Artificial Lift System Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

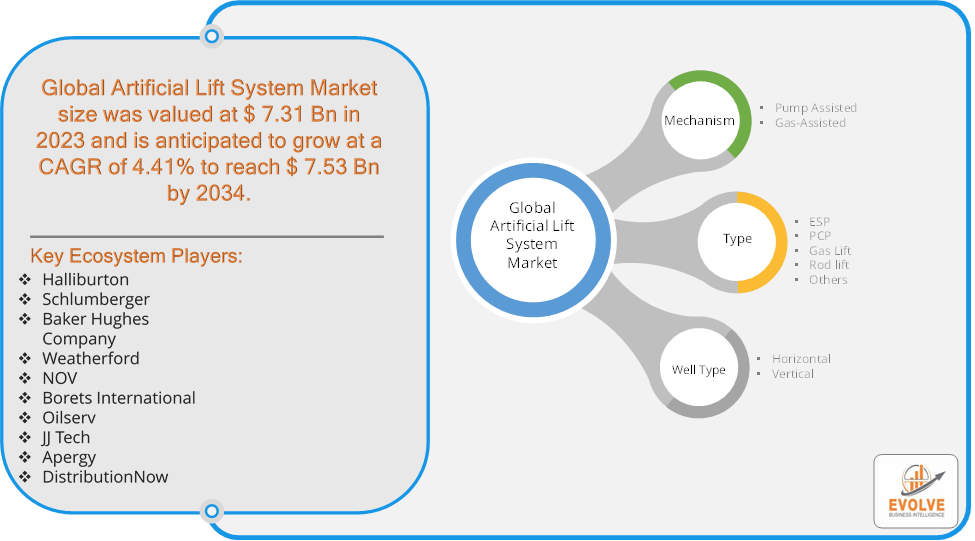

Artificial Lift System Market Research Report: Information By mechanism (Pump Assisted, Gas-Assisted), By type (ESP, PCP, Gas Lift, Rod lift, Others), By well type (Horizontal, Vertical), and by Region — Forecast till 2034

Page: 168

Artificial Lift System Market Overview

The Artificial Lift System Market size accounted for USD 7.31 Billion in 2023 and is estimated to account for 7.41 Billion in 2024. The Market is expected to reach USD 7.53 Billion by 2034 growing at a compound annual growth rate (CAGR) of 4.41% from 2024 to 2034. The Artificial Lift System Market refers to the industry focused on technologies and methods used to increase the flow of liquids, typically oil or water, from a production well. Artificial lift systems are employed when the natural pressure in the reservoir is insufficient to bring the oil or gas to the surface. These systems are critical in the oil and gas industry for maintaining and enhancing production efficiency, especially in mature fields or reservoirs with low-pressure conditions.

The market for artificial lift systems is driven by factors such as increasing demand for oil and gas, the need to optimize production from mature fields, and advancements in technology. As the industry continues to explore more challenging reservoirs, the importance of artificial lift systems will likely grow.

Global Artificial Lift System Market Synopsis

Artificial Lift System Market Dynamics

Artificial Lift System Market Dynamics

The major factors that have impacted the growth of Artificial Lift System Market are as follows:

Drivers:

Ø Technological Advancements

Innovations such as automated control systems, smart sensors, and real-time monitoring technologies improve the efficiency and reliability of artificial lift systems. These advancements reduce operational costs and downtime, encouraging wider adoption. Artificial lift systems allow operators to maximize production from low-pressure wells at reduced operational costs, which is critical in maintaining profitability in a fluctuating oil price environment. Stricter regulations around well production efficiency and emissions reduction are encouraging the use of artificial lift systems that optimize oil recovery while minimizing energy consumption.

Restraint:

- Perception of Fluctuating Oil Prices and Limited Use in High-Pressure Wells

Volatility in global oil prices can lead to reduced investments in new wells and production infrastructure. When prices drop, oil companies may delay or reduce spending on artificial lift systems, particularly in marginal fields. Artificial lift systems are mainly used in low-pressure wells. In high-pressure or naturally flowing wells, the need for artificial lift is reduced, limiting its application to specific well conditions. The global shift towards renewable energy and reducing reliance on fossil fuels is gradually leading to a decline in long-term investments in oil extraction technologies, including artificial lift systems, as companies prioritize greener energy solutions.

Opportunity:

⮚ Rising Demand in Unconventional Oil and Gas Extraction

The growth of unconventional oil extraction methods, such as shale oil and tight oil, presents a significant opportunity. These wells often have lower pressure and require artificial lift systems to optimize production from the outset, particularly in North America. While traditionally used in oil wells, artificial lift systems are increasingly being applied to gas wells to enhance production, particularly in regions focused on expanding their natural gas supply. This opens up new markets for lift system technologies. Global concerns about energy security and the desire for countries to be self-reliant on energy supplies are driving increased investments in maximizing oil production, leading to more opportunities for artificial lift technologies to maintain production levels.

Artificial Lift System Market Segment Overview

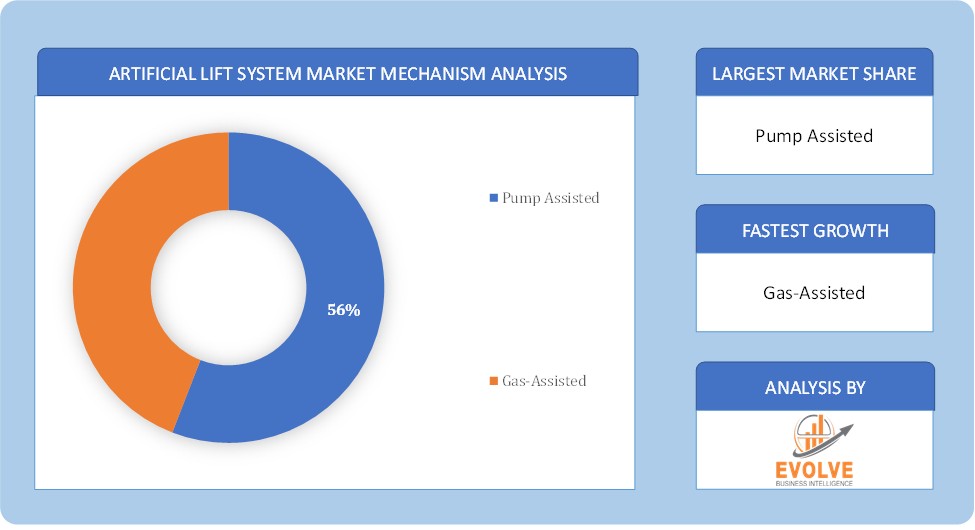

Based on Mechanism, the market is segmented based on Pump Assisted and Gas-Assisted. The pump-assisted segment dominated the market which further consists of dynamic displacement and positive displacement pumps. The growth of this segment is due to the rising adoption of progressive cavity pumps and electric submersible pumps.

By Type

Based on Type, the market segment has been divided into ESP, PCP, Gas Lift, Rod lift and Others. The electric submersible pumps (ESP) segment dominant segment the market. electric submersible pumps (ESP) offer high volumetric efficiency, capable of handling a wide range of flow rates, from low to exceptionally high. This makes them highly adaptable to various reservoir conditions and operational requirements. ESPs are exceptionally versatile and can be employed in different settings, including offshore, onshore, and even in deviated or horizontal wells.

By Well Type

Based on Well Type, the market segment has been divided into Horizontal and Vertical. The Horizontal segment dominant the market. horizontal drilling provides a greater contact area with the production reservoir compared to traditional vertical wells. This higher exposure significantly enhances the flow rates of hydrocarbons, making the extraction process more efficient. Furthermore, horizontal wells are particularly effective in the extraction of unconventional resources like shale gas and tight oil formations. They enable the optimization of hydraulic fracturing, a technique often essential for liberating hydrocarbons in these low-permeability reservoirs.

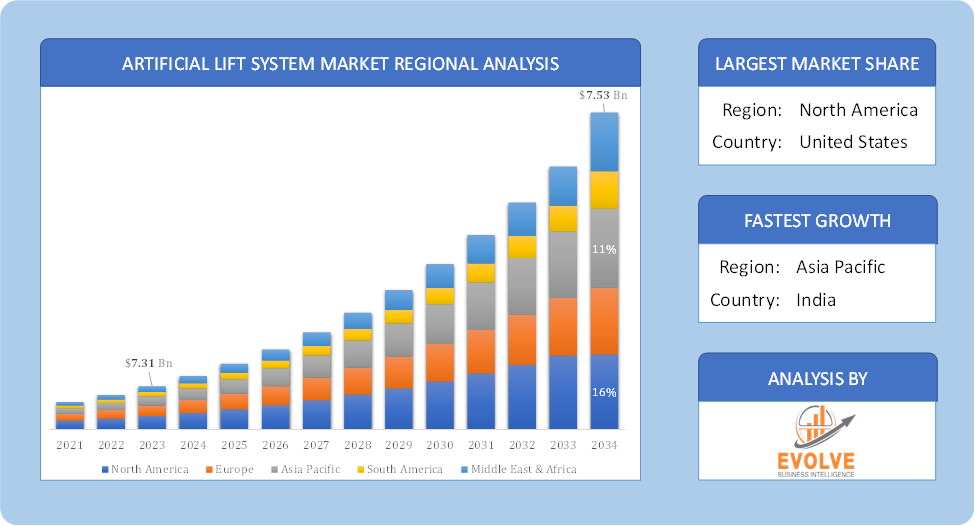

Global Artificial Lift System Market Regional Analysis

Based on region, the global Artificial Lift System Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Artificial Lift System Market followed by the Asia-Pacific and Europe regions.

Artificial Lift System North America Market

Artificial Lift System North America Market

North America holds a dominant position in the Artificial Lift System Market. North America is one of the largest markets for artificial lift systems, primarily driven by the U.S. shale oil boom and significant investments in unconventional oil production and U.S is One of the largest markets due to its mature oil and gas industry and extensive use of artificial lift technologies and Increasing focus on enhancing production in mature fields and deepwater exploration presents growth opportunities. The adoption of IoT and automation technologies is also on the rise.

Artificial Lift System Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Artificial Lift System Market industry. The Asia-Pacific region is witnessing increasing oil and gas exploration activities, particularly in countries like China, India, and Indonesia and the market is gradually shifting towards ESPs and other artificial lift technologies to optimize production and India is rapidly growing economy with increasing energy consumption, driving demand for artificial lift technologies.

Competitive Landscape

The global Artificial Lift System Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Halliburton

- Schlumberger

- Baker Hughes Company

- Weatherford

- NOV

- Borets International

- Oilserv

- JJ Tech

- Apergy

- DistributionNow

Key Development

In April 2024, SLB launched two revolutionary artificial lift systems, the Reda Agile compact wide-range electric submersible pump (ESP) system and the rodless Reda PowerEdge electric submersible progressive cavity pump (ESPCP) system.

In February 2024, ChampionX Corp, an oilfield technology and services firm, acquired Artificial Lift Performance Limited (ALP), which provides analytics solutions to improve oil and gas production performance.

Scope of the Report

Global Artificial Lift System Market, by Mechanism

- Pump Assisted

- Gas-Assisted

Global Artificial Lift System Market, by Type

- ESP

- PCP

- Gas Lift

- Rod lift

- Others

Global Artificial Lift System Market, by Well Type

- Horizontal

- Vertical

Global Artificial Lift System Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 7.53 Billion |

| CAGR (2024-2034) | 4.41% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Mechanism, Type, Well Type. |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Halliburton, Schlumberger, Baker Hughes Company, Weatherford, NOV, Borets International, Oilserv, JJ Tech, Apergy and Distribution Now. |

| Key Market Opportunities | · Rising Demand in Unconventional Oil and Gas Extraction · Increasing Use of Artificial Lift Systems in Gas Wells |

| Key Market Drivers | · Technological Advancements · Cost-Effective Operations |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Artificial Lift System Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Artificial Lift System Market historical market size for the year 2021, and forecast from 2023 to 2033

- Artificial Lift System Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Artificial Lift System Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Artificial Lift System Market is 2021- 2033

What is the growth rate of the global Artificial Lift System Market?

The global Artificial Lift System Market is growing at a CAGR of 4.41% over the next 10 years

Which region has the highest growth rate in the market of Artificial Lift System Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Artificial Lift System Market?

North America holds the largest share in 2022

Who are the key players in the global Artificial Lift System Market?

Halliburton, Schlumberger, Baker Hughes Company, Weatherford, NOV, Borets International, Oilserv, JJ Tech, Apergy and Distribution Now are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Mechanism Segement – Market Opportunity Score 4.1.2. Type Segment – Market Opportunity Score 4.1.3. Well Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Artificial Lift System Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Artificial Lift System Market, By Mechanism 7.1. Introduction 7.1.1. Pump Assisted 7.1.2. Gas-Assisted CHAPTER 8 Artificial Lift System Market, By Type 8.1. Introduction 8.1.1. ESP 8.1.2. PCP 8.1.3. Gas Lift 8.1.4. Rod lift 8.1.5. Others CHAPTER 9. Artificial Lift System Market, By Well Type 9.1. Introduction 9.1.1. Horizontal 9.1.2 Vertical CHAPTER 10. Artificial Lift System Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.3. North America: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.2.4. North America: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.5.2. US: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.2.5.3. US: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.3. Europe: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.4. Europe: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.7.2. France: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.7.3. France: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Product, 2024 – 2034($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.5.2. China: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.5.3. China: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.7.2. India: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.7.3. India: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million) 10.5.4. South America: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2024 – 2034($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Mechanism, 2024 – 2034($ Million) 10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By Well Type, 2024 – 2034($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Halliburton 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Schlumberger 13.3. Baker Hughes Company 13.4. Weatherford 13.5. NOV 13.6. Borets International 13.7. Oilserv 13.8. JJ Tech 13.9 Apergy 13.10 Distribution Now

Connect to Analyst

Research Methodology