanced corrosion protection and aesthetic appeal, making it a preferred choice for consumers seeking long-lasting and visually appealing wheel customization options.

By Vehicle Type

Based on the Vehicle Type, the market has been divided into Passenger Cars and Commercial Vehicles. Passenger cars account for a significant portion, driven by individual consumer preferences and customization trends, while commercial vehicles represent a robust market segment, fueled by fleet maintenance and replacement needs across various industries.

Based on the Vehicle Type, the market has been divided into Passenger Cars and Commercial Vehicles. Passenger cars account for a significant portion, driven by individual consumer preferences and customization trends, while commercial vehicles represent a robust market segment, fueled by fleet maintenance and replacement needs across various industries.

By Aftermarket Type

Based on Aftermarket Type, the market has been divided into New Wheel Replacement and Refurbished Wheel Fitment. While new wheel replacement offers fresh options, refurbished wheel fitment provides cost-effective alternatives, catering to a diverse range of consumer preferences and budgetary considerations.

Global Automotive Wheels Aftermarket Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Automotive Wheels Aftermarket, followed by those in Asia-Pacific and Europe.

Automotive Wheels Aftermarket North America Market

Automotive Wheels Aftermarket North America Market

The North American region holds a dominant position in the Automotive Wheels Aftermarket market. In the North American Automotive Wheels Aftermarket, steady growth is driven by factors such as rising vehicle customization trends, increasing demand for premium and high-performance vehicles, and a thriving automotive aftermarket industry. Alloy wheels dominate the market due to their lightweight construction, aesthetic appeal, and performance benefits. Additionally, stringent regulations regarding vehicle emissions and fuel efficiency are influencing the adoption of lightweight wheels to enhance vehicle efficiency. The presence of key players, technological advancements, and a strong consumer base further contribute to the region’s robust aftermarket for automotive wheels.

Automotive Wheels Aftermarket Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Automotive Wheels Aftermarket industry. In the Asia Pacific Automotive Wheels Aftermarket, rapid urbanization, expanding middle-class population, and increasing disposable income levels are driving significant growth. Alloy wheels are particularly popular due to their aesthetic appeal and performance advantages, aligning with the region’s preference for stylish vehicle customization. Additionally, the burgeoning automotive industry in countries like China, India, and Japan further propels aftermarket demand for wheels. Moreover, the region’s focus on sustainability and vehicle efficiency is fostering the adoption of lightweight materials and advanced manufacturing techniques

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Enkei Corporation, Ronal Group, Borbet GmbH, Maxion Wheels, and CM Wheels are some of the leading players in the global Automotive Wheels Aftermarket Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Enkei Corporation

- Ronal Group

- Borbet GmbH

- Maxion Wheels

- CM Wheels

- The Carlstar Group

- Arconic

- Superior Industries International, Inc.

- SSR Wheels

- LKQ Corporation

Key Development:

In January 2022, there might not be specific information available on Borbet GmbH’s key developments in the automotive wheels aftermarket during that time. For the latest updates on Borbet GmbH’s developments, including any new products, partnerships, or initiatives in the automotive wheels aftermarket, I recommend checking their official website or recent press releases.

Scope of the Report

Global Automotive Wheels Aftermarket Market, by Material

- Alloy

- Steel

- Other Materials

Global Automotive Wheels Aftermarket Market, by Coating Type

- Liquid Coating

- Powdered Coating

Global Automotive Wheels Aftermarket Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive Wheels Aftermarket Market, by Aftermarket Type

- New Wheel Replacement

- Refurbished Wheel Fitment

Global Automotive Wheels Aftermarket Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $1.34 Billion |

| CAGR | 5.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material, Coating Type , Vehicle Type, Aftermarket Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Enkei Corporation, Ronal Group, Borbet GmbH, Maxion Wheels, CM Wheels, The Carlstar Group, Arconic, Superior Industries International, Inc., SSR Wheels, LKQ Corporation |

| Key Market Opportunities | Lack of awareness Low disposable income levels |

| Key Market Drivers | Increasing Consumer Demand Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Wheels Aftermarket Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Wheels Aftermarket market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Wheels Aftermarket market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Wheels Aftermarket Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Automotive Wheels Aftermarket Market?

The analysis covers the period from 2021 to 2033, offering insights into long-term trends and forecasts in the aftermarket for automotive wheels.

What is the growth rate of the Automotive Wheels Aftermarket Market?

The Automotive Wheels Aftermarket Market is projected to grow at a compound annual growth rate (CAGR) of 5.87% from 2023 to 2033, indicating steady expansion driven by changing consumer preferences and technological advancements.

Which region has the highest growth rate in the Automotive Wheels Aftermarket Market?

North America emerges as the region with the highest growth rate in the Automotive Wheels Aftermarket Market, attributed to rising vehicle customization trends and a thriving aftermarket industry.

Which region has the largest share of the Automotive Wheels Aftermarket Market?

The North American region commands the largest share of the Automotive Wheels Aftermarket Market, driven by factors such as increasing demand for premium and high-performance vehicles and a strong consumer base.

Who are the key players in the Automotive Wheels Aftermarket Market?

Key players in the Automotive Wheels Aftermarket Market include Enkei Corporation, Ronal Group, Borbet GmbH, Maxion Wheels, CM Wheels, and others, leading innovation and product development in the aftermarket for automotive wheels.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Material Segement – Market Opportunity Score 4.1.2. Coating Type Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.1.4. Aftermarket Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Wheels Aftermarket Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automotive Wheels Aftermarket Market, By Material 7.1. Introduction 7.1.1. Alloy 7.1.2. Steel 7.1.3. Other Materials CHAPTER 8. Global Automotive Wheels Aftermarket Market, By Coating Type 8.1. Introduction 8.1.1. Liquid Coating 8.1.2. Powdered Coating CHAPTER 9. Global Automotive Wheels Aftermarket Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial Vehicles CHAPTER 10. Global Automotive Wheels Aftermarket Market, By Aftermarket Type 10.1. Introduction 10.1.1. New Wheel Replacement 10.1.2. Refurbished Wheel Fitment CHAPTER 11. Global Automotive Wheels Aftermarket Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Coating Type , 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Aftermarket Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Enkei Corporation 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Ronal Group 13.3. Borbet GmbH 13.4. Maxion Wheels 13.5. CM Wheels 13.6. The Carlstar Group 13.7. Arconic 13.8. Superior Industries International, Inc. 13.9. SSR Wheels 13.10. LKQ Corporation

Connect To Analyst

Research Methodology