Automotive Fuel Cell Vehicle Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Automotive Fuel Cell Vehicle Market Research Report: By Technology (Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cell, and Others) By Power Rating (Below 100 kW, 100 – 200 kW, Above 200 kW) By Vehicle Type (Passenger Car and Commercial Vehicle) By Component (Fuel Processor, Fuel Stack, and Air Compressor, Power Conditioner, and Others), and by Region — Forecast till 2033

Page: 131

Automotive Fuel Cell Vehicle Market Overview

Automotive Fuel Cell Vehicle Market Size is expected to reach USD 2.78 Billion by 2033. The Automotive Fuel Cell Vehicle industry size accounted for USD 0.35 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 2.78% from 2023 to 2033. The automotive fuel cell vehicle market refers to the segment of the automotive industry that focuses on vehicles powered by fuel cells, which convert hydrogen into electricity to propel the vehicle. These vehicles emit only water vapor and heat as byproducts, making them environmentally friendly alternatives to traditional internal combustion engine vehicles. While still a niche market, advancements in fuel cell technology and infrastructure development are driving growth. Major automakers are investing in research and development to bring fuel cell vehicles to market, aiming to address concerns about emissions and fossil fuel dependency in the transportation sector. Despite challenges such as high production costs and limited hydrogen infrastructure, fuel cell vehicles offer promising potential for zero-emission transportation solutions.

Global Automotive Fuel Cell Vehicle Market Synopsis

The Automotive Fuel Cell Vehicle market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic significantly impacted the automotive fuel cell vehicle market, causing disruptions in production, supply chains, and consumer demand. Lockdown measures and economic uncertainties led to reduced sales and delayed vehicle launches. However, the crisis also accelerated focus on sustainable transportation solutions, potentially driving increased interest and investment in fuel cell technology as part of recovery efforts and future resilience strategies.

Global Automotive Fuel Cell Vehicle Market Dynamics

The major factors that have impacted the growth of Automotive Fuel Cell Vehicle are as follows:

Drivers:

⮚ Increasing Investments and Partnerships

Automotive manufacturers, technology companies, and energy firms are investing heavily in fuel cell technology and infrastructure. Collaborations and partnerships between different stakeholders are driving innovation, reducing costs, and expanding the availability of FCVs in the market.

Restraint:

- High Initial Costs

FCVs typically have higher upfront costs compared to traditional internal combustion engine vehicles and battery electric vehicles (BEVs). This cost differential is primarily due to the expensive nature of fuel cell technology and the limited economies of scale in manufacturing FCVs. High initial costs can deter consumers from purchasing FCVs, especially in price-sensitive markets.

Opportunity:

⮚ Technological Advancements

Continued advancements in fuel cell technology have the potential to enhance the performance, efficiency, and durability of FCVs. Research and development efforts focused on improving catalyst materials, membrane durability, and system integration can lead to more cost-effective and reliable fuel cell systems. Breakthroughs in hydrogen production, storage, and distribution technologies can further bolster the viability of FCVs.

Automotive Fuel Cell Vehicle Market Segment Overview

By Automotive Fuel Cell Vehicle

Based on the Automotive Fuel Cell Vehicle, the market is segmented based on Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cell, and Others Among these, PEMFC dominates the market landscape, primarily due to its suitability for automotive applications, offering high power density, quick start-up, and efficient operation. This dominance underscores PEMFC’s widespread adoption in fuel cell vehicles, driven by its technological maturity and compatibility with mainstream automotive engineering requirements.

By Power Rating

Based on Power Rating, the market has been divided into Below 100 kW, 100 – 200 kW, Above 200 kW . Dominance is notably observed in the Below 100 kW segment, reflecting a significant market share driven by the demand for fuel cell vehicles in urban commuting and short-range applications. This segment’s prominence underscores the emphasis on efficiency and affordability, catering to a broad spectrum of consumers seeking sustainable mobility solutions.

By Vehicle Type

Based on the Vehicle Type,the market has been divided into Passenger Car and Commercial Vehicle. Passenger Cars hold a significant dominance, fueled by growing consumer interest in eco-friendly transportation solutions and government incentives promoting clean energy initiatives. The passenger car segment’s prominence underscores the shifting consumer preferences towards sustainable mobility options and the expanding infrastructure supporting fuel cell vehicles in the passenger vehicle segment.

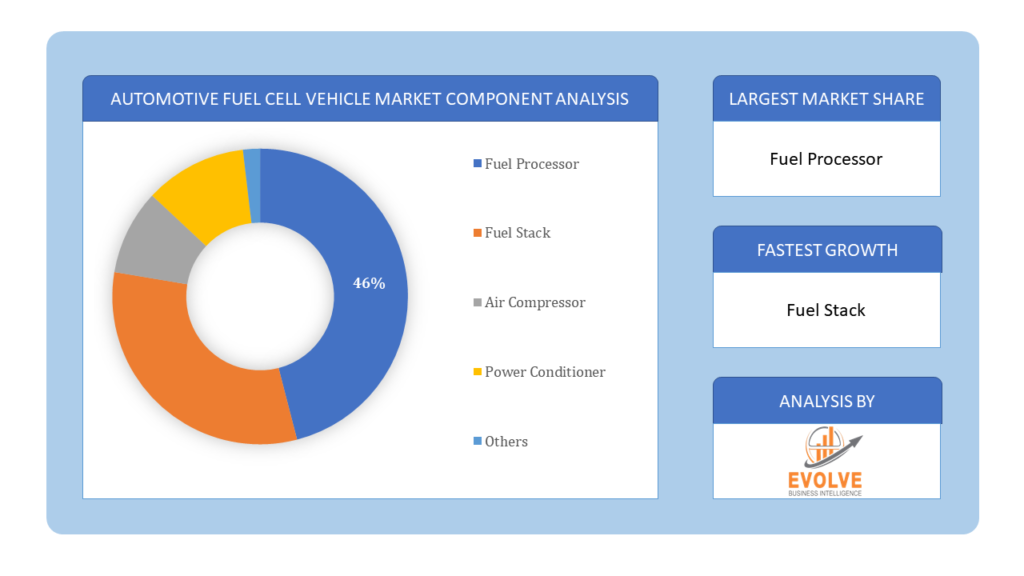

By Component

Based on Component, the market has been divided into Fuel Processor, Fuel Stack, and Air Compressor, Power Conditioner, and Others. Among these, the dominance is notably observed in the Fuel Stack segment, which plays a pivotal role in the generation of electricity through the chemical reaction between hydrogen and oxygen. This segment’s significance underscores its crucial contribution to the overall performance and efficiency of fuel cell vehicles.

Based on Component, the market has been divided into Fuel Processor, Fuel Stack, and Air Compressor, Power Conditioner, and Others. Among these, the dominance is notably observed in the Fuel Stack segment, which plays a pivotal role in the generation of electricity through the chemical reaction between hydrogen and oxygen. This segment’s significance underscores its crucial contribution to the overall performance and efficiency of fuel cell vehicles.

Global Automotive Fuel Cell Vehicle Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia Pacific is anticipated to dominate the market for the usage of Automotive Fuel Cell Vehicle, followed by those in North America and Europe.

Automotive Fuel Cell Vehicle Asia Pacific Market

The Asia Pacific region holds a dominant position in the Automotive Fuel Cell Vehicle market. Asia Pacific region is expected to dominate the automotive fuel cell market due to the increased number of passenger vehicles in the overall production of the vehicles in countries such as India, China, and Japan. The Asia Pacific is considered the largest market for the environment-friendly technologies in the world which includes the fuel cells and hence dominated the market.

Automotive Fuel Cell Vehicle North America Market

The North America region is witnessing rapid growth and emerging as a significant market for the Automotive Fuel Cell Vehicle industry. In North America, the Automotive Fuel Cell Vehicle Market exhibits robust growth, fueled by increasing environmental consciousness and government initiatives promoting clean energy transportation. The region boasts a thriving ecosystem of fuel cell technology developers, automotive manufacturers, and supportive infrastructure projects, contributing to market expansion. Moreover, strategic collaborations between industry stakeholders and research institutions further accelerate innovation and adoption, positioning North America as a key hub for fuel cell vehicle development and deployment.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as ITM Power, Ballard Power Systems, Delphi Technologies, Doosan Corporation, and Hydrogenics are some of the leading players in the global Automotive Fuel Cell Vehicle Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- ITM Power

- Ballard Power Systems

- Delphi Technologies

- Doosan Corporation

- Hydrogenics

- Proton Power System PLC

- Plug Power

- Hyundai

- General Motors

- Toyota

Key Development:

In September 2022, Toyota, a frontrunner in fuel cell vehicle technology, made significant strides in advancing its hydrogen-powered vehicles. The company unveiled groundbreaking innovations, possibly including enhanced fuel cell stacks, improved efficiency, or expanded infrastructure partnerships, reaffirming its commitment to sustainable mobility and solidifying its position as a leader in the automotive fuel cell sector.

Scope of the Report

Global Automotive Fuel Cell Vehicle Market, by Automotive Fuel Cell Vehicle

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cells

- Solid Oxide Fuel Cell

- Others

Global Automotive Fuel Cell Vehicle Market, by Power Rating

- Below 100 kW

- 100 – 200 kW

- Above 200 kW

Global Automotive Fuel Cell Vehicle Market, by Vehicle Type

- Passenger Car

- Commercial Vehicle

Global Automotive Fuel Cell Vehicle Market, by Component

- Fuel Processor

- Fuel Stack

- Air Compressor

- Power Conditioner

- Others

Global Automotive Fuel Cell Vehicle Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.78 Billion |

| CAGR | 2.78 % CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Automotive Fuel Cell Vehicle, Power Rating, Vehicle Type, Component |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ITM Power, Ballard Power Systems, Delphi Technologies, Doosan Corporation, Hydrogenics, Proton Power System PLC, Plug Power, Hyundai, General Motors, Toyota |

| Key Market Opportunities | Increases the demand for the fuel cell as a greener alternative to the traditional cells |

| Key Market Drivers | The need for greener alternative for automobile fuel can impel |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Fuel Cell Vehicle Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Fuel Cell Vehicle market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Fuel Cell Vehicle market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Fuel Cell Vehicle Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Automotive Fuel Cell Vehicle market?

The study period for the Automotive Fuel Cell Vehicle market extends from 2023 to 2033.

What is the growth rate of the Automotive Fuel Cell Vehicle market?

The Automotive Fuel Cell Vehicle market is expected to grow at a compound annual growth rate (CAGR) of 2.78% from 2023 to 2033.

Which region has the highest growth rate in the Automotive Fuel Cell Vehicle market?

The Asia Pacific region is projected to exhibit the highest growth rate in the Automotive Fuel Cell Vehicle market.

Which region has the largest share of the Automotive Fuel Cell Vehicle market?

Currently, the Asia Pacific region holds the largest share of the Automotive Fuel Cell Vehicle market.

Who are the key players in the Automotive Fuel Cell Vehicle market?

Key players in the Automotive Fuel Cell Vehicle market include ITM Power, Ballard Power Systems, Delphi Technologies, Doosan Corporation, Hydrogenics, Proton Power System PLC, Plug Power, Hyundai, General Motors, and Toyota.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Automotive Fuel Cell Vehicle Segement – Market Opportunity Score 4.1.2. Power Rating Segment – Market Opportunity Score 4.1.3. Vehicle TypeSegment – Market Opportunity Score 4.1.4. Component Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Automotive Fuel Cell Vehicle 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Fuel Cell Vehicle Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automotive Fuel Cell Vehicle Market, By Automotive Fuel Cell Vehicle 7.1. Introduction 7.1.1. Proton Exchange Membrane Fuel Cell 7.1.2. Phosphoric Acid Fuel Cells 7.1.3. Solid Oxide Fuel Cell 7.1.4. Others CHAPTER 8. Global Automotive Fuel Cell Vehicle Market, By Power Rating 8.1. Introduction 8.1.1. Below 100 kW 8.1.2. 100 – 200 kW 8.1.3. Above 200 kW CHAPTER 9. Global Automotive Fuel Cell Vehicle Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Car 9.1.2. Commercial Vehicle CHAPTER 10. Global Automotive Fuel Cell Vehicle Market, By Component 10.1. Introduction 10.1.1. Fuel Processor 10.1.2. Fuel Stack 10.1.3. Air Compressor 10.1.4. Power Conditioner 10.1.5. Others CHAPTER 11. Global Automotive Fuel Cell Vehicle Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. ITM Power 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Ballard Power Systems 13.3. Delphi Technologies 13.4. Doosan Corporation 13.5. Hydrogenics 13.6. Proton Power System PLC 13.7. Plug Power 13.8. Hyundai 13.9. General Motors 13.10. Toyota

Connect to Analyst

Research Methodology

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Automotive Fuel Cell Vehicle Segement – Market Opportunity Score

4.1.2. Power Rating Segment – Market Opportunity Score

4.1.3. Vehicle TypeSegment – Market Opportunity Score

4.1.4. Component Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Automotive Fuel Cell Vehicle

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Automotive Fuel Cell Vehicle Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. MArket Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Global Automotive Fuel Cell Vehicle Market, By Automotive Fuel Cell Vehicle

7.1. Introduction

7.1.1. Proton Exchange Membrane Fuel Cell

7.1.2. Phosphoric Acid Fuel Cells

7.1.3. Solid Oxide Fuel Cell

7.1.4. Others

CHAPTER 8. Global Automotive Fuel Cell Vehicle Market, By Power Rating

8.1. Introduction

8.1.1. Below 100 kW

8.1.2. 100 – 200 kW

8.1.3. Above 200 kW

CHAPTER 9. Global Automotive Fuel Cell Vehicle Market, By Vehicle Type

9.1. Introduction

9.1.1. Passenger Car

9.1.2. Commercial Vehicle

CHAPTER 10. Global Automotive Fuel Cell Vehicle Market, By Component

10.1. Introduction

10.1.1. Fuel Processor

10.1.2. Fuel Stack

10.1.3. Air Compressor

10.1.4. Power Conditioner

10.1.5. Others

CHAPTER 11. Global Automotive Fuel Cell Vehicle Market, By Region

11.1. Introduction

11.2. NORTH AMERICA

11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

11.2.2. North America: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.2.3. North America: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.2.4. North America: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.2.5. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.2.6. US

11.2.6.1. US: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.2.6.2. US: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.2.6.3. US: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.2.6.4. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.2.7. CANADA

11.2.7.1. Canada: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.2.7.2. Canada: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.2.7.3. Canada: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.2.7.4. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.2.8. MEXICO

11.2.8.1. Mexico: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.2.8.2. Mexico: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.2.8.3. Mexico: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.2.8.4. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3. Europe

11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

11.3.2. Europe: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.3. Europe: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.4. Europe: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.5. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.6. U.K.

11.3.6.1. U.K.: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.6.2. U.K.: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.6.4. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.7. GERMANY

11.3.7.1. Germany: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.7.2. Germany: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.7.4. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.8. FRANCE

11.3.8.1. France: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.8.2. France: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.8.3. France: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.8.4. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.9. ITALY

11.3.9.1. Italy: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.9.2. Italy: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.9.4. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.10. SPAIN

11.3.10.1. Spain: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.10.2. Spain: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.10.4. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.11. BENELUX

11.3.11.1. BeNeLux: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.11.2. BeNeLux: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.11.4. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.12. RUSSIA

11.3.12.1. Russia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.12.2. Russia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.12.4. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.3.13. REST OF EUROPE

11.3.13.1. Rest of Europe: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.3.13.2. Rest of Europe: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.3.13.4. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4. Asia Pacific

11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

11.4.2. Asia Pacific: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.3. Asia Pacific: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.5. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.6. CHINA

11.4.6.1. China: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.6.2. China: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.6.3. China: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.6.4. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.7. JAPAN

11.4.7.1. Japan: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.7.2. Japan: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.7.4. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.8. INDIA

11.4.8.1. India: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.8.2. India: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.8.3. India: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.8.4. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.9. SOUTH KOREA

11.4.9.1. South Korea: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.9.2. South Korea: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.9.4. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.10. THAILAND

11.4.10.1. Thailand: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.10.2. Thailand: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.10.4. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.11. INDONESIA

11.4.11.1. Indonesia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.11.2. Indonesia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.11.4. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.12. MALAYSIA

11.4.12.1. Malaysia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.12.2. Malaysia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.12.4. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.13. AUSTRALIA

11.4.13.1. Australia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.13.2. Australia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.13.4. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.4.14. REST FO ASIA PACIFIC

11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.5. South America

11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

11.5.2. South America: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.5.3. South America: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.5.4. South America: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.5.5. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.5.6. BRAZIL

11.5.6.1. Brazil: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.5.6.2. Brazil: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.5.6.4. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.5.7. ARGENTINA

11.5.7.1. Argentina: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.5.7.2. Argentina: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.5.7.4. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.5.8. REST OF SOUTH AMERICA

11.5.8.1. Rest of South America: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.5.8.2. Rest of South America: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.5.8.4. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.6. Middle East & Africa

11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million)

11.6.2. Middle East & Africa: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.6.3. Middle East & Africa: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.6.5. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.6.6. SAUDI ARABIA

11.6.6.1. Saudi Arabia: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.6.6.2. Saudi Arabia: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.6.6.4. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.6.7. UAE

11.6.7.1. UAE: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.6.7.2. UAE: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.6.7.4. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.6.8. EGYPT

11.6.8.1. Egypt: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.6.8.2. Egypt: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.6.8.4. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.6.9. SOUTH AFRICA

11.6.9.1. South Africa: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.6.9.2. South Africa: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.6.9.4. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

11.6.10. REST OF MIDDLE EAST & AFRICA

11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Automotive Fuel Cell Vehicle, 2023 – 2033 ($ Million)

11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Power Rating, 2023 – 2033 ($ Million)

11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type,2023 – 2033 ($ Million)

11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. ITM Power

13.1.1. Business Overview

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million

13.1.2.2. Geographic Revenue Mix, 2020 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Ballard Power Systems

13.3. Delphi Technologies

13.4. Doosan Corporation

13.5. Hydrogenics

13.6. Proton Power System PLC

13.7. Plug Power

13.8. Hyundai

13.9. General Motors

13.10. Toyota