Automotive Glazing Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Automotive Glazing Market Research Report: By Material (Glass, Polycarbonate, and Polymer Blends) By Sales Channel (OEM and Aftermarket) By Vehicle Type (Passenger Cars and Commercial Vehicles) By Application (Front Windshield, Rear Windshield, Sunroof, Front Lighting, Other Application), and by Region — Forecast till 2033

Page: 141

Automotive Glazing Market Overview

Automotive Glazing Market Size is expected to reach USD 38.42 Billion by 2033. The Automotive Glazing industry size accounted for USD 23.78 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.74% from 2023 to 2033. The automotive glazing market encompasses the production and distribution of glass and advanced glazing materials for vehicles. It includes traditional automotive glass as well as innovative solutions such as polycarbonates, laminated glass, and smart glass technologies. Key drivers of the market include regulatory requirements for safety and energy efficiency, the rising demand for electric vehicles, and advancements in glazing technologies. Opportunities lie in areas such as advanced safety features, smart and connected vehicle trends, customization options, and global expansion into emerging markets.

Global Automotive Glazing Market Synopsis

The Automotive Glazing market experienced a detrimental effect due to the Covid-19 pandemic.The COVID-19 pandemic significantly impacted the automotive glazing market, causing disruptions in production, supply chains, and consumer demand. Lockdowns and restrictions led to temporary closures of automotive manufacturing plants, affecting glazing suppliers. However, the shift towards remote work and increased demand for personal transportation post-lockdowns drove a recovery in vehicle sales, boosting demand for glazing materials.

Global Automotive Glazing Market Dynamics

The major factors that have impacted the growth of Automotive Glazing are as follows:

Drivers:

⮚ Technological Integration

The integration of glazing solutions with emerging technologies such as augmented reality (AR) displays and heads-up displays (HUDs) is opening up new opportunities in the automotive glazing market. These technologies enhance the driving experience by providing real-time information to the driver while minimizing distractions, thereby driving demand for advanced glazing solutions.

Restraint:

- High Production Costs

Advanced glazing materials and technologies often come with higher production costs compared to traditional glass, which can make them less economically viable for mass adoption, particularly in price-sensitive segments of the automotive market. Manufacturers face the challenge of balancing the benefits of advanced glazing solutions with cost considerations.

Opportunity:

⮚ Smart and Connected Vehicle Trends

The integration of smart and connected technologies in vehicles presents opportunities for advanced glazing solutions that enhance the driving experience and provide additional functionalities. Smart glass technologies, such as self-tinting windows and electrochromic coatings, offer opportunities to improve occupant comfort, privacy, and energy efficiency. Furthermore, integration with vehicle connectivity systems allows for enhanced control and customization of glazing features, opening up new revenue streams for manufacturers.

Automotive Glazing Market Segment Overview

By Material

Based on the Material, the market is segmented based on Glass, Polycarbonate, and Polymer Blends. Glass dominates the market due to its long-standing use in automotive windows for its clarity and scratch resistance. However, Polycarbonate and Polymer Blends are gaining traction owing to their lightweight properties, impact resistance, and design flexibility, especially in electric vehicles aiming for improved efficiency and safety. As automotive manufacturers seek to enhance vehicle performance and reduce weight, the demand for Polycarbonate and Polymer Blends in automotive glazing is expected to grow significantly in the coming years.

By Sales Channel

Based on Sales Channel , the market has been divided into OEM and Aftermarket. Currently, OEM sales dominate the market, driven by the integration of glazing materials during the manufacturing process of new vehicles. However, the Aftermarket segment is gaining traction due to the increasing demand for replacement glazing products driven by factors such as vehicle maintenance, repairs, and customization preferences among vehicle owners.

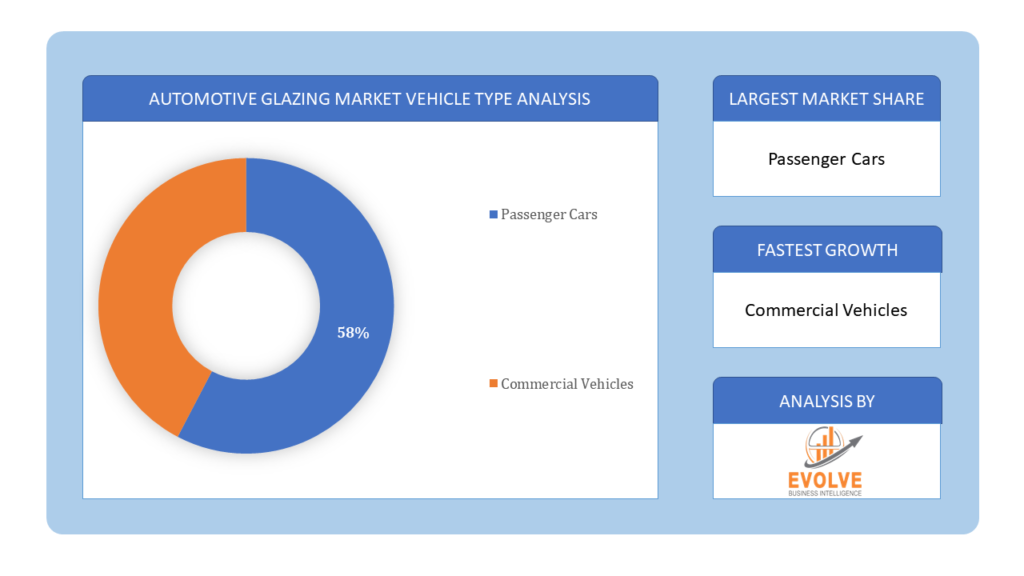

Based on the Vehicle Type, the market has been divided into Passenger Cars and Commercial Vehicles. Due to the rising sales of passenger automobiles in China and India, the passenger vehicle sector dominates the market. Because of the growing demand for intra-city trucks and buses as well as crossover SUVs, the LCV category is expected to rise steadily.

By Application

Based on Application, the market has been divided into Front Windshield, Rear Windshield, Sunroof, Front Lighting, Other Application. With the highest market revenue, the sidelite category leads the market. OEM’s main focus is using polycarbonate to minimize weight in vehicles like buses because their sidelites have a bigger surface area.

Global Automotive Glazing Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia Pacific is anticipated to dominate the market for the usage of Automotive Glazing, followed by those in North

Automotive Glazing Asia Pacific Market

The Asia Pacific region holds a dominant position in the Automotive Glazing market. The market for automotive glazing in Asia Pacific is dominated by the increase in the production and sale of passenger cars, government investments in transportation infrastructure development, rising disposable income in densely populated nations like China and India, and the region’s rapid industrialization and urbanization.

Automotive Glazing North America Market

The North America region is witnessing rapid growth and emerging as a significant market for the Automotive Glazing industry. The market for automotive glazing in North America is anticipated to grow at the quickest rate possible between 2024 and 2032. This is a result of both safety concerns and the quick uptake of cutting-edge technologies. In addition, the US market for glazing for automobiles had the most market share, while the Canadian market for the same product had the quickest rate of growth in the North American continent.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Nippon Sheet Glass Company Limited, Chimei Corporation, Saint Gobain S.A., Fuyao Glass Industry Group Co., Ltd., and Webasto SE are some of the leading players in the global Automotive Glazing Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Nippon Sheet Glass Company Limited

- Chimei Corporation

- Saint Gobain S.A.

- Fuyao Glass Industry Group Co., Ltd.

- Webasto SE

- Covestro AG

- Saudi Basic Industries Corporation (SABIC)

- Teijin Limited

- Mitsubishi Engineering Plastics

- AGP America S.A.

Key Development:

February 2021: Teijin Limited acquired Benet Automotive to enlarge its European automotive business. It is known for availing advanced technologies for carbon-fiber and glass-fiber reinforced plastic modeling of vehicles.

September 2020: An innovative automotive headlight concept for vehicles was launched by Covestro AG. The approach relies on various types of polycarbonate Makrolon and focuses on providing high demand in functionality and aesthetic terms.

Scope of the Report

Global Automotive Glazing Market, by Material

- Glass

- Polycarbonate

- Polymer Blends

Global Automotive Glazing Market, by Sales Channel

- OEM

- Aftermarket

Global Automotive Glazing Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive Glazing Market, by Application

- Front Windshield

- Rear Windshield

- Sunroof

- Front Lighting

- Other Application

Global Automotive Glazing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $38.42 Billion |

| CAGR | 5.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material, Sales Channel , Vehicle Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Nippon Sheet Glass Company Limited, Chimei Corporation, Saint Gobain S.A., Fuyao Glass Industry Group Co., Ltd., Webasto SE, Covestro AG, Saudi Basic Industries Corporation (SABIC), Teijin Limited, Mitsubishi Engineering Plastics, AGP America S.A. |

| Key Market Opportunities | Polycarbonate usage to remove the blind spot area A-pillar. |

| Key Market Drivers | Increase in the use of polycarbonate and rise to fulfill consumers’ requirement of safety, comfort, and security |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Glazing Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Glazing market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Glazing market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Glazing Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Automotive Glazing Market?

The analysis spans from 2021 to 2033, offering insights into long-term trends and forecasts in automotive glazing materials and technologies.

What is the growth rate of the Automotive Glazing Market?

The Automotive Glazing Market is projected to grow at a compound annual growth rate (CAGR) of 5.74% from 2023 to 2033, indicating steady expansion driven by advancements in safety and energy efficiency.

Which region has the highest growth rate in the Automotive Glazing Market?

The North America region is poised for rapid growth in the Automotive Glazing Market, with the US market exhibiting substantial growth potential due to safety concerns and adoption of cutting-edge technologies.

Which region has the largest share of the Automotive Glazing Market?

Asia Pacific leads the Automotive Glazing Market, driven by factors such as increased production and sale of passenger cars, government investments in transportation infrastructure, and rapid industrialization.

Who are the key players in the Automotive Glazing Market?

Key players in the Automotive Glazing Market include Nippon Sheet Glass Company Limited, Chimei Corporation, Saint Gobain S.A., Fuyao Glass Industry Group Co., Ltd., and Webasto SE, driving innovation in glazing materials and technologies.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Material Segement – Market Opportunity Score 4.1.2. Sales Channel Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.1.4. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Glazing Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automotive Glazing Market, By Material 7.1. Introduction 7.1.1. Glass 7.1.2 Polycarbonate 7,1.3. Polymer Blends CHAPTER 8. Global Automotive Glazing Market, By Sales Channel 8.1. Introduction 8,1,1, OEM 8.1.2. Aftermarket CHAPTER 9. Global Automotive Glazing Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial Vehicles CHAPTER 10. Global Automotive Glazing Market, By Application 10.1. Introduction 10.1.1. Front Windshield 10.1.2. Rear Windshield 10.1.3. Sunroof 10.1.4. Front Lighting 10.1.5. Other Application CHAPTER 11. Global Automotive Glazing Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Sales Channel , 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Nippon Sheet Glass Company Limited 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Chimei Corporation 13.3. Saint Gobain S.A. 13.4. Fuyao Glass Industry Group Co., Ltd. 13.5. Webasto SE 13.6. Covestro AG 13.7. Saudi Basic Industries Corporation (SABIC) 13.8. Teijin Limited 13.9. Mitsubishi Engineering Plastics 13.10. AGP America S.A.

Connect To Analyst

Research Methodology