Gems and Jewelry Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

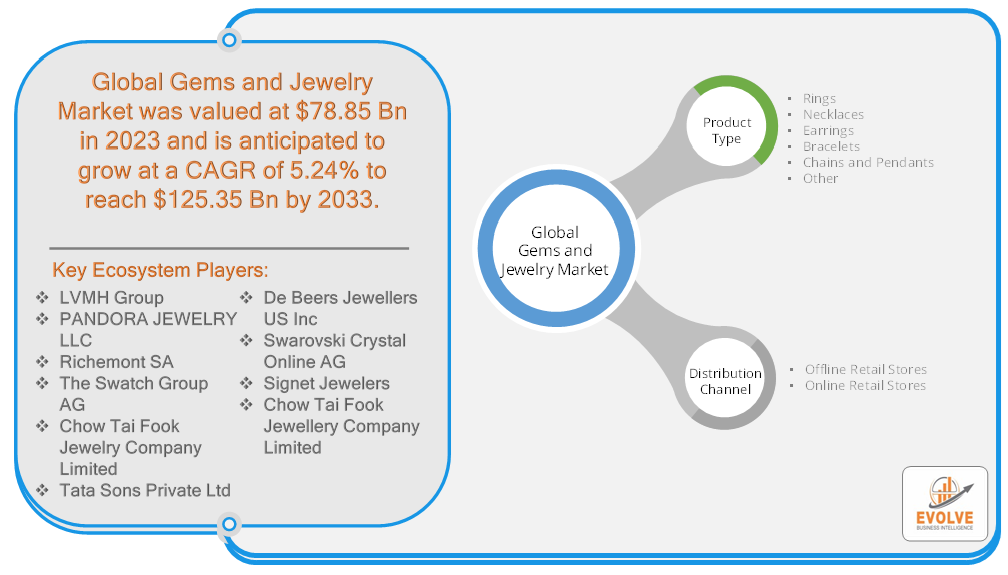

Gems and Jewelry Market Research Report: Information By Product Type (Rings, Necklaces, Earrings, Bracelets, Chains and Pendants, Other), By Distribution Channel (Offline Retail Stores, Online Retail Stores), and by Region — Forecast till 2033

Gems and Jewelry Market Overview

The Gems and Jewelry Market Size is expected to reach USD 125.35 Billion by 2033. The Gems and Jewelry industry size accounted for USD 78.85 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.24% from 2023 to 2033. Gems and jewelry refer to precious stones and ornamental items that are crafted and designed for aesthetic purposes, personal adornment, and symbolic value. Gems encompass natural or lab-grown gemstones, such as diamonds, rubies, emeralds, sapphires, and pearls, which possess rarity, beauty, and durability. Jewelry comprises a wide range of wearable accessories, including rings, necklaces, earrings, bracelets, brooches, and pendants, which are often crafted using precious metals like gold, silver, and platinum, and adorned with gemstones or other decorative elements. The gems and jewelry industry involves various processes, including mining, cutting, shaping, polishing, designing, manufacturing, and retailing, and is influenced by factors such as market trends, cultural preferences, craftsmanship, and gemological standards. It encompasses both high-end luxury pieces and more affordable options, catering to diverse consumer segments and occasions, such as personal adornment, gifting, and investment.

Global Gems and Jewelry Market Synopsis

The COVID-19 pandemic had a significant and transformative impact on the Gems and Jewelry market. The industry faced multiple challenges as lockdowns, travel restrictions, and economic uncertainty disrupted the global supply chain, manufacturing, and retail operations. With brick-and-mortar stores temporarily closing and consumer spending decreasing, the industry experienced a decline in demand. However, as people adapted to the new normal and sought to find ways to uplift their spirits, there was a shift toward online jewelry shopping. E-commerce and virtual platforms gained prominence, allowing jewelry retailers to reach customers remotely. Furthermore, as traditional weddings and events were postponed or downscaled, there was a surge in demand for more affordable and sentimental jewelry pieces. Sustainable and ethical practices also gained attention, influencing consumer preferences. As the industry recovered, players focused on digitalization, customization, and enhancing the online shopping experience.

Gems and Jewelry Market Dynamics

The major factors that have impacted the growth of Gems and Jewelry are as follows:

Drivers:

Increasing Disposable Income and Consumer Demand

One of the primary drivers of the Gems and Jewelry market is the increasing disposable income and consumer demand. As economies grow and individuals have more purchasing power, the demand for luxury goods, including gems and jewelry, tends to rise. Rising affluence, urbanization, and the desire for personal adornment and status symbols contribute to the growth of the market. Moreover, the rising popularity of online retail channels and the ease of access to a wide range of jewelry options have further fueled consumer demand.

Restraint:

- Fluctuating Raw Material Prices and Supply Chain

Fluctuating raw material prices, particularly in the case of precious metals and gemstones, pose a significant restraint on the Gems and Jewelry market. The prices of these materials are influenced by factors such as mining output, geopolitical events, and currency fluctuations. Such volatility affects the overall production costs and pricing strategies of jewelry manufacturers. Additionally, the industry faces challenges related to the complex global supply chain, including issues like ethical sourcing, traceability, and counterfeit products, which can hinder market growth.

Opportunity:

⮚ Growing Preference for Ethical and Sustainable Jewelry

An opportunity in the Gems and Jewelry market lies in the growing preference for ethical and sustainable jewelry. Consumers are increasingly concerned about the environmental and social impact of the products they purchase. This trend has led to a rise in demand for jewelry made from recycled materials, ethically sourced gemstones, and responsibly manufactured products. Jewelry companies that embrace sustainable practices and transparency in their supply chain have the opportunity to tap into this market segment and attract environmentally and socially conscious consumers.

Gems and Jewelry Segment Overview

By Product Type

Based on Product Type, the market is segmented based on Rings, Necklaces, Earrings, Bracelets, Chains and Pendants, Other. The Rings segment is expected to have a larger market share throughout the forecast period. Rings hold significant cultural and symbolic value and are widely worn for various occasions, including engagements, weddings, anniversaries, and fashion statements. The demand for rings remains consistently high, driving the growth of this segment within the Gems and Jewelry market. Additionally, the versatility of rings in terms of design, materials, and customization options appeals to a wide range of consumers, further contributing to their market dominance.

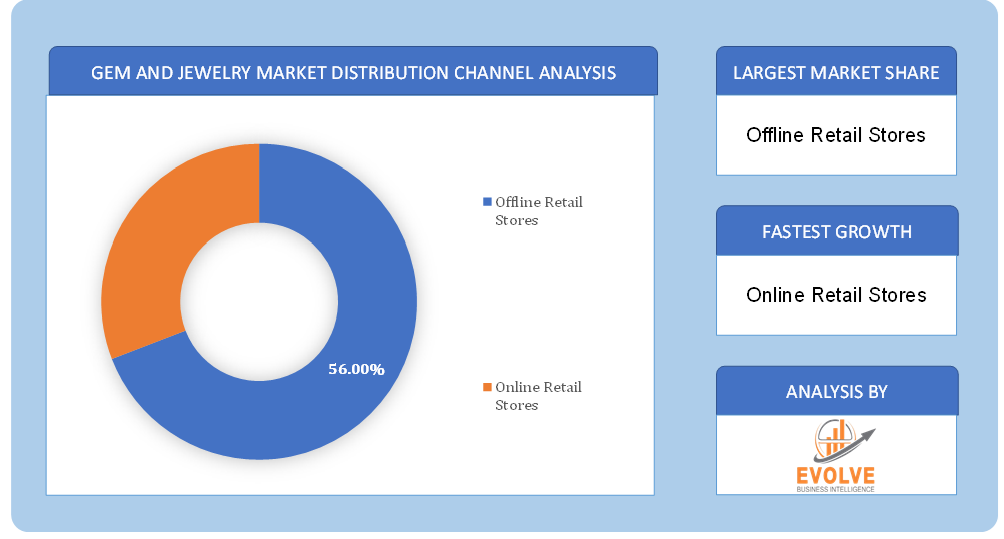

By Distribution Channel

Based on Distribution Channel, the market has been divided into Offline Retail Stores, Online Retail Stores. The Offline Retail Stores segment is anticipated to dominate the market. Offline retail stores provide customers with the opportunity to physically see and try on jewelry, receive personalized assistance from sales representatives, and experience the ambiance of a physical store. This tactile and immersive shopping experience is valued by many consumers, especially for high-value purchases like gems and jewelry, where trust and assurance are crucial.

Based on Distribution Channel, the market has been divided into Offline Retail Stores, Online Retail Stores. The Offline Retail Stores segment is anticipated to dominate the market. Offline retail stores provide customers with the opportunity to physically see and try on jewelry, receive personalized assistance from sales representatives, and experience the ambiance of a physical store. This tactile and immersive shopping experience is valued by many consumers, especially for high-value purchases like gems and jewelry, where trust and assurance are crucial.

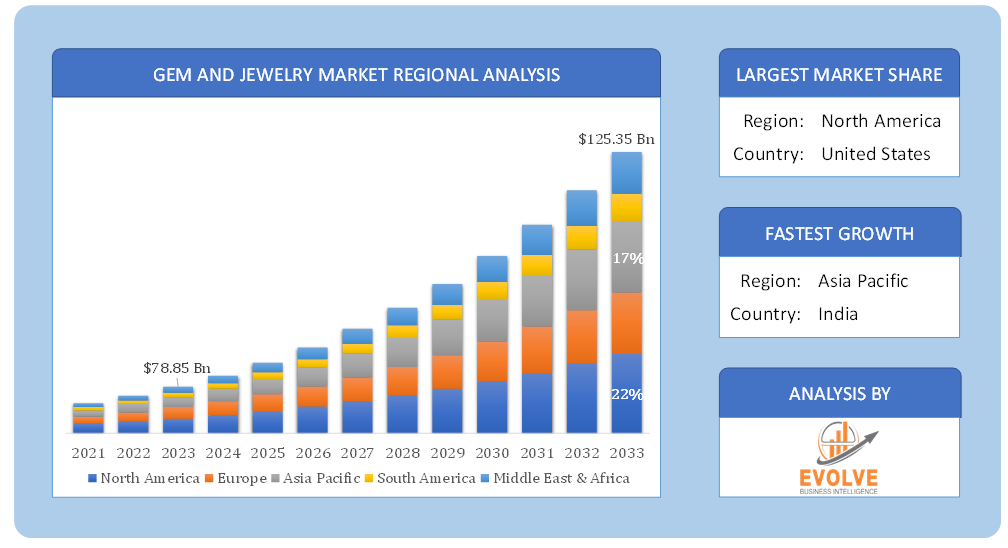

Global Gems and Jewelry Market Regional Analysis

Based on region, the global Gems and Jewelry market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Gems and Jewelry market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America has consistently held a dominant position in the Gems and Jewelry market. The region’s dominance can be attributed to several factors. North America has a strong and affluent consumer base with a high demand for luxury goods, including gems and jewelry. The region’s stable and developed economies, such as the United States and Canada, contribute to higher disposable incomes, allowing consumers to indulge in luxury purchases. North America is home to several renowned jewelry brands, designers, and manufacturers, which have a global presence and cater to both domestic and international markets. These established players contribute to the overall market dominance of North America. Moreover, North America has a well-established infrastructure for the Gems and Jewelry industry, including a robust retail network, gemological institutes, and specialized trade shows and exhibitions. These resources support the growth and competitiveness of the market within the region.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as a rapidly growing market for the Gems and Jewelry industry. Several factors have contributed to the region’s significant growth and increasing prominence in the market. The Asia-Pacific region has experienced rapid economic development, leading to a rise in disposable incomes and an expanding middle class. As a result, consumer purchasing power has increased, and there is a growing demand for luxury goods, including gems and jewelry. Countries like China and India, in particular, have witnessed tremendous growth in their domestic Gems and Jewelry markets. These countries have large populations with a strong cultural affinity for jewelry, where it holds significant traditional and social importance. The rising prosperity in these nations has led to increased jewelry consumption and demand.

Competitive Landscape

The Global Gems and Jewelry market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- LVMH Group

- PANDORA JEWELRY LLC

- Richemont SA

- The Swatch Group AG

- Chow Tai Fook Jewelry Company Limited

- Tata Sons Private Ltd

- De Beers Jewellers US Inc

- Swarovski Crystal Online AG

- Signet Jewelers

- Chow Tai Fook Jewellery Company Limited

Key Development

In September 2022, Tanishq paid homage to the Chola Dynasty, a revered period in Indian history, by introducing a new exclusive collection called The Chola. This collection was designed as a tribute to the dynasty’s grandeur and significance.

In August 2022, Pandora introduced the ‘Pandora Brilliance line of jewelry in the United States and Canada. This line showcased diamonds that were created using 100 percent renewable energy and cultivated within the United States, highlighting Pandora’s commitment to sustainable and ethically sourced materials.

Scope of the Report

Global Gems and Jewelry Market, by Product Type

- Rings

- Necklaces

- Earrings

- Bracelets

- Chains and Pendants

- Other

Global Gems and Jewelry Market, by Distribution Channel

- Offline Retail Stores

- Online Retail Stores

Global Gems and Jewelry Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $125.35 Billion |

| CAGR | 5.24% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | LVMH Group, PANDORA JEWELRY LLC, Richemont SA, The Swatch Group AG, Chow Tai Fook Jewelry Company Limited, Tata Sons Private Ltd, De Beers Jewellers US Inc, Swarovski Crystal Online AG, Signet Jewelers, Chow Tai Fook Jewellery Company Limited |

| Key Market Opportunities | • Technological advancements and innovation in jewelry design and manufacturing. • Expansion of the middle-class population in emerging markets. • Shifts in consumer preferences towards unique and personalized jewelry pieces. |

| Key Market Drivers | • Increasing consumer demand for luxury goods and personal adornment. • Rising disposable income and affluence, particularly in emerging markets. • Cultural traditions and occasions that drive the demand for gems and jewelry. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Gems and Jewelry market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Gems and Jewelry market historical market size for the year 2021, and forecast from 2023 to 2033

- Gems and Jewelry market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Gems and Jewelry market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

The study period of the global Gems and Jewelry market is 2021- 2033

The Global Gems and Jewelry market is growing at a CAGR of 5.24% over the next 10 years

Asia Pacific is expected to register the highest CAGR during 2023-2033

North America holds the largest share in 2022

LVMH Group, PANDORA JEWELRY LLC, Richemont SA, The Swatch Group AG, Chow Tai Fook Jewelry Company Limited, Tata Sons Private Ltd, De Beers Jewellers US Inc, Swarovski Crystal Online AG, Signet Jewelers, Chow Tai Fook Jewellery Company Limited are the major companies operating in the market.

Yes, we offer 16 hours of analyst support to solve the queries

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Gems and Jewelry Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Gems and Jewelry Market 4.8. Import Analysis of the Gems and Jewelry Market 4.9. Export Analysis of the Gems and Jewelry Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Gems and Jewelry Market, By Product Type 6.1. Introduction 6.2. Rings 6.3. Necklaces 6.4. Earrings 6.5. Bracelets 6.6. Chains and Pendants 6.7. Other Chapter 7. Global Gems and Jewelry Market, By Distribution Channel 7.1. Introduction 7.2. Offline Retail Stores 7.3. Online Retail Stores Chapter 8. Global Gems and Jewelry Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Distribution Channel, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. LVMH Group 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. PANDORA JEWELRY LLC 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Richemont SA 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. The Swatch Group AG 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Chow Tai Fook Jewelry Company Limited 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Tata Sons Private Ltd 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. De Beers Jewellers US Inc 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Swarovski Crystal Online AG 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Signet Jewelers 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Tanishq 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology